How to compute expanded withholding tax in the Philippines? How to file BIR Form 1601-E or the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) return? This is the follow up post on our previous published article titled “Expanded Withholding Tax in the Philippines”, where we’ve discussed its definition, nature and the individuals or entities who are required to file the expanded withholding tax returns.

As we tackled in our previous article, Expanded Withholding Tax is a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of the payee for the taxable quarter or year in which the particular income was earned. If you are engaged in business, you need an office or commercial space, but you don’t own a land or building, you definitely resort into renting. Thus, you become a lessee and pay rental expense to your lessor. In this case, you become a withholding agent who shall withhold tax on the rental payment you pay to the lessor.

Companies and businesses also often need to outsource services from professionals, such as Certified Public Accountants, lawyers, engineers, architects and software programmers. When this happens, they also need to withhold expanded withholding tax on the income payments they pay to those professionals through monthly filing of BIR Form 1601E and annual submission of BIR Form 1604E (Annual Information Return of Creditable Income Taxes Withheld (Expanded)/ Income Payments Exempt from Withholding Taxes). In return, the professionals and the lessor above can claim the taxes withheld as creditable taxes which they can deduct against their income taxes due for the corresponding taxable quarter or year. They can do that by asking for BIR Form 2307 (Certificate of Creditable Tax Withheld at Source) from the withholding agent and attaching it to their income tax returns.

How to Compute Expanded Withholding Tax

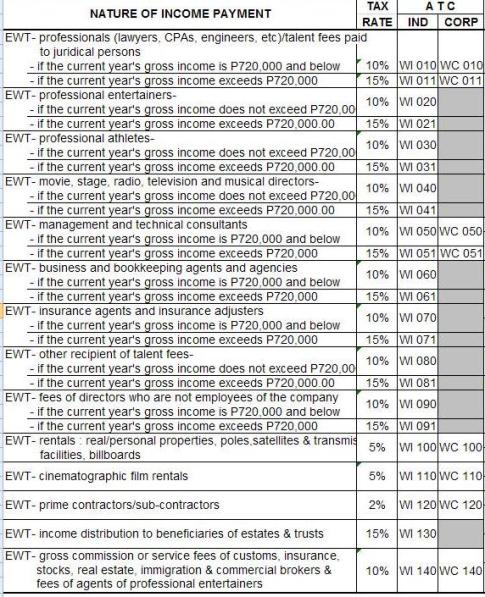

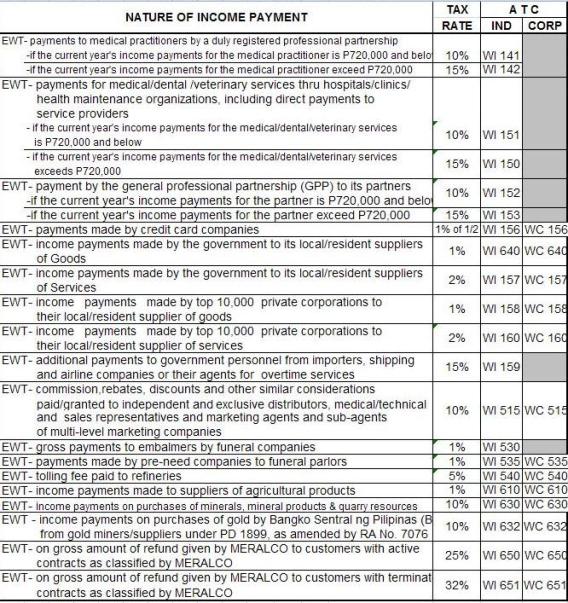

The calculation of expanded withholding tax is simpler than the computation of withholding tax on compensation. Expanded withholding tax is computed using the fixed rates imposed on different natures of income payments as shown below:

Expanded Withholding Tax Rates as shown on the back of BIR Form 1601E

Sample Computation of Expanded Withholding Tax

Let’s assume Company A is paying a gross monthly rental of P20,000 to Mr. B for the office space rented by Company A. What is the monthly tax that should be withheld and remitted to the BIR by Company A?

Answer:

The nature of income payments paid by Company A belongs to rentals, which include real/personal properties, poles, satellites & transmission, facilities and billboards (please refer to the tax rate schedule above). This type of income payment has a tax rate of 5%. Hence, the computation of tax to be withheld is as follows:

EWT= Income payments x tax rate

EWT= P20,000 x 5%

EWT=P1,000

Computation of expanded withholding tax is easy as you only refer to the tax rates table above. Now let’s try for our own actual computation.

