How to compute quarterly income tax return in the Philippines for self-employed individuals? If you are a professional who practice your profession or a self-employed individual engaged in a sole proprietorship business, you may be looking for a guide on how to prepare your BIR Form 1701Q. BIR form 1701Q is filed quarterly for the first quarter, second quarter and third quarter. For the annual income tax return, the BIR form 1701 is used. The following are the steps, procedures, requirements, tips and other important information you need to know in computing and preparing your quarterly income tax returns.

What is the BIR form to be used?

The return we need to file is BIR Form No. 1701Q: Quarterly Income Tax Return for Self-employed Individuals, Estates, and Trusts (Including Those with both Business and Compensation Income)

The following are the documentary requirements that need to be attached with the form, if applicable:

1. Certificate of Income Tax Withheld at Source (BIR Form 2307), if applicable

2. Certificate of Income Payments not Subjected to Withholding Tax (BIR Form 2304) if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Previously filed return, if an amended return is filed for the same quarter

Who are required to file BIR Form 1701Q?

This return shall be filed in triplicate by the following individuals regardless of amount of gross income:

1) A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

2) A resident alien, non-resident citizen or non-resident alien individual engaged in trade, business or practice of profession within the Philippines.

3) A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

When are the deadlines or due dates of filing the return?

The following are the deadlines for manual filing of BIR Form 1701Q :

1st qtr: On or before April 15 of the current taxable year

2nd qtr: On or before August 15 of the current taxable year

3rd qtr: On or before November 15 of the current taxable year

How to compute and prepare the quarterly income tax returns?

The following are the steps in the computation and preparation of your quarterly income tax returns. You can also check the sample computation we have provided below. For better understanding, please download BIR Form 1701Q here.

STEP 1: Fill up completely the Part 1 of BIR form 1701Q with the applicable information, which include your Taxpayer Identification Number (TIN), registered name, registered address, line of business or occupation, method of deduction (itemized deduction or optional standard deduction), and other information that are applicable. Also fill in the year, quarter, check if amended or not, and the no. of sheet/s attached which can be found on the top of the return.

STEP 2: Fill up Part 2 of the form, which is the computation of the quarterly income tax. Refer to the form 1701Q to check the line items and their corresponding reference numbers.

Step 2.1: Determine your [26] Sales/Revenues/Receipts/Fees. Add any [27] Amount You Received as a Partner from General Professional Partnership (except loans), if any, to arrived at [28] Total.

Step 2.2: Calculate your [30] Gross income from Operation by subtracting your [29] Cost of Sales/Services to your [28] Total in Step 2.1. Costs of services are the direct costs attributable to the rendering of your services, such as the depreciation of the building for business engage in building rental, internet cost for internet café business, salaries of janitors for business engaged in janitorial services, and others.

Step 2.3: Compute your [32] Total Gross Income by adding [30] Gross Income to your [31] Other Income, if any.

Step 2.4: Determine and compute your total allowable [33] Deductions for the quarter. You can choose one from the two (2) methods of deduction: (a) Itemized deduction or the (b) Optional Standard Deduction (OSD). Your chosen method of deduction will be your method of deduction for the entire taxable year. The following are the bases for computing the two methods:

Option 1: Optional Standard Deduction (OSD) – A maximum of 40% of their gross sales or receipts shall be allowed as deduction in lieu of the itemized deduction. This type of deduction shall not be allowed for non-resident aliens engaged in trade or business. Example, if you have P100,000 gross sales or receipts for the quarter, you can claim an allowable deduction (OSD) of P40,000 (P100,000 x 40%), if you choose OSD instead of Itemized deduction.

Option 2: Itemized Deduction – There shall be allowed as deduction from gross income all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade, business or exercise of a profession including a reasonable allowance for salaries, travel, rental and entertainment expenses. Examples of itemized deductions are the following:

Step 2.5: Calculate your [34] Taxable Income this Quarter by deducting your [33] Allowable Deduction computed in Step 2.4 to your [32] Total Gross Income.

