How to compute quarterly income tax return in the Philippines for self-employed individuals? If you are a professional who practice your profession or a self-employed individual engaged in a sole proprietorship business, you may be looking for a guide on how to prepare your BIR Form 1701Q. BIR form 1701Q is filed quarterly for the first quarter, second quarter and third quarter. For the annual income tax return, the BIR form 1701 is used. The following are the steps, procedures, requirements, tips and other important information you need to know in computing and preparing your quarterly income tax returns.

What is the BIR form to be used?

The return we need to file is BIR Form No. 1701Q: Quarterly Income Tax Return for Self-employed Individuals, Estates, and Trusts (Including Those with both Business and Compensation Income)

The following are the documentary requirements that need to be attached with the form, if applicable:

1. Certificate of Income Tax Withheld at Source (BIR Form 2307), if applicable

2. Certificate of Income Payments not Subjected to Withholding Tax (BIR Form 2304) if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Previously filed return, if an amended return is filed for the same quarter

Who are required to file BIR Form 1701Q?

This return shall be filed in triplicate by the following individuals regardless of amount of gross income:

1) A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

2) A resident alien, non-resident citizen or non-resident alien individual engaged in trade, business or practice of profession within the Philippines.

3) A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

When are the deadlines or due dates of filing the return?

The following are the deadlines for manual filing of BIR Form 1701Q :

1st qtr: On or before April 15 of the current taxable year

2nd qtr: On or before August 15 of the current taxable year

3rd qtr: On or before November 15 of the current taxable year

How to compute and prepare the quarterly income tax returns?

The following are the steps in the computation and preparation of your quarterly income tax returns. You can also check the sample computation we have provided below. For better understanding, please download BIR Form 1701Q here.

STEP 1: Fill up completely the Part 1 of BIR form 1701Q with the applicable information, which include your Taxpayer Identification Number (TIN), registered name, registered address, line of business or occupation, method of deduction (itemized deduction or optional standard deduction), and other information that are applicable. Also fill in the year, quarter, check if amended or not, and the no. of sheet/s attached which can be found on the top of the return.

STEP 2: Fill up Part 2 of the form, which is the computation of the quarterly income tax. Refer to the form 1701Q to check the line items and their corresponding reference numbers.

Step 2.1: Determine your [26] Sales/Revenues/Receipts/Fees. Add any [27] Amount You Received as a Partner from General Professional Partnership (except loans), if any, to arrived at [28] Total.

Step 2.2: Calculate your [30] Gross income from Operation by subtracting your [29] Cost of Sales/Services to your [28] Total in Step 2.1. Costs of services are the direct costs attributable to the rendering of your services, such as the depreciation of the building for business engage in building rental, internet cost for internet café business, salaries of janitors for business engaged in janitorial services, and others.

Step 2.3: Compute your [32] Total Gross Income by adding [30] Gross Income to your [31] Other Income, if any.

Step 2.4: Determine and compute your total allowable [33] Deductions for the quarter. You can choose one from the two (2) methods of deduction: (a) Itemized deduction or the (b) Optional Standard Deduction (OSD). Your chosen method of deduction will be your method of deduction for the entire taxable year. The following are the bases for computing the two methods:

Option 1: Optional Standard Deduction (OSD) – A maximum of 40% of their gross sales or receipts shall be allowed as deduction in lieu of the itemized deduction. This type of deduction shall not be allowed for non-resident aliens engaged in trade or business. Example, if you have P100,000 gross sales or receipts for the quarter, you can claim an allowable deduction (OSD) of P40,000 (P100,000 x 40%), if you choose OSD instead of Itemized deduction.

Option 2: Itemized Deduction – There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of a profession including a reasonable allowance for salaries, travel, rental and entertainment expenses. Examples of itemized deductions are the following:

Step 2.5: Calculate your [34] Taxable Income this Quarter by deducting your [33] Allowable Deduction computed in Step 2.4 to your [32] Total Gross Income.

Step 2.6: Compute your [36] Taxable Income to Date by adding your [35] “Taxable Income for the Previous Quarter/s” during the taxable year to your [34] Taxable Income this Quarter. Take the following guides:

- For the 1st quarter, you don’t have [35] Taxable Income for the Previous Quarter/s since it is the beginning quarter of the taxable year.

