What is a sin tax? Sin tax, as it name suggests, is a tax levied on products or activities, which are considered sinful or harmful and considered as objects of social disapproval, such as liquor, tobacco and gambling. Sin tax or sometimes called sumptuary tax or sumptuary law is … [Read more...]

How to get a TIN ID from the BIR Philippines

How to get a TIN (Taxpayer Identification Number) ID from the BIR in the Philippines? Before you can file your taxes with the government through the Bureau of Internal Revenue, you need to supply your BIR form with a TIN. Likewise, before your employer (if you’re a local … [Read more...]

How to Register with the BIR (for Professionals)

How to register with the Bureau of Internal Revenue (BIR) as a self-employed professional in the Philippines? A self-employed individual can be either a person who is engaged in business (sole proprietorship) or a person who practice his profession. In this article, we will … [Read more...]

Tax Guide Philippines

If you’re looking for an online tax guide in the Philippines, this blog strives to provide you that. We know that taxation is an essential part of doing business. We also understand that it may involve anyone who earns income, whether it’s from business, profession or … [Read more...]

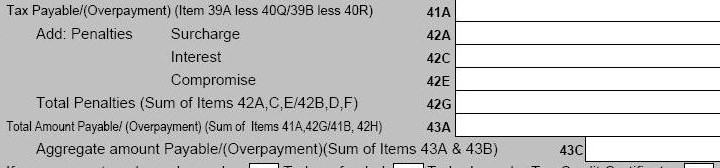

Penalties for Late Filing of Tax Returns

How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But … [Read more...]

Income Tax Computation in the Philippines

This post is a summary of all our published articles related to income tax computation in the Philippines. The deadline for filing and paying your annual income tax return, which is on April 15, is only a few days ahead. That is why I decided to share all of our available tax … [Read more...]

- « Previous Page

- 1

- …

- 6

- 7

- 8

- 9

- 10

- 11

- Next Page »