How to compute SSS contribution in the Philippines? Employers must know how much employer’s contribution (ER) they must pay to the Philippine Social Security System (SSS) for their employers. If you’re an employee, you might also ask how much employee’s contribution (EE) is deducted, withheld and remitted by your employer to the SSS from your salary. For self-employed persons, such as professionals, businessmen and entrepreneurs, their SSS contributions are paid entirely by themselves. This is different from the contributions made by employees, because employers contribute for the benefit of their employees. That is why employers SSS contributions form part of employees’ benefits expense incurred by employers.

How to determine SSS contributions

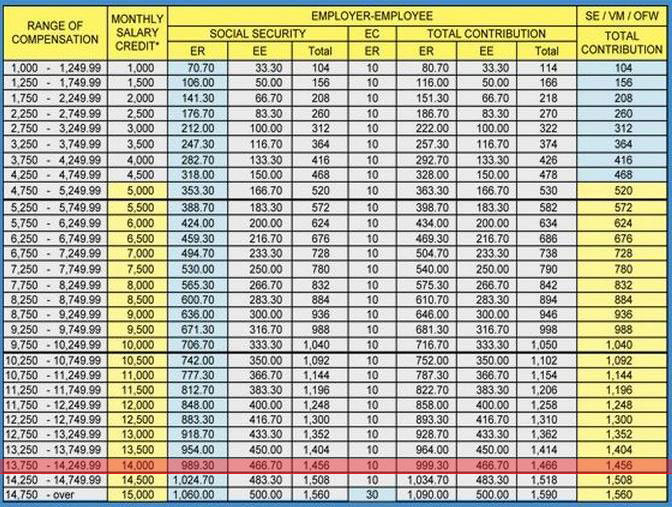

Determining how much employees contribution (EE) an employer should deduct from his employees salary and how much employers contribution (ER) he should contribute to the SSS is quite easy. We only need to refer to the New SSS Contribution Schedule issued by the Social Security System. Let’s assume the following as an example:

Example:

Mr. Santos is an employee working for Mr. Cruz, his employer. Mr. Santos earns a monthly salary equivalent to P14,000.

Questions and answers:

1. Question: How much Employees Contribution (EE) should Mr. Cruz deduct from Mr. Santos salary?

Answer: Php 466.70 (See schedule on the Total Contribution of EE in the P14,000 Monthly Salary Credit range [highlighted in red]).

2. Question: How much is the total Employers Contribution (ER) Mr. Cruz should remit to the SSS for Mr. Santos?

Answer: Php 999.30 (See schedule on the Total Contribution of ER in the P14,000 Monthly Salary Credit range [highlighted in red]).

3. Question: How much is the total SSS contribution that should be remitted to the SSS for Mr. Santos?

Answer: Php 1,466.00 (See schedule on the Total Contribution of ER + EE in the P14,000 Monthly Salary Credit range [highlighted in red]).

New SSS Contribution Schedule

For Self-employed (SE) persons, Voluntary Members (VM) and Overseas Filipino Workers (OFW), since they don’t have employers, they pay their total SSS contributions alone. Their total contribution is determined by simply looking at the last column (SE/VM/OFW Total Contribution) of the schedule based on their monthly salary /earnings credit range. Thus, if you’re self-employed and you earn P14,000 a month, the total SSS contribution you should remit to the SSS amounts to P1,456.

SSS contributions as deductions for computing income tax

A common mistake made by employers or their accountants and bookkeepers is claiming the total (ER and EE) SSS contributions as expenses or deductions against their taxable income. Only the total employer’s contributions (ER) should be recorded as expenses (employees’ benefits) in the books of the employer. Accordingly, ER expenses are the only allowable deductions an employer should claim against his taxable income. This is because ERs are the only expenses actually incurred and paid by employers. Employees’ contributions (EEs) are actually paid by employees – these are deducted from their salaries.

