How to compute quarterly income tax return in the Philippines for self-employed individuals? If you are a professional who practice your profession or a self-employed individual engaged in a sole proprietorship business, you may be looking for a guide on how to prepare your BIR Form 1701Q. BIR form 1701Q is filed quarterly for the first quarter, second quarter and third quarter. For the annual income tax return, the BIR form 1701 is used. The following are the steps, procedures, requirements, tips and other important information you need to know in computing and preparing your quarterly income tax returns.

What is the BIR form to be used?

The return we need to file is BIR Form No. 1701Q: Quarterly Income Tax Return for Self-employed Individuals, Estates, and Trusts (Including Those with both Business and Compensation Income)

The following are the documentary requirements that need to be attached with the form, if applicable:

1. Certificate of Income Tax Withheld at Source (BIR Form 2307), if applicable

2. Certificate of Income Payments not Subjected to Withholding Tax (BIR Form 2304) if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Previously filed return, if an amended return is filed for the same quarter

Who are required to file BIR Form 1701Q?

This return shall be filed in triplicate by the following individuals regardless of amount of gross income:

1) A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

2) A resident alien, non-resident citizen or non-resident alien individual engaged in trade, business or practice of profession within the Philippines.

3) A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

When are the deadlines or due dates of filing the return?

The following are the deadlines for manual filing of BIR Form 1701Q :

1st qtr: On or before April 15 of the current taxable year

2nd qtr: On or before August 15 of the current taxable year

3rd qtr: On or before November 15 of the current taxable year

How to compute and prepare the quarterly income tax returns?

The following are the steps in the computation and preparation of your quarterly income tax returns. You can also check the sample computation we have provided below. For better understanding, please download BIR Form 1701Q here.

STEP 1: Fill up completely the Part 1 of BIR form 1701Q with the applicable information, which include your Taxpayer Identification Number (TIN), registered name, registered address, line of business or occupation, method of deduction (itemized deduction or optional standard deduction), and other information that are applicable. Also fill in the year, quarter, check if amended or not, and the no. of sheet/s attached which can be found on the top of the return.

STEP 2: Fill up Part 2 of the form, which is the computation of the quarterly income tax. Refer to the form 1701Q to check the line items and their corresponding reference numbers.

Step 2.1: Determine your [26] Sales/Revenues/Receipts/Fees. Add any [27] Amount You Received as a Partner from General Professional Partnership (except loans), if any, to arrived at [28] Total.

Step 2.2: Calculate your [30] Gross income from Operation by subtracting your [29] Cost of Sales/Services to your [28] Total in Step 2.1. Costs of services are the direct costs attributable to the rendering of your services, such as the depreciation of the building for business engage in building rental, internet cost for internet café business, salaries of janitors for business engaged in janitorial services, and others.

Step 2.3: Compute your [32] Total Gross Income by adding [30] Gross Income to your [31] Other Income, if any.

Step 2.4: Determine and compute your total allowable [33] Deductions for the quarter. You can choose one from the two (2) methods of deduction: (a) Itemized deduction or the (b) Optional Standard Deduction (OSD). Your chosen method of deduction will be your method of deduction for the entire taxable year. The following are the bases for computing the two methods:

Option 1: Optional Standard Deduction (OSD) – A maximum of 40% of their gross sales or receipts shall be allowed as deduction in lieu of the itemized deduction. This type of deduction shall not be allowed for non-resident aliens engaged in trade or business. Example, if you have P100,000 gross sales or receipts for the quarter, you can claim an allowable deduction (OSD) of P40,000 (P100,000 x 40%), if you choose OSD instead of Itemized deduction.

Option 2: Itemized Deduction – There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of a profession including a reasonable allowance for salaries, travel, rental and entertainment expenses. Examples of itemized deductions are the following:

Step 2.5: Calculate your [34] Taxable Income this Quarter by deducting your [33] Allowable Deduction computed in Step 2.4 to your [32] Total Gross Income.

Step 2.6: Compute your [36] Taxable Income to Date by adding your [35] “Taxable Income for the Previous Quarter/s” during the taxable year to your [34] Taxable Income this Quarter. Take the following guides:

- For the 1st quarter, you don’t have [35] Taxable Income for the Previous Quarter/s since it is the beginning quarter of the taxable year.

- For the 2nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to your [34] Taxable Income this Quarter in the 1st quarter.

