How to compute Percentage Tax payable in the Philippines? How to prepare and file your percentage tax return with the Bureau of Internal Revenue (BIR) or with an Authorized Agent Bank (AAB)? The following are steps and guidelines in the preparation and computation of percentage tax due and payable.

What is percentage tax?

Percentage Tax is a business tax imposed on persons or entities who sell or lease goods, properties or services in the course of trade or business whose gross annual sales or receipts do not exceed P1,500,000 and are not VAT-registered.

Who are required to file the percentage tax return?

The following persons and entities are required to file percentage tax return:

A. Required to file Monthly Percentage Tax Return (BIR Form 2551M)

1. Persons whose gross annual sales and/or receipts do not exceed P1,500,000 and who are not VAT-registered persons.

2. Domestic carriers and keepers of garages, except owners of bancas and owners of animal drawn two- wheeled vehicle.

3. Operators of international air and shipping carriers doing business in the Philippines.

4. Franchise grantees of electric, gas or water utilities

5. Franchise grantees of radio and/or television broadcasting companies whose gross annual receipts for the preceding year do not exceed Ten Million Pesos (P 10,000,000.00) and did not opt to register as VAT taxpayers.

6. Banks and non-bank financial intermediaries and finance companies

7. Life insurance premiums

8. Agents of foreign insurance companies

B. Required to file Quarterly Percentage Tax Return (BIR Form 2551Q)

1. Operators of communication equipment sending overseas dispatch, messages, or conversations from the Philippines, except on services involving the following:

a. Government of the Philippines – for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities

b. Diplomatic services – for messages transmitted by any embassy and consular offices of a foreign government

c. International organizations – for messages transmitted by a public international organization or any of its agencies based in the Philippines enjoying privileges, exemptions and immunities which the government of the Philippine is committed to recognize pursuant to an international agreement

d. News Services – for messages from any newspaper, press association, radio or television newspaper broadcasting agency, or newsticker services to any other newspaper, press association, radio or television, newspaper, broadcasting agency or newsticker services, or to bonafide correspondents, which messages deal exclusively with the collection of news items for, or the dissemination of news items through public press, radio or television broadcasting or a newsticker service furnishing a general news service similar to that of the public press

2. Proprietor, lessee, or operator of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and race tracks

C. Required to file Percentage Tax Return (BIR Form 2552)

1. Every stock broker who effected a sale, barter, exchange or other disposition of shares of stock listed and traded through the Local Stock Exchange (LSE) other than the sale by a dealer in securities

2. Corporate issuer / stock broker, whether domestic of foreign, engaged in the sale, barter, exchange or other disposition through Initial Public Offering (IPO) seller in secondary public offering of shares of stock in closely held corporations

D. Required to file Percentage Tax Return (BIR Form 2553)

All taxpayers liable to pay percentage tax under special laws.

