How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s … [Read more...]

Business Taxes in the Philippines

Business taxes in the Philippines can either be Value Added Taxes (VAT) or Percentage Taxes. Furthermore, an Excise Tax can also be imposed on certain taxpayers who are in the course of trade or business as an addition to VAT. Unlike an income tax, which is based on the … [Read more...]

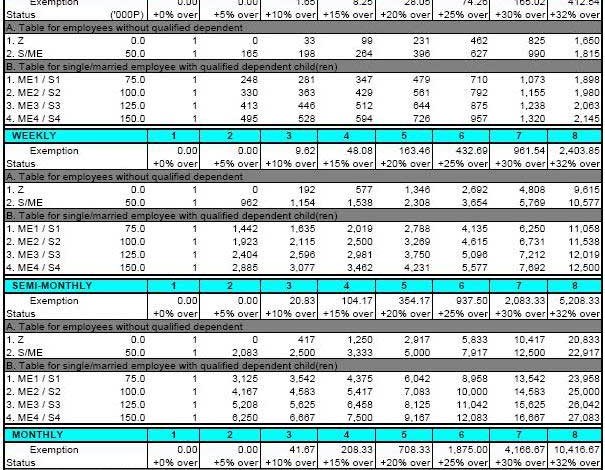

Withholding Tax on Compensation in the Philippines

Tax is the bread and butter of our nation. That is why our government, legislators and the Bureau of Internal Revenue (BIR), strive to improve our tax system for better internal revenue collection. Withholding taxes, such as withholding tax on compensation, expanded withholding … [Read more...]

How to Compute VAT Payable in the Philippines

How to compute Value Added Tax (VAT) payable in the Philippines? Any person or entity who is engaged in trade, business or in the practice of profession may be liable to business taxes. Business taxes can be either a Percentage tax or a Value Added Tax. Furthermore, a taxpayer … [Read more...]

How to Compute Percentage Tax Payable (BIR Philippines)

How to compute Percentage Tax payable in the Philippines? How to prepare and file your percentage tax return with the Bureau of Internal Revenue (BIR) or with an Authorized Agent Bank (AAB)? The following are steps and guidelines in the preparation and computation of percentage … [Read more...]

How to Compute Overtime Pay in the Philippines

How to compute overtime pay in the Philippines? Justice and equality must be served in the workplace. That is why our Labor Code has fixed the maximum hours and days of work, which is equivalent to a maximum of eight (8) hours a day (Article 83, Labor Code of the Philippines) for … [Read more...]