- For the 3nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to the “total of your taxable [34] Income this Quarter in the 1st and 2nd quarters” or the “total [36] Taxable income to Date of the 2nd quarter”.

- There is no 1701Q filed and computed in the fourth quarter. Instead the annual income tax return (BIR Form 1701) is filed and computed. To learn how to compute annual income tax for self-employed please read our article on “How to compute income tax in the Philippines for self-employed individuals”.

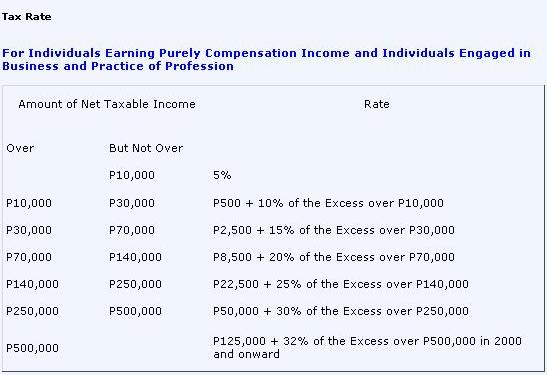

Step 2.7: Compute your [37] Tax Due using the Graduated Tax Table for Individuals. You can jump below Step 2.9 to see tax rates table and our sample computation.

Step 2.8: Compute your [39] Tax Payable by deducting to your [37] Tax Due to your [38] total tax Credits/Payments for the Quarter, which include [38A/B] Prior Year’s Excess Credits, [38C/D] Tax Payment(s) for the Previous Quarter(s), [38E/F] Creditable Tax Withheld for the Previous Quarter(s), [38G/H] Creditable Tax Withheld Per BIR Form 2307 for the Quarter, and [38I/J] Tax Paid in Return Previously Filed (if you are filing an amended return).

Step 2.9: Compute your [41] Total Amount Payable by adding any [40] Penalties (surcharge, interest and compromise), if there is any. Penalty is charged for late filing. To learn more about computing penalties, please check our article “How to compute BIR penalties”.

Sample computation of quarterly income tax due and payable

Example: Let us assume the following financial information of J. Santos, single and Filipino Citizen, for the 3rd Quarter of 2011. Santos has chosen to claim itemized deduction, instead of Optional Standard Deduction (OSD). He is also filing the return before the due date, which is also not an amended return.

Gross sales: P300,000

Cost of Sales: P 180,000

Expenses (rent, depreciation, salaries, taxes and licenses): P 60,000

Other income: P 20,000

Total taxable income for the 1st and 2nd Quarters: P40,000

Income tax paid for the 1st and 2nd Quarters: P1,000

Creditable tax withheld for the previous quarters: P3,000

Creditable tax withheld per BIR form 2307 for this quarter: P2,000

What is your income tax due and payable for the 3rd quarter of 2011?

Answers and computation:

| Gross Sales [26] | P 300,000 |

| Add: Share from Gen. Prof. Partnership [27] | 0 |

| Total [28] | 300,000 |

| Less: Cost of Sales [29] | 180,000 |

| Gross Income from Operation [30] | 120,000 |

| Add: Other Income [31] | 20,000 |

| Total Gross Income [32] | 140,000 |

| Less: Deductions [33] | 60,000 |

| Taxable Income This Quarter [34] | 80,000 |

| Add: Taxable Income for the Previous Qtrs [35] | 40,000 |

| Taxable Income to Date [36] | 120,000 |

| Tax Due [37] * | 18,500 |

| Less: Tax Credits/Payments: [38] | |

| Tax Paid for the Previous Quarters | 1,000 |

| Creditable tax withheld for the previous quarters | 3,000 |

| Creditable tax withheld per BIR form 2307 for this qtr | 2,000 |

| Tax Payable [39] | 12,500 |

| Less Penalties [40] | 0 |

| Total Amount Payable [41] | P 12,500 |

* Computation of tax due:

Since P120,000 is under the “over P70,000 but not over P140,000, your tax due is equal to P8,500 + 20% of the Excess of 70,000.

Tax Due = P8,500 + 20% of the Excess over 70,000.

Tax Due = 8,500 + [20% (120,000 – 70,000)]

Tax Due = 8,500 + (20% x 50,000)

Tax Due = 8,500 + 10,000

Tax Due = P18,500

Notes:

1. The personal and additional exemptions of the taxpayer are only claimed on the computation of annual income tax return..

2. Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.