Step 2.6: Compute your [36] Taxable Income to Date by adding your [35] “Taxable Income for the Previous Quarter/s” during the taxable year to your [34] Taxable Income this Quarter. Take the following guides:

- For the 1st quarter, you don’t have [35] Taxable Income for the Previous Quarter/s since it is the beginning quarter of the taxable year.

- For the 2nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to your [34] Taxable Income this Quarter in the 1st quarter.

- For the 3nd quarter, your [35] Taxable Income for the Previous Quarter/s is equal to the “total of your taxable [34] Income this Quarter in the 1st and 2nd quarters” or the “total [36] Taxable income to Date of the 2nd quarter”.

- There is no 1701Q filed and computed in the fourth quarter. Instead the annual income tax return (BIR Form 1701) is filed and computed. To learn how to compute annual income tax for self-employed please read our article on “How to compute income tax in the Philippines for self-employed individuals”.

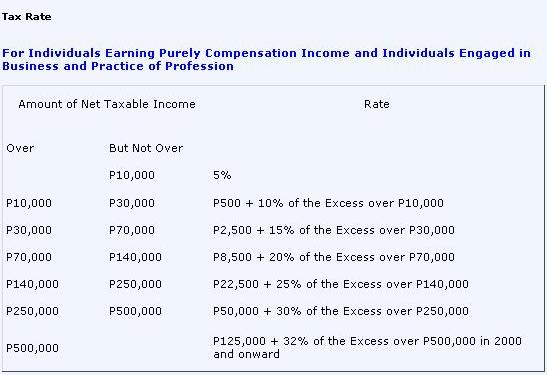

Step 2.7: Compute your [37] Tax Due using the Graduated Tax Table for Individuals. You can jump below Step 2.9 to see tax rates table and our sample computation.

Step 2.8: Compute your [39] Tax Payable by deducting to your [37] Tax Due to your [38] total tax Credits/Payments for the Quarter, which include [38A/B] Prior Year’s Excess Credits, [38C/D] Tax Payment(s) for the Previous Quarter(s), [38E/F] Creditable Tax Withheld for the Previous Quarter(s), [38G/H] Creditable Tax Withheld Per BIR Form 2307 for the Quarter, and [38I/J] Tax Paid in Return Previously Filed (if you are filing an amended return).

Step 2.9: Compute your [41] Total Amount Payable by adding any [40] Penalties (surcharge, interest and compromise), if there is any. Penalty is charged for late filing. To learn more about computing penalties, please check our article “How to compute BIR penalties”.

Sample computation of quarterly income tax due and payable

Example: Let us assume the following financial information of J. Santos, single and Filipino Citizen, for the 3rd Quarter of 2011. Santos has chosen to claim itemized deduction, instead of Optional Standard Deduction (OSD). He is also filing the return before the due date, which is also not an amended return.

Gross sales: P300,000

Cost of Sales: P 180,000

Expenses (rent, depreciation, salaries, taxes and licenses): P 60,000

Other income: P 20,000

Total taxable income for the 1st and 2nd Quarters: P40,000

Income tax paid for the 1st and 2nd Quarters: P1,000

Creditable tax withheld for the previous quarters: P3,000

Creditable tax withheld per BIR form 2307 for this quarter: P2,000

What is your income tax due and payable for the 3rd quarter of 2011?

