How to avoid a BIR tax audit? April 15 is fast approaching and you need to make your annual income tax complete, filed and paid before that deadline comes. But though you need to hurry to make it before the due date, it’s still better to be prudent in the preparation and … [Read more...]

What are Deductions and Exemptions to Income Tax (Philippines)

What are the deductions and exemptions you can claim against your taxable income in computing income tax and preparing your annual tax return? The computation for income tax expense and payable for individuals and corporations (including taxable partnerships) differs. Individual … [Read more...]

Deductible Expenses (Allowable Deductions) in the Philippines

April 15 is fast approaching, and if you have taxable income, you need to file and pay your income tax before that due date. In computing your income tax, you need to determine your deductible costs and expenses to arrive at your net taxable income. In doing the computation, we … [Read more...]

BIR Tax Filing and Payment Deadlines (Income Taxes)

People need money to finance their cost of living (i.e., food, clothing, medicine, education, leisure, et cetera). Thus, they strive and work hard to earn such money to cover those expenses. However, in almost every country, especially the Philippines, tax is inherent. Income tax … [Read more...]

20 Tips to Avoid BIR Tax Penalties

Taxes are burden imposed to persons and entities who earn income, engage in business, transfer personal or real properties, and other taxpayers who are required to pay taxes by the National Internal Revenue Code (NIRC) and other applicable laws. If a tax means cash outlay, … [Read more...]

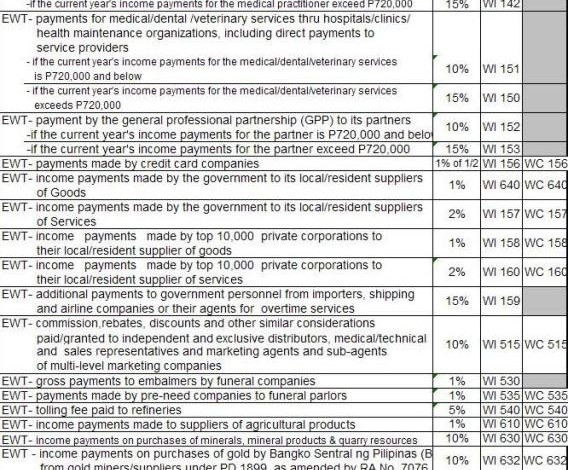

How to Compute Expanded Withholding Tax in the Philippines

How to compute expanded withholding tax in the Philippines? How to file BIR Form 1601-E or the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) return? This is the follow up post on our previous published article titled “Expanded Withholding Tax in the … [Read more...]

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- Next Page »