Step 2.10. If you are filing consolidated income tax return with your spouse, aggregate your income tax payable.

Step 2.11 Put your signature over your printed name. Also fill the Title/Position of Signatory.

STEP 3: Fill out the details of payment in Part III

How to file the quarterly income tax returns?

The following are the procedure in filing the quarterly income tax returns:

1. Fill-up BIR Form 1701Q in triplicate.

2. If there is payment:

- Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you registered and present the duly accomplished BIR Form 1701 Q, together with the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and present the duly accomplished BIR Form 1701Q, together with the required attachments and your payment.

- Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

3. For “No Payment” Returns including refundable/ creditable returns with excess tax credit carry over and returns qualified for second installment:

- Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701Q, together with the required attachments.

- Receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

Reference: Bureau of Internal Revenue Philippines

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi Vic,

This is very informative since I am a Professional. This is the answer to my questions in mind. But I have more questions, I hope you won’t mind:

01 Who’s going to decide if what kind of deduction I can use (OSD or Itemized)?

02 Can I choose or it should be BIR?

03 What are the pros and cons for each one?

04 If i choose OSD today, can I switch to Itemized for next quarter or vice versa?

05 I read another source and it says that the deadline for the 2nd quarter income tax is July 15. Is it July 15 or Aug 15?

06 I am registered as a professional starting March 14, 2011 and I haven’t filed the return yet though I have no income. How much do you think will I pay for the penalty?

Thanks a lot Vic!

how to compute the quarterly income tax return if the deduction is bigger than the total gross income?

@ Norie

If your deduction is bigger than than gross income, you don’t have any taxable income for that quarter, hence, just leave your taxable income this quarter as zero. For the 2nd and 3rd quarters, you need to compute your cumulative taxable income. So even if you have zero taxable income for this quarter (except in 1st quarter) you may still have taxable income for computation that are carried over from previous quarters.

hi, if no due for the quarter, do we have to go to BIR offices for filing it? of online submission is okay? Thanks in advance

hi, vic!

thanks, this is very helpful. i just got a little confused…why is your taxable income for previous quarters 40,000 instead of 45,000? everything else is clear though.

Hi Iya,

Thanks for noting that. It was a typo error. The example should be 40,000 instead of 45,000 taxable income for the previous quarters.

thanks, vic! 😉 that makes me more confident in making my own taxes. God bless and more power to your website.

Thanks Iya.

For further discussions about Philippine Taxation, you can join us in BusinessForum.ph , this is our extension forum and discussion area for further questions on our published articles. Registration is free and you can also send and receive private messages.

Thanks

Hi sir Vic! i just want to ask if i am working with the 1701Q for the 2nd quarter, what should i fill up with the creditable tax witheld for the previous quarter/s?is it the creditable tax witheld per bir form 2307 during the first quarter?i am very confused..hope you could help..thanks alot!

Hi, good day! Sir, what is the requirements in filing quarterly income tax 1701Q with 0 net income? Last April and August I did pay in bank but now the expenses is bigger than gross, where do I submit the 1701Q form with 0 quarterly income tax?

Thank you.

thanks vic

Thanks Vic. Very helpful indeed. More power to you.

Dear Mr. Vic,

I put up a small business and it started last aug.15. My problem is i don’t know how to compute my quarterly income tax return. I don’t know if im going to use the OSD or itemized. Thanks a lot Vic.

Hi Remedios, I suggest you enroll at our BIR compliance programs so you will learn about business accounting, returns to be filed, books of accounts, and more.

helllo sir,inquire lang sana how to renroll sa BIR compliance programs?thanks so much

Hi Lizzy! You may please visit our website, Taxacctgcenter.org and you may select your intended programs. You may either register online through the contact form or contact us via phone for reservations. Thanks.

Hi Vic,

I’d like to ask, is it okay if I don’t attend the seminar for new registrants with BIR but I have somebody else to proxy for me?

Thanks!

You’e got to call the BIR office in your jurisdiction to confirm this.

HELLO!!!

We used the OSD in computing the quarterly income. Can you give sample computation to that. It was computed that i am going to pay for 10k+. I did not gain in the past few months,so i am wondering why will i have such a big amount to pay.

Thanks!

Hi Vic,

This is a silly question.

