How to compute Percentage Tax payable in the Philippines? How to prepare and file your percentage tax return with the Bureau of Internal Revenue (BIR) or with an Authorized Agent Bank (AAB)? The following are steps and guidelines in the preparation and computation of percentage tax due and payable.

What is percentage tax?

Percentage Tax is a business tax imposed on persons or entities who sell or lease goods, properties or services in the course of trade or business whose gross annual sales or receipts do not exceed P1,500,000 and are not VAT-registered.

Who are required to file the percentage tax return?

The following persons and entities are required to file percentage tax return:

A. Required to file Monthly Percentage Tax Return (BIR Form 2551M)

1. Persons whose gross annual sales and/or receipts do not exceed P1,500,000 and who are not VAT-registered persons.

2. Domestic carriers and keepers of garages, except owners of bancas and owners of animal drawn two- wheeled vehicle.

3. Operators of international air and shipping carriers doing business in the Philippines.

4. Franchise grantees of electric, gas or water utilities

5. Franchise grantees of radio and/or television broadcasting companies whose gross annual receipts for the preceding year do not exceed Ten Million Pesos (P 10,000,000.00) and did not opt to register as VAT taxpayers.

6. Banks and non-bank financial intermediaries and finance companies

7. Life insurance premiums

8. Agents of foreign insurance companies

B. Required to file Quarterly Percentage Tax Return (BIR Form 2551Q)

1. Operators of communication equipment sending overseas dispatch, messages, or conversations from the Philippines, except on services involving the following:

a. Government of the Philippines – for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities

b. Diplomatic services – for messages transmitted by any embassy and consular offices of a foreign government

c. International organizations – for messages transmitted by a public international organization or any of its agencies based in the Philippines enjoying privileges, exemptions and immunities which the government of the Philippine is committed to recognize pursuant to an international agreement

d. News Services – for messages from any newspaper, press association, radio or television newspaper broadcasting agency, or newsticker services to any other newspaper, press association, radio or television, newspaper, broadcasting agency or newsticker services, or to bonafide correspondents, which messages deal exclusively with the collection of news items for, or the dissemination of news items through public press, radio or television broadcasting or a newsticker service furnishing a general news service similar to that of the public press

2. Proprietor, lessee, or operator of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and race tracks

C. Required to file Percentage Tax Return (BIR Form 2552)

1. Every stock broker who effected a sale, barter, exchange or other disposition of shares of stock listed and traded through the Local Stock Exchange (LSE) other than the sale by a dealer in securities

2. Corporate issuer / stock broker, whether domestic of foreign, engaged in the sale, barter, exchange or other disposition through Initial Public Offering (IPO) seller in secondary public offering of shares of stock in closely held corporations

D. Required to file Percentage Tax Return (BIR Form 2553)

All taxpayers liable to pay percentage tax under special laws.

Computation of Percentage Tax Due and Payable

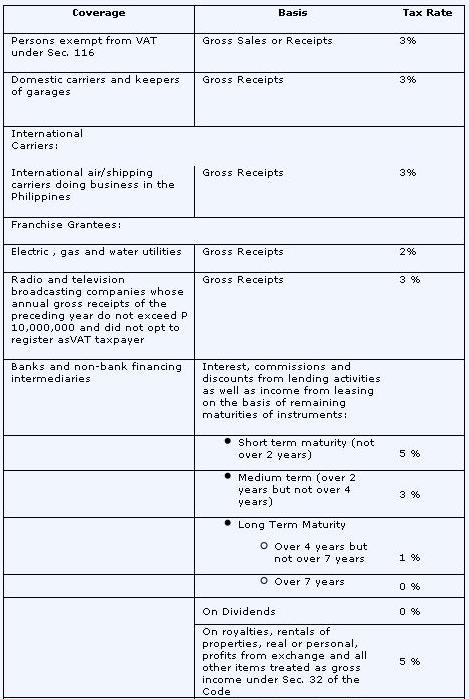

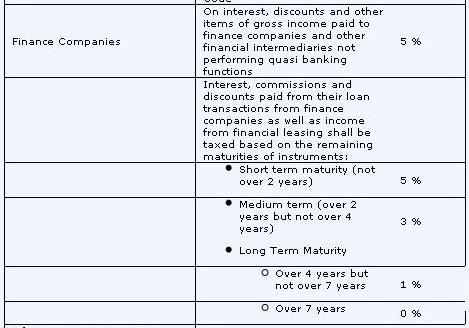

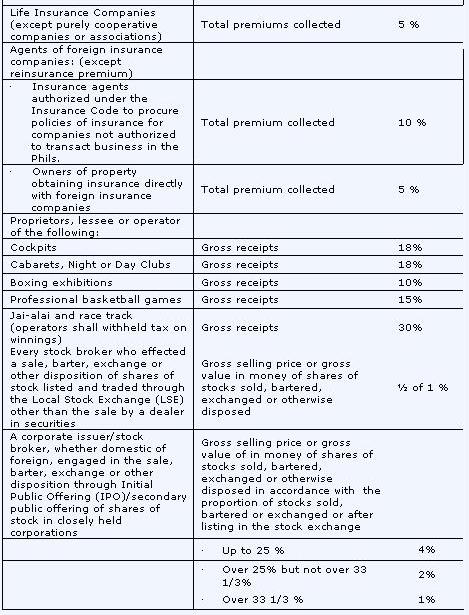

Percentage tax is computed using on the following applicable tax rates depending on the coverage.

Definition of Terms

“Gross receipts” means all amounts received by the prime or principal contractor, undiminished by any amount paid to any subcontractor under a subcontract arrangement.

For the purpose of the amusement tax, the term “gross receipts” embraces all the receipts of the proprietor, lessee or operator of the amusement place. Said gross receipts also include income from television , radio and motion picture rights, if any.

“Closely Held Corporation” means any corporation at least fifty percent (50%) in value of the outstanding capital stock or at least fifty percent (50%) of the total combined voting power of all classes of stock entitled to vote is owned directly or indirectly by or for not more than twenty (20) individuals.

Sample computation of Percentage Tax Due and Payable

Assuming a person who is registered as a self-employed professional (e.g., lawyer, accountant, doctor, architect, engineer, writer or blogger), has an annual gross receipts of P1,200,000, and is a NonVAT registered taxpayer, receives gross receipts for the month of February amounted to Php 100,000.

In the case above, the person is under taxpayers who are required to file Monthly Percentage Tax Return BIR form 2551M. The computation of his PT due and payable for the month of February is as follows:

Monthly Percentage tax due = gross receipts x 3%

=P100,000 x 3%

=P3,000

Assuming he don’t have any creditable percentage tax withheld Per BIR form 2307, is not filing an amended return, and he is filing on or before the due date, the total amount payable for the month is equal to his percentage tax due for the month.

Percentage tax due

Less: Creditable percentage tax withheld per BIR form 2307

Less: Tax paid in return previously filed (for amended return)

Equals: Total Percentage Tax Payable

Add: Penalties (Interest, surcharge and compromise)

Equals: Total amount payable

When and where to file?