How to file BIR Form 1601-E

Below, are the requirements and procedures of filing the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded).

Documentary Requirements

1.Return previously filed and proof of remittance, if amended return

2. Monthly Alphalist of Payees (MAP)

3. For advance payment, BIR Form No. 0605

4. Tax Remittance Advice (for NGAs)

Procedures

1. Read instructions indicated in the tax return.

2. Accomplish BIR Form No. 1601-E in triplicate copies.

3. If there is tax required to be remitted:

a) Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you are registered or taxpayer concerned is registered and present the duly accomplished BIR Form No. 1601- E, together with the required attachments and your payment.

b) In places where there are no AAB’s, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered or taxpayer concerned is registered and present the duly accomplished BIR Form 1601 E, together with the required attachments and your payment

c) Receive your copy of the duly stamped and validated form from the teller of the AAB’s/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

4. If there is no tax required to be remitted:

a) Proceed to the Revenue District Office where you are registered and present the duly accomplished BIR Form 1601 E, together with the required attachments.

b) Receive your copy of the duly stamped and validated form from the RDO representative.

Deadline

Filing Via EFPS

Group A – Fifteen (15) days following end of the month

Group B – Fourteen (14) days following end of the month

Group C – Thirteen (13) days following end of the month

Group D – Twelve (12) days following end of the month

Group E – Eleven (11) days following end of the month

Note: The staggered manner of filing is only allowed to taxpayers using the Eletronic Filing and Payment System (EFPS). Please refer to RR No. 26-2002 for the groupings of taxpayers based on the industry classification.

Payment Via EFPS

On or before the fifteenth (15th) day of the month following the month withholding was made, except for taxes withheld for the month of December which shall be paid on or before January 20th of the succeeding year

Manual Filing and Payment

On or before the tenth (10th) day of the month following the month the withholding was made, except for taxes withheld for the month of December which shall be filed and paid on or before January 15 of the succeeding year

Disclaimer:

New and subsequent BIR rulings, issuances, memorandums and or laws may render the whole or part of the article obsolete or inaccurate. Furthermore, there may also be other relevant information that have been missed to include in this article. For more information, please visit the Bureau of Internal Revenue (BIR) website.

Source:

BIR Income Tax information on withholding tax

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi Sir,

Pls help me, im quite confused regarding EWT on supplier or goods and services, do you mean that if for example im one of the top 10,00 corporation does it means that i’m automatically w/hold 2% (for services), 1% (for goods)to supplier?

Many Thanks

Hi Sir,

What if in this scenario, for example my company belongs to top 10,000 corporation and i purchased some goods and services to my supplier, does it means i’m automatically less 1% and 2% to goods and service provider respectively?

Thanks

Hi Ted,

Top 20000 corporations are required to withhold a tax of 1% or 2% on all its purchases of goods and services that are not covered by specific rates of withholding, as amended by new tax laws and issuances. This means that as a withholding agent, you will withhold 1% or 2% on your income payments to local/resident suppliers other than those covered by other rates of withholding. This further means that you will less 1% or 2% to your income payment to those suppliers, then you will remit those 1% or 2% to the BIR by filing expanded withholding tax returns.

RR No. 3-2009 amends further RR No. 9-2001 by expanding the EFPS coverage to include the top 20,000 private corporations duly identified under RR No. 14-2008

how to compute a CWT to a government agency? or to company owned by government? is it =gross/1.12*.01 or .05?

Hi!

I have question regarding the basis of expanded wtax if service is rendered to a nonVAT entity. the billing amount is VAT inclusive and net of wtax. Based on my knowledge, nonVAT entity does not recognized input VAT, so it will recognized expenses inclusive of VAT charges, so what will be the basis now of there wtax?

the computation of the wtax is always based on the invoice amount NET of VAT, assuming the company for which we are paying is VAT registered entity. Consequently, the computation of the wtax from payment to NON-VAT entities will be the gross invoice price.

Hi Vic,

Excellent article! I’ve been looking for some resource about this since I went ahead and signed-up to be a VAT-registered person. I’m interested in this because as a real estate broker, I can have salespersons under me whom I will pay commissions to. However, the market practice by developers is to already deduct the 10% withholding tax from the commission before they pay out. If this is the case, I will no longer need to file 1601-E myself, I just need to ask the developer to furnish me with form 2307, right? Another question is, what and where do I find the Monthly Alphalist of Payees?