Computation of Percentage Tax Due and Payable

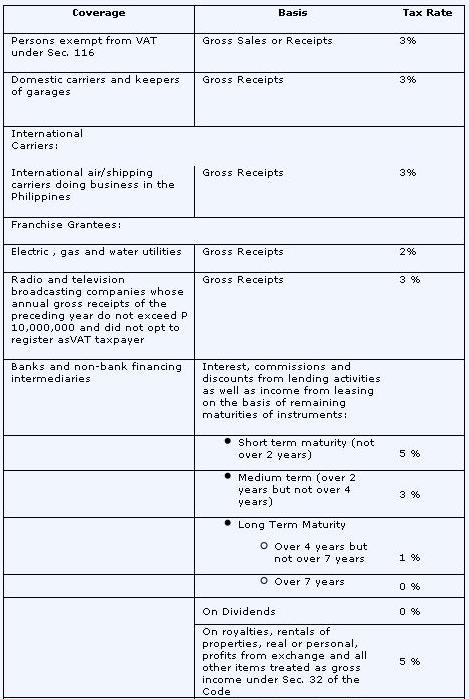

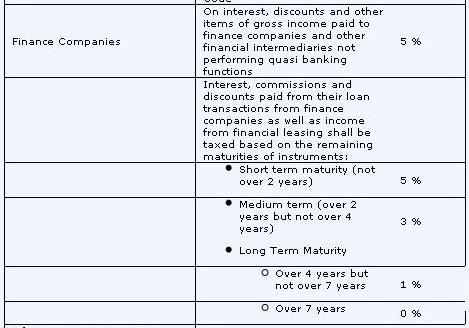

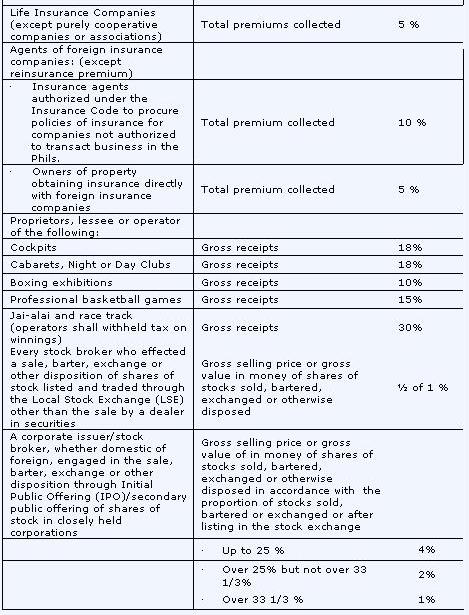

Percentage tax is computed using on the following applicable tax rates depending on the coverage.

Definition of Terms

“Gross receipts” means all amounts received by the prime or principal contractor, undiminished by any amount paid to any subcontractor under a subcontract arrangement.

For the purpose of the amusement tax, the term “gross receipts” embraces all the receipts of the proprietor, lessee or operator of the amusement place. Said gross receipts also include income from television , radio and motion picture rights, if any.

“Closely Held Corporation” means any corporation at least fifty percent (50%) in value of the outstanding capital stock or at least fifty percent (50%) of the total combined voting power of all classes of stock entitled to vote is owned directly or indirectly by or for not more than twenty (20) individuals.

Sample computation of Percentage Tax Due and Payable

Assuming a person who is registered as a self-employed professional (e.g., lawyer, accountant, doctor, architect, engineer, writer or blogger), has an annual gross receipts of P1,200,000, and is a NonVAT registered taxpayer, receives gross receipts for the month of February amounted to Php 100,000.

In the case above, the person is under taxpayers who are required to file Monthly Percentage Tax Return BIR form 2551M. The computation of his PT due and payable for the month of February is as follows:

Monthly Percentage tax due = gross receipts x 3%

=P100,000 x 3%

=P3,000

Assuming he don’t have any creditable percentage tax withheld Per BIR form 2307, is not filing an amended return, and he is filing on or before the due date, the total amount payable for the month is equal to his percentage tax due for the month.

Percentage tax due

Less: Creditable percentage tax withheld per BIR form 2307

Less: Tax paid in return previously filed (for amended return)

Equals: Total Percentage Tax Payable

Add: Penalties (Interest, surcharge and compromise)

Equals: Total amount payable

When and where to file?

1. Monthly Percentage Tax Return – BIR Form No. 2551M

The return shall be filed not later than the 20th day following the end of each month. Any person retiring from a business subject to percentage taxes shall notify the nearest Revenue District Office, file his return and pay the tax due thereon within twenty (20) days after closing his business.

The return shall be filed with any Authorized Agent Bank (AAB) within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register/conducting business. In places where there are no AABs, the return shall be filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer within the Revenue District Office where the taxpayer is required to register/conducting business.

A taxpayer may, at his option, file a separate return for the head office and for each branch or place of business or a consolidated return for the head office and all the branches except in the case of large taxpayers where only one consolidated return is required.

2. Quarterly Percentage Tax Return – BIR Form No. 2551Q

The return shall be filed within twenty (20) days after the end of each quarter, provided, however, that with respect to taxpayers enrolled with the Electronic Filing and Payment System (EFPS), the deadline for e-filing and e-paying the tax due thereon shall be five (5) days later than the deadline set above. Any person retiring from a business subject to percentage taxes shall notify the nearest Revenue District Office, file his return and pay the tax due thereon within twenty (20) days after closing his business.

The return shall be filed with any Authorized Agent Bank (AAB) within the territorial jurisdiction of the Revenue District Office where the taxpayer is required to register/conducting business. In places where there are no AABs, the return shall be filed with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer within the Revenue District Office where the taxpayer is required to register/conducting business.

A taxpayer may, at his option, file a separate return for the head office and for each branch or place of business or a consolidated return for the head office and all the branches or place of business except in the case of large taxpayers where only one consolidated return is required.

3. Percentage Tax Return – BIR Form No. 2552

This return shall be filed as follows:

a. For tax on sale of shares of stock listed and traded through the Local Stock Exchange (LSE), within five (5) banking days from date of collection.

b. For shares of stocks sold exchanged through primary public offering, within thirty (30) days from date of listing of shares of stock in the LSE; and

c. For tax on shares of sold or exchanged through secondary public offering, within five (5) banking days from date of collection.

The return shall be filed with any Authorized Agent Bank (AAB) located within the jurisdiction of the Revenue District (RDO) where the Local Stock Exchange is located.

A stockholder or corporate issuer, in addition to BIR 2552, is required to submit on Monday of each week to the Secretary of the Stock Exchange, of which he is a member, a true and complete return which shall contain a declaration of all the transactions effected through him during the preceding week and of taxes collected by him and turned over to the Bureau of Internal Revenue.

