How to compute expanded withholding tax in the Philippines? How to file BIR Form 1601-E or the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) return? This is the follow up post on our previous published article titled “Expanded Withholding Tax in the Philippines”, where we’ve discussed its definition, nature and the individuals or entities who are required to file the expanded withholding tax returns.

As we tackled in our previous article, Expanded Withholding Tax is a kind of withholding tax which is prescribed on certain income payments and is creditable against the income tax due of the payee for the taxable quarter or year in which the particular income was earned. If you are engaged in business, you need an office or commercial space, but you don’t own a land or building, you definitely resort into renting. Thus, you become a lessee and pay rental expense to your lessor. In this case, you become a withholding agent who shall withhold tax on the rental payment you pay to the lessor.

Companies and businesses also often need to outsource services from professionals, such as Certified Public Accountants, lawyers, engineers, architects and software programmers. When this happens, they also need to withhold expanded withholding tax on the income payments they pay to those professionals through monthly filing of BIR Form 1601E and annual submission of BIR Form 1604E (Annual Information Return of Creditable Income Taxes Withheld (Expanded)/ Income Payments Exempt from Withholding Taxes). In return, the professionals and the lessor above can claim the taxes withheld as creditable taxes which they can deduct against their income taxes due for the corresponding taxable quarter or year. They can do that by asking for BIR Form 2307 (Certificate of Creditable Tax Withheld at Source) from the withholding agent and attaching it to their income tax returns.

How to Compute Expanded Withholding Tax

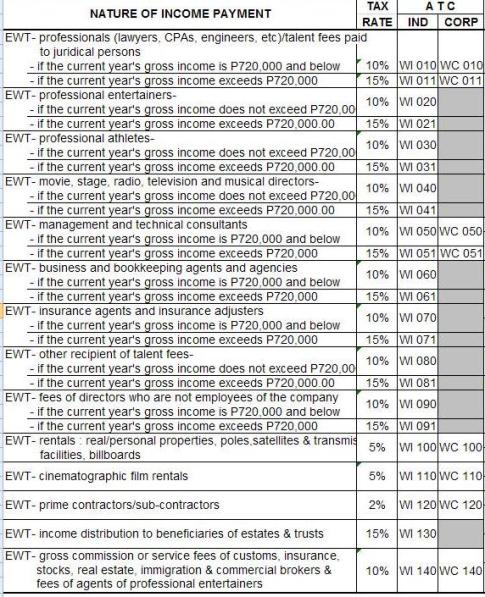

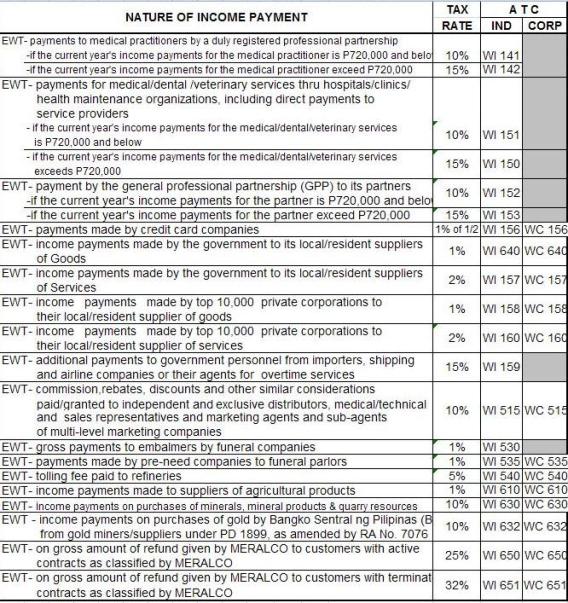

The calculation of expanded withholding tax is simpler than the computation of withholding tax on compensation. Expanded withholding tax is computed using the fixed rates imposed on different natures of income payments as shown below:

Expanded Withholding Tax Rates as shown on the back of BIR Form 1601E

Sample Computation of Expanded Withholding Tax

Let’s assume Company A is paying a gross monthly rental of P20,000 to Mr. B for the office space rented by Company A. What is the monthly tax that should be withheld and remitted to the BIR by Company A?