Answers and computation:

| Gross Sales [26] | P 300,000 |

| Add: Share from Gen. Prof. Partnership [27] | 0 |

| Total [28] | 300,000 |

| Less: Cost of Sales [29] | 180,000 |

| Gross Income from Operation [30] | 120,000 |

| Add: Other Income [31] | 20,000 |

| Total Gross Income [32] | 140,000 |

| Less: Deductions [33] | 60,000 |

| Taxable Income This Quarter [34] | 80,000 |

| Add: Taxable Income for the Previous Qtrs [35] | 40,000 |

| Taxable Income to Date [36] | 120,000 |

| Tax Due [37] * | 18,500 |

| Less: Tax Credits/Payments: [38] | |

| Tax Paid for the Previous Quarters | 1,000 |

| Creditable tax withheld for the previous quarters | 3,000 |

| Creditable tax withheld per BIR form 2307 for this qtr | 2,000 |

| Tax Payable [39] | 12,500 |

| Less Penalties [40] | 0 |

| Total Amount Payable [41] | P 12,500 |

* Computation of tax due:

Since P120,000 is under the “over P70,000 but not over P140,000, your tax due is equal to P8,500 + 20% of the Excess of 70,000.

Tax Due = P8,500 + 20% of the Excess over 70,000.

Tax Due = 8,500 + [20% (120,000 – 70,000)]

Tax Due = 8,500 + (20% x 50,000)

Tax Due = 8,500 + 10,000

Tax Due = P18,500

Notes:

1. The personal and additional exemptions of the taxpayer are only claimed on the computation of annual income tax return..

2. Compensation income need not be reported in the Quarterly Income Tax Return. The same shall be reported in the Annual Income Tax Return only.

Step 2.10. If you are filing consolidated income tax return with your spouse, aggregate your income tax payable.

Step 2.11 Put your signature over your printed name. Also fill the Title/Position of Signatory.

STEP 3: Fill out the details of payment in Part III

How to file the quarterly income tax returns?

The following are the procedure in filing the quarterly income tax returns:

1. Fill-up BIR Form 1701Q in triplicate.

2. If there is payment:

- Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you registered and present the duly accomplished BIR Form 1701 Q, together with the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and present the duly accomplished BIR Form 1701Q, together with the required attachments and your payment.

- Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

3. For “No Payment” Returns including refundable/ creditable returns with excess tax credit carry over and returns qualified for second installment:

- Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701Q, together with the required attachments.

- Receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

Reference: Bureau of Internal Revenue Philippines

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

good afternoon sir vic

may mga ilang katanongan lang po ako

1. Nung angdeclare ako ng 1701Q nung april 2015 para sa first quarter nagbayad lang po ako sa bangko. Tama po ba yung ginawa ko? o kailangan ko pang punta sa RDO para mavalidate yung 1701Q ko?

2. yung cover ng 2nd quarter mula april hanggang july tama po ba? bakit yung first Quater at Third Quarter…3 months lang ang cover bakit yung 2nd Quarter 4 months yung cover?

maraming salamat po sana po masagot ninyo… God Bless

Hi po papaano ko ba malalaman kung anong method of deduction ang gagamitin ko.. June this year lamg po nag start yung business namin and magbabayad kami ng quarterly income tax ano pa ba ang method na gagamitin OSD or yung Itemized deduction. Thanks po.

Good Day Sir Vic,

i got confused re: computation on 1701Q, its 3rd qtr by this time, am using ebirforms , kindly confirm the ff:

1. the taxable income for 3rd qtr = 1st and 2nd qtr taxable income

-if I failed to include my 1st qtr taxable income during the 2nd qtr. therefore I should file an amended 1701Q for 2nd qtr.

2. after filing the amended 2nd qtr 1701Q, , I should now be able to add the 1st and 2nd qtr (amended) taxable income for the 3rd qtr 1701q taxable income.

am I right?

also, if my tax due for the 1st qtr is negative (-) where can i place that for the 2nd qtr?

kindly advise.

thanks a lot

hi ask ko lng anong month bracket po ang pasok sa 1st, 2nd, and 3rd quarter po….tnx po in advance sa sasagot

Hello,

How can I file an ITR if it says “”NO OPERATION” ?

