Expanded withholding tax on certain income payments and withholding tax on compensation are two of the common withholding taxes you should withheld and remit to the government, when applicable. In turn, the payees of these income payments can claim those taxes withheld as … [Read more...]

How to File Income Tax Return in the Philippines

How to file your annual income tax return in the Philippines? On April 15, 2011, every individual or entity (eg., partnership or corporation), who are required to file their income tax return and or pay their corresponding income tax due and payable should already be done doing … [Read more...]

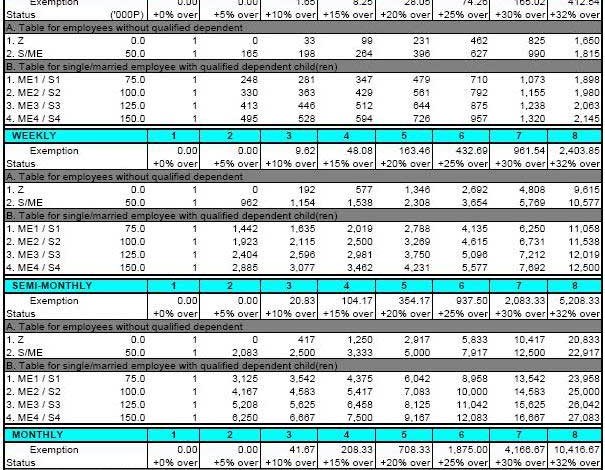

How to Compute Withholding Tax on Compensation (BIR Philippines)

How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s … [Read more...]

Business Taxes in the Philippines

Business taxes in the Philippines can either be Value Added Taxes (VAT) or Percentage Taxes. Furthermore, an Excise Tax can also be imposed on certain taxpayers who are in the course of trade or business as an addition to VAT. Unlike an income tax, which is based on the … [Read more...]

Withholding Tax on Compensation in the Philippines

Tax is the bread and butter of our nation. That is why our government, legislators and the Bureau of Internal Revenue (BIR), strive to improve our tax system for better internal revenue collection. Withholding taxes, such as withholding tax on compensation, expanded withholding … [Read more...]

How to Compute VAT Payable in the Philippines

How to compute Value Added Tax (VAT) payable in the Philippines? Any person or entity who is engaged in trade, business or in the practice of profession may be liable to business taxes. Business taxes can be either a Percentage tax or a Value Added Tax. Furthermore, a taxpayer … [Read more...]