Answer:

The nature of income payments paid by Company A belongs to rentals, which include real/personal properties, poles, satellites & transmission, facilities and billboards (please refer to the tax rate schedule above). This type of income payment has a tax rate of 5%. Hence, the computation of tax to be withheld is as follows:

EWT= Income payments x tax rate

EWT= P20,000 x 5%

EWT=P1,000

Computation of expanded withholding tax is easy as you only refer to the tax rates table above. Now let’s try for our own actual computation.

How to file BIR Form 1601-E

Below, are the requirements and procedures of filing the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded).

Documentary Requirements

1.Return previously filed and proof of remittance, if amended return

2. Monthly Alphalist of Payees (MAP)

3. For advance payment, BIR Form No. 0605

4. Tax Remittance Advice (for NGAs)

Procedures

1. Read instructions indicated in the tax return.

2. Accomplish BIR Form No. 1601-E in triplicate copies.

3. If there is tax required to be remitted:

a) Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you are registered or taxpayer concerned is registered and present the duly accomplished BIR Form No. 1601- E, together with the required attachments and your payment.

b) In places where there are no AAB’s, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered or taxpayer concerned is registered and present the duly accomplished BIR Form 1601 E, together with the required attachments and your payment

c) Receive your copy of the duly stamped and validated form from the teller of the AAB’s/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

4. If there is no tax required to be remitted:

a) Proceed to the Revenue District Office where you are registered and present the duly accomplished BIR Form 1601 E, together with the required attachments.

b) Receive your copy of the duly stamped and validated form from the RDO representative.

Deadline

Filing Via EFPS

Group A – Fifteen (15) days following end of the month

Group B – Fourteen (14) days following end of the month

Group C – Thirteen (13) days following end of the month

Group D – Twelve (12) days following end of the month

Group E – Eleven (11) days following end of the month

Note: The staggered manner of filing is only allowed to taxpayers using the Eletronic Filing and Payment System (EFPS). Please refer to RR No. 26-2002 for the groupings of taxpayers based on the industry classification.

Payment Via EFPS

On or before the fifteenth (15th) day of the month following the month withholding was made, except for taxes withheld for the month of December which shall be paid on or before January 20th of the succeeding year

Manual Filing and Payment

On or before the tenth (10th) day of the month following the month the withholding was made, except for taxes withheld for the month of December which shall be filed and paid on or before January 15 of the succeeding year

Disclaimer:

New and subsequent BIR rulings, issuances, memorandums and or laws may render the whole or part of the article obsolete or inaccurate. Furthermore, there may also be other relevant information that have been missed to include in this article. For more information, please visit the Bureau of Internal Revenue (BIR) website.

Source:

BIR Income Tax information on withholding tax

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi Vic!

I am really worried about my situation right now. Let me try to explain it and please advice me. I am renting a space, rental amount per month is 10,000 pesos. We are the one who renovate the place and the owner agrees to deduct it in our rental. We deduct 4,000 (replenish due to renovating the place) from the 10,000, so basically I am only paying 6,000 to the Lessor but in the receipt it is as is 10,000 pesos. Now, as I went in the BIR to pay my taxes they ask me to fill the form 1601-E. That means I’m gonna pay 5% of the 10,000 which the 5% is 500 pesos and should I also deduct the 500pesos to the amount that I’m paying to the lessor? You see, I talk to the Lessor, he argues me with this because as he says this does not happened to him ever since. That’s my worries since I am new to business and all that I need someone to advice me what to do. Please help Mr. Vic.

Thank you!

Hi Ellaine. It is mandatory for you to deduct the 5% on the rental payments because you are automatically appointed as an agent of the government for the withholding of the 5%. 5% is a deduction from your remittance to the lessor and their refusal is not justifiable. The BIR will penalize you if you will not do it.

We invite you to our seminars on BIR compliance so you learn more about tax compliance and avoid being penalized. Please click on my name above for the details of the program.

