How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s employees. You will not have an idea on the computation of the tax withheld on compensation for each of those employees. In this article, we will tackle how a withholding tax is computed for each of them. So let’s proceed.

Requirement of Withholding

According to Section 79 of the National Internal Revenue Code (Republic Act No. 8424), as further amended by RA 9504, “except in the case of a minimum wage earner as defined in Sec. 22(HH) of this code, every employer making payment of wages shall deduct and withhold upon such wages a tax determined in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner.” This means that employees and workers who earn minimum wages are not subject to withholding tax. The summary of the current regional minimum wage rates can be viewed at the Department of Labor and Employment (DOLE) official website.

Methods of computing tax withheld on compensation

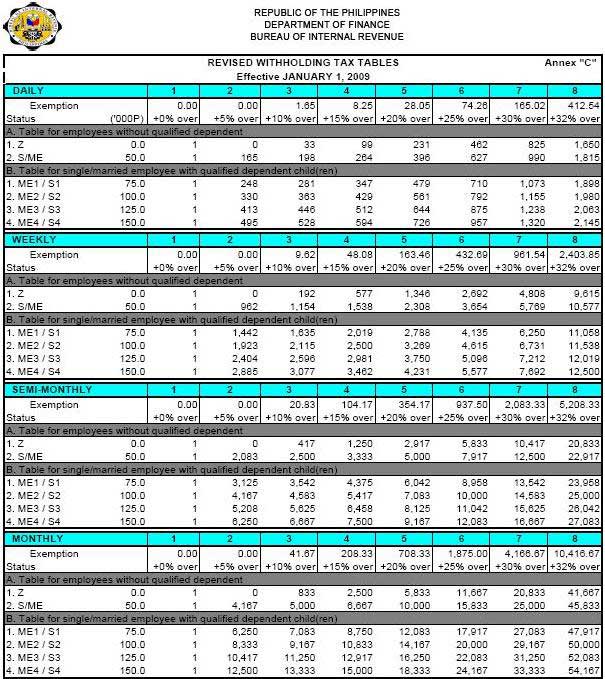

1. Use of withholding tax table. In general, every employer making payment of compensation shall deduct and withhold from such compensation a tax determined in accordance with the prescribed Revised Withholding Tax Tables (Annex C) which shall be used starting January 1, 2009. Below are the four withholding tax tables prescribed in these regulations:

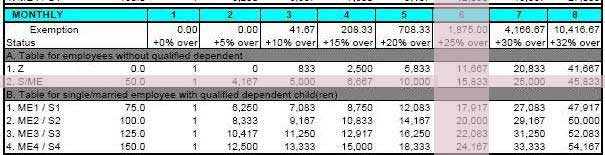

a. Monthly tax table – to be used by employers using the monthly payroll period;

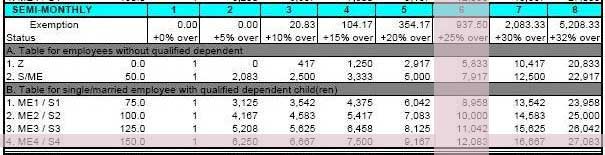

b. Semi-monthly tax table – to be used by employers using the semi-monthly payroll period;

c. Weekly tax table – to be used by employers using the weekly payroll period;

d. Daily tax table – to be used by employers using the daily payroll period.

Legend:

Z-Zero exemption

S-Single

ME-Married Employee

1;2;3;4- Number of qualified dependent children

S/ME = P50,000 Each Working employee

Qualified Dependent Child = P25,000 each but not exceeding four (4) children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEES WITH NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is unemployed.

2. Married Employee (Husband or Wife) whose spouse is non-resident citizen receiving income from foreign sources.

3. Married Employee (Husband or Wife) whose spouse is engaged in business.

4. Single with dependent father/mother/brother/sister/senior citizen.

5. Single

6. Zero Exemption for Employees with multiple employers for the 2nd,3rd…employers (main employer claims personal & additional exemption)

7. Zero Exemption for those who failed to file Application for Registration

USE TABLE B FOR THE FOLLOWING SINGLE/MARRIED EMPLOYEES WITH QUALIFIED DEPENDENT CHILDREN

1. Employed husband and husband claims exemptions of children

2. Employed wife whose husband is also employed or engaged in business; husband waived claim for dependent children in favor of the employed wife.

