A valid photo identification (ID) card is needed and required whenever we do transactions, such as sending and receiving money at Western Union and other money transfer agencies, opening a savings or checking account at different banks, doing other financial transactions with … [Read more...]

What is the Most Business Friendly City in the Philippines?

If you’re a Filipino businessman, entrepreneur, capitalist, investor or just a curious business minded person, you might have asked what is the most business friendly city in the Philippines. Recognizing Philippine cities to be convenient when it comes to opening and registering … [Read more...]

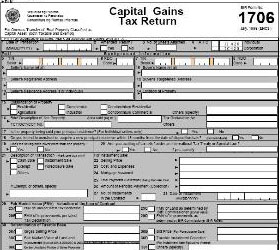

How to Compute Capital Gains Tax on Sale of Real Property

How to Compute Capital Gains Tax on Sale of Real Property in the Philippines? When a person sells real property, classified as “capital asset”, he may be liable for taxes, which include local property taxes, documentary stamp tax and capital gains tax. Capital Gains Tax, as it … [Read more...]

How to Compute Documentary Stamp Tax (DST) on Transfer of Real Property

How to compute Documentary Stamp Tax (DST) on transfer of real property in the Philippines? When we sell or buy real property, we execute a contract or deed of absolute sale, where the selling price, parties, details of property and other stipulations are stated. The deed of sale … [Read more...]

How to Register Land Property in the Philippines

Section 4 of the Presidential Decree No. 1529 known as the Property Registration Decree” states that in order to have a more efficient execution of the laws relative to the registration of lands, geared to the massive and accelerated land reform and social justice program of the … [Read more...]

Tips on How to Detect Fake Land Titles in the Philippines

Land is one of the most valuable assets a person or an entity could have. It doesn’t depreciate and in most cases, its value appreciates over time. Business owners, who own land and building, can already avoid the cost or expense of renting their office or store space from a … [Read more...]

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 23

- Next Page »