1. Monthly Percentage Tax Return – BIR Form No. 2551M

The return shall be filed not later than the 20th day following the end of each month. Any person retiring from a business subject to percentage taxes shall notify the nearest Revenue District Office, file his return and pay the tax due thereon within twenty (20) days after closing his business.

The return shall be filed with any Authorized Agent Bank (AAB) within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register/conducting business. In places where there are no AABs, the return shall be filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer within the Revenue District Office where the taxpayer is required to register/conducting business.

A taxpayer may, at his option, file a separate return for the head office and for each branch or place of business or a consolidated return for the head office and all the branches except in the case of large taxpayers where only one consolidated return is required.

2. Quarterly Percentage Tax Return – BIR Form No. 2551Q

The return shall be filed within twenty (20) days after the end of each quarter, provided, however, that with respect to taxpayers enrolled with the Electronic Filing and Payment System (EFPS), the deadline for e-filing and e-paying the tax due thereon shall be five (5) days later than the deadline set above. Any person retiring from a business subject to percentage taxes shall notify the nearest Revenue District Office, file his return and pay the tax due thereon within twenty (20) days after closing his business.

The return shall be filed with any Authorized Agent Bank (AAB) within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register/conducting business. In places where there are no AABs, the return shall be filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer within the Revenue District Office where the taxpayer is required to register/conducting business.

A taxpayer may, at his option, file a separate return for the head office and for each branch or place of business or a consolidated return for the head office and all the branches or place of business except in the case of large taxpayers where only one consolidated return is required.

3. Percentage Tax Return – BIR Form No. 2552

This return shall be filed as follows:

a. For tax on sale of shares of stock listed and traded through the Local Stock Exchange (LSE), within five (5) banking days from date of collection.

b. For shares of stocks sold exchanged through primary public offering, within thirty (30) days from date of listing of shares of stock in the LSE; and

c. For tax on shares of sold or exchanged through secondary public offering, within five (5) banking days from date of collection.

The return shall be filed with any Authorized Agent Bank (AAB) located within the jurisdiction of the Revenue District (RDO) where the Local Stock Exchange is located.

A stockholder or corporate issuer, in addition to BIR 2552, is required to submit on Monday of each week to the Secretary of the Stock Exchange, of which he is a member, a true and complete return which shall contain a declaration of all the transactions effected through him during the preceding week and of taxes collected by him and turned over to the Bureau of Internal Revenue.

4. Return of Percentage Tax Payable under Special Laws – BIR Form No. 2553

Upon filing this return, the total amount payable shall be paid to the Authorized Agen Bank (AAB) where the return is files. In places where there are no AABs, payment shall be made directly to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer who shall issue a revenue Official Receipt (BIR Form No. 2524) therefore.

Source:

BIR Tax Information on Percentage Tax

Sections 116 to 128 of the National Internal Revenue Code

Disclaimer: New and subsequent BIR rulings, issuances and or laws may render the whole or part of the article obsolete or inaccurate. For more information, please inquire or consult with the BIR.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

am i still required to file quarterly percentage tax if i pay it monthly?

Hi Louie,

BIR Form 2551Q or quarterly income tax return is only required to be filed by the following:

1. Franchise grantees sending overseas dispatch, messages or conversation from the Philippines;and

2. Proprietor, lessees or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and racetracks.

Unlike VAT that is filed monthly and quarterly, percentage tax is generally paid monthly (BIR form 2551M). Just like me, I’m a self-employed professional, and I only file percentage tax monthly, not quarterly.

hello sir i am alma i just wanna consult my problem to you…i decided to stop may business operation this year after 5 years,all the while i thought that i was registered in percentage tax that’s why i only file 2551M,1601E,1701Q ever since…only now that i went to BIR to process may business closure i found out that i was registered in IT,PM,RF,UT,WE…. Please help me i really don’t know what to do…

If you have no income over such period, then, they are just simple open cases for failure to file a registered tax type. It is subject to a compromise penalty of P1,000 per unfiled return (P200 in some RDO). Payment is the key to explore with them.

Is this properly supported by a BIR regulation? In the RMO 19-2007, the penalty for the period wherein there is no income tax due is the compromise, with a graduated table for the fees and not just straight P1,000 penalty.

Hi, its been a few days since i’ve been reading this blog…thanks for all the help..i have a question though,

I’m a professional, practicing independently, but i also have a regular retainership, from which i get a fixed sum every month.Do i just combine all my earnings and pay the 3% monthly tax? if so, what other taxes do i pay?i.e quarterly yearly? Thank you in advance!

Hi Ryzel. If your monthly retainer is related to your practice of profession that is registered with the BIR, then, yes, you simply combine and pay them monthly in accordance with your BIR registration. If however, your retainership is by virtue of an employer-employee relationship, then, no 3% on such monthly retainership.

hi sir,

i would like to clarify some points regarding withholding tax at purchaser’s POV.

Say, the seller is a nonVAT entity (potable water, which I believe we should withhold 1% from the sales amount), and the Sales Invoice amount is P100. How much should we consider as withholding tax? How much should we pay the seller? Is the Sales Invoice amount the basis of 1% withholding tax? Should we pay the seller only P99, w/c is net of w/holding tax? and P1 as w/holding tax payable? Is this entry correct(?):

Dr. Expense 100

Cr. A/P 99

Cr. W/tax Pay’l 1

#

Thanks. =)

Hi Vic,

I am a dermatologists and registered with BIR as a professional. I have earnings in a clinic in Pasig and in QC (these are not my clinics, I’m just a resident derma). I also have a form 2307 from a hospital in Las Pinas since I’m also a resident there. I would like to know:

01 What city am I going to file my percentage and income tax returns?

02 To clarify the question above by Louie Lim, I don’t need to file a quarterly percentage tax return, right?

Thanks Vic!

Hi Hyaeth,

So you’re a registered professional with the BIR? Please check your BIR Certificate of Registration (COR) BIR Form 2303. The COR states your registered address (where you should file) and your taxability (the taxes you are required to file annually, monthly and quarterly).

Hi Vic,

Thanks for the reply. I have another question. Please help me with this. I’m not yet done with my predicament. Once I can file my March PT return, I’m good for the rest of the returns. I am a registered professional (derma) with BIR since March 14, 2011. I haven’t issued any OR for March so I have no income but I have two 2307’s – one for the 1st quarter for P45,000 (tax withheld P4500) from a hospital and the other for 01/13/2011 from another source for P300 (tax withheld P26.79) from an HMO. Will I be paying only the compromise for non filing of P200 and attach my 2307 when I pay to AAB?

Thanks a lot. I really learned a lot from reading in your website but still there are things that are confuisng to me. This is not my cup of tea after all.

Hi Vic,

I have to say that your site is a very nice find and I have it bookmarked for future reference. Hope you could help me out with my current problem;

I am an IT professional currently employed but will be moving to being self-employed by the second week of July. The company who hired me on a contractual basis shall withhold 15% of my gross pay and I was wondering if there are any other taxes I need to pay aside from that. I’ve heard stories from other contractors that their accountants were able to shrink their withholding tax to 2% provided they file returns on a quarterly basis and should have their expenses deducted from their taxable income. Is the 2% tax legit?