Thanks so much Sir.

hi sir vic,

bago lng po kasi ako sa business naisama ko po kasi sa filing ng 2nd quarter yung month of july pero bayad n po ako sa bir. then ngaun po magbbyad po ako for 3rd quarter paano po ang ggawin ko? thanks

Hello

i have a question about the quarters. cause for me the taxpayers guide is not clear. Until april 15 2016 i have to put which income at the form 1701Q? The income from sept-dec2015?

Thank you

Hi Sir!

Ask ko lang po sana, if yung overpayment po ba ng Annual Income Tax Return (1701) ay pwede i-deduct sa Quarterly (1701Q) 1st quarter and the following quarters pa?

Hi Sir Vic,

I’m working on with my mom’s 1701Q for this 1st Qtr. I would like to clarify the Step 2.8: Compute your [39] Tax Payable by deducting to your [37] Tax Due to your [38] total tax Credits/Payments for the Quarter, which include [38A/B] Prior Year’s Excess Credits, [38C/D] Tax Payment(s) for the Previous Quarter(s), [38E/F] Creditable Tax Withheld for the Previous Quarter(s), [38G/H] Creditable Tax Withheld Per BIR Form 2307 for the Quarter, and [38I/J] Tax Paid in Return Previously Filed (if you are filing an amended return).

Does it mean po ba mag rerefer ako sa Excess Credits sa 1701? Is this referring to the 4th qtr from last year po?

Dear sir,we are paying our monthly income but why we still need to pay for quarterly?

Hi Sir Vic,

I have a tailoring business which annual gross sales dont exceed the threshold to be a VAT reg entity,however quarterly sales exceeds 150k, so I need to provide statement of financial position and comprehensive income which are audited and certified by a CPA. It confuses me when I will use the 3% OPT and the computation format with the 40% OSD as I’ve seen in your other posts. And also, when do I have to file my tax payments? Monthly? Quarterly? Or just Annualy? Can a Newly passed CPA do the the auditing and certification of the financial statement? I am really confused on how to compute and when to file my taxes.

Thank you very much!

Hi Sir Vic,

Can you gave me example about computation of 1701Q SECOND QUARTER if the net taxable income is less than 10, 000.

Thanks a lot. Hope for your immediate response.

hi sir! i hope you can help me with this.

i am filing for the 2nd quarter today but i cant get through. i have a negative taxable income for the previous quarter but the system dont recognize parenthesis () or negative sign – .

what would it result if i input the amount anyway without negative or parenthesis sign?

Hi, how to fill up the 3rd quarterly income tax return?

Hello sir, may case po ba na hndi lhat may tax return kasi ung isa kong ka team mate, nbawasan pa po yung sweldo nya sa halip na madagdagan last january, paki xplain po, tnx

ask lng po kasi po 2 business ng ate ko boarding house saka convenience store kelangan po b 2 ang fill up kong 2551M o pwede ko n syang pagsamahin.thank you po sana masagot.

Hi sir vic,

Confirm ko lang po, yung expenses na idededuct sa 1701Q po ay net of vat po? Please reply po, baka po mali na po ang ginagawa ko.

Many thanks po..

hello.

i just hired and I dont know anything yet. May you help me .. when does Summary of Withholding Tax at source prepared? annually or quarterly?

Hi sir! Is it possible that we can’t have an ITR? but we are deducted with our taxes. Thank you for your response

Hi Sir Vic.

I just want to ask po kasi I’ve been reading the conversation here to get a better understanding of taxes to be filed. May nabasa po kasi ako na there is a penalty for not filing quarterly income tax even without income. I got my COR April 2016 and only started to operate July 2016. Does this mean mapepenalize ako since even without operation ng April I should have filed quarterly tax for 2nd quarter since covered pa un month ng April sa registration ko?

Salamat po.