4. Return of Percentage Tax Payable under Special Laws – BIR Form No. 2553

Upon filing this return, the total amount payable shall be paid to the Authorized Agen Bank (AAB) where the return is files. In places where there are no AABs, payment shall be made directly to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer who shall issue a revenue Official Receipt (BIR Form No. 2524) therefore.

Source:

BIR Tax Information on Percentage Tax

Sections 116 to 128 of the National Internal Revenue Code

Disclaimer: New and subsequent BIR rulings, issuances and or laws may render the whole or part of the article obsolete or inaccurate. For more information, please inquire or consult with the BIR.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Dear all,

hellO pO sa inyO, merOn lng pO akung katanungan sana po masagOt. small electronic service center po business naming mg’asawa 4years na pO ng’ooperate dito lng po province. single proprietor po nOn-vat merOn pO kmi bookkeeper perO kahit sila prang hinde din sure sa dapat tamang ginagawa. ang tanong kO po ay ganito: sa percentage tax anu pO dapat idedeclare naming sales hence services pO ung line of business namin. example: merOn nag paayos ng tv ung bill nya sa OR is this 500.00 parts 450.00 labor charge total amount paid is 950.00 alin po dapat jan ang taxable sa percentage ung total 950 ba or yung labor charge lang na 450 which is yun lng naman pO tlga ung kinita namin jan sa unit ung parts pinurchase lng din namin. for 4years of operation ung practice namin ni bookkeeper ay ung total amount na 950 yung ang tlgang denideclare namin po sa monthly naming percentage tax. tama ba yun?? hinde pO ba dapat na yung 450 lng na labor charge ang sangkop sa percentage tax namin dahil yun lng naman pO ung nging incOme namin pra dun sa tv na yun?? sana pO matulongan nyo kmi sa ganitong usapin, kung tama naman po yung naging practice namin sa apat na taon ay syempre icocontinue namin yung tama pero kung hinde naman eh prang nalugi kmi panu pa namin maitatama yun? ang laki kz tlaga na monthly percentage tax namin prang merOn mali tlga eh. plz help po

Hi Michelle. Sa akin pong palagay ay tama at batay sa regulasyon ung kasalukuyang ginagawa ng kookkeeper ninyo. Ang basehan po ng percentage tax ay gross sales sa goods at gross receipts sa services kaya pagsasamahin po sila. Marahil po ay ipa timbang sa bukkeper kong mas angkop ba sa inyo ang VAT registered base sa kumbinasyon ng input VAT mula sa binili na parts at sa ibang binibili ng makita kung onti lang ba ang babayaran sa VAT.

Kami po ay may mga programa na nagtuturo sa pagbubuwis at kayo po ay aming inimbitahan. Bumisita po sa aming website para sa ibang detalye at kaalaman sa mga ito. Maraning salamat.

salamat sa reply Ms. Belle, imumungkahi kO pO sa aming bukkper ung suggestion nyO kung which is better. Mlaking tulOng pO sa katulad naming maliliit lng na negosyo ang site na itO. I’ll check out yOur website aswell, salamat pO tlga ms. Belle, hanggang sa muli, God bless!!

Lubos po naming ikinagagalak ang malaman po na kayo ay aming napaglingkuran sa mumunting paraan. Nawa ay mas maging maunlad po ang inyong pinagkakaabalahang negosyo. Alam nyo na po kung san nyo kami matatagpuan sa panahon ng inyo pong pangangailangan.

Mabuhay po ang mga maliliit na negosyo kasi sila na po ang susunod na magiging mga business tycoons ng ating mahal na bansa.

Sir vic,

Currently im subject to percentage tax kasi below 1.5million pa ang gross receipts ko sa aking profession, Now nagpatayo ako ng building for rental..Eto po tanong ko, isasama ko din ba sa 2551M ko as consolidated ung receipt sa rental at ung receipt ko sa services ng profession ko? what if 1.2M ung sa profession ko tapos 500k naman ung sa building rental, am i subject to Vat kasi 1.7M na ung Gross Receipt ko? Sana matulungan nyo ako..Salamat po

tapos ano po ang mainam na gawin ko sa 2551m ng profession ko, kasi late na kung dumating ung 2307 ko (withholding of percentage)..kapag ngpafile po ako hindi ko maicredit ung nawithheld sa akin dahil ala ako attachment..can i amend nalang to reflect the withholding?tapos kung magnegative ung amendment,pede ko ba gamitin as tax credit nlang sa susunod na 2551M? salamat po ulit

Ang 2551 ay business tax samantala ang 2307 ay income tax kaya pwede magdeclare taxable sa 2551 kahit wala 2307 pero ddi pwede claim tax crdit kung walang 2307. Yes,pwede iamend. I suggest, you attend our basic tax compliance program to know more about basic applications and savings. Thanks.