I’ve searched far and wide to no avail (ok, maybe not that far and not that wide). The last accountant I talked to was not very familiar with how the 2% tax works for contractors and said it is only applicable to somebody who is engaged in the construction business. I am no accountant and have not read a single page in BIR’s books but I can tell that I would be missing a lot if I hire this accountant’s services.

Also, is it better to put up a single proprietorship company than to be self employed professional? What are the pros and cons? I may have mixed up the accounting terms so pardon me if you find descriptions confusing.

Thanks in advanced.

Hi Julius,

15% withheld to you by the company you are working is what we call expanded withholding tax, expanded w/holding tax is applicable to those professional (doctor, cpa, lawyer, etc.) 10% if the gross income is lower than 720,000 and 15% if above 720,000.

You can compel your employer to give you Form 2307 (withholding tax at source) this certifies that they w/held you 15% of your gross pay.

This 2307 is an attachment to your Annual Income tax return. Also please advice your employer if your gross income is not exceeding 720,00 you w/hold you only 10% of your gross salary.

If you have other concern dont hesitate to ask me,

Regards,

Hello.

If I have form 2307 (witholding tax at source), should I just file an Annual Income Tax Return (1701)? How about the Quarterly ITR? Who are required to file it?

How will the witholding affect the computation of my income tax return? A sample would be much appreciated. Sorry. I don’t know much about taxation.

Thank you!

@ Julius

The 2% withholding tax rate is based on EWT- prime contractors/sub-contractors. Some companies use this rate to withhold professionals in prime contractual / sub-contractual services. However, I’m not sure if this is fully legitimate in your case. I advise that you get a ruling from the BIR in your jurisdiction to make sure. The typical expanded withholding tax rates ((lawyers, CPAs, engineers, etc) is ‘10% (if the current year’s gross income is P720,000 and below) and ‘15% (if the current year’s gross income exceeds P720,000).

Actually, single proprietorship and self-employed professional status are almost the same. The only difference is that you might need to register with the DTI for your trade name for your single proprietorship business and may also require to pay local business taxes (ex. mayor’s permit). As a self-employed professional, you are not required to register with DTI if you will only use your personal NAME.

Dear Vic

I will be opening my small dental clinic in qc next month. i was looking at all the forms and tax requirements from the Bir & QC Hall. I also read from the Local Gov’t Code that professionals need only to pay for the PTR from the QC Hall. If I paid the PTR do I still to pay for a City Business Tax?

Thanks

@Jun

I’m not sure in your case. Other LGUs might require, especially, that you are opening a dental clinic (health services). Hence, it is advisable that you personally inquire and get confirmation at QC city hall to avoid future local tax deficiencies.

Hi, your site is very helpful, I am glad I found this site. I have bookmarked it for my reference. I just want to clarify pleas about what ou have mentioned concerning who are required to file percentage tax return are “1) Persons whose gross annual sales and/or receipts do not exceed P1,500,000 and who are not VAT-registered persons.” However, when I opened the link to your source which leads to BIR website, it states a different gross annual sales amount — only at 750,000 only. Is this the new requirement or it’s just not updated?

Thanks.

Hi Ronah,

The threshold should be P1.5M and not P750,000. The BIR should have updated their tax info. The P750,000 is already superseded by P1.5M.

Hi Sir.

Would like to seek your help, if I may. I am a newly established party needs shop, and I just filed for official receipt printing, including invoice. The thing is, I already have an event for which I will cover the next month. In my proposal, I indicated that the cost is net of all taxes. How do I compute for the taxes of my services? Package would include kidde arts station and a few food carts.

My business is registered as a sole proprietorship at the DTI, and the tax registration says it’s a percentage tax type.

For example – total contract is P20,000 only. Do I charge vat still?

Appreciate your help.

Gladys,

Since you’re NonVAT, you cannot charge VAT to your clients. Percentage tax is tax imposed on seller or service provider, not on buyers. It’s not transferable to buyer or clients like VAT.

You’re the one who should shoulder your percentage tax, since you are entitled to claim percentage tax as part of your taxes and licenses expense, which is an allowable deduction to your taxable income.

Yes, you cannot charge VAT since you are non-VAT registered. if you do charge, then, you shall be liable for such VAT charged but you cannot deduct input taxes from your purchases against such output VAT on sales.

Hi Vic,

Thanks for the prompt reply. I’ve already checked with BIR Pasig about the returns I need to file. My previous accountant did not file 2551M for March, April and June. But I have no income yet for these months, how much do you think will be my penalty?

I think my previous accountant scammed me about my receipts in QC. I already gave her money two months ago but until now, there are no receipts and she’s MIA. The last time we talked, she said that it is already printed and she will just pick it up. Can I ask BIR that I will print another set of receipts? I really need them since my QC patients are asking receipts from me.

Thanks so much for all the patience in answering all our questions. The BIR officer of the day that I approached was not helpful. She needs training in customer service 🙂

Hi hyaeth. Compromise penalty for late filing is P200 per return failed to be filed but some RDOs are charging P1,000 per return. As to the ORs, there has to be an Authority to Print (ATP) that has to be issued by the BIR-RDO of registration before you could print. I suggest you check with your accountant for that or directly with the BIR. If none was issued, then, you may proceed with the application for ATP and printing of ORs upon approval. If an ATP was issued, you have to justify why you have to print another set, say your actual scenario on your accountant’s alleged scam. We CPAs does not tolerate such activities of our co-CPAs. We adhere to such level of professionalism and we condemn such activities.

The BIR uses a schedule of compromise penalty for non-filing of tax returns. For more information on computing penalties on non-payment and/or non-filing of tax returns, please read our article http://businesstips.ph/penalties-for-late-filing-of-tax-returns/

Thanks Ghar! I signed an ATP before. Do I have to sign another ATP? Will there be a big penalty? I’m afraid of the consequences.

Ghar and Vic, I learned a lot from all your posts. Your replies saved me a lot of my busy time from going to BIR. I owe you big time guys. Please shoot me an email so I can give you 5-user QuickBooks Enterprise Accountant Edition 11.0. My sister is working as a sales support in INTUIT Texas and she has genuine licenses 🙂

There is no penalty for making another ATP application because of a justifiable reason. What is penalized is not issuing OR on sales, but as you said, no sales yet so no penalty. That is very kind of you to provide us a licensed Quickbooks for free. You may please send me at taxacctg.tutorials@gmail.com. Thanks a lot!

Hi Vic,

Sent you QBES and QB PRO already 🙂

Hi Ghar,

Sent you the details already for QBES 🙂

Thanks a lot hyaeth.

Thanks a lot Hyaeth,

Your participation and regular visits in this blog are already a big help. I don’t know how I can use the QB since I only have one very depreciated laptop. 🙂 Anyway, you can use the contact form above to mail me – thanks for sharing.

Thanks a lot Ghar for helping.

No Problem, Ghar. Just keep the details of the mail I sent because you can automatically upgrade to QBES 12.0 once released by end of this year.