How to determine the total contributions credited in your SSS records

It is very important that you should know how much is the total SSS contributions you have made and credited to your SSS account. This is to ensure that your contributions or the contributions made by your employers are actually and correctly reflected in your SSS records. To know you SSS records, you may inquire personally at the counter of the nearest SSS office in your area. If you have an SSS ID, you can use it in utilizing their kiosk. It’s an electronic machine like ATM that you can use to inquire your balances, such as your loan balances and total contributions made (this is what I do to check my records because it’s convenient and I don’t need to wait for hours for my name/number to be called at the counter). You may also try to visit and register at their website. But based on my experience, there is a problem in their web system. I have registered a few months ago, but I haven’t received any email confirming my registration. Thus, I still can’t log on to their website to check my records. I hope they could fix it as soon as possible. I also learned that there are several members who also experience this kind of problem. Good thing, I have my SSS ID.

Please don’t ask me how much is the total SSS contributions reflected in your records – I’m not an employee or an officer of the SSS. For more details and for your inquiries, you may visit or contact them at the following office address, telephone numbers, emal, website and facebook page.

Social Security System (SSS)

SSS Main Bldg, East Ave., Diliman, Q.C.

Trunkline: 920-6401

MRD email: member_relations@sss.gov.ph

To get information on your SSS data or membership, you can use their automated telephone service by calling the SSS IVRS at 917-7777 or call 920-6446 to 55 to speak to an SSS representative from 8:00 am to 5pm, Mondays to Fridays.

Website: www.sss.gov.ph

Facebook page: follow this link

Relevant law and resources:

Social Security Act of 1997, Republic Act No. 8282

Citizen’s Charter of the Social Security System

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

i would like to know how many years contributions to complete in order/before an sss member can avail pension?

thanks more power.

how about missing years unpaid contributions.,

Hi, we’ve got the following information. Members who are qualified to apply and avail SSS Pension include the following:

1. A member who is 60 years old, separated form employment or ceased to be self-employed, and has paid at least 120 monthly contributions prior to the semester of retirement.

2. A member who is 65 years old whether employed or not and has paid at least 120 monthly contributions prior to the semester of retirement.

—Please call or visit the nearest SSS Office in your area to confirm. Thanks.

Sir good day

If i paid more than 120 days total but not continuous, still it is valid?. because as of now i am applying for self-employed status.

Hi Roberto, do you mean 120 months? or days? The SSS contributions you made, though not continuous, will still be credited to your SSS records. But you can’t anymore pay the months that you have failed to pay. You can continue paying prospectively.

sorry sir, months. thank you very much for the clarifications.

more power.

Good day Mr. Vic..

In regard to the sharing computation between employee and employer for SSS contribution , what is the exact ratio there??? is it 70:30?? and why do some employer give only half as share to their employees account. Mean 50% employees share to sss and another 50% employer share to their employees sss account. i want to present this table of computation you’ve made for sss sharing contribution to our hr department. but i need first your advice for clarification.

Thank you sir..

God bless…..

Hi Leee. There is no prescribed percentage but specific amounts for employer and employee are provided. On the table it appears that employee’s share is equivalent to about 50% of the employer’s share. Example, at 13,750-14,249.99 bracket on the table, employer shares is P999.30, while employee shares is P466.70. Yes, you may present the table and make clarifications with your HR on how they compute. If you found out over withholding on your part, then, you may ask for refund from your employer or you may proceed to SSS to file charges against your employer if they will not make refunds.

thanks ghar…

follow up question, is there any way to check my share to sss online?? and how???

thanks a lot again

I am 27 years of age. I want to know the actual facts and figures to what benefits’ paid under the simple example given below. I am trying to figure the actual pay in payout ratio based on the median life expectancy.

If I pay 312 per month for 10 years my total contribution would be 37,440, I stop paying at age 37!

Years later I am now at 62 years of age and I want to collect my SSS.

What will I be able to receive monthly?

The sheet I was give indicates that I would receive almost 500,000 pesos during the 10 year payout period from my age of 62 to 72. I cannot accept this as factual.

I would think that the document that I have is in error or the President CEO is horrible at math. The signatory name is Corazon S. De La Paz.

This type of payout would bankrupt our system. Can someone please calculate the actual monies paid during the 10 year payout period assuming the current numbers would be the same some 30 years from now!

At best this would help me to decide if I really want to pay more or less or nothing at all.