- For the 2nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to your [34] Taxable Income this Quarter in the 1st quarter.

- For the 3nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to the “total of your taxable [34] Income this Quarter in the 1st and 2nd quarters” or the “total [36] Taxable income to Date of the 2nd quarter”.

- There is no 1701Q filed and computed in the fourth quarter. Instead the annual income tax return (BIR Form 1701) is filed and computed. To learn how to compute annual income tax for self-employed please read our article on “How to compute income tax in the Philippines for self-employed individuals”.

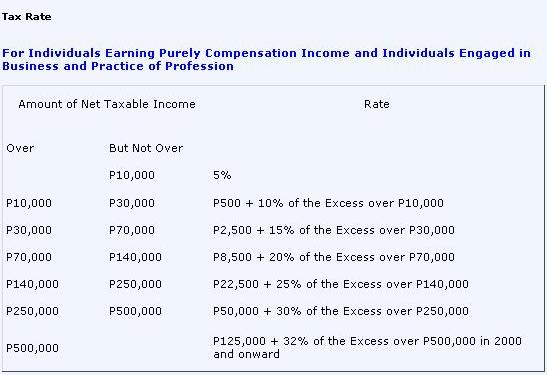

Step 2.7: Compute your [37] Tax Due using the Graduated Tax Table for Individuals. You can jump below Step 2.9 to see tax rates table and our sample computation.

Step 2.8: Compute your [39] Tax Payable by deducting to your [37] Tax Due to your [38] total tax Credits/Payments for the Quarter, which include [38A/B] Prior Year’s Excess Credits, [38C/D] Tax Payment(s) for the Previous Quarter(s), [38E/F] Creditable Tax Withheld for the Previous Quarter(s), [38G/H] Creditable Tax Withheld Per BIR Form 2307 for the Quarter, and [38I/J] Tax Paid in Return Previously Filed (if you are filing an amended return).

Step 2.9: Compute your [41] Total Amount Payable by adding any [40] Penalties (surcharge, interest and compromise), if there is any. Penalty is charged for late filing. To learn more about computing penalties, please check our article “How to compute BIR penalties”.

Sample computation of quarterly income tax due and payable

Example: Let us assume the following financial information of J. Santos, single and Filipino Citizen, for the 3rd Quarter of 2011. Santos has chosen to claim itemized deduction, instead of Optional Standard Deduction (OSD). He is also filing the return before the due date, which is also not an amended return.

Gross sales: P300,000

Cost of Sales: P 180,000

Expenses (rent, depreciation, salaries, taxes and licenses): P 60,000

Other income: P 20,000

Total taxable income for the 1st and 2nd Quarters: P40,000

Income tax paid for the 1st and 2nd Quarters: P1,000

Creditable tax withheld for the previous quarters: P3,000

Creditable tax withheld per BIR form 2307 for this quarter: P2,000

What is your income tax due and payable for the 3rd quarter of 2011?

Answers and computation:

| Gross Sales [26] | P 300,000 |

| Add: Share from Gen. Prof. Partnership [27] | 0 |

| Total [28] | 300,000 |

| Less: Cost of Sales [29] | 180,000 |

| Gross Income from Operation [30] | 120,000 |

| Add: Other Income [31] | 20,000 |

| Total Gross Income [32] | 140,000 |

| Less: Deductions [33] | 60,000 |

| Taxable Income This Quarter [34] | 80,000 |

| Add: Taxable Income for the Previous Qtrs [35] | 40,000 |

| Taxable Income to Date [36] | 120,000 |

| Tax Due [37] * | 18,500 |

| Less: Tax Credits/Payments: [38] | |

| Tax Paid for the Previous Quarters | 1,000 |

| Creditable tax withheld for the previous quarters | 3,000 |

| Creditable tax withheld per BIR form 2307 for this qtr | 2,000 |

| Tax Payable [39] | 12,500 |

| Less Penalties [40] | 0 |

| Total Amount Payable [41] | P 12,500 |

* Computation of tax due:

Since P120,000 is under the “over P70,000 but not over P140,000, your tax due is equal to P8,500 + 20% of the Excess of 70,000.

Tax Due = P8,500 + 20% of the Excess over 70,000.