3. Single with qualified dependent children.

If the compensation is paid other than daily, weekly, semi-monthly or monthly, the tax to be withheld shall be computed as follows.

a. Annually – use the annualized computation (see no. 3 below).

b. Quarterly and semi-annually – divide the compensation by three (3) or six (6) respectively, to determine the average monthly compensation. Use the monthly withholding tax table to compute the tax, and the tax so computed shall be multiplied by three (3) or six (6) accordingly.

2. Cumulative average method. This method is used if (a) in respect of a particular employee, the regular compensation is exempt from withholding tax because the amount thereof is below the compensation level, but supplementary compensation is paid during the calendar year or the supplementary compensation is equal to or more than the regular compensation to be paid; or (b) the employee was newly hired and had a previous employer/s within the calendar year, other than the present employer doing this cumulative computation.

3. Annualized withholding tax method. This method is used (a) when the employer-employee relationship is terminated before the end of the calendar year; and (b) when computing for the year-end adjustment (the employer shall determine the amount to be withheld from the compensation on the last month of employment or in December of the current calendar year).

Steps in computing amount of tax to be withheld

Step1. Determine the total monetary and non-monetary compensation paid to an employee for the payroll period, segregating gross benefits which include 13th month pay, productivity incentives, Christmas bonus, other benefits, received by the employee per payroll period, and employees’ contribution (employees’ contribution only and not the employers’ contribution) to SSS, GSIS, HDMF, PHIC, and union dues. Gross benefits which are received by officials and employees of both public and private entities in the amount of P30,000 or less shall be exempted from income and withholding taxes.

You may read our article about How to compute 13th Month Pay in the Philippines.

Step2. Segregate the taxable from the non-taxable compensation income paid to the employee for the payroll period. The taxable income refers to all remuneration paid to an employee not otherwise exempted by law from income tax and consequently from withholding tax. The non-taxable income are those which are specifically exempted from income tax by the Code or by other special laws as listed in Sec.2.78.1(B) hereof (e.g. benefits not exceeding P30,000, non-taxable retirement benefits and separation pay).

You may read our article titled “How to Compute Separation Pay in the Philippines”.

Step3. Segregate the taxable compensation income as determined in Step 2 into regular taxable compensation income and supplementary compensation income. Regular compensation includes basic salary, fixed allowances for representation, transportation and other allowances paid to an employee per payroll period. Supplementary compensation includes payments to an employee in addition to the regular compensation such as commission, overtime pay, taxable retirement pay, taxable bonus and other taxable benefit, with or without regard to a payroll period.

You may read our article on “How to Compute Overtime Pay in the Philippines”.

Representation and Transportation Allowance (RATA) granted to public officers and employees under the General Appropriations Act and the Personnel Economic Relief Allowance (PERA) which essentially constitute reimbursement for expenses incurred in the performance of government personnel’s official duties shall not be subject to income tax and consequently to withholding tax.

Step 4. Use the appropriate tables mentioned under Section 2.79 (B)(1) for the payroll period: monthly, semi-monthly, weekly or daily, as the case may be.

Step 5. Fix the compensation level as follows:

(a) Determine the line (horizontal) corresponding to the status and number of qualified dependent children using the appropriate symbol for the taxpayer’s status.

(b) Determine the column to be used by taking into account only the total amount of taxable regular compensation income. The compensation level is the amount indicated in the line and column to which the regular compensation income is equal to or in excess, but not to exceed the amount in the next column of the same line.

Step 6. Compute the withholding tax due by adding the tax predetermined in the compensation level indicated at the top of the column, to the tax on the excess of the total regular and supplementary compensation over the compensation level, which is computed by multiplying the excess by the rate also indicated at the top of the same column/compensation level.

