How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s employees. You will not have an idea on the computation of the tax withheld on compensation for each of those employees. In this article, we will tackle how a withholding tax is computed for each of them. So let’s proceed.

Requirement of Withholding

According to Section 79 of the National Internal Revenue Code (Republic Act No. 8424), as further amended by RA 9504, “except in the case of a minimum wage earner as defined in Sec. 22(HH) of this code, every employer making payment of wages shall deduct and withhold upon such wages a tax determined in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner.” This means that employees and workers who earn minimum wages are not subject to withholding tax. The summary of the current regional minimum wage rates can be viewed at the Department of Labor and Employment (DOLE) official website.

Methods of computing tax withheld on compensation

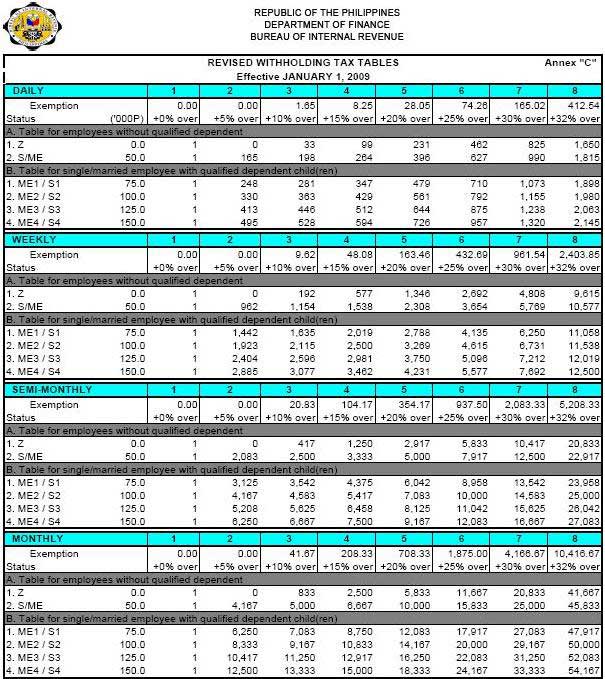

1. Use of withholding tax table. In general, every employer making payment of compensation shall deduct and withhold from such compensation a tax determined in accordance with the prescribed Revised Withholding Tax Tables (Annex C) which shall be used starting January 1, 2009. Below are the four withholding tax tables prescribed in these regulations:

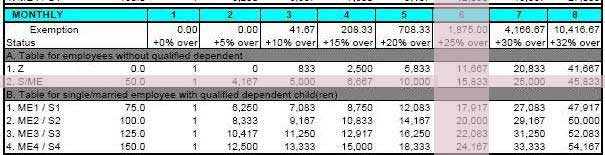

a. Monthly tax table – to be used by employers using the monthly payroll period;

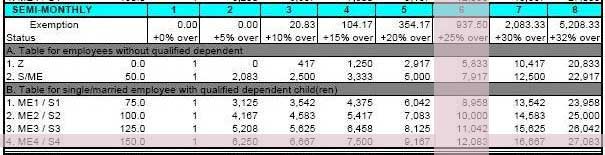

b. Semi-monthly tax table – to be used by employers using the semi-monthly payroll period;

c. Weekly tax table – to be used by employers using the weekly payroll period;

d. Daily tax table – to be used by employers using the daily payroll period.

Legend:

Z-Zero exemption

S-Single

ME-Married Employee

1;2;3;4- Number of qualified dependent children

S/ME = P50,000 Each Working employee

Qualified Dependent Child = P25,000 each but not exceeding four (4) children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEES WITH NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is unemployed.