I just want to ask if I would be fined if I accidentally wrote on the duplicate form of the receipt. I was working in a low light setting and instead of my writing it on the customer’s copy I wrote it on the duplicate. What I did is to erase it with pen as well and put cross signatures on all errors on the customer’s copy with a carbon paper to erase the pen writings on the duplicate.

I hope you understand what I meant. Your feedback will greatly be appreciated. It looked messy but I know the customer and he didn’t mind.

I’m kinda worried about the duplicate. HELP.

You shouldn’t be worry if you’re telling the truth, and if you can have supporting evidences to vouch for the truth.

thanks Vic!

btw, since i just started my business my expenses are more that what i earn. i think i get the part that i dont have to pay anythng for tax as long as i fill in the correct info. regarding itemized deduction is there any documents that i hve to provide to support this expenses. my cor reflects registration monthly percentage and income tax if it helps.

thanks.

very helpful as always. if youve noticed iv been on this site for month. but im still quite confused with thes taxes. hope you dot get tired answering my queries 🙂

Yes, fill the correct info, but ensure that those infos are substantially supported with documents. You need to keep your records (books of accounts) supported with the right documents, such as OR and invoices. You don’t need to present supporting original documents and books when filing ITR (quarterly and Annually). However, the BIR may request them during audit and examination.

hello sir, ask ko lang anong month ung dapat icompute sa third quarter, pasama na rin ung 1st and 2nd tnx po

@che

You will compute the “taxable income for the quarter” (ex. on 3rd quarter [July, Aug, Sept). However, in the return, you will need to add the “taxable income for the previous quarters” (1st and 2nd qtrs) to the “taxable income for the quarter” to arrive at “taxable income to date.” Then you will compute the tax due based on the “taxable income to date”. The tax due would be then deducted by the income taxes you paid for the previous quarters – to arrive at the income tax payable for the quarter. Please refer to the article.

thank you for being so helpful sir… God bless

Hi Sir, kung add to Taxable income to date yung previous quarter 1st & 2nd quarter, edi lalaki yung tax due and hindi po bayad na yun oer qauerter, ganun po ba talaga yun and hindi po kaya doble yung binayaran kung i-add yung Previous quarter to date sa filing ng 2nd and 3rd?

I am using 40%osd,pwede po ba ako mag less ng cost of sales and sevices? ask ko lang po kung ano ano pa ang pwede kong i less. thnk you.

hi sir, na curious lang po ako sa topic,, sir if we have to add the taxable income for first and second quarter on the 3rd quarter taxable income just to arrive n the taxable income up to date, and then we will compute the “tax due based” on the “taxable income to date”,sir question po, sir hindi po ba dapat yung taxable income for the third quarter lang po ang i-co-compute kasi nabayaran na po ang first and second quarter. kung ganito po lalabas pong 3X binayaran ang 1st quarter, 2x binayaran ang 2nd quarter at lalaki ang bayaran sa 3rd quarter. napansin ko lang po. salamat po

* hi vic. super gulo ng records namin. can we submit a tentative quarterly ITR just for purposes of being able to submit? all corrections/adjustments will be done in the annual ITR. is this safe to do?

* in our books, our tax credits (2307 form from customers) for the 3rd quarter amount to P50,000. but per actual 2307 forms that we have on hand, the total is only P40,000. what amount do we indicate in the 3rd quarter for the creditable tax withheld? it’s already too late to be asking the customers to submit the 2307 forms before the deadline (november 15). thanks.

I can’t advice to submit any tentative returns to BIR. However, the code does give taxpayer the right to amend his/her filed returns/declarations within 3 years or before the BIR issue a LOA (Letter of Authority) to audit or examine the taxpayer. In other words, if you file 3rd qtr ITR , you can still amend it (by filing amended QITR) to correct your previous filed return before the BIR issue a LOA.

Hi Mr. Vic.

Di ko alam kung live pa itong furom na to. Same Question with others. Pag isinama yong taxable income sa previous quater. parang doble tax na. kahit zero income sa current quater. May babayaran ka pa rin. saan ka kukuha ng pambayad mo kung zero income kja na.

Thanks baka mainlight naman ako dito.

@ sir ernie, meron pong 38 Less: Tax credits/payments… 38 C/D – tax payment/s for the previous quarter/s, dun po ilalagay ang binayaran na tax ng mga previous quarter kaya di na din po makakasama yun sa babayarang tax ng present quarter.

yan po ang pagkakaintindi ko sa form 1701q.

correct me sir vic if i’m wrong.

sana po nakatulong ako,

Hi Vic,

Help naman, hindi kase kami nagfile ng quarterly income tax return for the 1st, 2nd, and 3rd quarter of this year, okey lang ba na one time na lang kami magbayad yung final na lang?