Thanks again, I hope you come out with an article about VAT, too! Hope you’ll find time to answer these two questions I have 🙂

What is the tax consequences of a Domestic Corporation renting a property from a foreign Corporation? Will the domestic corporation with withheld a? If Yes? Where will the domestic corporation remit the tax withheld?

Joe, as a rule it is subject to withholding tax if the property is used in Phils and the rate will depend on the nature of the property – 7.5%, 4.5%,30%. Thanks.

Hi Vic,

I’d like to know your interpretation on these provisions in the lease contract.

a) “Monthly rent is P100,000 inclusive of VAT & w/h tax”.

b) “Monthly rent is P100,000 inclusive of VAT & exclusive of w/h tax”.

c) “Monthly rent is P100,000 inclusive of VAT & net of w/h tax”.

How much would be the net payable/income in the following cases?

(note: vat = 12%, w/h tax = 5%)

Thanks for the help!

Please tell me your actual case and purpose of computing.

I’d like to receive P100,000 as rent including all taxes and used provision A in this case.

However, tenant only issued check for P95,535. They interpreted it as P100,000 inclusive of vat. How about the w/h tax provision in case A?

So I’d like to know which of the following provisions will lead me to receiving P100,000.

100,000/(1.12-.05) = 100,000/1.07

basic rent =93,457.94 W/T 5% =4,672.90

VAT 12% 11,214.95

less W/T (4,672.90)

Total 100,000

provisions a,b&c will only lead you to a check amounting to 95,535.71.

provisions on rent should be 93,457.94 exclusive of VAT or 104,672.90 inclusive of VAT.

We are renting a space from a lessor amounting to P20,000. In the agreement it is the gross amount that we have to pay monthly and no stipulation on the VAT. Is it right to assume that the rent amount is already inclusive of VAT?

I computed the EWT based on net of VAT of P20,000 which is P17,857.14

EWT is 5% of P17,857.14 and not 5% of P20,000. Is it correct?

Yes Rose, I agree the P20k is inclusive in the absence of stipulation int he Lease Agreement. I go with your computation above. Ask them to issue O.R. with VAT shown separately.

how about if the lessor is not a BIR registered individual and doesn’t want to pay taxes? Our company uses a residential house as an office and we are paying 70, 000 per month. Do I need to file EWT? Is 70000 has VAT? No OR is being issued by the lessor because they do not have Official receipts. They just give us acknowlegment receipt instead. Is this valid? Please reply. thank you.

Sir, wala sa Cert of Registration ko ung EWT, but I’m VAT-registered and a professional.

1. Am I still required to file 1601-E monthly like VAT even if no payment?

2. May I ask the developer I’m working for to not withhold 10% of my commission? Instead, I will directly remit it to the BIR AAB instead?

Thanks!!!

Hi Jon, your developer is mandated by the tax code to withhold EWT on your prof income. Thus,if they won’t remit, they will be penalized by the BIR. It’s your developer (the withholding agent) who will file EWT and remit it to the BIR. What you should do is to ask for certificate of creditable withholding tax (BIR form 2307) to claim the withheld income to your tax payment. No need to worry if they will withhold your income. It’s just like you are paying tax in advance so that you will not have trouble in paying your tax cumulatively.

Hi Sir Vic

I just what to know on how the non-vat reg. dealing with the EWT in payment of their

sub. con. is it the gross amount inclusive of vat or the net of vat the basis of the computation of the 2% EWT.

thank you

Hi Rye. Withholding tax is always based on an amount net of VAT because it is based on income and tax remittable to the government like VAT is not an income on the part of the recipient.

Hi Sir. I want to consult about EWT too. I have a non-VAT sole proprietorship business on food manufacturing. One of our clients ask us EWT. I understand that as a payee, I could use it as a income tax credit. But the thing is, we’re registered as a BMBE, thus exempted from income tax. How are we supposed to gain back the EWT we paid? Thanks alot.

Hi Vin. Yes, as a BMBE, your income is not subject to withholding tax because withholding withholding tax is a n advance collection of income tax so there is nothing to advance. Either you get back to your payor and refund or get if from the Bir or forfeit and charge to experience if the amount is not material.

what does Prime Contractors/ Sub Contractors mean? please give me examples of service activities that qualifies to this category. thanks.