Tax Due = 8,500 + [20% (120,000 – 70,000)]

Tax Due = 8,500 + (20% x 50,000)

Tax Due = 8,500 + 10,000

Tax Due = P18,500

Notes:

1. The personal and additional exemptions of the taxpayer are only claimed on the computation of annual income tax return..

2. Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.

Step 2.10. If you are filing consolidated income tax return with your spouse, aggregate your income tax payable.

Step 2.11 Put your signature over your printed name. Also fill the Title/Position of Signatory.

STEP 3: Fill out the details of payment in Part III

How to file the quarterly income tax returns?

The following are the procedure in filing the quarterly income tax returns:

1. Fill-up BIR Form 1701Q in triplicate.

2. If there is payment:

- Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you registered and present the duly accomplished BIR Form 1701 Q, together with the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and present the duly accomplished BIR Form 1701Q, together with the required attachments and your payment.

- Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

3. For “No Payment” Returns including refundable/ creditable returns with excess tax credit carry over and returns qualified for second installment:

- Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701Q, together with the required attachments.

- Receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

Reference: Bureau of Internal Revenue Philippines

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi sir,

We are a construction firm which we register as principal office at Clark Freeport Zone

this year. For the previos yrs. we are a Vat registered co.

Please enlighten us re – 1st qtr itr submission. 5% tax incentives for freeport zone.

Thank you and hoping you could help us.

Estrellita Bandelaria

Do you have an article on how to fill out a 1702Q? Just a bit confused on which column to place my numbers (Exempt, Taxable Special Rate or Taxable Regular Rate). I hope you can help me out please. Thanks!

Hi. We don’t have that particular article yet. However, you can join our official forum at http://BusinessForum.ph to discuss that matter and your other concerns related to business.

Ask ko lang po, panu kung di po nkapagfile ng april 15 ng 1701Q, toz ang tax due nia naman is negative 10,000.00, may babayaran po ba ko? magkanu po?

nkabase po ba sa revenue na 5% ang penalty?

Hi Vic,

Ask lang question… what if I forgot to file my 1701Q for 1Q last April 15, pwede ba pagsamahin ko na lang lahat sa 2Q? As if wala akong income nang 1Q?

yes, penalty for not filing, P1000. you still need to file the 1st Q and 2nd Q separately.

I’m a first timer re: business…..thru Internet I followed how to apply and register my new business. i got my business name.and applied for a business permit in Quezon city. my business is bills payment and remittance..i filled up the forms stating the services which are Bills payment, Remittance , E-Loading and ticketing. The assesor from BPLO ask me to fill up another 2 sets of application and prepare same requirements each. in short, I got 3 business permit in one business name which I paid 3 X..I protested but to no avail, So now, I got 3 business permit & 3 plate numbers and repeatedly paid 3x in ONE BUSINESS NAME…which supposedly these are the services i’m going to offer..TAMA BA ito? TAMA BA NA tatlo ang inaplayan kong bisnis?? if not, can I still dispute or protest even i have my permit already. please educate me regarding this matter…thanks

hi sir vic,ask lang po ako,paano mag less ng cost of sales/services for the 2nd quarter,kasi po diba mag inventory daw,dapat daw may beginning and ending.so noong jan.lang nag start ang business po.Ang sa 1st quarter po ay 5000,so para naman sa 2nd quater,mag inventory ulit po ba?pls help me.hardware ang business ko po,pero dipa complet.thanks po

Sir,pwede po ba ako makahingi ng sample computation of quarterly income tax due and payable for 1st,2nd and 3rd quarter.Maliit na hardware ang business po,for references lang po sana.salamat po!

Hi Vic,

As of this writing it is July 1, 2013. I am already preparing the 1701Q for the second quarter. I have an “Overpayment” in 39A (“Tax Payable (Overpayment) ( 37A less 38K & 37B less 38L)”) of the 1701Q for the first quater.

I would like to verify if I should transfer this “Overpayment” amount in 38C (“Tax Payment(s) for the Previous Quarter(s)”) of the 1701Q for the second quarter or not since there was no payment (but I got penalized for late filing thus a followup question below).