2. Married Employee (Husband or Wife) whose spouse is non-resident citizen receiving income from foreign sources.

3. Married Employee (Husband or Wife) whose spouse is engaged in business.

4. Single with dependent father/mother/brother/sister/senior citizen.

5. Single

6. Zero Exemption for Employees with multiple employers for the 2nd,3rd…employers (main employer claims personal & additional exemption)

7. Zero Exemption for those who failed to file Application for Registration

USE TABLE B FOR THE FOLLOWING SINGLE/MARRIED EMPLOYEES WITH QUALIFIED DEPENDENT CHILDREN

1. Employed husband and husband claims exemptions of children

2. Employed wife whose husband is also employed or engaged in business; husband waived claim for dependent children in favor of the employed wife.

3. Single with qualified dependent children.

If the compensation is paid other than daily, weekly, semi-monthly or monthly, the tax to be withheld shall be computed as follows.

a. Annually – use the annualized computation (see no. 3 below).

b. Quarterly and semi-annually – divide the compensation by three (3) or six (6) respectively, to determine the average monthly compensation. Use the monthly withholding tax table to compute the tax, and the tax so computed shall be multiplied by three (3) or six (6) accordingly.

2. Cumulative average method. This method is used if (a) in respect of a particular employee, the regular compensation is exempt from withholding tax because the amount thereof is below the compensation level, but supplementary compensation is paid during the calendar year or the supplementary compensation is equal to or more than the regular compensation to be paid; or (b) the employee was newly hired and had a previous employer/s within the calendar year, other than the present employer doing this cumulative computation.

3. Annualized withholding tax method. This method is used (a) when the employer-employee relationship is terminated before the end of the calendar year; and (b) when computing for the year-end adjustment (the employer shall determine the amount to be withheld from the compensation on the last month of employment or in December of the current calendar year).

Steps in computing amount of tax to be withheld

Step1. Determine the total monetary and non-monetary compensation paid to an employee for the payroll period, segregating gross benefits which include 13th month pay, productivity incentives, Christmas bonus, other benefits, received by the employee per payroll period, and employees’ contribution (employees’ contribution only and not the employers’ contribution) to SSS, GSIS, HDMF, PHIC, and union dues. Gross benefits which are received by officials and employees of both public and private entities in the amount of P30,000 or less shall be exempted from income and withholding taxes.

You may read our article about How to compute 13th Month Pay in the Philippines.

Step2. Segregate the taxable from the non-taxable compensation income paid to the employee for the payroll period. The taxable income refers to all remuneration paid to an employee not otherwise exempted by law from income tax and consequently from withholding tax. The non-taxable income are those which are specifically exempted from income tax by the Code or by other special laws as listed in Sec.2.78.1(B) hereof (e.g. benefits not exceeding P30,000, non-taxable retirement benefits and separation pay).

You may read our article titled “How to Compute Separation Pay in the Philippines”.

Step3. Segregate the taxable compensation income as determined in Step 2 into regular taxable compensation income and supplementary compensation income. Regular compensation includes basic salary, fixed allowances for representation, transportation and other allowances paid to an employee per payroll period. Supplementary compensation includes payments to an employee in addition to the regular compensation such as commission, overtime pay, taxable retirement pay, taxable bonus and other taxable benefit, with or without regard to a payroll period.

You may read our article on “How to Compute Overtime Pay in the Philippines”.

Representation and Transportation Allowance (RATA) granted to public officers and employees under the General Appropriations Act and the Personnel Economic Relief Allowance (PERA) which essentially constitute reimbursement for expenses incurred in the performance of government personnel’s official duties shall not be subject to income tax and consequently to withholding tax.

Step 4. Use the appropriate tables mentioned under Section 2.79 (B)(1) for the payroll period: monthly, semi-monthly, weekly or daily, as the case may be.

Step 5. Fix the compensation level as follows:

(a) Determine the line (horizontal) corresponding to the status and number of qualified dependent children using the appropriate symbol for the taxpayer’s status.

(b) Determine the column to be used by taking into account only the total amount of taxable regular compensation income. The compensation level is the amount indicated in the line and column to which the regular compensation income is equal to or in excess, but not to exceed the amount in the next column of the same line.