Hi Bryan. As sole prop, the application of the 1,919,500 (starting January 2012) for VAT purposes is based on aggregate and not based on individual activity. I suggest you weigh down the impact of input VAT if VAT registered as compared to percentae taxpayer. Plese note also on the VAT exemption of rental on residential units for rental not exceeding P12k a month.

We can help you determine the better combination for your advantage. Please contact us for related concerns.

so ibig pong sabihin magiging vat po ako kung ung aggregate amount ng sales/receipt ko for the year is nsa 1.9M ( profession 1.2M plus rental 720K ). if hindi vat,paano po ang presentation sa 2551M? consolidated or separated?. sa profession kasi wlang input vat so lugi ako kpag nag-vat ako..ganun din sa building rental ko walang input vat..below 12k po ung rental per unit sa bldg..

tapos ung 2307 kasi dalawa po ung winiwithheld sa akin ng philhealth 15% sa income at 3% sa percentage, since late ang dating ng 2307 hindi ko rin maiclaim ung 3% na naideduct sa akin in advance ng philhealth..so i opt to declare smaller amount then iaamend ko nalang pag dating ng 2307 para maclaim ko rin ung withholding na 3%..question, tama po ba eto?..thank you po ulit

Oo nga bryan, sayang naman. Yes, consolidated. Baka naman may remedyo sa scenario mo kung atin lang tututukan ang sitwasyon. Send me mail pag may pagkakataon kaw.

I think much better kung dito nyo nalang ipost ung tamang sagot for the benefit of others (eto naman i think ung purpose ng site na eto) para mas madami kayong matulungan..thanks

Hi Sir Vic just want to ask if we’ll go straight na sa AAB to file and pay the tax payable or we need pa to go to our assigned RDO? Actually I really don’t know how to fill out form 2551M since it’s my first time to pay tax. I hope you could help me.

Thank you very much and Best Regards.

-Virgie

Hi, usually 2551M can be paid directly to AAB without any countersign from the BIR, if the return is made on or before the due date and no penalties computed. However, there are some BIR jurisdictions that requires BIR counter sign, like in some provinces I know. Thus, I would advice you to call first the BIR office in your jurisdiction. Please be guided with the article for filling out your 2551M. Thanks.

Hi… we are a delivery company. our truck is hired by a private entity and naka-register kasi kami sa percentage tax. gusto ko lang malaman kung:

1. dapat ko bang idagdag ang percentage tax sa billing

2. puede ko bang gamitin na deduction sa percentage tax yung 2% na wini-withheld nila

Tnx.

Hi Lyn. Direct tax ang percentage tax di tulad vat na pinapasa lang. Ang 2% na bawas ay bawas sa quarterly/annual na income tax at hindi sa percentage tax. Ang percentage tax naman ay bawas sa income para income tax. Salamat.

Thank you very much for the quick reply Sir!

You’ve been a great help.

mag-paupa ako ng vacant lot for a trucking firm, for 2 years. mag single prop non vat reg. ba ako? annual lease ko does not reach 1.9 M

would it be better as real estate professional then a non VAT single prop.?

osky

Yes, baka mas maganda OPT in either case.

Hello,

I have a concern about the gross sale entry in the application form for business license and i wonder how different business models r taxed.

following situation:

business 1: bording house – gross: 31500/month (750 per head) – costs not deducted (elec, water, helper, others)

business 2: sari-sari store – gross last year (by 16h/day) – 70200 (real win is around 17% of it) – costs not included – gross now (24/h 6days/week) – 98800

business 3: inet cafe (new)- gross: 26000 – costs not included

as u can see it in this example when i would fill out the gross sale section in that form – in theory my store has the biggest number on cash flow, but if u see through it u would know that my bording house is earning more than the store. so why should i pay then more tax on the store than on the bhouse? or will it b calculated seperately and with other percentage? i rly dnt get the system here in PH.

here the exmple of net win, after deduction of all costs: bhouse 16-19k, sari-sari 7-10k, inetcafe 4-6k

plz help. thanks a lot for any reply

btw regarding tax and other payments to make the netwin is then smaller, this is just a basic calculation and does not include those low months (like sem-break, summer break) what affects all businesses.

Hello Sir,

We are a corporation, in our COR it says our tax type is income tax and VAT. But for our branches (retail stores), i saw that some have no tax type, while others have witholding/expanded or witholding/compensation. My question is what is the best witholding taxes for a retail business? And does having different tax types or whitholding taxes althroughout our branches impact our tax payment? should we have a uniform tax type althroughout? hoping you can shed light on this matter.