In addition, I filed 1701Q for the first quarter late so I got a penalty even though I have an “Overpayment”. Does that invalidate the supposed “Overpayment” (meaning that I can’t put it in 38C of second quarter if ever it can be put there)?

Thanks in advance.

Regards,

Willy

Very useful page. I have a question, should we need to file 1701Q (1st, 2nd, and 3rd Quarter) per year plus 1701? what about the 4th Quarter?

Since 1701 is the annual ITR, will we compute again all the income rendered for that year? It sounds like double taxation. Sorry naguguluhan lang ako.

Thank you for this great post!

Thanks for the informative article. However, I want to clarify items that can be included as part of cost of services. I am a self-employed IT consultant and receive fees/income based on services rendered on a per project basis. Can I consider depreciation of vehicle (or a portion thereof) and parking fees as part of cost of services (to be deducted from gross income)? Or are these considered as operating expenses and therefore part of OSD if I’ve opted to use OSD instead of Itemized deductions

Thanks!

Wala ako makitang cleared na sagot.my query is yung second quarter ba is april -june? If that so kailan babayaran yung october – december?

sir ask ko lang po, what if net loss ka ng 1st quarter ng 10,000 pesos and net income ka naman ng 15,000 sa 2nd quarter, and taxable income na lang ba sa 2nd quarter ay 5,000 pesos?

hi there sir? dati po kaming may accountant na humahawak sa pagbabayad at pag file na may kinalaman sa lahat ng transaksyon sa BIR, tulad ng mga sumusunod:

1) MONTHLY PERCENTAGE AND RENTAL TAX

2) QUARTERLY INCOME TAX RETURN

3) ANNUAL INCOME TAX

4) AT MARAMI PANG IBA.

Sir, ngayon po malapit na ang filing ng 3RD QUARTERLY INCOME TAX on or before November 15, 2013 nais kopo sana na ako ang gumawa at mag fill ng declaration.Sir, ang mga sumusunod ay ang aking mga katanungan:

1) Ang 26 sales/Revenues/Receipts/Fees, ito po ba ang total gross sales ng July, August, September and October?

2) Ang 33 LESS: DEDUCTIONS, ito po ba ang total expenses like rental, licenses, salaries and wages,for the month of July, August, September and October?

Ang lahat po ng entries sa inyong Sample computation of quarterly income tax due and payable ay akin na pong naiintindihan.

Umaasa po at nagsusumamo ang inyong lingkod na inyo po marapatin na sasagutin ang aking mga nabanggit na katanungan sa lolong madaling panahon.

Gumagalang:

Albert A

Hello po,

Sir Vic,

Good Day!

Ask ko lang po, if paano po ba magcompute ng OSD sa Single Prop. with a Service rendered business and how about po sa trading business san po dapat ako magbase. At sa Corporation din po.

Thank You po.

How do you get the Less: Cost of Sales [29]? Is it the 40% OSD of the Quarterly Income?

hi vic,

can i have a favor please! how to compute the non vat in 3rd quarter?

Hello sir, I’m a real state sales agent with a single proprietor business.

Question: Where do i put my Income in real state?

a. In 27A?

b. In Other income 31A?

thanks

Hi SIr VIc,

What does “RMC no. 6- 2001: corporations, companies or persons whose gross quarterly sales, earnings, receipts or output exceed P 150,000.00 may not accomplish this form. In lieu thereof, they may file their annual income tax returns accompanied by balance sheets, profit and loss statement, schedules listing income-producing properties and the corresponding income therefrom, and other relevant statements duly certified by an independent CPA.” mean? I cannot understand “exceed P150,000”. WHat if my sales does not execeed, am I required to still submit 1701Q? THanks

Hi,

??Supposed the [39] Tax Payable (Overpayment) for the First Quarter is negative because the Tax Withheld was greater than the [37] Tax Due.

Can I carryover the excess to the succeeding quarter? If so, how can I do that?

If I input a negative figure under Tax Credits/Payments (for the 2nd or 3rd quarter) , its total will be decreased. But since there was an overpayment in the first quarter, isn’t the succeeding quarter’s tax credits supposed to be increased?

Please help me out. I would highly appreciated it.