Hi Vic, I tried to send a message in your contact form but I think it did not go through.

Here is my other public email businessbuidup@gmail.com – thanks a lot.

Vic

I recently upgraded (?) from Non-Vat to Vat. Prior to this upgrade I was paying income tax using the simplified accounting system wherein I deduct a maximum of 40% as deductions and pay 32% on the remaining 60% of the gross income. using this system I eliminate the need to keep books of accounts which is really a hassle for a single proprietor.

I had to switch to Vat because I have reached the 1.5m ceiling. Question is sicne I do not have any book of accounts, can I still claim any Input Vat on my expenses?

Hi Peter. It good to know that becoming VAT is a sign that your business is doing great. Yes, under OSD you are no longer required to file audited financial statements but you are still mandated to keep your books for the gross sales or gross receipts. Yes, you can still claim input VAT on expenses provided they are supported by VAT-registered invoices/ORs. You can even claim a transitional input VAT of 2% of the value of inventory on hand at the time you became VAT or actual VAT paid on such inventory, whichever is higher.

Vic

Thank you for the reply.

The reason why I opted for the OSD is so that I will not be “harassed” by the BIR. In my previous work in a corporation, administration would receive LOA from the BIR every few months. They would demand the company to submit various documents up to the point that even the original copy of the BIR Tax on Incorporation (the tax that you have to pay upon incorporation of the shares, not sure of the term) that was filed more than 15 years ago!.

I was told that with OSD you only have to show as proof of income your official receipts.

Regards.

That is the advantage of OSD. However, there is no assurance that BIR will not issue you a LOA. It’s only that they would concentrate on whether all gross sales/receipts were declared.

@ Peter

That was the Documentary Stamp Tax on the issuance of subscribed capital stock during the incorporation. The BIR have quotas on tax collections. That is why they are doing their best to meet those quotas. I just hope they don’t really become a too much burden to businesses, especially the SMEs that don’t have enough fund to cover the extra costs of those burden.

Where do I find out more about the simplified accounting system. It would help me to be able to use that system.

Cheers,

Roger

Your accounting system will depend on your type of industry, it’s size and many other factors.

Peter,

You cannot claim input vat on purchases prior or before you opted to change from Non Vat to VAT

Unless they fall under transitional input VAt.

Vic,

I’m currently reviewing for cpa board exam this coming october. Yesterday my uncle and aunt, just been checked by the bir about their tax compliance that’s why they asked me to prepare a books for them.the bir agent also checked that if they issue an official receipt to their patients.

My problem is that when is official receipt required?

They are both doctors and their clinic is registered as a professional partnership and they bill their patients a professional fee of just P300, will each consultation require to have an OR?

I have already checked the site of BIR but it does not tell about who is required to issue an OR.I know that a vat registered should issue an OR but what about for professional fee?knowing that professional fee usually differs for each person.

Hi Toti. God Bless for your October CPA Board. Section 237 of the Tax Code, as amended requires that a duly registered official receipts or sales or commercial invoice shall be issued for each sale of merchandise or for service rendered valued at P25.00. Based on this, consultation of P300 shall be issued a duly registered official receipt. Professionals are likewise subject to VAT, upon VAT registration so that said consultation fee shall likewise be subject to VAT. Since you are preparing for the CPA Board, I suggest you just outsource bookkeeping to co-CPAs handling bookkeeping services. You can have their services for at least P3,000 a month (depending on the volume of transactions) on a retainer basis.

Hello Ghar and Vic,

I hope that you can help me in filling out my forms. I am registered as a professional since Feb. 2011 and I have not filed any forms yet. Based on my COR, my taxes are Percentage tax, Withholding tax for rent and Income tax. I have an overview already about what to do since I read all the posts in your website (thank you!) but I am still confused on some things especially in filling out the forms. My questions are:

a) I am a dentist and I have 2307 from insurance companies that I receive every quarter. Do I have to include the income that I have from the insurance companies in the computation of my gross receipts though I did not issue any OR’s?

b) Do I have to deduct (20A) Creditable Percentage Tax Withheld Per BIR Form No. 2307 from the Percentage Tax due every month though I receive 2307’s every quarter only?

c) I filed NO INCOME by mistake (since it was easy to do) for April for Percentage Tax but I issued OR’s, I read somewhere here that I need to file another form for ammendment. Is there any payment for ammended returns?

d) Regarding Quarterly Tax Returns, I did not file any 1701Q yet for the first quarter since I did not issue any OR’s but I have 2307’s, do I have to include it also in my gross receipts, deduct the tax withheld from the tax due then compute the penalties from the negative difference? (Say, I have P3500 from HMO, tax withheld is P350, 3% PT of P3500 is only P105 so Percentage Tax due is negative P245 if I deduct P350.) – I’m so confused.

e) For the succeeding quarters, I noticed that I still have to add the taxable income for the previous quarters (35) and deduct the creditable tax withheld for the previous quarters (38E). Do I still have to include them in my computation though I have already declared them in my previous 1701Q?

f) Lastly, I have a lot of late forms and payments to be made. Do I have to use the payment form 0605 eveytime I pay to the AAB for late payments?

Thank You so much. Reading in your website has helped me a lot!

Hi Dok Caren,

I see you have a many confusions on application of 3% other percentage tax and CWT, but is happy to learn your interest in learning them. Please find my view beside your query.

a) I am a dentist and I have 2307 from insurance companies that I receive every quarter. Do I have to include the income that I have from the insurance companies in the computation of my gross receipts though I did not issue any OR’s? Ans. Yes, because that is a taxable professional fee as a dentist. I am worried you might be exposed for non-issuance of ORs because expectedly the Insurance Company will report the 2307 to the BIR.

b) Do I have to deduct (20A) Creditable Percentage Tax Withheld Per BIR Form No. 2307 from the Percentage Tax due every month though I receive 2307?s every quarter only? No, BIR Form 2307 is for income tax and not for Percentage Tax. You use that for income tax return filings – quarterly/annual.

c) I filed NO INCOME by mistake (since it was easy to do) for April for Percentage Tax but I issued OR’s, I read somewhere here that I need to file another form for ammendment. Is there any payment for ammended returns? Ans: Amendment is a matter of right within three (3) years from filing. If no additional tax on amended return, it will require no payment, but if there is an incremental tax due, then, there is an additional penalty imposable.

d) Regarding Quarterly Tax Returns, I did not file any 1701Q yet for the first quarter since I did not issue any OR’s but I have 2307?s, do I have to include it also in my gross receipts, deduct the tax withheld from the tax due then compute the penalties from the negative difference? (Say, I have P3500 from HMO, tax withheld is P350, 3% PT of P3500 is only P105 so Percentage Tax due is negative P245 if I deduct P350.) – I’m so confused. Ans: As said above, 2307 is not for percentage tax but for income. For income tax purposes, all gross receipts less expenses then applied the tax table for individuals then subtracted the 2307s. For percentage tax, gross receipts for the month multiplied by 3% and without any deduction of 2307.

e) For the succeeding quarters, I noticed that I still have to add the taxable income for the previous quarters (35) and deduct the creditable tax withheld for the previous quarters (38E). Do I still have to include them in my computation though I have already declared them in my previous 1701Q? Ans: Yes, income tax computation is cumulative which means that all income is aggregated quarterly and annually.

f) Lastly, I have a lot of late forms and payments to be made. Do I have to use the payment form 0605 eveytime I pay to the AAB for late payments? Ans: No, you will need BIR because AAB will not accept late filings without BIR verification.