Hi Fe. You will still be required to file for the quarterly ITR and is already penalizable.

Hello po! I’m 1styr accountancy student. I wanna help my mom to do her quarterly Income Tax return. This helped me a lot. But i’m still no on the difference between GROSS SALES and COST OF SALES? Can you help me? (: Tha! anyway.

Hello Kuya Vic,

Bago pa lang po ako sa business at may itatanong lang po sana ako about quarterly income tax return po. Yung 40% Optional Standard Deduction po ba kasama na dun yung mga nabayaran mo sa business permit, withholding tax, etc.? Wala na po bang ibang pweding ibabawas? Pwede na rin po bang mag file ng personal exemption sa first quarter palang? Kasi kung yung 40% lang talaga ang ibabasaw sa gross sales ko, mukhang malaki yata ang mababayan ko. Salamat mo ng marami sa mag rereply. God bless!

The 40% OSD is your optional standard deduction instead of the itemized deduction. So it would be “as if” all your allowable deductions. Remember that once you opt for OSD in the 1st quarter, it will be consistent up to your annual ITR. The advantage of opting for OSD is you will not be required to submit FS/SALN when filing your annual ITR.

No. You can’t claim personal and additional exemptions on the quarterly income tax filing. Personal/additional exemptions are only claimed on your annual ITR. T

Thanks Kuya Vic! Meron lang po sana akong karagdagang tanong. Last December 15, 2011 lang po ako nag start mag negosyo. Yung gross sales ko po from December 15, 2011 up to December 31, 2011 ay 79,012.00 pesos. Non-vat registered po ako so ang binayaran ko po ay yung monthly percentage tax na 3% sa gross sales ko. Nag bayad po ako last January 15, 2012 ng percentage tax base po ng kita ko from Dec. 15-Dec. 31,2011. Tama po ba ang ginawa ko?

Kuya Vic, sa first quarter po ba ng income tax return na babayaran sa April, ito po ba yung gross sales ko from January to March? Paano na po yung sales ko nung Dec15-Dec31, 2011 eh late nga po akong nag start. Isasali ko po ba yun sa first quarter ng income tax return ko? Naguguluhan po kasi ako.

Ulit Marami Pong Salamat.

Yes, it’s right the you pay your December percentage tax.

Your quarterly income tax (BIR 1701Q) for the first quarter of 2012 will only be based on your taxable income from Jan-March 2012.

Your taxable income for December 2011 will be reflected in your annual income tax return (BIR 1701) for the year 2011.

Both the 2011 Annual Income tax return (1701) and the 2012 First Quarterly income tax return (1701Q) are due on April 15 2012.

Hence, you will be filing them both on or before that date.

Marami pong salamat kuya Vic! Finally naintindihan ko na rin sa wakas. God Bless and more power po!

hi. i want to know how to compute my income tax, example im getting paid $110 per day, 20 days per month how much will i pay for my tax… if im a freelancer and married with two kids… i just started working this month thanks alot.. hope to hear from you soon…

Hi Sir, I find your site educative. Its been a problem to me from the start. Sir, I am a non-vat payee. I payed my percentage tax promptly per mos but I am not aware that I need to pay my Quarterly tax also. In my COR,I am required to pay ” Income tax, Percentage tax, Reg Fee and witholding” I thought Income Tax would be yearly does it mean it includes Quarterly also? Hope you can clear this thing. thanks alot

Yes you should be paying Quarterly income tax too. You can confirm that with the BIR office.

Hi Rin! Yes, I go with Vic that you ned to file quarterlu income tax return. Income tax, withholding tax, and percentage tax are reportorial returns you should not miss to avoid being penalized. We advocate to educate entreprenuers like you through seminars and workshops. Please visit our site for more details.

Sir Vic, just want to ask something regarding exemption sa mga anak. suppose i have 6 kids, of course 4 only would be subjected to tax exemption, what if one riches 21, can i still claim for 4? thanks

If the dependents becomes twenty-one (21) years old or becomes gainfully employed during the taxable year, the taxpayer may still claim the same exemptions as if the the dependents became 21 years old or became employed at the close of such year.

sir, clarify ko lang po…

1) i don’t think i filed quarterly income tax reports last year (1701Q), will i be penalized? i didn’t earn anything last year (sad, i know)

2) this month (feb), i was able to sell a property, and i’m going to get 350,000 as gross commission by March 20. since i’ll pay for VAT (37,500) and 10% will be withheld at source (31,250), my net commission will be 281,250. Based on the tax table, the tax I still have to pay will be 28,125 is that correct?