Joel

Pag forms po, “fill out”

Pag containers, “fill up”

Pag blanks, spaces, “fill in”

🙂

Hi Sir Vic, Kailangan ko po ang advice niyo. May 2 door apartment po ang nanay ko. Lumang luma na 3000 pesos each. Malimit bakante at madami ang balasubas na naupa aalis may utang pa at daming damages. Itong dati naming Brgy. Chairman pinilit kami magfile sa BIR. Kulang pa sa pambili ng gamot ng Nanay ko ang kita sa paupahan. Gusto na po namin itigil ang pagbabayad sa BIR kasi po hindi po ako nakakapagfile ng ITR regularly dahil hindi ko po maisikaso dahil malimit magkasakit kaming mag-anak. Aba eh malaki daw po ang penalty babayaran. Diyis ko po. Malaki na nga po ang binayad namin sa Business tax ngayong taon.Ano po ba ang dapat naming gawin. Tulong po please.

Hello, thank you for this post. Everything is clearer to me now than before. But I have to make it clear…. the Tax paid for the 1st quarter is also deducted as Tax paid from previous quarter (if I am filing for the 3rd Quarter 1701Q)? so we deducted the tax due and paid on both the 1st and 2nd quarter….. or is it only the Tax paid on the 2nd quarter since you already deducted on the 2nd Quarter 1701Q the Tax Paid previous quarter (1st quarter)?? Thanks for your help.

Sa BIR Form 1701Q po.. “38 K/L other payments made” .. included ba didto yung 500 na COR renewal? Please help!

I have a couple questions with regards to filing of tax returns by self-employed professionals. I hope you can help me with my tax dilemma. I am a home-based and online ESL tutor. I am registered with BIR as a self-employed professional.

1. I am still required to file for the tax returns (2551M, 1701Q, and 1701) even if I have no income for a a certain month/quarter/year, right?

2. The ESL company deducts 10 percent from my salary every month as a creditable withholding tax. It correspondingly provides me BIR Form No. 2307 every month and every quarter. I have an overpayment in taxes last year. Usually, I will just choose the “carry over” option and apply the overpayment to the next quarter/year. But this year, I have returned to formal employment as a regular employee for a BPO company. I cannot anymore use the “carry over” option as I am expecting no future income from self-employment. Is it viable to opt for the “tax refund” or “tax credit certificate option”? How can I apply for one if it is viable? What are the mandatory requirements/attachments?

My wife is a vegetable vendor…is she required to issue an official receipt? And Everytime she files the 1701q she is required to submit her book of accounts so she will be given the form…I have only known this just last week all I thought for the past 3 years her filing with BIR is smooth and I found out recently that the filing of her 1701 (2015) was itemized and she was force to pay 1k for Financial statement they made… I am not a CPA but I graduated BSBA in 1980

Hi. What if company worked for not registered- no Bir# statutory deduction. What certificate can I produce in place of 2305 as an initial new hire (new company) requirement

If a company reported a loss from prior year, can it use it as a LOSS CARRY FORWARD to offset current year’s income? Will that be okay with BIR?

Hi. Maybe you are referring to NOLCO or Net Operating Loss Carryover. NOLCO refers to the excess of deductible expenses over gross income in a given taxable year. There are certain requirements that must be met to properly claim NOLCO and use it to offset your current gross income. To learn more about NOLCO, please read this revenue regulation. http://www.lawphil.net/administ/bir/rr/rr14_01.pdf

Hello sir. yung creditable income tax po ba yung percentage na binabayaran po namin evry month? yun po kac naka.apppear sa form 2307 namin db dapat ideduct po yun sa form 1701Q sa may creditable income tax?salamat po

Hi. Creditable income tax is the amount of income tax your customers/clients are withholding from their payment to you and then they remit it to the BIR. That is the amount that you may claim as creditable tax. If you are talking about the monthly percentage taxes you are directly paying to the BIR, then they are not. I may not fully understand what percentage you are exactly talking about.