And please show the math so others may understand the system better.

Tarah

Hi,

I think it would be better if we really can see the document you are talking about.

It will also be proper if you can address your concern or complain to the SSS office.

Address and telephone numbers are provided at the bottom of this post.

Thanks.

Hi, I believe I have an SSS contributions for more or less 5 years until year 2005. I stopped the contributions due to an overseas job opportunity. I would like to re-activate my membership or contribution when I get home for vacation in November 2011.

I have only limited holidays, so I would appreciate if there’s someone will get back to me with regards to what to bring and how much to bring so it will be all settled for once when visiting the nearest SSS office from my place.

Would like to reactivate my membership as an OFW.

Thank you so much & appreciate your reply.

Regards,

Racquel

Hi Racquel, I’m glad that you will be visiting your own homeland soon. With regard to your question, what I only have in mind is that the important thing you need to show with the SSS is your SSS NUMBER. With your SS number, the SSS personnel can easily check your account and records in their database if you have indeed made contributions in the past. I’m not connected with the SSS, but you can also contact them on the contact information shown at the bottom of the article. Thanks.

Hi Vic, the post is very informative thank you. One question, is the “Salary” based on Basic Pay or Gross Pay(includes overtime, holiday pay, cola, etc)?

My husband died and he has was able to contribute for 34 years (408 months). I heard over the radio that any member that was able to contribute for more than 30 years are entitled to get at least Php7,000.00 monthly pension. I just want to confirm it that is true and if there is any law or Executive Order about this?

Thanks,

Margie

Hi! I would like to ask because I am a voluntary member of SSS ever since, I had 51 months contribution already. I am planning to apply a housing home finance my house is located at Dasmarinas Cavite, 152sq/m worth 3M. As of now I’m paying advance payments for my contribution. Can I avail this type of loan as well can I pay my skip payments?

What I know is that unpaid SSS contributions cannot be paid anymore after due dates, unlike Pag-ibig contributions which you can still pay the contribution you failed to pay on time.

same question with mharyano. is SSS based on Gross Basic Pay (Basic Pay + OT + Holiday Pay + Premium – late & undertime – absences)? or is it like the 13th month pay which is based on Basic Pay EARNED/RECEIVED (Basic Pay – absences – lates – undertime)?

Hi Anna & Mharyano. The way SSS defines salary seems to refer to the gross compensation but the practice of most companies is to concentrate on the basic salary only.

Until what age can a voluntary member continue to contribute?…and is there any benefit/advantage in terms of amount of pension that will be received by a voluntary member who continues/extends to contribute beyond the age he is required to contribute?

Hi Sir Vic,

Our company closed shop last 2009 and since then I am unemployed. I’m 53 yo now and my last deduction was Php1,560 (ER-EE) on August 2009 . How much pension will I received when I reached 60yo. Other option is if I continue paying my SSS as self employed how much will I received when I’m 60yo?

Thank you.

greetings…

hi sir, should i include commission pay to basic salary for the basis of sss contribution? since we incorporate payment of commissions of our sales employees to our payroll computation…we include overtime, allowances, lates and absences but not the commission…does sss has a ruling on this? so that we can comply what is must..thanks po.

I am an self employed member.. and i want to close my business.. what form do i need to fill up to update SSS that i can no longer pay my contribution since i am going to U.S.A?

Sir Vic,

Good Day!

I want to know what forms on SSS do i need to fill up because i want to close my business.. i am an self employed..

Maitanong ko lang po, I’ve already reach the 120 months paying my SSS contribution. Ok lang po ba kung mag stop na akung mabgayad since naka 120 months na po ako..tnx

MAGANDANG ARAW PO..

TANUNG KO LANG PO KUNG ILAN NA ANG AKING KONTRIBUSYON?

SALAMAT PO.

