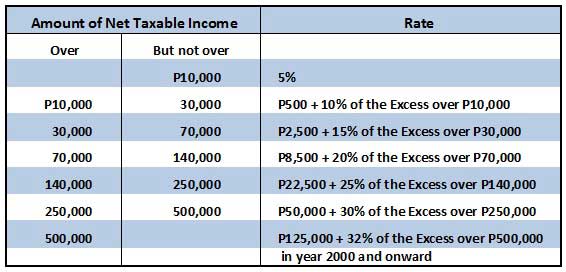

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]

BIR Annual Registration Fee Deadline

When is the deadline for paying our BIR annual registration fee? The BIR annual registration fee, using BIR Form 0605 (Payment Form) should be filed and paid upon registration of your new business and on or before January 31 of every year for renewals. In other words, the BIR … [Read more...]

How to Claim Employees’ Income Tax Refund in the Philippines

How can employees claim their income tax refund? If you are an employee, you may notice that your employer is deducting and withholding a tax amount on your compensation income on a monthly basis. Your employer is just actually complying with the Bureau of Internal Revenue (BIR). … [Read more...]

8 Reasons Why December 21, 2012 is not the End of the World

December 21, 2012 – this is the date of the end of the world said to be based on the Mayan calendar. This doomsday information is spreading on the Internet, on the TV news, and other media - and it is scaring out many people at this moment. Today is already the thirteenth day … [Read more...]

List of Business Permits and Licenses in the Philippines

People do business to make a living, serve their community, and pursue their dreams. It is good to hear a person who’s taking risk to start his or her business, whether small, medium or big. However, the process of starting and registering a business can be one of the most … [Read more...]

How to Get TIN (Taxpayer Identification Number) for Unemployed Individuals

A TIN (Taxpayer Identification Number) is usually given to new taxpayers, such as individual taxpayers (i.e., single proprietors, professionals, employees, and mixed income earners) and juridical taxpayers (e.g., partnerships and corporations). If you fall under those categories, … [Read more...]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 23

- Next Page »