There is only one week left until April 15 is here – the deadline for annual income tax filing. If you are already done filing your income tax return with the BIR, then congratulations for making it earlier than the due date. For others who have not yet filed their income tax … [Read more...]

Tax Tips for Income Tax Filing and Preparation in 2012

In a few months from now, we will be filing our annual income tax return for the calendar year 2011. In the Philippines, income tax returns for the taxable calendar year are to be filed on or before the 15th of April. Since April 15, 2012 will fall on Sunday, we can assume that … [Read more...]

How to Register with the BIR (for Professionals)

How to register with the Bureau of Internal Revenue (BIR) as a self-employed professional in the Philippines? A self-employed individual can be either a person who is engaged in business (sole proprietorship) or a person who practice his profession. In this article, we will … [Read more...]

Tax Guide Philippines

If you’re looking for an online tax guide in the Philippines, this blog strives to provide you that. We know that taxation is an essential part of doing business. We also understand that it may involve anyone who earns income, whether it’s from business, profession or … [Read more...]

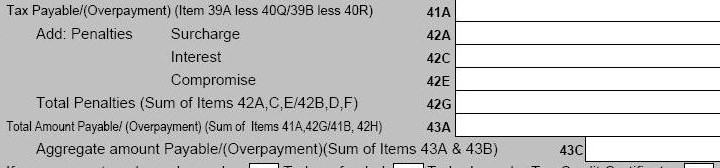

Penalties for Late Filing of Tax Returns

How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But … [Read more...]

Income Tax Computation in the Philippines

This post is a summary of all our published articles related to income tax computation in the Philippines. The deadline for filing and paying your annual income tax return, which is on April 15, is only a few days ahead. That is why I decided to share all of our available tax … [Read more...]