Examples: general engineering contractors, general building contractors, specialty contractors, and other contractors like:

-Filling, demolition and salvage work contractors and operators of mine drilling apparatus

-Operators of dockyards

-Persons engaged in the installation of water system, and gas or electric light, heat or power

-Operators of stevedoring, warehousing or forwarding establishments

-Transportation Contractors

How about a company hired the management of a certain establishment to provide services like measuring the experience and satisfaction of its customers with its products and testing how their employees actually relate and deal with their customers, is it considered to be a prime contactor?

i mean, ” a company hired BY the management….”

Hi,

Good evening.

I want to ask regarding the services of a CPA, doing bookkeeping for a client. example, her salary for the part time bookkeeping is Php 2000.00, is this service covered by withholding tax? how many percent?

Thank you so much!

If working as an individual, 10% if he can provide an affidavit received by BIR that its gross income during the year does not exceed P720,000, otherwise, use 15%. If a corporation, use 15%, but if a general professional partnership, no withholding. Thanks

hi Sir Vic,

I just wanna ask how will I reconcile the discrepancy in the computation of tax withheld…here is the scenario my co-worker used 5% instead of 2%….how will I deal with this….thank you so much…..and hoping for you reply….

You may just let it go, if not that material. Otherwise, tax credit or refund are options.

Hi Sir,

What are considered prime contractor/sub contractor?

Thanks,

Hi Sir,

I have confusions in withholding tax can you help me where website can I visit regarding the definition of each nature of payment classified on the expanded withholding tax.

thanks,

I suggest you visit Revenue Regulations No. 2-98, as amended, for further reference. Thanks.

Good day! I just want to ask how i should file my annual itr. I’m taxed as a professional at 10% but when i annualize my income and compute for tax due, i end up with a tax refund. Will this refund be due from the BIR or my employer?

Are you employed or not? Anyway, just get the creditable withholding tax certificate for your 10% withheld income (BIR form 2307). Then claim it as credit and attached it to your income tax return when you compute and file your income tax. I assume what you mean by your employer is the company who withheld 10% of your income. IF they withheld that way, you are not considered their employee, but a supplier of your professional services.

In your sample above. In which I am Company A. I paid the Tax withheld and I am the lessee.

Is the payment made by the lessee for the tax withheld will be later deducted to the lessee’s annual income tax due? or from the lessor’s annual income tax due?

The rent is an income of the lessor. So the withheld tax on rent income is creditable to the lessor’s income tax. The lessee, although he/she is the one who file/remit the withholding tax to the BIR, he/she only serves as the withholding agent. It is the lessor’s income that is deducted and withheld. Moreover, the rent will already reflect as rent expense in the books of the lessee.

When to recognize CWT, upon purchase or during payment? Thanks!

Upon payment and should be supported by Certificates.

Hi Vic,

Are PLDT, Smart, Globe and Meralco are included for 2% expanded w/holding tax.

If they are included how to compute esp. Meralco. Thank you.

Yes, they are if you are a top twenty thousand corp (TTC). 2% simply multiplied by the amount of billing excluding VAT.

Hi Sir Vic,

Just wanted to know which is the proper form to use for a person registered as a Marginal Income Earner but has earned an income exceeding 100,000 in the last taxable year. Furthermore, he does not have any compensation income but only rental income from personal properties.

Appreceiate your response regarding my query. Thank you!

Hi Christopher. It is not proper because government will be deprived of the taxes due on the transaction. His level of income will define whether it is a marginal income earner or not. Being in the leasing business places him in a position similar to those engaged in trade or business. BIR Form 1701 may be used for income tax purposes.

if payment is to a lawyer, what does “current year’s gross income is less than P720,000” mean? whose gross income are we referring to? the gross income of the lawyer or the gross income of the payer?

It is gross income of the lawyer. If the lawyer could provide a Certification duly received by the BIR that his gross income does not exceed P720k, then, use 10%, otherwise, use 15% withholding tax rate.

where’s is my post about accrual of expenses and withholding taxes?

good day.

our agency is hiring contractual personnel doing the encoding services. they are around 52 contractual earning wages of around 350 pesos for three months. Most of them are fresh graduates. are we going to withheld 2% EWT from their wages? thanks

good day.

our agency is hiring contractual personnel doing the encoding services. they are around 52 contractual earning wages of around 350 pesos per day for three months. Most of them are fresh graduates. are we going to withheld 2% EWT from their wages? thanks

I believe it should be withholding tax on compensation, 5-32%, unless they fall under minimum wage earners who are exempt from tax.

thank you

Hello Sir,

MY question is, under the EWT-professionals are “talent fees paid to juridical persons” the question is when do we consider the act as a talent as against if its a service being rendered only?