Step 6. Compute the withholding tax due by adding the tax predetermined in the compensation level indicated at the top of the column, to the tax on the excess of the total regular and supplementary compensation over the compensation level, which is computed by multiplying the excess by the rate also indicated at the top of the same column/compensation level.

Sample Computations Using the Withholding Tax Tables

The following are sample computations of Withholding tax on compensation using the withholding tax tables:

Example 1: Single with no dependent receiving monthly compensation

Juan Santos, single with no dependent, receives P18,000 (net of SSS/GSIS,PHIC,HDMF employee share only) as monthly regular compensation and P 7,000 as supplementary compensation for January 2011 or a total of P25,000. How much is the withholding tax for January 2011 for Juan?

Computation:

By using the monthly withholding tax table, the withholding tax for January 2011 is computed by referring to Table A line 2 S (single) of column 6 (fix compensation level taking into account only the regular compensation income of P18,000 which shows a tax of P1,875 on P15,833 plus 25% of the excess of P 2,167 (P18,000-15,833) plus P7,000 supplementary compensation.

Regular compensation: P 18,000

Less: compensation level

(line A-2 column 6) 15,833

Excess P 2,167

Add: Supplementary compensation 7,000

Total P 9,167

Tax on P15,833 P 1,875.00

Tax on excess (P9,167 x 25%) 2,291.75

Withholding tax for January 2011 P 4,166.75

Example 2: Married with qualified dependent children receiving semi-monthly compensation

Jose Cruz, married with three (4) qualified dependent children receives P14,000 (net of SSS/GSIS,PHIC,HDMF employee share only) as regular semi-monthly compensation. His wife is also employed but he did not waive his right in favor of the wife to claim for the additional exemptions.

Computation: Using the semi-monthly withholding tax tables, the withholding tax due is computed by referring to Table B line 4 ME4 of column 6 which shows a tax of P937.5 on P12,083 plus 25% of the excess (P 14,000 – 12,083 = P1,917).

Total taxable compensation P 14,000

Less: compensation level

(line B-4 Column 6) 12,083

Excess P 1,917

Tax on P12,083 P 937.50

Tax on excess (P1,917 x 25%) 479.25

Semi-monthly withholding tax P1,416.75

For more samples of computations, such as computations using the cumulative average method, and annualized withholding tax method for computing year-end adjustments and when the employer-employee relationship is terminated before the end of the calendar year, please read the BIR issued Revenue Regulations No. 10-2008, which you can download the full text at the following links:

Revenue Regulations No. 10-2008 PDF file from BIR Website or

Revenue Regulations No. 10-2008 PDF file from our website, in case the BIR link won’t work

You can also view/download the following:

Revised Withholding Tax tables

BIR form 1601-C -Monthly Remittance Return of Income Taxes Withheld on Compensation

BIR Form 1604C -Annual Information Return of Income Tax Withheld on Compensation and Final Withholding Taxes

Summary of current regional daily minimum wag rates (Department of Labor and Employment)

Disclaimer:

New and subsequent BIR rulings, issuances and or laws may render the whole or part of the article obsolete or inaccurate. For more information, please inquire or consult with the BIR.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi Vic,

Are parents ages 60 and up are qualified as a additional dependent?

Thanks.

An individual, whether single or married, shall be allowed an additional exemption of P25,000.00 for each qualified dependent child, not exceeding four (4). The additional exemption for dependents shall be claimed by the husband, who is deemed the proper claimant unless he explicitly waives his right in favor of his wife.

“Dependent Child” means a legitimate, illegitimate or legally adopted child chiefly dependent upon and living with the taxpayer if such dependent is not more than twenty-one (21) years of age, unmarried and not gainfully employed or if such dependent, regardless of age, is incapable of self-support because of mental or physical defect.

Just wish to add another point. Some authorities are advocating in favor of Senior Citizens as additional dependents by virtue of the amendments of the Senior Citizens Act but this is a minority view so that the common treatment is they are not entitled. Dependent child is what Vic quoted above and since senior citizens can never be a child of the taxpayer caring them, though sometimes they get back to being a child, they are not entitled the P25k a year additional personal exemptions.