Thank you!

hello,, ano po ang ilalagay sa 38c/d tax payments for the previous quarter ngaung 3rd quarter, yung ibinayad ko po ba nung 2nd quarter? nagpacompute po ako sa kakilili pero iba naman inilagay…

Thanks for this useful information.

Hello po sir Vic,

Ask ko lng po, ung sister ko last year sya ngstart ng busn pero this year lng po sya ng pa register nang business nya sa BIR…panu po un sir kailangan pa rn ba nyang mg file nag ANNUAL ITR (1701) this april 15, 2014 sa income nya sa 2013 kht d nya na register last yr?

Anticipating for your reply sir.. tnx po.

Hi sir Vic,

Ask ko lng kaka start lng ng business ko last Sept 2013, meron na ako remittace last quarter sa Nov 15. ito po ba ang basehan sa sa king annual income tax return including Nov. 16 to Dec31 sales ko. Sole proprietor po yung buiness ko po.

pls advise thanks Sir. Vic.

Sir i have a house for rent which 6,000 per month. i know it has ceiling on rentals of household units but i’m required to file a 1701Q since i have income . how can availed of no tax on rental.

Good day!

You said that “Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.”

I am a Physician, receiving a monthly compensation with a clinic. They also deduct 10% from my compensation via expanded witholding tax.

Does that qualify for as a Compensation Income not needed to be reported in the Quarterly ITR?

Thank you! 🙂

hi sir ask ko lng po kung paano e compute ang 1st quarter sa 1701q form?osd po opt ng mama qu..first time pp nmin kc salamat po..

Hi Sir Vic!

Thanks for the very informative site. But I want to clarify if the gross income in the 1701Q/1701 is exclusive of VAT?

Sir, what if may NOLCO ako from last 4th quarter, can I apply it this 1st quarter?

If yes, saang column ng 1701Q ko sya pwedeng ilagay? sa Deductions po ba?

Sir Vic;

Good day po… Im a Licensed Customs Broker which is exclusive hire my licensed to a company… Can I ask what should I do .. please correct me…. Im always filling 2551M every month at ang dinedeclare ko po yun compensation ko like Php 20,000.00 tapus multiply ko sya sa 3%…. ask ko lang po tama po ito… can you advise me sir kung anu dapat ko gawin na tama…. last year hindi po ako nagpapabawas sa opisina ng tax according sa salary ko kasi nagbabayad din po ako…. sana po matulungan nyo po ako…

ask ko lang po..paano po ang gagawin kapag ung 1st quarter ay net loss tapos ngayong 2nd quarter ay net income paano ko po gagawin ang 1701Q. may babayaran ba ako this quarter.

Hi sir,

I would like to ask about a friends’ case. She asks a BIR personnel to compute her 1701q 1st quarter. then now in filing her 2nd quarter she was asking me to make hers. I have checked her 1st quarter and I saw some errors in the computation and in certain fields. One of them, they did not include in the computation the tax withheld in the first quarter.

In making her 2nd quarter 1701q should I still follow the 1701q form made by the BIR personnel? or should she make amendment of 1701q return before filing 2nd quarter. or is it ok if we just ignore the 1st quarter return and make the 2nd quarter using the correct stats regardless what is in the first quarter return. thank you

Sir, what if our Taxable income to date is Negative? what will be our tax due and what category in the tax table will we use?

Hi sir vic. Is the tax table (rate) the same for a single prop. Non vat business?

Thank you.

Good pm sir asked ko lang kasi nagfile na ako ng 1st and 2nd quarter 1701q puro zero ok lang ba kung zero p din sa 3rd kasi mas malaki tlga expenses nm min kesa income start lng kami last march…

What will happen if in my past quarterly income tax returns, I did not follow step 2.6? I did not add the taxable income from previous quarters when I was filing for the third quarter tax return. I overlooked that part that taxable due should be cumulative from the previous quarters. Is it considered a violation? Would there be a corresponding penalty for that?

Thank you for responding.

Dear Sir,

I am in the rental business. I had no tenants for the first 6 months of the year yet I continue to incur expenses such as depreciation, condo dues, etc. I filed my 1701Q for my 1st and 2nd quarters such that the taxable income is negative. This July, I had a tenant come in for a lease contract of 6 months till the end of this year. May I know if I can reduce my taxable income for this quarter by the ‘deficits’ I accumulated for the 1st and 2nd quarters? The new BIR eforms do not allow entry of negative amounts under line item 35A “Taxable income from previous quarter(s)”. How are the amounts to be shown on the 1701Q if these are allowed?