Like in the case of a cameraman, if we avail his service one time only do we consider it under talent fees subject to 10% or as service subject to 2%? What is the difference?

thanks

Correct me if I am wrong but all talents and professionals are service providers. What distinguish talent or professional fee from a simple service is the degree of learning or intellect required to the service, either licensed or not.

do purchases below 10,000 pesos subject to expanded withholding tax of 1% for goods and 2% for services? Our agency purchased services in the amount of 780 pesos. should i withhold any tax? tnx.

Hi Carl, the rule you are referring applies to top twenty thousand corporation (TTC). As a TTC, the P780 is subject to EWT, if from a regular supplier, otherwise, it a casual purchase, the same is not subject because less than P10k.

Sir I have searched the internet but I am not convince with the explanations I read. What is the difference between Income Tax Withheld – deffered & Income Tax Withheld – current.

I just want to ask about withholding goods and services thing..our bookkeeper taught us this way:

Amount to be paid divided by 1.12 x 0.01 or 0.02 = the Tax withheld Payable is this correct? and for the rentals is just the Amount to be paid x 0.05? I am really confuse because on rentals she did not divide it by 1.12 how’s this be going? is 1.12 necessary?

I just want to ask what is the basis of computation of withheld tax by a medical practitioner if she is VAT registered or we will directly compute it by just 10% or 15% regardless of her tax type? Thanks.

Hi,

Just want to ask regarding the expanded w/tax remittance of Meralco, PLDT and Globe and Smart? Do you mean that I will not pay the gross amount in the Billing? I will deduct the amount of w/tax when paying? but that would be consider as lack of payment right? Can you please help me with this I’m confused?

Thanks..

Are there instances when professional fee is exempted in EWT or no need to file for EWT?

we are const. com. our client withhold in their downpayment (ex 19 million ewt2%-339285.71, when it comes the 1st billing to the client their basis in computing the etw is billed price in this connection they deduct recoupment of downpayment.is this correct?not after the recoupment & retention?. my computation is billing price- recoupment-retention=based of withholding tax. they mde like this(1st billing price 10000000/1.12=8928571.48)(w tax 8928571.43 x 2% 178571.43).but me (1st billing price 10,000,000.00-recoupment 2,500,000.00-retention 500,000.00=7,000,000.00/1.12=6,250,000.00 withholding tax 2%=125,000.00)compared to their computation(the client) ther is overwitholding of 53,571.43.is right that before the last billing they will adjust the w tax?.pls help me regarding this problem.thnx in advance

Who is responsible for paying EWT for the sale of a condo unit (seller or buyer)? Or does this only applies to renting of a property not of a sale?

If the seller’s acquisition cost of the unit is P2.8M and his selling the condo for P4.1M, is it fair to assume that the EWT should be computed based on the difference of the total cost of the sale and the acquisition cost. In this case P4.1M – P2.8M = P1.3M.

P1.3M x 5% = P65,000 EWT

Are VAT exempt transactions subject to Expanded Withholding Tax?

Thank You!

Good Day sir.

pasensya po kung tatagalugin ko .

panu po kung hindi nasama ung 2307 na form sa april 15 na deadline? hindi ko po kasi napadala agad sa supplier namin. na msplaced po kasi ung form. nung hinabol ko na po mabgay. late na po. tapos na gawin ng accountant daw po. ano po b mangyayare kung ganun po? ang worth po ng 2307 is almost 150k ;(

natatakot po ako. wala po akong ganung pera. isang secretary lang po ako na nagkamali. at natuto sa ngayon.

lubos ko pong tatanawin na utang na loob ang iyong pag sagot. maraming salamat po. Godbless.

