A number of new entrepreneurs find the money matters of starting their businesses among the most difficult and intimidating things they’ll need to go through. Unless it just so happens that an entrepreneur is already well-versed in tax rules and regulations, few will find the … [Read more...]

How to Fill Out BIR Form 1701A for Self-Employed and Professionals

Whether you’re a self-employed individual or a professional, it is a legal duty for every citizen in the Philippines to file an income tax return annually. This is because, according to the law, incomes, regardless of their sources, have corresponding income tax rates. … [Read more...]

Train Law: What We Need to Know on Tax Payments of a Real Estate Property (Infographics)

Early this year, the Philippines government has enacted the Tax Reform for Acceleration and Inclusion (TRAIN) law – a reform initiative that is said to be instrumental to the poverty-reduction and economic development goals of the country. This newly-implemented law has a far and … [Read more...]

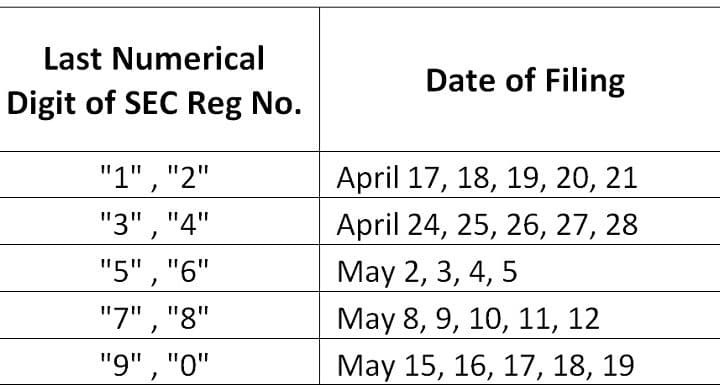

SEC Guidelines and Deadline for Filing Financial Statements in 2017

Section 141 of the Corporation Code of the Philippines requires a Corporation, lawfully doing business in the Philippines, to submit to the Securities and Exchange Commission (SEC) an annual report of its operations, together with a financial statement of its assets and … [Read more...]

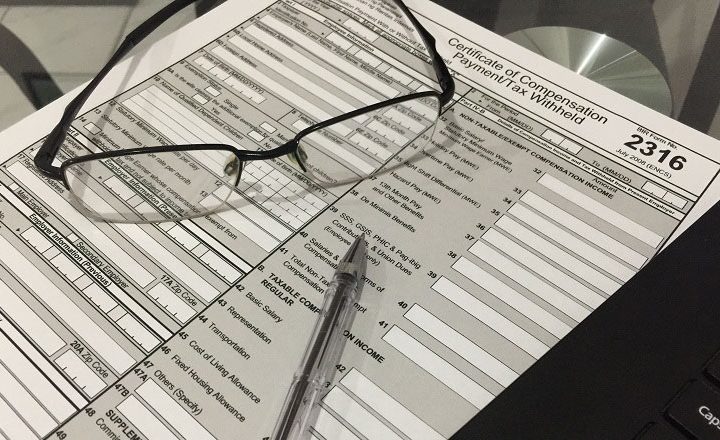

BIR Form 2316: What Employers and Employees Should Know

BIR Form 2316 or Certificate of Compensation Payment / Tax Withheld For Compensation Payment is a certificate issued by the employer to all employees receiving salaries, wages, and other forms of remuneration during the calendar year. It contains the total amount paid by the … [Read more...]

12 Tips for a Smooth Annual ITR Filing in the Philippines

The deadline of regular annual income tax return filing in the Philippines is April 15. Business owners, accountants, bookkeepers, auditors and the tax authorities will begin to feel the tax season's breeze in the coming months. Although it’s still a quarter of a year away from … [Read more...]

- 1

- 2

- 3

- …

- 11

- Next Page »