Sample Computations Using the Withholding Tax Tables

The following are sample computations of Withholding tax on compensation using the withholding tax tables:

Example 1: Single with no dependent receiving monthly compensation

Juan Santos, single with no dependent, receives P18,000 (net of SSS/GSIS,PHIC,HDMF employee share only) as monthly regular compensation and P 7,000 as supplementary compensation for January 2011 or a total of P25,000. How much is the withholding tax for January 2011 for Juan?

Computation:

By using the monthly withholding tax table, the withholding tax for January 2011 is computed by referring to Table A line 2 S (single) of column 6 (fix compensation level taking into account only the regular compensation income of P18,000 which shows a tax of P1,875 on P15,833 plus 25% of the excess of P 2,167 (P18,000-15,833) plus P7,000 supplementary compensation.

Regular compensation: P 18,000

Less: compensation level

(line A-2 column 6) 15,833

Excess P 2,167

Add: Supplementary compensation 7,000

Total P 9,167

Tax on P15,833 P 1,875.00

Tax on excess (P9,167 x 25%) 2,291.75

Withholding tax for January 2011 P 4,166.75

Example 2: Married with qualified dependent children receiving semi-monthly compensation

Jose Cruz, married with three (4) qualified dependent children receives P14,000 (net of SSS/GSIS,PHIC,HDMF employee share only) as regular semi-monthly compensation. His wife is also employed but he did not waive his right in favor of the wife to claim for the additional exemptions.

Computation: Using the semi-monthly withholding tax tables, the withholding tax due is computed by referring to Table B line 4 ME4 of column 6 which shows a tax of P937.5 on P12,083 plus 25% of the excess (P 14,000 – 12,083 = P1,917).

Total taxable compensation P 14,000

Less: compensation level

(line B-4 Column 6) 12,083

Excess P 1,917

Tax on P12,083 P 937.50

Tax on excess (P1,917 x 25%) 479.25

Semi-monthly withholding tax P1,416.75

For more samples of computations, such as computations using the cumulative average method, and annualized withholding tax method for computing year-end adjustments and when the employer-employee relationship is terminated before the end of the calendar year, please read the BIR issued Revenue Regulations No. 10-2008, which you can download the full text at the following links:

Revenue Regulations No. 10-2008 PDF file from BIR Website or

Revenue Regulations No. 10-2008 PDF file from our website, in case the BIR link won’t work

You can also view/download the following:

Revised Withholding Tax tables

BIR form 1601-C -Monthly Remittance Return of Income Taxes Withheld on Compensation

BIR Form 1604C -Annual Information Return of Income Tax Withheld on Compensation and Final Withholding Taxes

Summary of current regional daily minimum wag rates (Department of Labor and Employment)

Disclaimer:

New and subsequent BIR rulings, issuances and or laws may render the whole or part of the article obsolete or inaccurate. For more information, please inquire or consult with the BIR.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

you can use this link for the computation of your tax – birtaxcalculator.com/calculators/bir_withholding_tax_computation_2009

Hello Sir. My current status is M2 because my husband had waived his right in favor of me to claim for the additional exemptions. How much tax will be deducted if my salary is P14,500? Thank you.

Dear Sir,

I am learning Philippines payroll system and while doing so, I encountered some difficulties which I would appreciate if you could help me out.

If a company practise bi-monthly payrolls which are 01-15 pay period and 16-31 pay period; they are using fixed 313 as total working days in a year for salary related calculation, while fixed 287 total working days for Overtime elements calculation. For example:

– An employee’s work days: Mon – Sat, Sun is rest day.

– Employee’s annual salary is P144,000.

– For July 2011 payroll, the first pay period 01-15/07 has 13 days and the second pay period 6-31/07 also has 13 days.

I have used the following to calculate and as the result of it, employee will not receive his/her supposed monthly salary P12,000:

– First pay period: 144,000/313*13 = P5,980,83067

– Second pay period: 144,000/313*13 = P5,980,83067

–> Total pay of July/2011 = P5,980,83067 + P5,980,83067 = P11,961.66

The situation becomes worst with August 2011 payroll since the second pay period has 14 days.