Sir, M?ay itatanong lang? po sana ako regarding sa filing ng 1702Q, wala po kasi ako mahanap na forum for that topic. Nasend ko po kasi sa eBIR-submission na form ng 1702Q nakatick ay 2nd Quarter, na dapat 1st Quarter palang. Pero yung pinareceive ko po na form sa BIR ay 1st Quarter naman because mas maaga ko naprint than i send. Due to human error, accidentally ko pong napindot ang 2nd Quarter at di namalayang nasend sa E-BIR Submission. Pero yung asa deposit slip po na binayaran nun nakalagay naman for the period of 1st Quarter. Kailangan paba iamend yun kahit na tama naman po yung mga form na pinareceived namin personally sa BIR? Mali lang po yung nasend na Quarter pero same mga amount padin po.

Basically, every error that has been committed must be amended to be corrected. But I think, as long you have actually filed the correct form, I think it will just be fine, when it comes to quarterly filing. Anyway, you will be matching and correcting them when you prepare and file for the annual income tax return. To clarify your error, I advise you seek advice from the BIR in your RDO.

Hi sir! Ask ko lang for example may gross sales akong P330,000 for this quarter magkano po kaya xpected kong income tax (1701q) na dapat bayaran. Salamat po sa sasagot.

Hi Melvin, even with gross sales amount, we cannot determine your income tax since there are still many factors to consider, such as your cost of sales, allowable deductions, personal exemption, additional exemption, taxes previously paid, creditable taxes, and more.

Hi Vic, Tanong ko lang, bakit kailangang idagdag yung taxable income for the previous quarters? di ba na taxan na iyon?bakit kailangan uli syang bayaran? if you put it into context, lumalaki yung binabayaran quarterly dahil paulit-ulit na chinacharge yang “taxable income for previous quarters” na iyan?

Hi. The taxable income for the previous quarters are added to come up with the total taxable income to date. But it doesn’t mean you will be paying its corresponding tax again. Take note that the “Tax Paid for the Previous Quarters” are also deducted from total tax due to arrive with the total tax payable.

hi! possible po b n makakuha ako ng tax refund? last day of work ko ay Oct.30, 2017.

Thanks.

Hi. If the actual income tax withheld by your employer and remitted to the BIR is greater than your actual income tax due and payable at the end of the year, then you may be entitled to tax refund.

hello po tanong ko lang po sana kung sa pagkuha po ba ng itr, dapat pong ibase sa tatlong buwan na magkasunod? at kung talaga po bang dapat bayaran na pareho yung 1701Q at 1702Q? Salamat po sa pagsagot, God Bless po!

Hi po ask lang po sir parati po kasi negative ang tax payable kasi maliit lang din ang sales commission. Ano po ang gagawin pag negative po sya. Ano po ang ilalagay sa tax payment previous quarters if negative po?

Kelangan pa po ba pumunta sa BIR pag negative ang tax payable? Or mag file na lang sa offline e BIR forms?

Hoping for your reply.

Thanks.

Hello, if by all honesty it is really negative, then it’s really negative and there is no tax payable, but you only need to file the tax return. However, as I said, it should be honestly and reasonably negative so if BIR will examine it, you can vouch for its correctness.

Sir, I will be filing 1701Q 3rd qtr. of a doctor. Can I merge his/her gross sales in 2551M (%tax) to BIR form 2307 to come up with the Gross Sales in BIR 1701Q?

Can I include the percentage tax amount paid as deductions ( jul-ag-sep) in 1701q item#33?

Hi Arnel,

Can I merge his/her gross sales in 2551M (%tax) to BIR form 2307 to come up with the Gross Sales in BIR 1701Q? — I really don’t get what you mean, but the gross sales in BIR 1701Q for the quarter should be equal to the gross sales in 2551M for the corresponding 3 months (quarter). The gross sales that is only included in the BIR Form 2307 are the sales which has been subjected to withholding tax.

