Manual filing remains the traditional and most widespread method of submitting various tax returns for government revenue services in the Philippines. However, the tax environment is changing rapidly vis-à-vis the advancement of information and communication technology (ICT). As web technology is becoming more and more popular, the introduction of the internet filing has brought fundamental changes to the method of filing tax returns. In response, the BIR has introduced two (2) methods of electronic filing (e-filing) of tax returns: (1) Electronic Filing and Payment System (eFPS); and (2) Electronic BIR Forms (eBIRForms).

Methods of Online Filing

1. Electronic Filing and Payment System (eFPS)

Electronic Filing and Payment System is the electronic processing and transmission of tax return information including attachments, and taxes due thereon to the government made over the internet through the BIR website and was implemented under Revenue Regulations No. 9-2001.

Taxpayers intending to use the BIR eFPS facility are required to enroll through the BIR e-Lounge or may directly access BIR website for enrollment and required to maintain an online banking facility integrated with the eFPS.

How to File Tax Returns using Electronic Filing and Payment System (eFPS):

Upon successful enrollment with both eFPS and online banking with any of the Authorized Agent Banks (AABs), the taxpayer may simply access the BIR eFPS website, fill out the tax returns field with the required details, validate and submit it.

A Filing Reference Number (FRN) page is generated and displayed after a successful online filing and submission of the tax return. The system will likewise store e-filed tax returns for future reference.

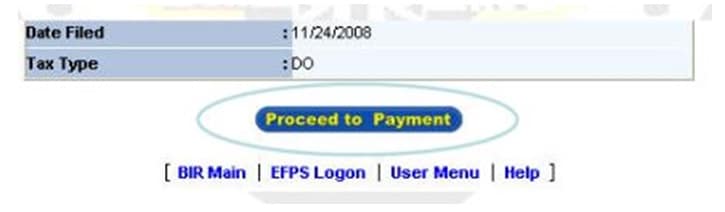

If the taxpayer has a tax due to be paid, click the Proceed to Payment button at the bottom of the FRN page.

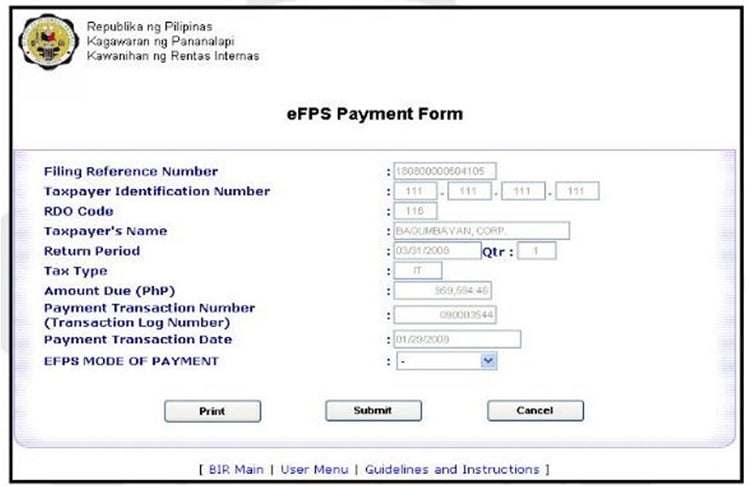

The eFPS Payment Form will be displayed with default payment information displayed and retrieved from the e-Filing service. Choose eFPS mode of payment and the authorized agent bank.

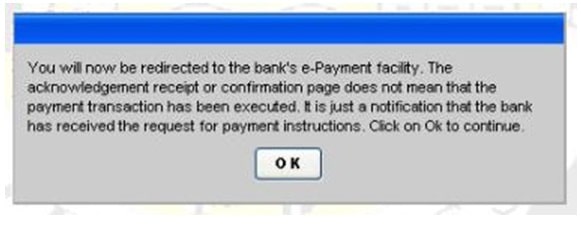

Click submit. The taxpayer’s payment instruction is submitted to the bank by redirecting the control over the participating bank’s URL.

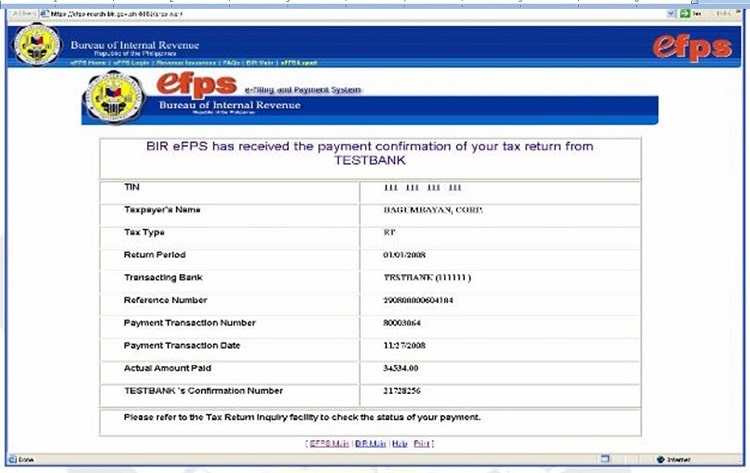

Upon successful payment, a confirmation screen stating that the BIR eFPS has received the payment transaction will appear, as proof of successful tax payment.