I hope the above view will shed you some light. We advocate on educating entrepreneurs on BIR compliance and you may wish to attend our schedules to avoid being penalized in the near future. Please click on my name beside my picture for our schedules.

Hi Ghar, thanks for all the answers. I’m not confused now especially with percentage tax and income tax.

a) My problem now is with substantiation of my income. Everytime I receive checks (say every month), I don’t issue OR’s. Is it okay if I issue the OR’s now but date it back to the actual date of the transactions?

b) With regard to the transaction dates – I do dental services say today but I get a lump sum check from the insurance company every month. Is it okay if I use the date that I received the check as the date of the transactions everytime I record in my books or in my OR’s?

Thank you so much!

Hi Caren. My views are beside your question.

a) My problem now is with substantiation of my income. Everytime I receive checks (say every month), I don’t issue OR’s. Is it okay if I issue the OR’s now but date it back to the actual date of the transactions?

Ans. As to taxes, they are taxable whether you issue OR or not so the date of OR may not matter much for as long as the related gross receipts are reported on date earned. If you did not declare those past income in the returns, then, dating back will confirm that you are subject to penalties. If you already declared them, then, dating back would only confirm such declaration or issuance under current date would not subject you penalties.

b) With regard to the transaction dates – I do dental services say today but I get a lump sum check from the insurance company every month. Is it okay if I use the date that I received the check as the date of the transactions everytime I record in my books or in my OR’s?

Ans.For income tax purposes, accrual basis of accounting is applicable where there is already income after you render your dental services even if your fee is not yet collected.Under the rules, Books of Accounts are required to be updated within 24 hours after the end of the transaction day and OR shall be issued after every receipt of payments for services rendered. With all these rules applied to your case, issuance of OR upon actual collection date would not be a problem but recording them on lump sum without making daily receivables to update books might be a problem. It may be burdensome an not be practical but that is how it should be.

Hi Caren, I also experienced same thing for my HMO checks. I am a dermatologist. I decided to use the date I receive the checks because if we use the date that we do the procedure, we don’t know what amount to record yet since the final amount depends on the HMO’s.

Hi Ghar, if we issue OR’s for each HMO check we receive, I think we will be taxed twice because those income are already taxed 10% withholding by the insurance companies then when we declare it in our 2551M’s, we tax it at 3%. What do you think?

Thanks!

Hi Dok Hyaeth. I think there is no double taxation. The 10% is creditable withholding tax for income tax purposes using BIR Form 1701 for individuals. while the 3% is a business tax using BIR Form No. 2551M that is separate and distinct from income tax.

Hi Ghar,

I’ve paid all my penalties already. Thanks a lot!

Hi Ghar & Vic,

Your website is very informative. I hope you can help me with my concern. I just started my business this March ( got my BIR Certificate of Registration last March 2011). However, I just started operations last July 4, 2011 since that’s when I got my Official receipts printed. So basically I don’t have any income since March. What should I file or pay?

Thanks in advance for your help!

Reiya

Hi Reiya P. On the BIR Certificate of Registration (COR) you will see your registered tax types (VAT or percentage tax, income tax, documentary stamp tax, etc.) that you will have to be filed and paid, if any with the BIR. VAT or Percentage tax, expanded withholding tax, Withholding tax on compensation are required to be filed every month after the date of BIR registration and every month thereafter. For the rental of your place, you may have to pay documentary stamp tax within 5 days of the month following the month where the lease contract was notarized. You have to be specific on the filing dates to avoid paying penalties.

We advocate in educating entrepreneurs like you on BIR compliance, basic business accounting, and etc. through tutorials, seminars, and trainings. Please click on my name above for our schedules and programs. Thanks.

Hi Ghar,

Thank you for your reply. I will be going to BIR personally to file my penalties.

Regards,

Reiya

good day po…ask ko lng po kc i have a money changer…im paying 2551M monthly ask ko lng papano po yun? dba magbabayad ako 3% ng gross sales or receipt monthly…pag nagpapalit po kc ng dollar kung magkano yung pinapalitan nya yun yung nilalagay namin sa resibo…pero ang kikitain lng namin sa 100 dollar na ipapalit eh 10pesos lng..so pag total po nun sa loob ng 1 araw is (100U$ x 43= 4300). kung may magpapapalit saakin ng 100U$ kada araw sa loob ng 1 buwan total po nun is (100US x 30 days x 43(exchange rate) = 129,000 pesos multiply po yun sa 3% = 3,870 monthly..kung tutuusin yung kikitain lng namin sa loob ng 1 buwan is 300 pesos lng…mas malaki pa ang babayaran naming TAX kesa sa kita namin..papano po yun? i hope you can help me..i have an accountant pero nung nalaman ko yung mga bagay na yan parang mas gusto kong magsara na lng ng shop..kc po khait anong gawin ko kahit marami ang magpapalit eh lugi pa din po ako! dahil sa tax na babayaran….

Hi Jarra,

You should change your accountant!How much do you pay for retainer’s fee? That’s supposed to be a very basic thing. You have a money changer business so basically the income should only be the gain in the exchange rates – which should be written in the OR for tax purposes and not the entire amount that you changed! I think you can still ammend the previously filed returns.

My accountant is very good in these things. I’ll recommend her to you.

hi jane,

can you also refer your accountant to me? how much does she charge? thanks

Hi Jarra, yes, you can still amend the returns and claim the excess payments as tax credits against future tax liabilities. So sorry to hear your story but it is a common thing. Entrepreneurs putting so much trust on their accountants/bookkeepers who happens to be incompetent. It could have been otherwise, if the entrepreneur itself, can supervise or can relate the work of the retainer paid accountant. This is what we advocate, to educate entrepreneurs about tax and accounting implications. Hiring a bookkeeper is good but knowing their work is better.

Hello Sir Vic,

Your column is really helpful to me, i find it easy to transact with the BIR, I am just an Accountancy undergraduate and currently working on a small software company as an accounting staff, I am only the staff here and that means i am the one who is responsible on all tasks in accounting. At first, I’m afraid because I don’t know what to do because I don’t have any experience yet. But when I search it on the internet and i found everything in bir here in your site, and now i am already knowledgeable on some information with regards to BIR.

But I have this problem,,,our monthly rental payment is in dollar,,,$294.40,,that means our creditable withholding tax is $14.72($294.40*5%)…since January I filed 1601-E with the amount of P 12,685.00 until June constantly as monthly rental in pesos and paid P 634.25 as Creditable Withholding Tax and just last week I found out that our lessor use P 12,868.20 in peso as our monthly rental as they file their 2307,,,my problem is, we don’t have the same amount in peso in filing BIR forms,,,what should I do now? Does it matters a lot??

