If you sell items on eBay, Etsy, on your own website, on online forums or other marketplaces on the Internet, your customers may choose to pay you using their credit cards. This may also be the same case if you’re a skilled worker who provides professional services online, your clients may also prefer to be charged through their credit cards.

If you sell items on eBay, Etsy, on your own website, on online forums or other marketplaces on the Internet, your customers may choose to pay you using their credit cards. This may also be the same case if you’re a skilled worker who provides professional services online, your clients may also prefer to be charged through their credit cards.

PayPal, a subsidiary of eBay, Inc., is a global ecommerce business that allows anyone to pay and get paid online. It is one of the most widely used online payment gateway worldwide. PayPal is available in 190 markets and 24 currencies around the world. It enables global ecommerce by making payments possible across different locations, currencies, and languages.

If you want to receive credit card payments from your customers online, PayPal may be just the easiest and most convenient way to use. If you will browse classifieds online or check items to buy at various online stores, you will most probably see a PayPal button option for payment. Online stores, Internet professionals, and even charitable websites use PayPal to accept payments or donations online.

Here are some tips and guidelines on how you may start to accept credit card payments online using PayPal:

Signup for a PayPal premier or business account

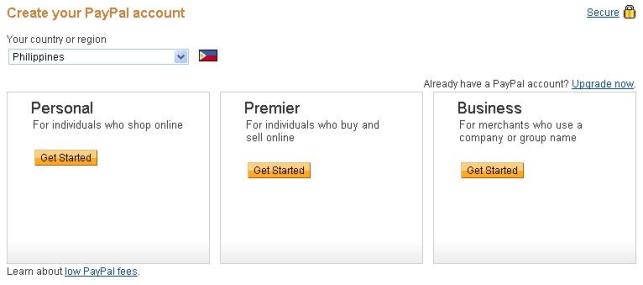

Go to PayPal website and create a Premier or a Business PayPal account. There are three types of PayPal account, namely, personal, premier and business.

Personal account is recommended for individuals who shop and pay online, or wish to send or receive personal payments for shared expenses such as splitting of dinner bills or rental charges. If you are a regular seller online who wants to receive payments online, this account is not recommended due to higher transaction rates and unlimited capabilities.

Premier account is recommended for casual sellers or non-businesses who wish to get paid online, and who also make online purchases.

Business account is recommended for merchants who operate under a company/group name. It offers additional features such as allowing up to 200 employees limited access to your account and customer service email alias for customer issues to be routed for faster follow-ups.

All these PayPal accounts actually allow you to send and receive payments. However, it is not recommended that regular sellers open a Personal account to receive online payments, as the transaction fees are higher and only premier and business accounts can accept unlimited credit card or debit card payments.

Verify your PayPal account

Get your account verified to improve your PayPal reputation and free yourself from limitations. Once you’re verified, you can:

• Send and receive money as much and as often as you like

• Boost your credibility with buyers and sellers worldwide

• Send payments instantly from your bank account

• Take advantage of exclusive services such as PayPal Seller Protection

• Getting Verified Means More Security for You

You can verify your account by adding your bank account or by adding a credit card.

For the first method, just add and confirm a bank account. PayPal will send your account two small deposits. Enter these deposits on the PayPal website. Answer a quick confirmation phone call from their third-party authentication service to validate your information, and you’re all set.

To get verified using your credit card, provide them with your info. They’ll make two small charges to your card. Return to PayPal and enter those charges along with the adjacent code as they appear on your credit card statement. PayPal reimburse you for the charges and you’ll be verified.

In the Philippines, if you don’t have a credit card, you can use Unionbank’s EON Debit Card to verify your account. The EON VISA Debit Card works just like a credit card.

Remember that the verification process may be different from countries to countries. In the US, a Verified member has either added and confirmed a bank account with PayPal or received approval for a PayPal Plus credit card. To learn more about PayPal’s verification process, please read PayPal’s verification FAQ.

Use PayPal’s merchant services

After verifying your premier or business account, go to PayPal’s Merchant Services/Tools to accept credit cards, bank transfers, debit cards, PayPal funds and more. PayPal has the following 3 solutions to meet your online business needs.

1. PayPal Website Payments Standard – This is an easy, quick way to start accepting credit cards online. A simple integration into your shopping cart allows your customers to pay securely and easily.

2. PayPal Email Payments – This is an easy, quick way to start accepting credit cards online. A simple integration into your shopping cart allows your customers to pay securely and easily.

3. PayPal as an Additional Payment Option – Give your customers another way to pay by adding PayPal.

With PayPal Website Payments Standard, you can create the following payment buttons on your website:

• Add to Cart button – Sell multiple items at a time (free PayPal shopping cart available).

• Buy Now button – Sell one item at a time.

• Subscribe button – Collect recurring or subscription fees.

• Donate button – Accept credit card and bank account donations on your website or via email.

• Buy Gift Certificate – Sell your own, personalized gift certificates on your website.

To create a PayPal payment button, just choose a button type and enter your payment details. You may also optionally track inventory, profit and loss, and customize advanced features.

PayPal Payments Standard has no setup or monthly pay. However, PayPal will charge you per transaction. To see the updated merchant fees, please visit this page.

Personal Note

I’ve been using PayPal for a couple of years now to send and receive money online. I’m using a premier account, which is verified through a Unionbank EON Debit card. With this, I can accept payments from clients for my professional services online. This is also what I am using to receive payments from direct advertisers on this blog. For me, PayPal is a very convenient way to shop on the Internet, do business with online clients, and perform other transactions online.

Disclaimer: This article includes links to affiliate programs, which may give us commission for referrals.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Just make sure that you are receiving payment from a reputable or a person that can be trusted. I had a very bad experience in receiving payment via paypal.

That’s right. There is no perfect solution. That is why we need be cautious on who are we dealing with. We must first check our clients if they have verified account, information, and credit cards. We have to deal business with people that we only trust. If you are selling goods on the Internet, it is advisable that you see to it that the tangible goods are delivered to the buyer and that is stated in the transaction to ensure that you, as the seller, is protected. Sorry for the removal of link, since it is against the comment policy. 🙂

When will we get Paypal Here?

I am looking for solutions in the philippines that allow

1) On-website credit card processing.

Shopping cart abandonment rates increase when you increase the number of steps involved in the checkout process OR when you take your customers OFF your website to make their payment (like what paypal standard does). Paypal offer “Payments Pro” for USA customers, but not filipino. Not everyone likes to use Paypal, so when you force shoppers to use Paypal (regardless of whether they do or do not have an existing paypal account) you lose sales.

Also, with Paypal standard, your customer cannot specify a PO box as the delivery address. We have customers in rural (province) areas that can only receive goods through delivery to a post office (box). This means we lose those sales too.

2) A virtual credit card terminal.

We accept telephone orders and currently PayPal Philippines do NOT offer any virtual terminal service to take payments over the phone.

3) Recurring payments

We have clients that pay a monthly service fee. Currently all I can read on PayPal for Philippines is setting up a recurring buy button on a website. There is nothing about setting up a recurring billing option in the back end of your paypal account.

Also finding it very hard to find a bank in Philippines that can offer a merchant account (one that will tie in to our existing shopping cart)

Any comments appreciated.

I’m curious. When you said you’re accepting cc payment via paypal (verified by an EON account), do you mean to say you do not have a merchant account with Unionbank? just a regular eon account that you used to verify your paypal account?

Thanks for the reply

do you know a free virtual terminal?

It works really well for me