Hi Ghar, please put your real name or nick name in the name field. It is one of our commenting policy which aims to recognize truly our commentators. Thanks for the additional point.

Noted with thanks Vic. You do have a healthy forum here.

To develop your thorough understanding of Compensation – tax computation and exemptions, I have created a seminar that where you may participate in order to understand how it works, what are the related BIR forms to file, and how BIR makes assessment on compensation. Please visit link on my name for details, inquiries, and reservations. Thanks.

If a foreign company in Europe hired you on a fixed-term contract as a consultant to do IT job but put your contract in their local sales company which is not doing IT at all so paperwork is faster, how would you be taxed considering that 100% of your time you travel abroad and directly reports to your counterparts in Europe?

Will you be taxed 10% or maybe 15% or the regular 29-32%? More so, if you are getting an amount set in your job offer every 6 months directly from the office in Denmark as a reward for your efforts, how will that be taxed?

If your salary is invoiced by the local sales company to the head office in Europe as an expense, are you to be taxed full? Aren’t you an employee then of the foreign company though your contract was put locally for convenience?

If for the past 2 years, the former finance manager has been imposing a 10% tax on you and suddenly on the end of the 2 year period, a new finance manager arrives and taxes you 29% instead, will that be correct?

If the amount you usually get from headoffice as a form of goodwill or reward is given to you in full for the past 2 years, is it reasonable to tax it in full 29% due to the arrival of the new finance manager? Please kindly assist. Thank you.

Hi Son,

Seems you are have a long list of clarifications. Please find my views to your concerns beside your question.

If a foreign company in Europe hired you on a fixed-term contract as a consultant to do IT job but put your contract in their local sales company which is not doing IT at all so paperwork is faster, how would you be taxed considering that 100% of your time you travel abroad and directly reports to your counterparts in Europe?

Ans. The tax would depend on where you do the IT work, how long have you been out of the Philippines to do the work, and if the local company shoulders said expenses. If the work is done abroad and you stayed there more than 183 days, then the same is not taxable in the Philippines because you shall be considered a non-resident citizen taxable only on income within the Philippines and said income is an income outside of the Philippines for being the work being done abroad. If the local company shoulders said expenses, then, there has to be a tax Treaty relief with the BIR ITAD, or a ruling from BIR-Law Division, otherwise, the BIR will look at it as taxable. On the contrary, you are taxable in the country based on tax table with rates 5% to 32% depending on your tax bracket. No VAT shall be imposed on services performed abroad.

Will you be taxed 10% or maybe 15% or the regular 29-32%? Ans. 5-32% tax table applies because you are not an employee of an RHQ.

More so, if you are getting an amount set in your job offer every 6 months directly from the office in Denmark as a reward for your efforts, how will that be taxed? Ans. Same taxable implications as said above, the manner and frequency of payment is not material.

If your salary is invoiced by the local sales company to the head office in Europe as an expense, are you to be taxed full? Aren’t you an employee then of the foreign company though your contract was put locally for convenience? Ans. Same tax implications as above, who shoulders you fee is not material.

If for the past 2 years, the former finance manager has been imposing a 10% tax on you and suddenly on the end of the 2 year period, a new finance manager arrives and taxes you 29% instead, will that be correct?

Ans. The new Finance Manager maybe correct at one point or maybe wrong at another point. I think, the 10% is only a creditable withholding tax that is withheld by the old Finance Manager which means that you should have been filing ITR based on 5-32% tax table if you are taxable. If you are not subject to income tax in the Philippines as discussed above, then, both of them are incorrect.

If the amount you usually get from headoffice as a form of goodwill or reward is given to you in full for the past 2 years, is it reasonable to tax it in full 29% due to the arrival of the new finance manager?

Ans. It does not matter also because such amounts are treated as compensation for services.

Hope the above clarifies your concerns.