Appreciate your feedback!

Thank You!

Hi Anne! I think you just have a dollar conversion issue as the two of you might just have used different rates. It would appear however that your company under-declared the expense as rental expense in your books and rental income on that of the lessor’s books. While you can amend the filed returns, I do not think it is the proper remedy because as far as your books is concerned, then, your withholding is correct at the level of recorded rental expense. Maybe you just tie-up the figures in the subsequent rentals if that amount is really the peso equivalent.

Thank you so much sir ghar, maybe I’ll just use the same amount used by our lessor on the next payment!

THANK YOU!

We have opened an engineering consulting and construction firm and we already VAT registered. How do we compute our payable taxes? Are we required to pay percentage tax as well as VAT?

Suppose our Gross or Contract price is abt. PhP950,000.00 (for constructing a house. Please advise.

Hi Mel. As VAT-registered, you shall be liable for 12% VAT and not 3% percentage tax. For VAT purposes, your gross receipts multiplied by 12% less VAT on your purchases from VAT-registered entities. In your case, the VAT due is P114,000.00 (P950,000.00 x 12%) since there is no input tax.

Should you wish to know more, we have a program on BIR compliance you might be willing to invest. Please click on my name for schedules. Thanks.

hello sir. just came across with this very informative site and i want also to inquire.my situation is like this.paano po kung di ako nakapagbayad ng monthly percentage tax for more than a year (from march 2010 to may 2011) dahil nag stop ang operation ng business namin dahil sa pagrepair at update ng mga makinang ginagamit..ang mga taxes sa certificate ay income tax, registration fee at ung monthly percentage at non-vat po kami.ano pong kaylangan pra i prove ang mga reasons ko sa pag stop temporarily ng business at ano po ung mga expected penalties ko…ngayon po ay back to operation ulit ung business namin at nakapagbayad ako ng percentage tax for the month of june…pero di ko pa rinirefer sa BIR na di me pa nakapagbayad for the previous months…please help pra alam ko expected ko…thanks a lot.

Hi Son. Since there is no sales during the time of repair, then there might be no taxes due.In such a case, penalty for non-filing is P1,000 per reportorial return. You could check with the BIR for open cases and have them paid or simply do nothing about it until they get you with the penalties.

you should have filed your 3% monthly tax forms even if the value of your income is 0.

i think you can still submit the monthly % tax forms although may penalty of P1,000 per form per month. usually it is 20% or 25% penalty but since 0 ang tax base ay 0 din pero may tinatawag na compromise na P1,000.

proof of 0 income are the receipts.

Hi! Please help me too. I want to register a printing shop kasi, pero home based siya.

Sabihin na nating 10,000 ang total lahat ng receipt ko sa 1 month, sa pagkakaintindi ko, Non-Vat yun. Also 3% monthly tax tama? Kung sa 1 month, 10,000 siya, so 300 ang babayaran ko.

Paano kung sa 1 buwan, walang sales? Okay lang ba yun? Ano babayaran ko kung wala naman akong sales?

Is it okay na wala na akong accountant since small time lang talaga?

Re. sa mga book of accounts, pwede bang ako narin mag-ayos nun? Pero no idea ako dun, is it complicated?

Thanks po.

Hi Tin,

-Yes, you may fall to being a NonVat which you may be taxed of percentage tax which is 3% of your gross sales.

-Yes 3% of 10,000 is percentage tax of P300

-If you actually don’t have sales in a particular month, you will not have any percentage tax to pay, but you are still required to file your monthly percentage tax return and have it stamped received by a BIR officer.

-Accountant is not required.

-You can self-book keep your own books and records.

-Yes it will be hard if you’re not an accountant.

-I recommend you seek for accounting tutorials.

Thanks

Good evening Vic

What a blessing that I chanced upon your site while trying to figure out what to do with my husband’s 2307. My husband has just converted from pure compensation to self-employed. He had been an employee for the longest time and we never realized that filing ITR is so complicated. We’re so used with tax withheld equals tax due. We are ever willing to comply and pay the right taxes even though as it is , I feel that Individual income tax and PT is double taxation. Each may just be distinct in purpose/label but BOTH are imposed on the one person on the SAME income. Anyway pay we surely will. Hubby now is a retainer and gets a fixed monthly fee with 10% EWT. The first time I filed his 2551M I paid in a bank even if I hesitated to do so because 2551M Section 20A has a slot for Creditable PT that requires 2307 attachment. At the time I did not have his 2307 so I just filed and paid than be penalized. However, for his second PT somebody suggested to file a ‘no transaction’ since he is getting his income as a retainer in the practice of his profession while his newly registered business has not closed a single deal so far. That means his business’s foot-high OR booklets are the waiting for buena mano.

Now comes his 1701Q, with 40%OSD applied I figured out that his 2307 is more than enough to cover his tax dues. How do I apply 2307 to PT as can be seen from form 2551’s 20A and Schedule 1. Schedule 1 has ‘Applied’ column, so with 3% Applied to PT, the remaining 7% will be applied to Section 38A of 1701Q. Do I file 2551M first with attached 2307 then next the 1701Q with attached 2551M? Or should I continue filing and paying PT/2551M just like I did the first time? But then can the overpayment from 2307 over 1701 be applied as payment/tax credit for his PTs next year? Again, it’s okay with us to pay them both correctly, but what happens to the overpayment? The overpayment cannot be applied to next year’s 1701 as his 2307 will continually accumulate overpayment because monthly 10% EWT will continually be withheld. How come with pure compensation, adjustments can be made to make the tax withheld equal to tax dues? Much as we would like these done by an accountant, we cannot afford 3000 pesos a month accountant/bookkeeper fee. That’s more than his monthly WT! It’s as if we got to have a double of him earning: him to pay for tax and the double to pay for the bookkeeper. 🙂

One last thing, I understand that with 40% OSD there’s no need for AIF/FS; with no other income source aside from those that the 2307 reflects, does that mean there’s no more need for the BIR stamped accounting books/journals?

Hope you have the patience to answer my queries. Thank you and more power.

Hello,

I think some of your questions have already been answered by the answers on the other similar questions and comments. Anyway, you percentage tax and income tax are not the same. For tax purposes, your percentage tax is considered business tax (generally taxed based on gross sales) rather than income tax. You need to check in your BIR 2307, the kind of tax that is withheld: it is income tax withheld or percentage tax withheld? (Please see answer on PERLA D. JAYLO comment). With regard to the privilege given by BIR to OSD claimants, AIF/FS are the only attachments that may not be required to be attached. Your Annual Books must still be registered with the BIR on due time. The thing is… books are not attached to the ITR upon filing; AIF/FS are usually attached to the ITR.

I am a non-vat janitorial contractor whose income is less than 1.5m. my client giving me a quarterly 2307. How can i deduct the paid amount of quarterly 2307 in my filing of monthly percentage return?