Hi Jay. You have a choice whether to have tax payments centralized or every branch has it.

Hi Sir,

Just want to asked i have a client which as per COR is subject to Income tax and Percentage tax. Now here is my question. Is the input vat on purchases specially Property plant and equipment with exceeding 1M can be capitalized and included in the balance sheet account or corresponding input vat for that can be record as outright expense?

Thanks and More Power,

Rene

Hi Madiskarte. If it is your client who bought, ang diskarte to capitalize is the proper treatment because no separate acctg for vat for non-vat registerd. If Vat registered buyer from vat registered seller, then, there is a need to allocate the input vat to 60 months or useful life, if less that 60 months.

Hi Belle,

Thanks for info, but still my question unanswered, Here is the actual scenario. The client purchases fixed assets amounting 1.5m the accountant separate 160,714 and recorded as input vat and the 1,339,285 as PPE. but since based on COR the company is subj to percentage tax could i make an adjustment to bring back the input vat to PPE and record the whole 1.5m as PPE?

Thanks

Hi Reneng, let me rephrase my answer above in a more direct statement. Since your client is non-VAT registered, it will have to record the asset at P1,500,000 despite the input VAT because VAT is not separate from cost or expense if the buyer is non-vat.

Hi Belle,

Thanks, that’s why my officemate calling me madiskarte because of my ability.

Best Regards,

Rene Madiskarte

Nice there Rene. Easier said than done.

Hello Sir,

I’m glad, I found your site, it’s very informative. Anyways, I’m new into business and I don’t have much idea regarding those taxes, and my question is when should I file my percentage tax, is it after a month since my business started or after a year since it states “gross annual sales or receipts do not exceed to 1.5?

Thank you so much.

Hi Isang. Percentage tax is normally filed on a monthly basis. I invite you to our seminar workshop about basic BIR compliance so you will learn much about tax compliance. Please click my name to reach our website.

Hi po,

Pahelp po sana about the following:

1. Accounting treatment for percentage tax? Is this considered an expense of the business? Deductible to taxable income?

2. What will happen if when the percentage tax (3%) has been offsetted to BIR Form 2307 which is supposed to be for income tax return? Are there penalties imposed? Ammend + pay penalties of 25% surcharge + 20% interest expense annual + compromise penalty?

Thanks,

Karen

Definitely percentage payment is considered as allowable expense and recorded as taxes and licenses based on actual percentage tax payment.

For question no. 2, your assumption is correct.

Hi Karen. Yes, percentage tax is an expense deductible from gross income under itemized deductions, part of taxes and licenses. There migt be no additional liability for the error as 2307 amount eill tend to increase and more allowable deductions for the percentage tax previously not deducted.

Sir, i’m so happy at nakita ko etong website nyo. may problema po kasi ako sa mga naging accountant ko. bale wala po kaming accountant talaga dahil hindi naman ganun kalaki ang business at minsan wala namang income daily. ask kolang po may small travel agency. ang proplema kopo is yung pag issue ng official receipt which is addiitonal 3% for non vat. let say ang ticket domesti is P8000 x 3% = P240 ang markup lang po is 250 bale yan po yung service charge na tinatawag namin so kita ko lang is 10 peso. ngayon ang advise sa akin ng accountant ko is gawing vat para ma less yung binabayaran sa airlines dahil vatable napo sya. ngayon nahihirapan naman sya kung paano iaanalize. mahirap po ba ang computation ng non vat sa vat pad sa travel business po? gusto kona po sana magpalit ng accountant baka may mairecommend po kayo. dito po kami sa rizal. salamat…

Hi Jud. Ang isa pong alternatibo ay i rekord na kita yung service fee lamang at issuehan ng official receipt sa pangalan ng pasahero. Un namang cost ng ticket ay issuehan ng acknowledgement receipt bilang re-imbursement ng bayad nyo ng ticket na nakapangalan sa pasahero. Ang nakikita ko po na problema sa suggestion ng accountant nyo ay ung pagsupporta ng input VAT dahil ang ticket nga po ay nakapangalan sa pasahero at d sa travel agency. Kung magpapasadya naman po ng resibo mula airline na nakapangalan sa agency ay baka po di ganun kadali sa mga maliliit na agencies. Pwede nyo po kami kontakin para sa rekomendasyon ng bagong accountant kung sakali. Pa click ang pangalan ko upang ikaw ay mapunta sa website namin.

Hi, one question. Our business is paying the 3% Monthly Percentage Tax. We have been consistent on that. Question, is it really required to file a 1702Q for every quarter? We have been receiving tax credits (from the credit card swipes – whenever we swipe a customer’s card, an amount withheld is deducted) and from our rental payments, by the way. Thanks.

