Cryptocurrency, like stocks, appears to be a profitable industry with numerous opportunities to increase your savings. However, scams do occur. Since the beginning of 2021, more than 46,000 people have claimed to have lost more than $1 billion in cryptocurrency scams, according to the FTC. The average reported loss is $2,600 per person.

Cryptocurrency is not governed by any government agency, and investments are not protected in the same way that savings or checking accounts are. With so much money at stake, it’s critical to recognize the warning signs of a cryptocurrency scam.

The following are ten red flags to look for when investing in cryptocurrency, analyzed by CoinWire.

Huge return on investment promise

Unrealistic claims are a common sign of a crypto scam. If a website selling cryptocurrency makes a claim that appears too good to be true, it most likely is. Be wary of any offer that makes lofty promises without providing evidence to back them up.

For example, if an advertisement claims you can earn a tenfold return on your investment in a short period of time, that should raise a red flag. Be wary of any project that promises guaranteed returns, regardless of the amount invested.

Another example is a project that claims to have created a “new and improved” blockchain technology that is far superior to all others. You should be wary of investing unless the team can provide solid evidence to back up their claims.

Missing listings on namely exchanges

If you want to invest in cryptocurrency, see if it’s available on major exchanges like Coinbase or Gemini. If it isn’t, you should think twice about investing.

Cryptocurrencies that are not listed on major exchanges are frequently scams. Listing on an exchange necessitates paperwork for registration, which most scammers are unwilling to complete.

No detail information of ICO paper

If an initial coin offering (ICO) paper is lacking in details, it may be best to refrain from investing. A well-written whitepaper should provide concise and clear information about the project, team, and cryptocurrency. If critical information is missing, the ICO is unlikely to be a good investment.

Before investing in an ICO, conduct thorough due diligence and research. You want to make certain that you’re entering a project with a solid foundation.

An ICO without a proper whitepaper

An ICO without a whitepaper is frequently indicative of a poorly thought-out project, an inexperienced team, or a scam. Request and read the whitepaper before investing in an ICO. If the group is unable to provide one, walk away.

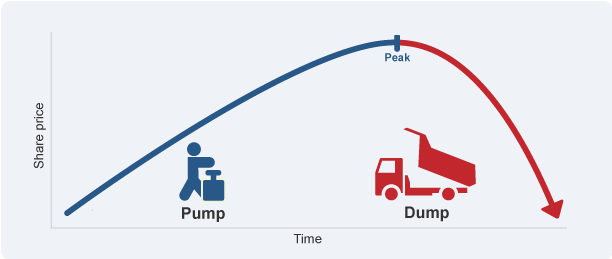

Be aware of Pump-and-dump scheme

If an ICO exhibits pump-and-dump behavior, you should look elsewhere. Pump-and-dump schemes artificially inflate the price of cryptocurrency in order to increase its value. When the price rises and attracts new investors, the original owners sell out, leaving new investors with much lower-valued crypto.

Pump-and-dump schemes are considered fraud and are illegal in the stock market. Investigate who is promoting a cryptocurrency and monitor the price to see if it is a scam.

Celebrity endorsement is not always trustworthy

Celebrity endorsements can be deceptive at times. Floyd Mayweather and DJ Khaled, for example, were both paid to promote a cryptocurrency scam called Centra Tech in 2017, but they did not disclose these payments in their social media promotions.

Assume you’re thinking about investing in cryptocurrency that a celebrity has endorsed. Here’s what you should look for:

- Check to see if the celebrity has a history of endorsing dubious projects or scams.

- Look into the project to see if there are any red flags.

- Seek the advice of an investment advisor for a second opinion.

Celebrity endorsements can be a good way to learn about new investment opportunities, but they should not be your only consideration when making an investment decision.

Small and inactive community

When contemplating an investment in a cryptocurrency project, it is critical to evaluate the strength and activity of the community that supports it. A small and inactive community may show a lack of interest or belief in the project, ultimately leading to its failure.

A large and active community, on the other hand, demonstrates a high level of engagement. It implies that the project is more likely to succeed. As a result, taking into account the size and activity of a project’s community is an essential part of due diligence.

Founder team information is missing

Founder team information is a must to be provided on a project’s official website. If there is little to no information available, the project may be untrustworthy. A team that is unwilling to share personal information about themselves may be concealing something. As a result, it is best to avoid investing in projects with little information on the founding team.

Team members lack of experience

A disorganized or inexperienced team may indicate that they are inexperienced. You’ll want to make certain that the people running the company are capable and have a track record of success.

Look for online reviews and testimonials from other investors to help you with your research. You can also follow the team on social media to see how they interact with the community. Are they unprofessional or do they not take their work seriously?

The source code is not publicly available

Anyone can view, download, and modify the code of an open-source project. The project’s credibility is strongly based on this transparency. A closed-source project, on the other hand, keeps the code hidden from view.

Because of the lack of transparency, it may be difficult to determine whether the project is legitimate. Scams are unfortunately common in technology, and many scammers may attempt to conceal their code in order to avoid detection.

As a result, when considering a closed-source project, you should proceed with caution. If you’re not sure whether to trust a project, choose an open-source alternative instead.

Conclusion

You can avoid becoming a victim of a crypto scam by being aware of some of these red flags. Always do your homework and never invest more money than you can afford to lose.

These are just a few of the factors to consider when evaluating a cryptocurrency investment. If it sounds too good to be true, it probably is, and there are more reliable ways to increase your bank account balance.

BusinessTips.ph is an online Business Ezine that provides free and useful articles, guide, news, tips, stories and inspirations on business, finance, entrepreneurship, management and leadership, online and offline marketing, law and taxation, and personal and professional development to Filipinos and all the business owners, entrepreneurs, managers, marketers, leaders, teachers and business students around the world.

Leave a Reply