Hi,I dont know how to compute my taxes but my salary is 20,000 a month less SSS,PH,HD a total of 812.50 and my tax is 3,502.97 a month, is this correct computation?

appreciate your help, thanks

Hi alvin,

are you single, married and with dependent/s??

If gross salary is 20,000.00, the following benefits should be deducted to your salary:

SSS ——————————- 500

PH ——————————- 250

HD ——————————- 100

_________________________________________

Total Deduction of —————- 850

And the Withholding tax deduction for single / married with 0 dependent child is ————– 2,704.25

Note: the withholding tax will change if you’re married with dependents as well as if you have Overtime or Night Diff.

can you please show me the computation? thanks

@jordieza, can i ask how to compute the 2704.25? the detailed one pls.

what is the withholding tax deductible if my salary is 22,650.00 and i have 2 dependents?

Hi flerie,

Is this a gross salary or net salary? What I mean to say is that, is this a salary with benefits deductions or no benefits deductions yet.

I need your response, for me to compute for your withholding tax.

I just want to ask what if deployment incentive is taxable or not? thanks,

do you have an e-mail address?

Hi Don! Yes, it is taxable. As a rule, all income earned in the Phils. is taxable regardless of source and the designation. You can send me mail at taxacctg.tutorials@gmail.com.

hi vic, can you help me to compute may withholding tax? my basic salary now is 10, 800 with sss deduction of 366.70, phic 366.70, hdmf 216…

last school year my basic salary was 7000 pesos but my employer withheld us 200.. is this correct?

Hi Mike,

Based on your basic salary, your PHIC monthly deduction should be 125 while the rest were correct.

Please see the ff. withholding tax deduction per month based on your status:

1. Single/Married w/ 0 dependent child —————— 726.79

2. Single/Married w/ 1 dependent child —————— 409.68

3. Single/Married w/ 2 dependent children ————— 134.20

4. Single/Married w/ 3 dependent children ————— 0.00

5. Single/Married w/ 4 dependent children ————— 0.00

I hope this answers your query.

With regards to your second question if they deduct the right withholding tax, my answer is yes if and only if you’re single / married with no dependent child. Withholding Tax should be 199.59 ~ 200 if you have a gross sallary of 7,000.

Hi, Ghar can you help me in computing my tax may salary is 20,000 w/ total deduction of 812.50 a month, appreciate your help.thanks

Any breakdown on the 812.50 deduction?

Hi Ghar,

I sent you a mail, I don’t know if you have received it.

Hi guys! It seems more are interested in learning how to compute their respective withholding taxes on compensation. You might be willing to invest in knowing more about withholding taxes, we have a seminar this coming August 4, 2011. To see details, please click on my name and click on the program to View Program. Thanks.

Ghar;

Thank you for your very useful answer. My question now is that you mention that if an employee has worked for 183 days abroad, he should not be taxed, is this 183 days need to be consecutive or just a total of series of foreign trips?

I have been in Europe for 3 months straight and every other week afterwards, I have been going from one country to another spending a week or sometimes 2-3 weeks onsite implementing projects.

After each rollout, I go back to Manila for a short 1-2 weeks break. As such, I may say that I have stayed abroad for more than 183 days if I were to compute for the total of work days I have been rendering services abroad. Will that be the right translation or it has to be 183 consecutive days?

One more thing, the signatories in my contract were my boss in Europe, the Regional Director in Malaysia and the Country Manager in Manila. Since I am hired by the HQ in Europe but put on contract in Manila and signed by RHQ, am I not an RHQ employee?

Thank you so much!

Hi Ghar,

I would like to know if for example; I have been employed for the current year for 4 months from my 1st employer and i got terminated( regardless of offense ). Then I got employed by a 2nd employer on the same year. Am I still entitled for the 2316 form from my 1st employer???

@Ervin,

BIR Form 2316 is a certificate of withholding tax on your compensation. Thus, if your 1st employer has withheld tax on your compensation, whether it’s only for 1 month or 4 months, you have the right to get 2316 from them.