Hi Kristine. Yes, you are required. 3% monthly percentage tax is a business tax while 1702Q is income tax and they are different tax types that is required to be paid. Let me invite you to our seminar programs on BIR compliance for wider working knowledge on tax implications of your leasing business.

Hi Vic / Belle,

Ive been reading this thread for the whole day hoping I can be able to read concern similar as mine. Hope you can help me. Im an accountant working in a training agency and the company im working with is registered non – vat (we are paying 3% percentage vat). We have suppliers who are vatable entity and therefore charging us 12% vat. am i right in my knowledge that this 12% charge should be accounted as our expense and shall form part of our purchase? this is just to clarify because our accounting head is asking me to call the supplier and ask for refund of the vat billed to us. If my understanding is correct, I hope you can assist me in ruling out to them that we dont need to ask for refund coz the 12% vat is a valid charge and is there a BIR ruling that will help me explain this to my head accountant? Thanks so much.

Hi Pia. Please refer to my thoughts on your comment with the same concern. I go with your understanding that the 12% VAT passed on to a non-VAT registered entity is part of expense or cost and that asking for a refund might be baseless. I suggest you invite your head accountant to attend out VAT, In and Out seminar this coming May 28, 2012. Thanks

Hi, ask ko lang regarding cumulative tax. medjo nalito lang ako, if ever an employee started work by March, do i need to compute the 2 mos na wala sya work. fro example net salary of 10k for march is it 10K x 3 (since this is the 3rd month) or just 10K x 1 (since ka start pa lang ng work)? We do they need to pay tax on the 2 mos na wala sila work? confusing lang. thanks very much

Income tax is based on income so no income no tax. Just withhold for March and do not let the employee suffer from huge withhooding tax for being unemployed in the first two months. Thanks.

hi! i am a pharmacist by profession and currently employed by a corporation where i am receiving a monthly compensation. can i still change my tax from employed to professional. sayang naman kasi yung mga pwede ko pang i deduct na expenses. if yes, how?

super thanks!

As compensation income, you can only deduct the personal exemption and the insurance premium of P2,400 a month. To make your wish possible, you need to be engaged in practice of profession with your corporation as your client.

I am so greatful that I found your site. In our COR it’s only income tax and registration. but in the course of our business, we have incurred expenses like venue rental, tables and chairs rental in areas where we had our event. I just also learned about 1601E EWT.

Please enlighten if do we need to deduct the appropriate EWT rate for venue rental and for tables and chairs rental? subsequently to apply as a withholding agent, too?

thank you so much

Good day sir! Thank you for this informative site. I have questions not yet tackled on the previous posts. Im a young dentist and practicing in Manila. I decided to have a branch in Quezon City where I am a subleasee of another dentist in a multispecialty clinic. The main dentist is paying 30000 for the clinic space. I am paying 10000 as my rent to the main dentist. I have registered this QC clinic in BIR and the tax type i’ll be paying is the registration fee and 1601E EWT. However, the main dentist ask me to have the 1601E ammended/removed because he’s already paying for the witholding tax and there will be a double tax entry, and that its not really an income for him because it goes directly to the clinic expenses(the 30000 rent and secretary). On my side, I wanted the rent to be included in my tax deductions, so im having second thoughts on having it ammended. i even offered him that i’ll be the one to pay for the witholding tax(500), so he’ll still be getting the full 10000 monthly instead of 9,500- this setup is fine to me.

My question is do i need to get a receipt from him in order to have my rental fee be a tax deduction, would the sublease contract and 1601E payment suffice to that, if he should issue a receipt, can he use his OR for his patients/practice?

Another question, how can i file the monthly percentage tax of my branch in QC, because on my BIR form it doesnt require me. should i just add it up on my 2551M in my main in Manila( should i fill up two 2551M forms for 00 and 01).

Taxation really give me headaches. please also let me know if you offer taxation services and if you’re BIR certified CPA, im looking for one.

Thank you so much

Hi good day!

Kindly help me with my query.

I’m a new employee of this company. Actually this is only a sole prop / practicing professional. We even aren’t declared employees. My problem is this, the taxpayer is registered in Quezon City but now renting space in Manila area for travel conveniency. He was no business registration here in this area like mayors permit and Bir. But now we are trying our best to make this business legal. However,things seems complicated since a requirement for registration that is the 3 year Contract of Lease was already one year past. I have went to BIR Manila but the officer of the day told me that we will be penalized since the contract was a year expired. In this case, how much will likely the penalty? And about the lessor, can we say that they reported rental income from this tenant when in fact COR submitted to them was addressed in QC and that form 2307 wasn’t submitted to them? I’m confused about this Withholding tax. I found out that the accountant wasn’t remitting this to BIR since the taxpayer was claiming 40%OSD. Lack of knowledge seems to be the reason why this was happening.