Thank you.

Hi Maria,

Negative amounts as far as I know will not be accepted in the new systems by the BIR and that’s one of the comment by other taxpayer.

What if I was not able to file the 1st quarter, I only filed the 2nd quarter, can I incorporate the 1st quarter with the 3rd quarter income? Or should i just incorporate the 1st quarter on the last quarter which is in April of the 2015?

sir,

give me example quarterly computation of BIR

Hi Vic,

Thank you for sharing your knowledge with us. I really learned a lot. I’ll be visiting your blog often:)

Hi,

We have a negative overpayment of 2000plus and we had a penalty of 400 for not paying on time. Can we deduct this to the negative? the BIR officer want us to pay the 400 which I doubt. I already consulted a bookkeeper and tols us that we don’t have to pay any..

Thank you

Hi Victor,

I was recently hired as a consultant by a Company. The company is withholding 10% of my income and I understand that this represents EWT. I also understand that I would need to file 1701q by the end of the first quarter. I would just like to know if there is a possibility that the return would result to overwithholdings (meaning, the total taxes withheld are greater than the supposed tax due for that quarter? Because it is my understanding that I can deduct 40% OSD when I file 1701q. In case the return resulted to an overwithholding, how would i be able to claim the excess withholdings? Thank you in advance.

Hello,tokayo

Ask lang po ako. about sa 2307 form. dalawa kasi yung deduction ang nakalagay sa form 2307. example:

1.)Income Payments Subject Expanding Withholding Tax – 942.00

2.)Money payment subject to Withholding of Bus. Tax – 4,713.00

Question:

1. Sa BIR 2550M item 23C alin dito ang ilagay?

2. Sa BIR 1701Q Item 38G nman po, alin din dito ang ilagay?

Thank you. Hope you reply immediately. this is my first time to file 1701Q with a 2307. Thank you again

Dear Mr. Abrugar,

I am Senior Citizen, I just started my business last January 02, 2015.

I found your website very informative and please guide me on the below listed:

1. Do I have to file Income Tax?

2. What are the allowed deductions for Income Tax.

3. If I used the Optional Standard Deductions (40%) will it be through out the life of the business. Or I can switch to itemized Deductions.

4. When I registered my business, In the form 1901 Part II Civil Status, there is an item= Benefactor of a Qualified Senior Citizen (RA 7432). Will you please enlighten me on this.

I am no longer update with Taxation since the time I handled Money Transfer Operations till the time of my resignation. I am a graduate of U.E with BSBA (Accounting) but no longer practicing.

Thanks and hoping to hear from you.

Melita C. Carlos

Good eve. Sir, I just want to confirm. I have just registered as self-employed professional (homebased online teacher) this Feb. 2015. I ended my work last 2013 as employed teacher in a private school. The 2014 I just worked as online tutor but unregistered yet. My question is, Do I still need to file for ITR this April 2015? I suppose the filing of ITR will be next year April 2016 right?

Hello expert

Do i have to file 1701Q and pay every quarter or 1701 and pay annually?

Please help

Hi Sir,

I am a new employee on the company & i am assigned to accounting.

I would like to ask how to compute the companys 1702 Q.

I really need your help po.

ThankYou!

Sir Vic, May Attached documents po b pag magdedeclare ng cost of sales/services sa bir form 1701q or quarterly income tax return? Bakeshop po ang business ko.

thanks!

Hi sir vic, ano po ba ang composition ng cost of sales? Pwede po bang direct nalang sa gross income? Salamat po.

Sir, self study lang ako planning to put up business hope to help me to understand well the flow and how to prepare 1701Q.

29: what is cost of sales/service

30: gross income from operation

33: less deductions? from what?

34:….

from item 29 to 37 nalilito lang ako on how to prepare

thanks

Good morning sir vic.. ask ko lang po tamang computation para sa 2nd quarter kase ang ginawa ko po

SALES LESS EXPENSES. ANU PO susunod na step para makuha q tax q for this 2nd quarter? Thank you and godbless