Hi Izha. If the 2307 was not claimed during your income tax filing, your income tax payable was overstated. Meaning, the income tax you paid is more than the actual payable. What you can do is to amend the income tax return, and in that amended income tax, claim the 2307 so that the correct tax payable will be reflected. Taxpayers have the right to amend their income tax as long as there is still no Letter of audit served by the BIR.

thankyou so much sir. pasensya po sa abala. ang problema po. ayaw na i amend ni company A . kasi daw po mag iisip si bir na may tinatago si company A . kasi pabago bago. amend ng amend.

kaya iniiwasan nila mag amend.

pero actualy po db in favor sa bir kasi mas malaki macolect nila?

ang nangyare,, c company A sinisingil po kame kasi daw po imbis na mbwasan ung bayad nila. lumaki kasi hindi sakanila nabigay agad ung 2307 po. thankyou po talaga. sana po makakuha po ulit ako ng reply. Godbless.

It should be amended to reflect the 2307 for that period. Yes, BIR has collected in excess, since you’ve paid in excess in the amount that should be credited by the 2307. 2307 is supposedly to be credited on the period/year they are paid. I am not sure if BIR will allow the 2307 to be claimed on the succeeding year. I suggest you personally visit and inquire BIR for this matter.

Hi!

We are leasing an office space and the lessor charges us the electricity and water charges based on meter readings (we pay to the lessor and not directly to Meralco or Manila Water). Should we deduct 2% on the billed amount of the lessor?

By the way, we are PEZA registered and included as TTC.

Do you know of the exact ruling or regulation, so that we may have a reference. Thank you very much.

Hi Hazel. I think RMC 72-04 has the answer if I recall it right and it says yes, withhold based on gross. Just check it out. Thanks.

Thank you Sir! Yes, I found the answer in RMC 72-04. =)

Hi Sir,

I have a question on deadline. Currently we follow manual Filing and Payment.

Today is July 03, 2012. I received rental billing covering June 01-30, 2012 due on July 7, 2012. When should be the remittance of EWT to BIR ? Is it on July 10, 2012? Or on August 10, 2012.

Thank you.

Rex

Sir,

I have applied for BIR registration for my business. I just got my business permit last month and the contract of lease of the rented space started last September 2011. They said that there is already a penalty for it. How much would it be? (rough estimate)

In our lease of contract there was no stipulation as to taxes…Will there be any withholding tax?

Thanks

Hi Sirs/Ma’am:

Good day! I am working in an NGO and this is my first job. Their current practice is to withhold suppliers/service providers whether they are regular (suppliers) or not for every 10,000.00 and above invoices as per advise of BIR years ago. I was trying to look for any article/BIR rulings for this practice however I was not able to find one. In this case, less than 10,000.00 invoices are not withheld for taxes, even though they are regular suppliers. Is our practice safe/acceptable?

Thanks.

James

Good day, i am working in a government institution. i just want to ask if what is the EWT of educational materials like books, journals, etc.? could you please provide me a circular about this.

im inquiring about this one because our supplier is questioning us if what is our basis in deducting EWT 1% when we purchase a journal. i open the website of BIR but i found nothing about it.

thanks

just to clear it out please. As a lessee, are we the one who’s filing the 1601-E and we are the ones who will pay the 5% to BIR? How can we get it back? Can we deduct it from the payment of rent to lessor? thanks

if a corporation has an inventory of real estate – some are hlurb approved (as in a developed subdivision) and some are commercial property and some residential properties not in an approved subdivision, which applicable tax can be applied to a sale? I understand that if a subd. is approved then EWT is used, however, if a corporation is a dealer or habitually engaged in real estate transaction, it is not correct to use the expanded witholding tax ? if for the sake of argument, the corporation is required to pay capital gains – meaning to treat the asset as a capital asset (when it is not) do I have to include this in my sales and subject to income tax? is this not double taxation?

thanks in advance

Sir, nababayad po kasi kami ng 65,000 as lessee inclusive expanded withholding tax of 5%. Paano po presentation sa 2307 form nun? thanks po

Hi,

Applicable po ba ang EWT sa dividend?

tia

Hi John. final withholding tax or FWT is applicable for dividends.

When a contract says that a fee is exclusive of withholding tax. Does that mean you need to gross up the amount to get the EWT due? Which one is correct:

Fess is 120,000

a) EWT = 120,000 x EWT rate

b) EWT = 120,000/(1-EWT rate)x EWT rate

We believe Letter (b) is correct Yohko.

Will a Company be required to withhold tax on its income payments to its suppliers for the purchase of materials like rebars and cement considering that the Company is not one of the top 20,000 corporations listed by the BIR?

Hi She, we believe its a no. Please seek confirmation with the BIR.