3) since i’m getting my commission on march 20 (or later), should i file and pay for the VAT on April?

Thanks!!!

went to the BIR RDO a while ago and learned a few things:

1) penalty for not filing quarterly income tax (even if no income) – P200 per quarter (maybe it’s different per RDO?)

2) according to my example, if the commission is 350,000:

Gross Sales (vat-exclusive): 312,500

Less: OSD (40%): 125,000

Taxable income: 187,500

rate: over 140,000 but not over 250,000

(22,500 + 25% of excess over 140,000)

therefore, tax due is:

187,500 – 140,000 = 47,500 * 25% = 11,875 + 22,500 = 34,375

since 10% is already withheld (31,250)

then: 34,375 – 31,250 = 3,125 is the tax due

very nice people from the BIR 🙂

They may have failed to emphasize that OSD for annual ITR requires that you must have already opted in your first quarterly ITR within the taxable year. If you have missed your quarterly ITRs, I fear you may not be able to apply OSD on annual basis. Thanks, Jon.

Hi Belle,

Unfortunately, I didn’t have any income last year, so whether OSD or itemized, it doesn’t make any difference. Although I will pay penalties for last year, that’s ok. The computation above is for this year’s first quarter, so I’ll be sure to choose OSD so when I file for the annual income tax report for 2012, it will be OSD all the way.

Additionally, and I hope it’s not off-topic, is it okay if I ask the developer not to withhold the 10% of my commission? I’ll remit it directly to the BIR instead. Is that possible or are there any repercussions?

Thanks!!!

I do not think the developer will allow that because they are required by tax regulations and such will not be deductible as an expense without the withholding tax.

Thanks Belle for helping me out. To date, the developer has not provided me BIR form 2307, what should I do? They can’t give me any information when they’ll be able to give me the said proof that 10% of my income was withheld, so what should i pay the BIR? should i not declare it for this quarter and just file it next quarter instead? please help, i’m panicking over this because i don’t want to keep being penalized.

Thanks so much for this post. Really helpful. I have a few more questions, though. I work on a PROJECT basis full time for Company A and part time for Company B. Because I’m a mixed earner (pure compensation but 2 employers), I’m thinking this is the right form to file – 1701Q.

Q1: If each company gives me form 2307, I need to attach both forms when I file Form 1701Q, is that correct?

Q2: The 2307 forms I have are signed by the Payors’ authorized reps but they have no BIR stamp. Will these do or is it necessary to get BIR stamp on form 2307?

Thanks for your help!

A1. Yes. But remember that 1701Q is for quarterly filing, annual income tax uses 1701.

A2. They don’t necessarily need to be stamped by the BIR, since employers are assumed to have filed and remitted your withholding taxes appearing on the certificates. Just make sure, they have accurately computed and tallied the amounts to the actual taxes withheld.

I appreciate your quick and very clear response. Thank goodness I came across your site. Great job you’re doing here helping clueless folks like me. Thanks so much!

Hi Eunice. I suggest you attend our basic bir compliance programs to develop sufficient working knowledge in bir compliance and avoid paying penalties.

If you are receiving BIR Form 2316 from 2 employers at the same time i.e. pure compensation, you should use BIR Form 1700.

If you have an employee-employer relationship with one and you’re an independent contractor of the other, then yes, you would need to file BIR Form 1701 and 1701Q

Hi,

I’m confused about this note above: “Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.” I’m getting compensation income only, does it mean I don’t have to file quarterly? Just the annual ITR 1701? Thanks again.

Eunice

hi sir,

i am in a non vat service oriented business with several branches, do i need to file a separate quarterly tax for each branch, or ill just add them up and be filed as one quarterly tax?

thanks!

Like to ask is cost of sale filed per quarter at 1701Q must be the same cost of sale that must be filed at 1701 im using itemized deduction wud just like to ask because i missed to include a lot of receipts of expenses in my quarterly report and just found them last week thank you

Hi Jon, it is the developer’s problem if it will not withhold on your commission so you will still declare the gross amount received. If they withheld, then, you secure the 2307 by all means because it is their obligation to issue and remit the amount withheld.