Hi Miss Belle! I already attend the seminar. My only problem is the Lessor and his wife. They don’t believe me because as they said that does not happened to them. I mean of course, because they are very ignorant and they ignore law. So what should I do? Should I report them to the B.I.R. for that? It’s really a hassle in my part because every time they collect the rental and wanted to ask the 5% they will just argue me over and over again. Such a headache. Please help!

Hi Ellaine. I see it’s really a headache. What about going for a new place with a tax abiding lessor. Less headaches, smooth tax compliance.

Hi,

Do you have a list of the top 20,000 private corps that need to withhold tax?

Thanks.

Clarissa

Sir;

1601-E is not found on our certificate of registration. Once we have already filed and remitted the 10% professional fees tax we have deducted from the billed amount of a CPA’s services, are we still mandated to file certain alphalists of payees?

Hi Joan. First, you have to update registration using BIR Form and yes, you attach a monthly alphalist of payees on BIR Form No. 1601E.

Hi! I just want to ask how to go about this witholding tax. I am new in business and the lessor told me that I will pay the 5% witholding tax and they will pay the VAT. Where do I pay this and what are the requirements?

Hi Sir,

I`d just like to ask the computation of our 2307 if our rental is 78,000..thank you sir

I’m working for a cooperative do i have to withheld?

If your cooperative belongs to the top 20,000 corporations, your cooperative is required to withhold 1% from the regular suppliers of goods and 2% from the regular suppliers of services…

Our company is not included in the top 20000 private companies,however we were informed that the BIR asked the company to get 2% from us because of this m) Income payments made by the top 20,000 private corporations to their purchase of goods and services from their local/resident suppliers other than those covered by other rates of withholding.

I am working as a freelance operator for the company and thus, not paying an income tax or the company is not withhelding income taxes from us, however the company is asking 2% from the freelancers because the BIR said so. what should be our stand as freelancers? and where can i get a copy of the top 20000 companies? thank you

To be included in the top 20,000 private corporations, your company should have any of the following criteria:

1. Classified and duly notified by the Commissioner as a large taxpayer under Revenue Regulation No. 1-98 as amended, or belonging to top five thousand (5,000) private corporations under RR 12-94, or

top ten thousand (10,000) private corporations under RR 17-2003, unless previously de-classified as such or had already ceased business operations(automatic inclusion).

2. Any taxpayer with the net VAT paid or payable for the preceding year of at least P 100,000;

3. Any taxpayer with annual income tax paid or payable for the preceding year of at least P 200,000;

4. Any taxpayer with percentage taxes for the preceding year of at least P 100,000;

5. Any taxpayer whose gross sales for the preceding year is over P 5,000,000;

6. Any taxpayer whose gross purchase for the preceding year is over P 5,000,000.

Your company is required to withhold 1% from the regular suppliers of goods and 2% from the regular suppliers of services if your company belongs to the top 20,000 private corporations.

Since you are considered a regular supplier of services to your company as a freelancer, your company is required to withhold 2% from you if your company meet any of the above criteria.

For more info please read Revenue Regulation No.: 14-2008…

Our company is engage in chair rentals… One of our client Funenaria Paz is asking for a commission. What form do I need to fill-up for the said commmission in order for us to recognize it as expense. And do I need to withheld tax for that?

I suppose you mean “discount” not “commission”. It would be termed as “commission” if you are paying somebody by promoting your services to increase your sales. If your client is asking a cut to the original prize then that would be called a “discount”. A “commission” is an expense account while a “discount” is a deduction to you total sales to get the net sales. If you are paying a commission then you are obliged to withhold tax on compensation. If you are giving a discount, then there would be no withholding tax because a discount received by a client does not result from a rendition of service but a privileged given by the seller.

Hi Sir Vic. You been great for all your advise. Thank You. Ask ko lang, are diagnostic clinic vat exempt here in the Philippines? Bless you..

Hi po. Thank you for providing a venue where we can ask for advice. My uncle who is retired in the US has some properties in the Philippines that he is going to rent out for a total of P300,000 paid annually. What taxes should he pay?

Thank you very much.