2. Electronic BIR Forms (eBIRForms)

The Electronic BIR Forms (eBIRForms) was developed primarily to provide non-eFPS taxpayers and their accredited tax agents (ATAs) with an accessible and more convenient service through easy preparation and filing of tax returns and is mandated under Revenue Regulations No. 6-2014. It consists of the following:

a. Offline Package – a tax-preparation software that allows the taxpayers and their ATAs to prepare tax returns offline with automatic computations and validation features to lessen human error.

Taxpayers with internet can download the eBIRForm Package from the BIR website (https://ebirforms.bir.gov.ph). Those without internet may copy the eBIRForms Package from the BIR RDO e-lounges through USB flash drives.

b. Online Package – a filing infrastructure that accepts, validates, processes and stores tax returns submitted online. The system creates secure user accounts for taxpayers, ATAs and Tax Software Providers (TSPs) for use of the Online System. It also allows ATAs to file on behalf of their clients. The system also has a facility for TSPs to test and certify the outputs of their tax preparation software. It is likewise capable of accepting returns data filed using system-certified TSP tax preparation software.

Taxpayers who are required to use this need to enroll by accessing the eBIRForms website. After successful enrollment and account activation, taxpayers or tax filers can already e-file their tax returns.

How to File Tax Returns using Electronic BIR Forms (eBIRForms):

- Download the latest Offline eBIRForms Package;

- After downloading the Package, exit the BIR website to avoid site traffic congestion;

- Returns can be prepared offline after installation;

- Select the form and FILL-UP by encoding data in the return;

- VALIDATE after completely encoding all the necessary information;

- A copy of the tax return can be saved by clicking the button FINAL COPY;

- Go online and click SUBMIT to electronically submit the tax return through the use of Online eBIRForms System. Taxpayer will be asked to provide a username and password.

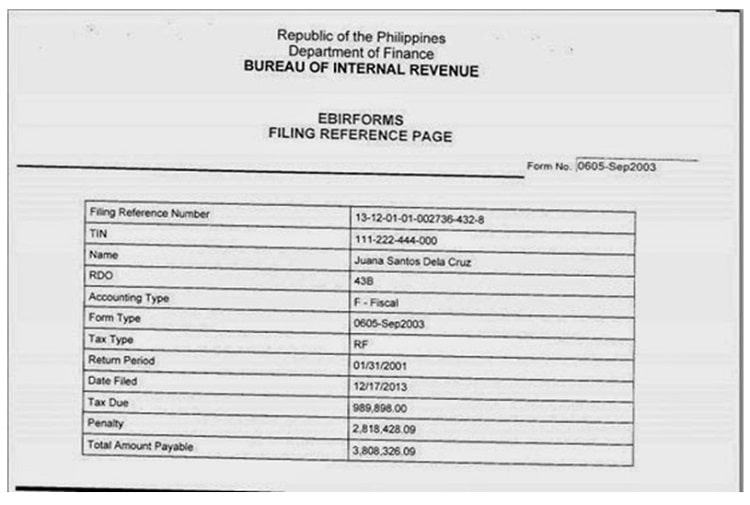

- A Filing Reference Number (FRN) will be generated in all returns as acknowledgment of its receipt along with the continue button to go to the FRN page. The page likewise displays a message “The form has been successfully filed”.

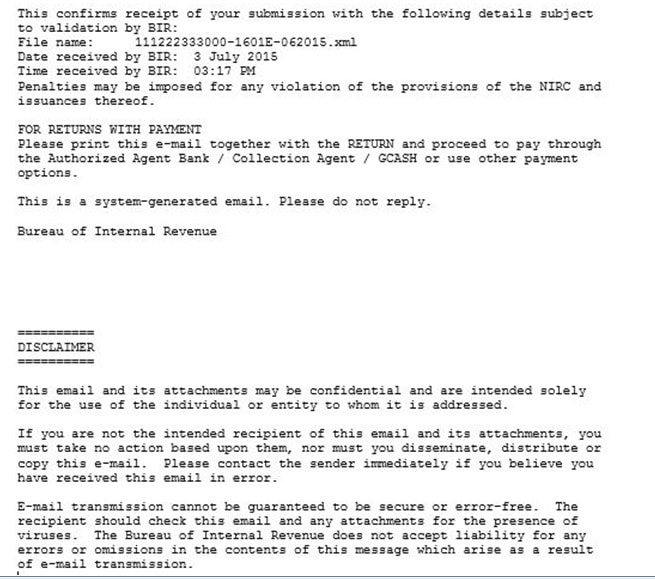

9. In case of unsuccessful submission, click FINAL COPY button to use the alternative mode of electronic submission of returns. An email confirmation will be received by the taxpayer.