Nothing to worry about, we can help you with your ITR for a minimal fee. Our office is located in Pasay near OWWA or we could set a meeting with my colleagues.

Hi sir. Sir tanong ko lang po. bago lang po kasi ako ngkaron ng TIN. self-employed po ako. wala po akong business. di ko po kasi maintindihan ung computation. and the terms, i don’t know what’s their meaning. can you help me fill-up my form? My total income from February (when i received my TIN#) upto now is PHP2500 and my expenses is PHP494. On-call nurse lng po kasi ako kya mbaba lng ang kita ko. thank you po.

Hi sir. I already have a computation for my income tax but I’m having a hard time plotting it in form 1701. I hope you could help me as to which lines should I place the following information:

1. Gross Income (Total Compensation)

2. Personal Exemption

3. Taxable Income

4. Tax Due

5. Taxes Withheld

6. Tax Payable

These were the contents of the computation made by my friend. Sadly, he already left & I don’t know how to plot the contents in form 1701.

Help please. Thank you so much.

Hi. If you are preparing for 1701, try using the interactive forms. businesstips.ph/bir-interactive-forms-for-income-tax-filing-now-available/

helo sir..just want to ask something..d b sa quarterly..january, february and march ang sakop..we started our business last march..we filed our monthly percentage tax..how am i going to compute it?

Yes, Jan, Feb and March. Just compute using the figures on those 3 months, whether zero or not.

do i need to attached an income statement or the financial statements for the quarter to the bir form 1701Q

No. Check out the last page of the form 1701Q and every BIR form, instructions and guidelines are stated there, as well as the attachments required.

have another query on the monthly percentage tax…. do i need to attached a SAWT form to the 2551M form? I am engaged in my profession. am i required to file this 2551Q also?

am a non vat registered taxpayer. can i opt to change to a vat registered even if my gross receipts do not reach 1.9M?

Ask ko lang po, example hnde ako nkapagfile nkapagfile ng 3 consecutive quarters during 2009. Paano po ang penalties nun kung ngayong 2012 lang ako magbabayad? thanks po

Hi. There are already penalties on them, which include interest, surcharge and compromise, depending on your tax liability and date of payment.

Hi! Thank goodness I found this very informative site.You mentioned that in order to use the 40% OSD, you need to have used it from the first quarter. We started our business this April, meaning we didn’t file for the first quarter.

a. Will we still be able to use the 40% OSD? or we have to start using it next year?

b. For a small business, is it better to use the 40% OSD rather than the itemized deduction?

c. We also paid for the 3% percentage tax monthly from our gross sales (being non-vat), can’t we use that as a deduction also?

d. Being a small company, are we still required to have financial statements monthly? anually? Signed by a CPA?

We are just starting but I would really like to get everything right, to avoid any problems in the future. Thanks so much! You are being so much help to us.

Karen

Hi Karen! Your first opportune time for the OSD is the 2nd quarter and I believe you are still qualified. Quantitavely, not all could benefit fom OSD it only favors more of service concerns and those with less expenses. under OSD, automatic rate of 40% in lieu of all itemized deductions so the 3% percentage tax payments is no longer deductible. I suggest you take more doze of education to better keep them right and eliminate the need for a retainer paid CPA. Audited financial statements apply if you exceed P150,000 in any one quarter.

I invite you to attend our basic BIR compliance seminar for our teachings on the basics of tax compliance and doing them yourself. Please visit our website for the schedules and reservations.

So does this mean that you do not have to file 2551m if you avail of the OSD.

We started an instrumentation business with no employee at the start and only my husband do the job but now there’s a need to hire a helper with minimum wage. We went to BIR to apply for TIN for the person we intend to hire but the BIR personnel told us that we need to update our registration. Do we really need to update our COR with the BIR and request for “Change Tax Type Details” and add “Withholding Tax on Compensation” even if the employee we will hire will be exempted from filing income tax and there will be no tax to withhold? Please help. Thanks.

Good morning, this is a clarification on the deadline of filing of the 1st qtr 1701. As indicated at the back of the form it is April 15, I’ve notice that the of the 1st qtr lead time is only 30 days not like in 2nd & 3rd qtr deadline it is 45 days. I’m just confused. Thank you & GOD bless.