I work 3 times a week as a cook and paid P479 a day. I am married. Is my wage subject to withholding tax?

@buds,

Where are you working at? Your location and type of employer?

I am receiving pure salary only P12,000.00 less only philhealth P150.00 can i get ITR 2316?

If you were withheld taxes on compensation, then, you can secure 2316 from your employer yearly every after January annualization or within 30 days after resignation.

hi..just want to ask if the daily allowances are subject to tax? I have 10,000 regular salary and 5000 allowance for transportation,meal etc..will the 15,000 amount subject to tax?btw, I don’t have any dependents.

Yes, they will be subjected. Allowances are taxable, as a rule.

hi sir can you pls explain to me what is the meaning of the 25000 per dependent, i will relay to you my situation. I am married with a son and my wife is not working since then. i have 25000 salary per month gross, and i just started working in this new company last july,2011 can you give me my net salary and what is the meaning of 25000 pesos per dependent plus if i am married another 25000 what is the 50000 all about to do with my tax and my salary? thank you very much and hoping for your reply

hi sir vic,, mAy i knOw who are allowed to haVe witholding taX compensation? is tHat trUe thAt thOse whO are aLlowed tO haVe witholding tAx cOmpensatIon aRe those mOnthLy salary is aBove P8,500?

Hi sir just want to add something, i just got my pay last week its my first pay in this new company but i notice they didnt deduct tax on me, can you explain to me why, and i heard a rumor that they will take it all in nov or dec this year, i mean from july- oct 2011 taxes of mine they will deduct it only in nov. is that possible sir

Hi Omar. To compute you withholding tax on compensation would be to apply first SSS, Philhealth & Pag-ibig deductions using the corresponding tables to arrive at taxable net income. I regret, It will be time consuming here but we do it in our workshops for withholding tax on compensation. Using the taxable net income figure, you can now compute using the withholding tax table above under the bracket appropriate for you – Monthly, ME1. P25,000 is the additional personal exemption of every qualified dependent child and up to four (4) children.

Withholding tax on compensation applies every payday and could not be cumulative. I will not like it if I am the employee because I will receive more on early paydays but will be surprised to receive a very minimal amount because all withholding taxes for several months.

hi, can you compute my tax pls?

my basic salary is 27149 – 500 sss, 100 pagibig, 375 philhealth..

sometimes incentive of 1500 or 2000 monthly, night differential of 1200 or 1500, 800 rice and laundry allowance,perfect attendance(depends) 660…married w/ 1 dependent and my husband provided me already the waiver and submited to HR as well as BIR and I have it as release..so how much would it cost for a monthly tax? thanks in advance

sir gar you said in your reply 25000 is the additional personal exemption, so i have a son. How does it affect my taxes? what does the 25000 have to do with my salary and taxes, i am sorry if i’m a little slow on this but what does the 25,000 do with my salary? Does it mean that i’m not gonna be taxed for 1 month because i have 25,000 salary so does it mean i will not have taxes for 1 month sir? could you please clarify thank you very much sir gar

Hi Omar! P25 is applied on an annual basis and is already considered in the withholding tax table on compensation.

Hi Omar! P25000 is applied on an annual basis and is already considered in the withholding tax table on compensation.

hello good day to all…

can anyone can help me with this …pls…

my uncle’s monthly income is 90,000.00 and his company is deducting 11,000.00 per 15

days…so for one month his tax is 22,000.00 is this right???

Hi Sir,

Im just a little bit curious.Are allowances to employees are part of deductions or it is taxable still?In case here I’ve just heard that we are exempted from the tax having the basic salary of 5,500 + 2000 bonus every month of work..Can you explain me further if what are the cases that employees are exempted in income tax or the with holding tax..Thank you Sir, advance..

2000 allowances rather for every month..

thank you..

hi again sir gar ty for the response, by the way i heard from an officemate that it is no longer 25k but 50k exemption is it true? 50k for every dependant? and 100k for ME1? thanks sir gar i appreciate your responses.