Please enlighten me. I would like to help this company because I believe this taxpayer wanted to comply with BIR regulations.

hi, as of date, we our OR is still being printed hence our sales have not been issued an OR how shall we file our 2551M given the situation. what will be our basis for the computation..We just started our business and was registered only April 12, 2012. our BIR ATP is May 28, 2012. what data shall we put in our 2551M…. thanks

Hi Toti. The taxable amount is the total gross receipts or gross sales regardless of whether you issue OR/SI or not. Non-issuance of OR/SI is another thing subject of penalty and independent from 2551M. While it is normal to base taxable base in OR/SI, this only applies if you declared all.

GoodDay! I hope you can enlighten me because I am very confused and may well encounter problems in filing taxes in the future because in the past I have always been an employee and the companies I worked for did this for me. Now I am starting a a different career as a new real estate broker while retaining my job (a full time employee at a company). I registered my realty as non vat so I know I am supposed to pay monthly percentage tax. However, I do not know how to compute it – For example I receive 150,000 as gross commission for a sale and then pay my agent/referrer his commission, say 50,000. My questions are:

1. do I pay the 3% percentage tax based on the gross commission I received from the developer? If so, that would mean I alone shoulder the percentage tax, am I correct? I,as the business owner pay even for the taxable share of my agent’s commission?

2. Don’t they (agents) pay their own percentage tax if they are registered individuals with the BIR?

3.What about agent’s income taxes? Can I opt NOT to withhold taxes and just let them settle payment of income taxes by themselves? (I honestly prefer not to, because of my limited knowledge about taxes and I do not think I can allot time)

Thank you for your time and help. Your site is really informative.

Hi Joan, Let me share views after your questions which I copied below.

1. do I pay the 3% percentage tax based on the gross commission I received from the developer? If so, that would mean I alone shoulder the percentage tax, am I correct? I,as the business owner pay even for the taxable share of my agent’s commission?

Views – As non-VAT registered, I believe you are for the commission you will get from the sales. Commission is your taxable gross receipts.

2. Don’t they (agents) pay their own percentage tax if they are registered individuals with the BIR?

Views – Your agents will likewise pay their 3% percentage tax for their corresponding share in the commission. Their share in the commission is your taxable gross receipts and would not matter under the fact that the same commission had already been taxed at your level.

3.What about agent’s income taxes? Can I opt NOT to withhold taxes and just let them settle payment of income taxes by themselves? (I honestly prefer not to, because of my limited knowledge about taxes and I do not think I can allot time)

Views – The commission you will pay your agent’s would constitute as your deductible expense and as such you are automatically constituted as a withholding tax agent in deducting the 10% tax based on gross commission. Limited knowledge may not be an excuse and BIR will penalize you for not withholding where you will pay not only the basic amount you should withheld, but with 25& surcharge, 20% interest and compromise.

We can help you learn the basic things you need for BIR tax compliance with our two-day Non-VAT seminar workshop. Please click on my name to reach our site and the details of our Basic Business Accounting and BIR Compliance for Non-VAT. Thanks

gudam sir.. just wanna ask what are the forms required to file if i am an owner of an internet cafe aside from the monthly percentage tax and the annual ITR FS? thank you…

Sir,

Thanks po this informative tips about Tax, Im planning to put my own Business, self employed, Do you have any tips on how can I reduce my Tax,

Thanks

Benjie

Hi Vic,

Thank you for posting this, it was really helpful. 🙂 I have a similar situation with “Mark Gomez” above (the only difference is my sublessor and I have a different business – does this matter?) Anyway, can you answer our concern about being a sublessee but want to have the rent included in the tax deductions?

Thanks!

Sir,

I really appreciate of having found like this, it’s very helpful and informative. I browsed and read the questions but didn’t found concern like mine.

I am working in a transport business, I am looking for the definition of Domestic carrier and keeper of garage. I am confuse whether we are to file as VATable tax – 2550M/2550Q or 2551M(as per our COR)

Thanks,

iya

Sir,

I just want to know if how much is the minimum amount if in case BIR’s RDO conduct tax mapping like for example my father is into hardware (only small time) and since his accountant/bookkeeper just passed away last sept. 2012 his books of accounts were not updated when they had their tax mapping last sept 13 but only for sept transactions, they charged my father P3000 penalty and another P3000 penalty for not listing the vat computation on the receipts. My father’s hardware is the typical old fashioned hardware store although he uses the calculator and no longer the abacus, still he doesn’t know how to operate a cellphone and what more of computers and they are requiring reports to be submitted into cd’s.i hope to hear from you! thank you!