Can I include the percentage tax amount paid as deductions ( jul-ag-sep) in 1701q item#33? Yes, percentage tax is included as itemized deductible expenses in the form of taxes and licenses if you are claiming itemized deductions instead of the OSD.

Hello sir vic,

Filling 3rd quarterly tax ask ko lng sana po if sa # [33] Less Deductions kung and total amount salary I earn from July – September is considered deductible? should I combine my allowed deductibles (Transpo, internet bill, electricity, water etc..) + Salary? or no need to include the salary total amount ? since na basa ko po na allowed deductible as expenses ? or this mean if you have a business paying for a salary (compensation) for your your manpower? here is from the article of yours :

*** Expenses (rent, depreciation, salaries, taxes and licenses): P 60,000****

***2. Itemized deductions. These deductions from gross income include all ordinary and necessary trade and business expenses paid or incurred during the taxable year in carrying on or which are directly attributable to the development, management, operation and/or conduct of the trade and business. Itemized deductions include the following:

a) Expenses

b) Salaries

c) Interest *

d) Travel

Hi Margareth, the salary described as Itemized deductions in that article is the salary you pay to the employees/workers of your business, not the salary you earn from other companies.

Hi,

Thanks for this very informative article. I just have some questions regarding deductions, please see below:

1. I’m a mixed income earner and I’ve read on some other blogs that as a mixed income earner, I can only use itemized deductions. Is this correct?

2. As of now I’m assuming I am in #1 (use itemized deductions) as it is the best thing to do since business expenses is higher than 40% (OSD). So my next question is what’s the difference between Schedule 4 (cost of sales/services) and Schedule 6 (ordinary allowed deductions) in a 1701 form?

3. Both schedules have fields like salaries, rental, depreciation and some other items on Schedule 6 can fall on the field direct charge s – materials, supplies and facilities and direct charges – others. So when do we use Sched 4 or Sched 6, are there any general guideline on which to use on those 2?

Hope you can help me on these queries. Thanks in advance.

Basically not, since 1701Q is a separate return. And since it has error, you have to amend and correct that particular BIR return. Well, you may ask BIR for confirmation.

Hello Sir Vic,

I’m put up a online business last Sept 28, 2017 and still working as medical staff married with 2 college students. My question on my gross sales i will add my salary and business sales? or do i need to file separate income tax for my business and salary? I started filling for percentage tax last oct 2017. I will start to file for income tax for 1st quarter? then 1701 annual income tax ( oct-dec)?

Hoping for your response..

Hello Margie. Here are some answers to your questions:

1. On BIR Form 1701Q, I think there is no box there to add your income from compensation but only Sales/Revenues/Receipts/Fees, hence, you don’t need to add your salary as an employee on 1701Q. Also Income from salary is not filed by an employee on a quarterly basis.

2. You need to file 1701 for 2017 since you started business Oct 2017. Your annual 1701 shall reflect both your income from business and income from compensation – you can check the form to see boxes intended for them. You also need to attach your 2316 to claim deduction for the taxes that were already withheld on your income from compensation.

3. You need to file 1701Q for Jan-March 2018. There is no 4th quarter 1701Q, since this is already covered in your annual 1701.

i just registered my business last month but not operational yet. i was told that today is last day of filing for 2nd qtr.

sole proprietorship, filed my business last march 26, home service massage

please help me what i should fill up and attach.

salamat

Hi,

My friend is a working professional categorized as Mixed income earner in BIR system.

in my understanding he is required to file 1701 as being a practicing profession and his employer the usual compensation tax return.

Now, his only source of income is from employer, no income from business or practice of profession, is he still required to file 1701Q? please take note that I am referring to the quarterly filling.

hello po sir vic!magfile n b ako ng quartely income tax kung kakasimula lng business nun sept2018 po?

Hi Jenny. The third quarter ITR covers the months of July, August and September, so just to be safe, it’s better to file 3rd quarter income tax return whether you have a tax payable or none.