Hello,

Determine if your 2307 is creditable against your Income Tax (quarterly) or against your Percentage Tax. If the tax withheld in your 2307 is income tax, then claim it against your Quarterly Income Tax in the BIR return (1701Q [individual]/1702Q [corporation]) under “Creditable Tax Withheld Per BIR Form No. 2307

for this Quarter”. You must attached the 2307 on the BIR returns. If the tax withheld on your 2307 is percentage tax, then claim it against your percentage tax. Usually 2307 for percentage tax occurs when there are Government Money Payments.

I have the same case as Jarra above (Jul 21, 2011 post). for example, I buy something for 1000 pesos and sell the same thing for 1,050 pesos, margin is only 50 pesos. Paying the percentage tax at 3%, it should be 1,050 x 3% = 31.5 pesos. But from your comment on Jarra’s case, what we should put on the OR is only 50 pesos? if this is the case, the customer will be very angry at me for giving him an OR of 50 pesos only after paying me 1,050 pesos. pls enlighten me on this.

Hello,

What kind of business are you operating? You mean you are also in a money changing business? If you’re in a money changing business, your customer should not be angry, since the amount of money they exchange is not an expense on their part. They will only have expense if they will incur loss on exchange (value of foreign currency declines). On the other hand, their expense/loss on exchange will be your gain on exchange, since value of Peso increases. The gain on exchange will only be the amount to be taxed on your part. In the same case, your customer’s loss on exchange will be the only amount that is considered their expense. Hence, that is only the amount that they need to reflect in your OR. Giving them OR reflecting the total amount they exchange with you will be useless, since they cannot claim it as expense on their part.

Hello Vic, I’m operating a small travel agency. so, im not sure if customers will agree if we write only our profit on the OR and they will know how much we earn from them also if we do this.

Sir Eugene,

Ano po ang naging reply ni sir vic? meron din po kasi travel agency. (home-based) 2 bookkeeper na po ang naghahawak ng libro kaya lang sa mga nabasa kong procedure ng pag f-file mukang over payment kami kasi ang ginagawa ng unang bookkeeper po yun total amount ng nasa resibo multiply sa 3%. halos wala na po kaming kinita.

hi kuya vic im so lucky na nakita ko itong website mo .. pero may little bit confusing sa pag compute ng income tax at with holding tax. since percentage tax po ako at newly business …. ano po ba ang kailangan ko na gawin at kailan ako magfile ng aking mga tax ? printshop po kasi ang business ko so di ko po alam kung paano mag compute ng with holding at income tax? kailan ang filling?Quarterly pano po ba ang pag compute? annual income tax returns ? salamat po

Hello aj,

First, check your BIR certificate of registration (BIR form 2303). The taxes you should file and or pay are stated there.

If you are required to pay withholding tax on compensation (BIR form 1601C), read this article: http://businesstips.ph/how-to-compute-withholding-tax-on-compensation-bir-philippines/

If you are required to pay expanded withholding tax (BIR form 1601E), read this article: http://businesstips.ph/how-to-compute-expanded-withholding-tax-in-the-philippines/

Filing of income tax for individual is discussed in the following articles:

BIR form 1701Q: http://businesstips.ph/how-to-compute-quarterly-income-tax-return-philippines/

BIR form 1701A: http://businesstips.ph/how-to-compute-income-tax-in-the-philippines-single-proprietorship/

Thanks

Good day to all!.

I just started a fishing venture this year with a monthly gross receipts between 75-100K. I have plans to expand mid 2012. Here are the questions.

1. Which tax should I pay. Shall I pay the percentage tax or VAT. The previous owner was paying a percentage tax based on the fact that we are selling these marine food products in their original state.

However, meron din akong nakita na if the aggregate amount of actual gross sales or receipts exceeds One Million Five Hundred Thousand Pesos (P1,500,000.00), then it is subject to VAT.

2. If I do expand next year, do I have to switch from percentage tax to VAT? Or I am still eligible to use the percentage tax?

Thanks in advance.

Hi John,let me share my views. On the premise that you are VAT-exempt as dealing with marine food products, then, it should have likewise been exempted from percentage tax. Sad to say, it was a misapplication of the rules to your disadvantage. even if you expand next year, if you deal with the same exempt marine food products, then, the P1.5M rule will not be applicable and you will continue to be exempt. Thanks

Dear Vic/ Ghar,

Is recording of accrual for percentage tax proper? How to booked it?

Regards

Yes, accrual applies. Under accrual, income is recorded even if not yet collected while expense recorded when incurred even if not yet paid. Tax base for percentage tax however, remains to be based on gross receipts for services even under accrual accounting.

Hi Sir!

I am new about taxes and I got 3 BIR Forms: Form No. 1601-E for every 10th of the month, Form No. 2551M for every 20th of the month and Form No. 0605 annually. May I ask, am i getting the right forms for a small business of goods and services with deduction of 3% at its due?

Thank you for helping.

Hi Beverly. You still need BIR Form 1701Q(quarterly)/1701(annually) if you are a sole prop or BIR Form 1702Q(quarterly)/1702 (annually) if a corporation; BIR Form 2000 – one time for the lease contract of the office, if any; BIR Form No. 1601-C, if you do have an employee. We do offer basic BIR compliance tutorials, please see us at our website. Thanks

hi sir, i just came across this page and find it extremely useful.

it would be very kind of you if you can help me please. i just opened new business and we got tax type as percentage tax – monthly. my supplier (janitorial items) is charging me of 12% VAT on our purchases. despite of showing BIR certificate of percentage tax-monthly, my supplier is still insisting me to pay it. my question, is there legal basis to charge me the 12% VAT despite the fact that our company is a registered non-VAT? If i do pay it, how could i pass it on to consumers?

Thanks and i will really appreciate your immediate response.

gudpm sir.. i am an owner of a computer shop/internet cafe.. i just wanna know sir if i still have to file my 2551Q quarterly though i am filing my 2551M monthly? .. i hope you could help me sir.. thank you..

Hi Analyn. 2551Q shall only be filed : (1) Franchise grantees sending overseas dispatch, messages or conversation from the Philippines;and (2.)Proprietor, lessees or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and racetracks. In your case, you only need to file 2551M monthly percentage tax and not 2551Q quarterly percentage tax.

Hi Sir,

Good afternoon. What is the real basis of GPBT for international carriers? Is it only for shipment from the Philippines going to any destination (export) or it will include also import shipments? I’m confused because I have asked two different companies and got different answers from them. Thank you for your time Sir and hope you could help me in this matter.

Thanks.

Hi Lhen,

Import shipment does not generate billings for revenue but purchases. Accordingly, not part of GPBT.

Hi Sir Ghar,

Thank you so much for answering my question. Buti na lang I did only include export shipments as basis of our GPBT. 🙂

Another question po, Non-Vat registered business kame, I’m confused if we are entitled or going to apply 2307 for all the billings/purchases named under our company name. Please advise po how.

Thank you ulet Sir!

Hi Sir,

I’m about to start a business, single proprietor, I’m a bit confuse regarding VAT and percentage tax. Am I exempted to pay percentage tax if I am VAT registered? Need your help on this. Thanks

Hi,

You can only be either VAT registered (liable to VAT) or NonVAT registered (liable to Percentage Tax). You cannot be both.