Hi Mr. Vic, I’m an OFW here in Qatar and have paid our (with wife) SSS contributions for January to June 2012 last Jan. 18 from a remittance center that sends to SSS bank account in manila. But, until now it is still not updated on the website. I already sent an email to member_relations(at)sss.gov.ph with attached receipts for almost a month now informing them to update my contributions and received only an auto reply that it will be acted upon accordingly. So, until how long should I wait for it to be acted upon? I used to pay that kind of transaction before and after a month or less it’s already updated in the system website. Please advice. Thanks Po. God bless..

tanong ko lang po, pag mas malaki ang hulog monthly, mas malaki din ba ang makukuha na pension every month? Thanks!

goodevening po sa inyo….tanong ko lang po may mga workers ako tapos ung business name ko kailangan ko palitan every year for the business purposes po,paano ko mahahandle yong sss contribution ng mga workers ko,kung every year ako magchange ng business name? hoping you to reply my email add..thank u so much..god bless you po

Hi Lyn. On view, I do not see any problem with that if you are under a sole proprietorship business because change of name does not involve change of identity. It is still you who employs them and continues to be under obligation to your employees.

Why do you have to change name every year?

Hi po pwedi magtanong. Delayed ng 1yr contribution ang employer ko sa SSS ko now ko lang po nalaman. Pwedi pa po bang bayaran nila yung 1yr lapse? If not, pwedi ba sila mag bayad ng 1yr advance? Meron po bang penalty doon sa mag bayad ng advance? Thanks po.

paano kaya pag ayaw kong maghulog sa SSS? pwede kaya yun? Parang di ko rin siya magagamit. Thanks! wait ko reply niyo 🙂

Hello,

Want to inquire if Monthly Salary Credit would mean Basic Pay or Gross Earnings or Net Earnings during the month? Net Earnings amount is that which has been credited to an employee’s payroll account.

Please help.

Many thanks!

Hi, just want to share what I have just read.. I think you are pertaining to “Compensation” & not the monthly salary credit right?.. Here is what’s written on our laws: “RA 8282 Sec.8 (f)(f) Compensation – All actual remuneration for employment, including the mandated cost-of-living allowance, as well as the cash value of any remuneration paid in any medium other than cash except that part of the remuneration in excess of the maximum salary credit as Provided under Section Eighteen of this Act.”

hi vic..i just want to ask of what is the formula in knowing a pensioner’s pension in limp sum of 18mos. tnx..God bless!

gud mrning sir. my father was already 64 yrs old. nagwork po xa almost 24 yrs. ngpepension na po xa pero masyadong mababa po ang nakukuha nia. normal lang po ba na 2,000php plus lang ang nakukuha nia every month? meron lang daw po xang calamity loan na 3,ooo at salary loan dati na mga halagang 3,000. ndi nia po alam kong bakit hanggang ngayon ganun pa rin ang nakukaha niang pera. malayo po kc sa sa office ng sss kaya ndi xa nakakapunta. pls help po.

I would just like to ask, if the Overtime and absences/tardy/undertime as subject to SSS? thank you and appreciated very much your immediate response.

i think it is the same because sss is based on monthly salary

how about pag ibig and philhealth?

Hi Vic,

I just got a nanny for my son. I’m paying her P3,000 monthly and planning to enroll her as SSS member. (I understand from the table above that total contribution is P312). My question is, the nanny obviously has no ITR, what will SSS’ basis for checking the compensation? Does SSS membership go with ITR hence I can not enroll her? By the way, what does EC stand for which is P10 in above table?

Thanks for the help.

can you provide an article on to pay salary loans incurred by employees? thank you.

Tanong ko lang kung both husband and wife are SSS pensioner at kung mamatay yung wife malilipat ba sa husband yung pension nya kahit na may pension na rin sya. Bali magiging 2 ang pension nya.

Hello sir,

Good day to you! I just want to ask if what should I do, starting January 2013 i am not employed already. My last payment in SSS is this December 2012. currently im here now in Switzerland. I^ll be back in the Philippines in March 2012. I want to still pay my contributions continuosly. Can you please give me advice and the amount that i should pay since i am not already employed? thank you very much!

I hope to receive immediate response from you! have a nice day

cherdoll;)

Good day sir, may tanong lang ako, nakalimutan ko ang akin I.D user at password. ano ang gagawin ko, para magamit ko ulit para sa pag update ko sa akin sss contribution. thank you very much…