Hi. It is really April 15 for 1701Q – individual. Yes, 1st quarter has earlier deadline than 2nd and 3rd quarters. From the close of taxable quarter (March 31), we only have actually 15 days to Apri 15 to file our individual 1st Quarter ITR.

i am single and is considered head of the family. My mom, 69, lives with me. Can she be included as my dependent? If ever, How? I asked this because according to our accounting department, there is no more category of single with qualified dependent

sir vic are there any books or references that we could use as guide for the preparation of our taxes due?like for example for 2550m,2550q,1702q,1701q..reading materials that could help me more familiarize in taxation..thanks..

Hi sir vic,i want to ask i was planning to start internet cafe mga 5 pc lang since may katabi ako internet cafe.first before i open i want to have all the licensed first before to operate para walang sumita sa aking just in case mag start na ako….i have no idea about this BIR,QUESTION IS DO I REALLY NEED TO GET THIS BIR THOUGH I ONLY HAVE 5 PC TO START? Or pwede na muna yun marors permit.I am renting apartment 4 years na ako dito but ngayun ko lang naisiip mag open internet sa hirap ng panahon gusto ko mkay extra income ako..If need ko talaga mag reister sa BIR pwede po ba annual para yearly ako magbayad..Magkano kaya ang babayarin ko yearly? thanks in advance

hi, sir vic.

do ledgers (books of accounts) need to be hand-written or can i just print it electronically and paste on each book page? would that be an issue when BIR examines the books?

resending:

hi, sir vic. need your help on this—should i carry forward “1Q tax overpayment” to my “2Q prior years’ excess credits”?

1Q 2Q

Tax due 300 1,350

Less tax credits/payments:

Prior years’ excess credits 1,400 1,100

Previous quarter tax payment – 300

Total tax credits 1,400 1,400

Tax overpayment (1,100) (50)

hi!if i would add the previous taxable income.. the tax due is bigger than the actual tax due for the 2nd qtr? why is that.. for example the tax due in your example is 10.5K without the previous t/i. why is that? thnak you — kai, a student

hi sir Vic,

just want to say thank you for having a website like this it really helped me. just want to ask one question what would be the required documents as a proof for the cost of services amount. Thanks & God bless you more!

hello po, i would like to ask, what amount should i put in the item 38C-the tax payment/s for the previous quarter/s for the third quarter… tnx… =)

Hi Vic, just want to ask if ang isang non vat nag exceed na ang sales nya sa limit for non vat at ngaun lang mag file ng 1905 for VAT may effect ba un sa ANNUAL ITR.. pls help thanks

Hi Sir Vic,

If for the first quarter you get a negative “Taxable Income” ex. -25,000 because your expenses are higher than your sales. Do you place the -25,000 on the 2nd quarter 1701Q as taxable income previous quarter?

Regards,

Danny

Dear Sir,

Can you please help me on the following:

I am a new real estate broker. I was able to register my business to the BIR and were able to get my receipts. For the past few months I am reporting NO Operation since there are really no income since I am not yet focusing on my profession.

But I am planning now to practice it. My question is for example for the month of January I earned a commission of Php30,000. I will pay 900(?) since my monthly percentage tax is 3% if I am not mistaken. Now for the months of Feb and Mar i have no income.

How much tax should I know pay for my Quarterly Income Tax Return? Kindly correct me if I am wrong

QUARTERLY SALES PHp30,000

COST OF SALES (40% is this OSD?) 12,000

GROSS SALES 18,000

Taxable Income is 18,000

Tax Due is (500 + 10% of 8,000) 1,300

Less Tax Payment (for Jan) 900

DO I STILL NEED TO PAY 400?

Is my computation correct or my Quarterly Tax Rate is Still 3%?

Thank you very much!

may penalty ka na. kahit walang kita, you need to report to BIR sa monthly income at ideclare na “No Transacation.”

Hi, may I ask what is the difference between Tax base and taxable income?

Sir, yung Sales/Revenues/Receipts/Fees cumulative po ba yan? ibig ko po sabihin kasama na rin po yung sales ng previous quarters sa pagcompute ng sales ng isang quarter? thnx po!

Hi,

What if a wrong Quarterly Tax Due happened? Will the Annual Income Tax correct or adjust it? If not, how can it be reflected or adjusted in the Annual Income Tax?

Thanks!

You have to amend the wrong quarterly income tax return by filing amended 1701Q.

can i annualized the error and correct on the annual?