Could you please provide me with your professional advice what have went wrong with the above calculation.

Thank you for your help in advance and I am looking forward to your soonest advice.

Best regards,

Robin Thao Nguyen

Hi, perhaps this article can give you some help. http://businesstips.ph/how-to-compute-overtime-pay-in-the-philippines/

A quick tip is to determine and established if a certain employee is paid per day, per hour, or per fixed monthly salary.

If an employee is paid per day or hour, then he may only be paid for the day or hour he works.

If he is paid per fixed monthly salary – he may be paid for his fixed monthly or semi-monthly salary regardless of the number of days there are in a salary period.

The employee-employer employment contract shall determine for that.

The fundamental rule is that the employee should not be underpaid.

I recommend that you inquire with the Department of Labor and Employment Office for more information and confirmation.

Thanks.

Hi Vic,

Thank you for spending Friday’s time to reply me with the advice, I do appreciated.

I have well noted on your tip and recommendation, will do the same.

Once again, thank you for looking into my query and have and wonderful week ahead.

Hope receiving your kind support again if I have any further concerns.

Thank you.

Best regards,

Robin Thao Nguyen

Sir good day. I just want to clarify some points regarding the withholding tax on compensation. Here are the scenarios (1)An employee who joins the company on June 1, 2011. Single without dependent. Earning 14K a month . Assuming that the amount is net of allowable deductions (SSS, HDMF, PHIC) The company is withholding 1,508.33 a month(based on the tax table). At the end of the year, the company withholds 10,558.31 (1,508.33 X 7). Is the withholding tax equal to the annual tax due to be paid by the employee?

(2) An employee joins the Company on January 1, 2011. Single without dependent. Earning 14K from January 2011 to June 2011. and earns 20K from July 2011 to December 2011. Assuming that the amount is net of allowable dedections (SSS,HDMF,PHIC). The company withholds a total of 26,550.48 for the whole year (using the tax table). Is the withholding tax equal to the annula tax due to be paid by the employee?

Thanks

Hi Sir, can you compute my tax pls? my basic salary is 12000 – 200 sss, 100 pagibig, 100 philhealth.. I hope you can help me out. Thanks

Hi Peachy. You can visit my blog. I’d posted there “Paano nga ba tuusin ang Tax sa sahod natin” I attached payroll calculator excel file there. Hope it can help you.

Hi!

I just want to ask if what will be the entry for remmiting of the withholding taxes on BIR?

Hi Red,

Please try this:

Dr: Withholding tax on compensation payable

Cr: Cash

Thanks.

Hello sir pls help me compute my annual withholding tax…Im married with 3 dependent children. My monthly income (for 10months only) is Php 15,247.57 after deducting my GSIS, Pag Ibig, Philhealth..

Thank you and more power.

Gladys

Hi Gladys, Your employer will do it comes year-end, annualization.

Hi sir. My friend was offered to work as a contractual employee. And being a contractual, she has no 13th month and no benefits. Please compute her tax if she will be getting 100k per month in 1 year.

good day sir. just a question, how would i compute my tax if i am both an employee and business owner?

i am a min wage earner right now and planning to put up a business. how should i file that? thanks.

Hi, you should compute your tax as a mixed earner (mix income from business and from compensation). You can check this article http://businesstips.ph/how-to-compute-income-tax-in-the-philippines-single-proprietorship/

thank you sir for the link. did i read correctly that i just need to file the quarterly income tax return for the business? then at the end of the year, i need to file the annual income tax return attached with my 2316, 2304 (if applicable) and 2307(if applicable)?

Hi,

I hope you can assist me with my concern about the taxable 13th month pay.

I understand this “According to the Bureau of Internal Revenue (BIR), Thirteenth month pay and other benefits amounting to P 30,000 and below are not subject to income tax. This means, if you receive P 50,000, the P20,000 excess is already taxable.”

What I needed to know are how much is the deduction and how it is calculated?

Please show me a sample calculation for these ff/ing sallaries, P35,000 P40,000 and P80,000.