Hi Leng,

If your activity is VATable but you do not expect to exceeAT, but, there may still input VAT from purchases. After you exceeded the P1.5M threshold, then, you shall become mandatorily liable for VAT.

I suggest you attend our advocacy programs to develop a better picture of BIR compliance and avoid penalties. Please click my name to reach our website. Thanks

Hi Vic good day , I have a question regarding the issuance of BIR Form 2307. Say, I issued the 2307 for the goods purchased last March 2011 (Q1). Now (Q3), the portion of the goods bought are to be returned because they are defective which means there will be an adjustment also with the tax withheld. Can I reflect or offset from the Form 2307 I am going to issue the said adjustments since we have another transaction with the same vendor? Hoping for your help on this and God bless!!!

hello po.. sino po responsible sa pagbabayad sa documentary stamp tax declaration/return or BIR form 2000? is it the lessor or the lessee? thanks!

Hi Sir,

Good afternoon.

I’m happy to see this website that answers queries of people who are confuse about tax filing. And I am one of them.

Sir,please kindly help me with some issues i don’t understand with tax filing. I’m working in a tutorial services company. Small company that only has four employees so I’m the one na rin who is in charge of their BIR filing.

Before I started here nag-fifile na sila ng percentage tax form 2551M. I’m confuse lang po kasi “no operations” every month for a year now ang file ng company. I have no idea rin naman po how much ang earnings ng company per month, because the mode of payment transaction ng mga students po is through bank. And I think wala naman pong resibo na na-iissue. Kailangan po ba namin ng accountant para i-ayos to?

HI Apple.

Yes you need the help of an accountant or a bookkeeper or else you need to spend more time to study accounting for yourself. Your company may choose the following:

1. Hire an in-house accountant/bookkeeper employee – this is the most expensive since your company will hire an additional employee

2. Outsource an accountant/bookkeeper – this is cheaper but they don’t usually offer extensive accounting service

3 or learn accounting bookkeeping – this is time consuming, but when you get the knowledge it can be rewarding.

Hi,

I worked with a company before and resigned July this year. Same month I’m hired with a different company. My new company is asking for my ITR 2011. I have my ITR for 2010 only since I worked with that company until July only. Will I become payable for that?

Thanks,

Cherry

sir,

good afternoon. i would like to know if my mom, who is already a senior citizen, need to file bir tax return for her 3 door apartment? she is paying the yearly lot and improvement tax in city hall. hope you can help me. Thanks in advance.

Hi Kris, yes she will be required to.

hi!,

i just recently opened a travel agency( NON VAT) SIngle proprietor Home Based Businss, and im confused on what to right in terms of gross sales receipt — 3% percentage tax, example someone book a flight amounting to P10,000 + service charge of P160 =P10,160 x 3%? is that how is it computed or it should be the P160 x 3%? because it should only be the gain that is taxable, and my second question is, what if a company book with me, and ask for an O.R. what should i give them, since its going to cover as travel expense for them, can i only give them an acknowledgement receipt/sales invoice, what type of receipt can i issue to them,

vic, this is the same question that i have I’m a travel agency owner too) home based-sole proprietorship, if we are going to issue an O.R and just put the total gain from the service we provide, they will not accept that as well as they will know how much mark-up do we put if we issue the O.R (Indicating the Profit that we gain from the service) can we instead use any receipt, like an acknowledgement receipt or a sales invoice perhaps?would that be ok, does BIR will not question that? Thanks. hope for your reply on this matter.

Hi Kris-ann, your taxabilit would be dictated by how you will issue your o.r. If you issue the same for the full amount, then, 3% shall be based on the same. If you issue an o.r. based on the mark-up only and using an acknowledgment for the cost of the ticket, then, you shall be taxed based on such amount of mark-up only.

Hi,

thanks for a this very informative post. i have already went to BIR to inquire about paying my taxes but the guy who assisted me has no idea on how i should pay my taxes.

i was previously employed and now i am working at home with an online job. my questions are:

– should i re-apply for a new TIN or i could use my current one

– what if i dont have any receipt for my income as the payments are directly sent to my bank account. the only proof that i have received my salary is via email stating that my client have already transferred the payment to my account.

– should i pay first in the bank then file the form to bir or file the form first then pay in the bank

– if i am to pay for my january tax, that is to be filed until before feb 20?

– for the previous months, should i file 2551M for each month

– do i have to pay anything for ITR and when/how do i get one?

– do i also need accounting books and OR’s?

thank you very much.

Hi jhoy. I believe you are not an employee of your foreign counterpart and is a freelancer. In such case, you shall be considered engaged in trade or business, thus, being required to pay business tax, income tax,and such other tax types. I suggest you enroll our basic BIR compliance program tat you may learn filing out returns, issuing official receipts, and maintaining books of accounts.

Hi All,

I have a question regarding taxability of my income as to tax type and rate. I am an artist doing paintings and other artworks as my source of income. Now, I don’t know what is the tax consequences of this, i don’t even know if it will form part of my individual income subject to Sec. 24A or i will be paying final withholding tax of 10%. Also, if i am required to pay percentage taxes?

please enlighten me and hope you can provide me a bir provision or concrete basis for this. Thank you guys in advance. hoping for your reply.

Hi Marvin. I feel sorry for the misconception you have about taxes. Income tax is one tax type in Sec. 24a and percentagentax or Vat, if your gros receipts exceeds P1,919,599 in 12-mont period, is another tax type. Payments to you withheld 10% is a withholding tax on your income and creditable from your income tax. Maybe you check Sections 105, 106, and 116 of the tax code, as amended.

I also suggest you join our program on basic business accounting and bir compliance to learn much about applicable taxes to your undertaking and how to deal with them.

water district is a gocc, and we pay franchise tax monthly, the problem is some of our concessionaires withheld 2% franchise tax. as my understanding only government agency, gocc, cooperative and gfi and other government institution can withheld. but some private Establishment withheld. there is no problem to our institution because what they withheld we don’t remit to bir. but my question is the private sector are qualify to withheld franchise tax..hoping to ur reply…thnx in advance

Hi Reynan! So your company is a water district? Franchise tax is not covered by the withholding tax rules and is a required direct remittance from the franchisee. 2% withheld may be the 2% required of a top twenty thousand corporation fortheir purchase of services from regular suppliers, please check.

gud morning, as a percentage tax ang binabayaran ko sa sales invoice or sa official receitps lng ba ang d n diclare na as gross sales, halimbawa na in xerox wla ako binibigay na receipts kc kung minsan 2.00 lng. paano i declare yan sa BIR, Kc wala nman sya na receipts. thanks po

Taxable base is based on actual gross receipts or gross sales and hindi lamang po kung magkano ang inissuehan ng o.r. or invoice. Ang hindi po pag iisue ng invoice o o.r ay may penalty.

hello sir vic,

are prc certified dentists lawfully required to file percentage tax?

thanks,

patrick

Yes if you are not a pure employee or you are practicing your profession (self-employed or mixed [earning from practice and earning from employment]. It’s either percentage tax or VAT, depending on your gross sales/receipts.