Hi sir,

I am married with no more dependent. i computed my withholding tax for the 12 months period from Jan. to dec. 2011. Tax due for said period is divided to 12 and deducted monthly from payroll. Total basic salary for said period -P323,472.00; Bonus & Cash Gift-P31,956.00 for a total of P355,428.00.Non-Taxable personal contribution is P65,532.48. May I know my total taxes for the whole year so I may adjust it earlier before the end of November 2011.

Thank you so much.

Jane

Hi Omar. 50k applies to basic personal exemption regardless of status (before, 20k single, 25k head of family & 32k married), while 25k is for additional personal exemption for every qualified dependent child up to 4 children (8k before per child up to 4)

so for me just to be clear sir my annual income tax exemption would be 75k? am i right sir? 50k for me and another 25k for my dependant? Thank you again sir gar you are a big help to people who is lost with regards to their tax questions.

Yes, correct. Our pleasure to share our views.

I consult that BIR table (above) occasionally also. The table looks very clear to me…but my computation doesn’t seem to equate with my wtax.

Please help!

I will post figures in a bit.

So,here it is—

we have 2 paydays in a month.

1st pay:

gross taxable:11,696.30

wtax: 1,882.41

2nd pay:

gross taxable:12,068.65

wtax: 1766.12

sss: 500

philhealth: 237.50

pagibig: 100

Is this correct? My wtax looks odd. 😀

what is the supplementary compensation, is this allowance? sorry I don’t get the 7,000 on the example

could you define supplementary compensation as used in the sample computation above. is overtime pay considered supplementary compensation? thanks!

Never mind the technical aspect of it. It would just give you headache. just compute based on the withholding tax table!

@ Vin and Marriane

Please read the whole article, as stated in the article which is referenced to the BIR implementation examples,

“Supplementary compensation includes payments to an employee in addition to the regular compensation such as commission, overtime pay, taxable retirement pay, taxable bonus and other taxable benefit, with or without regard to a payroll period.”

Just a geeky tip, you can click “Ctrl” + “F” in your computer’s keyboard to easily FIND a particular word on any web page. You can use that to search for a certain word or topic you want to read, such as “supplementary compensation.”

Thank you for visiting. 🙂

Personally, I do not go with the BIR sample computation on withholding taxes using the supplementary income approach. I would give a lower withholding in the interim but will make a high withholding tax on compensation at the end. I would be rather be taxed more in the interim that be taxed much on the last pay that I may not have something to take home. Try to have a closer look at the BIR format and see the difference.

my basic pay is 20344 with cola of 1800, ahed 1200.

sss contributionof 500per cut off and pag ibig of 100. May tax akong 1900 and 2200 total of 4100 madalas every month. Is this correct?, Ask ko, never pa akong nakareceive ng tax refund for 4 years im married with 2 dependents.

wat does basic salary sa 2316 means? is gross pay less sss, phic, hdmf contributions?

I’m a foreigner employee – non-citizen. Married with 1 dependant

Semi-Monthly: 18,536.92

Tax Deduction: 3,581.90

SSS employee share 500.00

Pag-ibig employee share 100.00

Philhealth employee share 362.50

Is the above computation correct???

My tax code is: M1 what does it mean………

Hi Quincy. On M1, M stands for married and 1 stands for dependent. In other words, you are a married employee with 1 qualified dependent child and is entitled to P75,000 a year of compensation exempt from withholding tax. This is built-in in the tax table.

Thx. Ghar for your clarification.

Now the year end comes and each company starting to finalize all expenses for their staff. based on that I’ve a question?

First Question (1-3)

– Year End income up to-date(414,102.54)

– Tax w/held (88,311.18)

– Our company (Multi-National) send an e-mail saying that they will start processing Yearend Annualized Income Tax based on the current payroll data, i’m now asking myself am i taxed correctly or not? based on (http://www.bir.gov.ph/taxcode/1577.htm) – SEC. 25. Tax on Nonresident Alien Individual. engaged in trade and business- Chapter (C). Note that our company is engaged in international trade business with so many affiliate around the globe.