Thanks

hi there..

is thic correct..

salary =11,000

deduction

sss 333.30

philhealth 125.00

pagibig 200.00

Withholding tax = 920.91??

my salary is 5,500 per half month..

i work in pasig city. technical support.. nature of business is system provider..

Hi,

I would like to seek some help here. I’m monthly earner and my company said they used monthly annualized tax so that in year end no adjustment to be made payable/refund to employee. My question, what is the formula for monthly annualized? and what tax table to be use for this is it monthly tax or annual tax table?

Thank You and More Power

hi,

I’m a self employed architect. kakaregister ko lang sa bir nun sept.2 got paid on my first ever project around sept.5, 2011. since my client is a company they charged me with 10% withholding tax. my professional fee is 20k a month up to the turnover of the project. yun withholding tax nila na ni-less sakin is amounting to 2,222.22 nun september. i got the form 2307 from them na. nabayaran ko na rin last month yun percentage tax na 3%. ask ko lang paano po compute yun quarterly? deadline is nov.15 ata. thanks. hope u can help me.

Hi. You can check this article we published here to guide you in computing your quarterly income tax. businesstips.ph/how-to-compute-quarterly-income-tax-return-philippines/

Hi Guys, still no one answer me about my previous question regarding Foreign employee.

Can any one also define non-resident alien from none resident alien.

Regards,

P.S. you will find my question under the name Quincy here. CTRL+F.

Hi Ghar,

Can you help me with docs stamp regarding related party advances? Are there really docs stamp tax on those?

Thanks,

Billy

I honestly can’t understand the chart. I don’t know how to read it. 🙁

But I work in a BPO and they say that our tax should be 20 percent (for single employees). I get 20k a month. Every cut-off, which is every second Friday, we were being deducted tax every cut-off. Even our incentives are taxable. 🙁 Is it really 20 percent? When we ask them, they would always answer: “We are 3rd party…”. I don’t get it, really. 🙁

hi good evening.. i started working march of 2011 and my gross income to date is 149,700 / net income to date 127,669. how i will compute for my tax refund? thank you

Hi Sir/Ma’am,

Early month of 2010 to July 2011, I am a Minimum Wage earner for my Regular Pay, but I am receiving daily 120 Pesos Temporary Allowance + 20 Pesos Transportation allowance. With that my Gross (Regular + Allowances) is subject for Tax. I just don’t understand why my Whole Salary is taxable to think, my Night Differential, Overtime (if any), Holiday Pay and 13th month Pay is only base from my Regular Salary. It is right to BIR to Tax me?

Thanks in advance and your expertise are highly appreciated,

~jaeson

Hi! please help me with my tax computation. I am a call center agent with basic pay of

P18,000.00/month (Married with NO dependent)

Less:

Pag-ibig premium- P100.00

Philhealth premium- P225.00

SSS premium- P500.00

Withholding tax: P1,975.01/cut-off

I was hired just July 25 this year and here is the withholding forecast they gave me:

Tax Exempt Code: P50,000.00

MBS: P18,000.00

Gross Taxable Income as of 10.31.2011 P61,718.62

Add: Gross Tax Income- Nov. 1-15 payroll P 8,484.75

MBS Nov. 16- Dec. 2011 P27,000.00

Net Tax Income- Prev ER P79,174.88

Less:

SSS/PHIC/HDMF Jan- Oct 2011 (P2,475.00)

SSS/PHIC/HDMF Nov- Dec 2011 (P1,650.00)

Tax EXEMPT (P50,000.00)

NET TAXABLE INCOME: P122,253.25

Total Tax Due: P18,950.65

Tax withheld as of 10.31.2011 (P8,635.81)

Tax withheld-Prev employer (P2,417.79)

Tax stil due/ (REFUND) P7,900.05

Tax to be deducted (Nov 15- Dec 31) P1,975.01

Regular tax for the period P1,079.44

Actual Tax deducted P1,975.01

Tama po ba itong computation nila? parang lumalabas ako pa may utang daw kse from Nov.15/Nov.30/Dec.15 and Dec.30 pay-out kakaltasin nila ung P1,975.01 tax skin.

Please help!

Thanks….