Many of our prominent and successful business entities in the country have already established foundations as intensification to their corporate social responsibility. Ayala Corporation has Ayala Foundation; Metropolitan Bank and Trust Company (Metrobank) has Metrobank … [Read more...]

2011 SEC Schedule of Filing Annual Financial Statements

This is a reminder for all corporations whose fiscal year ends on December 31, and are required to file their annual audited financial statements (AFS) with the Philippines Securities and Exchange Commission (SEC) head office. The commission, on its SEC Memorandum Circular No. 6 … [Read more...]

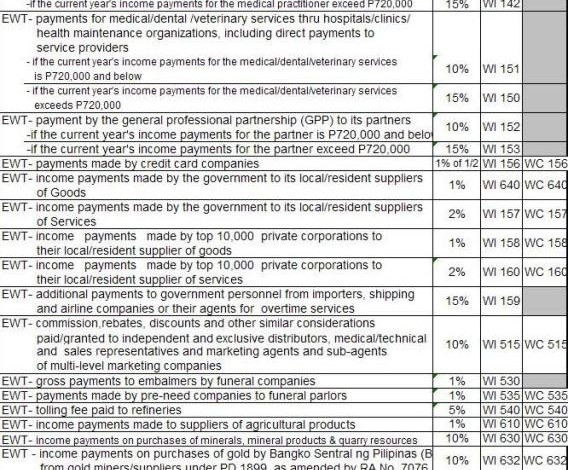

How to Compute Expanded Withholding Tax in the Philippines

How to compute expanded withholding tax in the Philippines? How to file BIR Form 1601-E or the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) return? This is the follow up post on our previous published article titled “Expanded Withholding Tax in the … [Read more...]

Expanded Withholding Tax in the Philippines

Expanded withholding tax on certain income payments and withholding tax on compensation are two of the common withholding taxes you should withheld and remit to the government, when applicable. In turn, the payees of these income payments can claim those taxes withheld as … [Read more...]

How to File Income Tax Return in the Philippines

How to file your annual income tax return in the Philippines? On April 15, 2011, every individual or entity (eg., partnership or corporation), who are required to file their income tax return and or pay their corresponding income tax due and payable should already be done doing … [Read more...]

Timeless Business Tips from the Bible

When it comes to great business tips, I am more confident of those timeless tips that come from eternal sources – the verses from the Bible. Years will pass and generations will change, but the wisdom and insights that are in the Holy Scriptures will not fade. I’ve been reading … [Read more...]