BIR Form 2316 or Certificate of Compensation Payment / Tax Withheld For Compensation Payment is a certificate issued by the employer to all employees receiving salaries, wages, and other forms of remuneration during the calendar year. It contains the total amount paid by the … [Read more...]

12 Tips for a Smooth Annual ITR Filing in the Philippines

The deadline of regular annual income tax return filing in the Philippines is April 15. Business owners, accountants, bookkeepers, auditors and the tax authorities will begin to feel the tax season's breeze in the coming months. Although it’s still a quarter of a year away from … [Read more...]

23 Tips for the Preparation of Annual Income Tax Return (ITR) in the Philippines

Individual and corporate taxpayers in the Philippines, who are required to file and pay their annual income tax return, should be done fulfilling their obligation on or before April 15, 2015 to avoid penalties for late filing. With three months time remaining (as of this post) … [Read more...]

Tax Tips for Small Businesses in the Philippines

Unlike large companies and corporations, small companies and micro businesses may not afford to establish a tax and accounting department or hire accounting firms to do the tedious tasks of taxation, accounting and bookkeeping for their business. That is why they sometimes have … [Read more...]

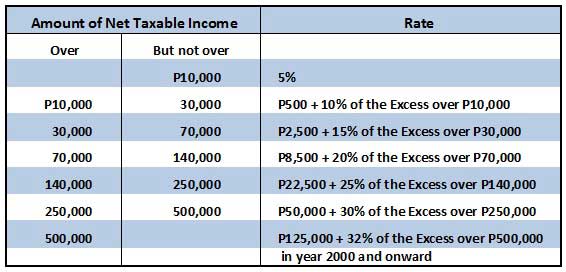

What are the Income Tax Rates in the Philippines for Individuals?

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]

BIR Annual Registration Fee Deadline

When is the deadline for paying our BIR annual registration fee? The BIR annual registration fee, using BIR Form 0605 (Payment Form) should be filed and paid upon registration of your new business and on or before January 31 of every year for renewals. In other words, the BIR … [Read more...]