Sir tanong lang po. Gusto ko magkaroon ng business na uv express or gt express. paano po ba ang kaltas ng tax nun? at ilang percent ba? may idea rin po ba kayo magkano register sa LTFRB ng linya? tnx po.

Hi

Kindly support me here please.

I have a sari sari store, just opened. I have a barangay permit. I am selling cigarettes, cookies, candies , soft drinks and Beer. My question is that how much TAX should I pay and to whom should I pay it. I am getting nervous now since I found your site and realized that I am required to pay TAX. Please need here your advice.

Hi, got a question regarding deduction, i have a simplified bookeeping record for my new business, just wondering for the method of deduction should it be itemized deduction or 40% optional deduction, not sure which one should i put on my returns.

Hello.

I am working w/a non-stock non-profit corporation, so tax exempt cya. Now, we have 2 branches, 1 is in service activity and the other 1 is selling of goods, both none related to the main activity of the MAIN. Our 1st branch is the services w/c does not exceed to any thresholds kaya it was registered to BIR – 2551M (Percentage Tax).

Then we have this Selling of goods as our 2nd branch, over and above cya sa thresholds kaya we are obliged to register to VAT – 2550M/Q.

Question:

Is the corporation as a whole now registered to VAT? or only the 2nd Branch?

Just like my aging neighbors/friends having the same line of business activity, i own/operate a ‘rooms for rent’ business but i didn’t register it with the BIR ever since. I just renew every year my barangay and mayor’s business permit and pay the corresponding fees imposed by the LGU’s. The reason i didn’t register it with the BIR is because its meager annual gross income does not even reach the 100K limit. Besides, its income is not even enough to support the daily medical expenses and other basic necessities of my wife and myself more so with the headache of maintaining the so-called book of accounts and issuing receipts to our tenants. More often than not, the tenants themselves even shoulder at their own volition the expenses in maintaining/improving their tenanted rooms. What then is my liability of not registering my only means of livelihood? To tell you frankly, my wife and I, being already in our twilight years suffering from a host of body ailments, are ready to die in jail if this corrupt government will demand us to register with the BIR and allow them to bite a portion of our scanty income. Throughout my 40 years of employment in the past, I have already contributed tens of thousands of withholding tax deducted from my monthly salary. Enough is enough! The senior citizen privileges that we get now is just the government’s ‘pa-consuelo de bobo’ for dying citizens like us. Your valuable insight/advice will be deeply appreciated. Thank you.

Hi Vic,

My company’s producing a play that will be staged in QC. I was told we’re supposed to pay an 8% amusement tax to the local government plus 18% percentage tax to BIR and I wanted to double check if this was correct. We’re not a “cockpit” nor a “club”, so I’m wondering where the 18% came from. And is it possible to have the local amusement tax waived?

Many thanks!

Hi sir vic,

This is a very helpful blog. I just want to ask how much is the percentage tax rate for water refilling station thru franchise, is it 2 or 3%.

Thanks a lot. What if 2%, can i use the overpayment from 2010-2012 as tax credit sa 2013 2551m ko kahit nagamit ko sya as allowable deduction sa income tax payment ko?

Hi Sir,

Good day. Just recently, I handled a restaurant business with Jai-Alai betting machine. I’m an accountant. They are VAT registered. I file and pay monthly and quarterly VAT. but as i read percentage tax, their mixed business falls into percentage tax which is Jai-Alai. What should I do? Should I also file percentage tax aside from VAT that I file and pay monthly and quarterly?

and they are not operators of Jai-Alai, they just accept bets. They bought betting machines exclusively for use on betting on Jai-Alai. Now I’m confused, Is all the receipts entered into the betting machine considered “gross receipts” that is taxable by 30% percentage tax? Becoz they are only remitting all the bets entered into the machine to the Operator and they just get a certain percentage as commission for putting up those betting machines. They are not operators but merely accepting bets.

Pls help..

Thanks a lot..

pls email me at ladyreyn1985(@)yahoo.com

Hi Ma’am/Sir,

I am a gym instructor in one of the premier clubs in a manila but I am not a regular employee. We are considered accredited coaches/trainer. The club recently started withholding taxes from us. They withhold 10% tax from us. We recently to reclassify ourselves so to bring down the wt to 2% instead of 10%. But as the finance people in the club explained ti us, regardless how much tax they take from us monthly, it is important that consider the income tax that we will shoulder at the end of the year. One of my friends suggested to me the idea of percentage tax. My question is, will this apply to me? how do i go about the process if yes? because ive been hearing about form 2551 that I need to get from the club but all they are saying is that I should be registered in DTI. I hope you can answer my question. Thank you and more power to your blog. Jay

Hi po ask ko lang what form needed meron akong isang taxi nag operate ng feb 2013 at the same time employed and teach me na din po kung anong computation ang gagawin. thanks po