Second Question (2-3)

13 Month Pay Tax

– Total Taxable Income : 19,100.00

– Withholding Tax 5,730.00

– Total Deductions 5,730.00

– Basically i’m been taxed (30%)

– Is it correct even though i’m M1 Code (married with one dependent, I’ve a doubt about it?

Third Question (3-3)

– my wife is not working for a year, can she be a dependent.

Hi,

A dependent means a qualified dependent child. So your wife is not qualified whether working or not. With regard to your other questions, we suggest that you clarify this to the BIR to ensure that they can give you a ruling. You may review the article and the answers provided to other commenters. Thanks.

Good day gar i’m here again, gar i just want to ask you again, if i only strated working here last july 18, 2011, because i was working abroad and i wnet home last dec. 2010 and i am without a job until this july 2011, then how will it affect my taxes? because i am marride with one son so for a year my total exemption would be 75k right sir gar? if my gross pay from july to dec which is the cut-off is 100,000

then i should be 100,000-75,000= 25,000. So does it mean that they will only take taxes on the 25,000 sir? Thank you very much again sir hoping for your reply

Hi Omar, Yes, you got it right. If the 100,000 will include the 13th month pay and other benefits, then, it shall not also be taxed.

reason why i am asking this sir gar is because, since i started here in last july and we had 3 paydays already they have not yet deducted any taxes from my salary, other co-employees advices me to wait until Dec. because they will add it all up and deduct it from my Dec. salary, so i was thinking if they deduct it all in dec then i would not have a salary for half a month. can you help me compute it pls sir Gar, my half month gross pay is 11,800. from july 2011- dec 2011, my 13month pay would be pro rata 11000 since i only started last july. I am married with a son, can you please help me compute the total deductions if ever they will sum up all my taxes from july-dec. minus my exemptions pls sir. Thank you very much sir gar

At P11,800 gross bi-monthly salary, I estimate your withholding taxes every payday to be around PhP1,450 using the tax table above. The pro-rated 13th month pay is exempt. For the 2011, your income tax may appear as follows:

Gross (P11.8kx11) P129.8k

Less: SSS/PHIC/HDMF 6.6k

Exemptions 75k

Taxable P48.2k

Tax Due-annual approx P5,230

So if they will withhold on a monthly basis, it would appear you will have a refund in excess of P5,230.00. If they will not withhold now, then, you the approximate tax due of P5.23k will be deducted one-time. I suggest you save up to that amount, if your employer will not withhold on a monthly basis.

Thanks sir Ghar you are the best, that is actualy what i am thinking of doing save up.

Thank you for all your help you are doinh us a big favor giving us peace of mind. Have a nice day

Our pleasure, Sir Omar. Your satisfaction and peace of mind brings joy to our hearts.

Hi Ghar,

Im just wondering if the VAT is included in valuation of fringe benefit tax like VAT on monthly lease payment or VAT on car granted to managers..

I hope you can help me.

Thanks,

Billy

Nice question Billy. For a VAT-registered, input VAT has a separate treatment as credit against output VAT, so I am on the view that it should not be part for FBT purposes. To include VAT would be to a tax on a tax.

Thanks Ghar. Got it.

My pleasure Billy.

Hi if my Monthly salary is 8070 or 269/day how much is my witholding tax.my sss deduction is 233.33,philhealth 100 and pag-ibig 100.then the company was deducted me 418.78 is this correct? and im single

hi sir, this is jenny. is 13th month pay taxable?

basically, 13 month pay is not taxable up to the extent of 30,000….

Hello, just want to ask if SSS Medicare is deductible to get the taxable income..

cause here in our company they do not take it as a deduction, only the SSS and Pag-ibig are deductible. Thank You.