Note: For those who are not yet enrolled to the eBIRForms System, it is required to fully and unconditionally agree to the Terms of Service Agreement (TOSA).

For tax returns with payment, print the tax return together with the FRN or e-mail notification and proceed to manually pay through the authorized agent bank or Collection Agent.

If no email notification is received, what shall I do?

To be able to receive the EMAIL NOTIFICATION from the BIR on the submitted tax return, make sure that all of the following are complied with:

- The email address indicated/encoded in the return is VALID and ACTIVE.

- The mailbox has enough space/not “quota exceeded”.

- BIR email is not in the SPAM folder.

- BIR website “bir.gov.ph” is NOT BLOCKED by your email provider.

Non-compliance in any of the above requires re-encoding and re-submission of the return.

If all of the above were undertaken and still NO EMAIL is received after two (2) hours from efiling, then MANUALLY e-mail the generated xml file following the steps in Annex D of RMC 14-2015.

If, after MANUALLY emailing following the steps in Annex D of RMC 14-2015, no email is received after two (2) hours, then call the BIR for assistance, the help desk number to call are also contained in Annex D of RMC 14-2015.

Benefits of Online Filing

1. Electronic Filing and Payment System (eFPS)

- Convenient and easy to use. It is quick and simple to use as well as secure.

- Interactive. Information exchange is immediate and online users get immediate feedback from the system when enrolling, e-filing or performing e-payments.

- Self-validating. Errors are minimized because all of the information supplied by the taxpayer is validated before final submission.

- Fast. Response or acknowledgment time is quicker than manual filing.

- Readily available. eFPS is available 24 hours a day, 7-days a week including holidays.

- Secure. Return and payment transactions are more secure, as all data transmission is encrypted.

- Cost-effective. Processing cost of returns and payments is minimized (e.g. receiving, pre-processing, encoding, error-handling and storage).

- All e-filed tax returns with corresponding FRN shall be deemed duly stamped received by the BIR except for Annual Income Tax returns (RR 3-2005).

- Staggered filing of tax returns based on industry classification (RR 26-2002).

- The system will store e-filed tax returns for future references.

2. Electronic BIR Forms (eBIRForms)

- Saves time because of automatic computations and auto-populated fields;

- Easy to use;

- Lessens human errors because of the validation feature;

- Available even to those without consistent internet connection;

- Captures taxpayer data; and

- Lessens manual encoding.

Who are mandated to use Online Filing?

1. Electronic Filing and Payment System (eFPS)

The eFPS was initially intended for large taxpayers with respect to some tax returns in the past but was later further developed. It is almost available to all taxpayers at their option. However, certain taxpayers are mandated to file their tax returns via EFPS as follows:

a. Taxpayer Account Management Program (TAMP) Taxpayers (RR 10-2014);

b. Accredited Importer and Prospective Importer required to secure the BIR-ICC and BIR-BCC (RR 10-2014);

c. National Government Agencies (NGAs) (RR 1-2013);

d. All licensed local contractors (RR 10-2012);

e. Enterprise enjoying fiscal incentives (PEZA, BOI, Various Zone Authorities, etc.) (RR 1-2010);

f. Top 5,000 Individual Taxpayers (RR 6-2009);

g. Corporations with paid-up capital stock of P10 Million and above (RR 10-2007);

h. Corporations with complete Computerized Accounting System (CAS) (RR 10-2007);

i. Procuring Government Agencies with respect to withholding of VAT and Percentage Taxes (RR 3-2005);

j. Government bidders (RR 3-2005);

k. Insurance companies and Stock brokers (RMC 71-2004)

l. Large taxpayers (RR 2-2002, as amended); and

m. Top 20,000 Private Corporations (RR2-98, as amended).

2. Electronic BIR Forms (eBIRForms)

RR 6-2014 mandates the use of eBIRForms to the following taxpayers:

a. Accredited Tax Agents / Practitioners and all its client-taxpayers who authorized them to file on their behalf;

b. Accredited Printers of Principal and Supplementary Receipts / Invoices;

c. One-Time Transaction (ONETT) taxpayers;

d. Those engaged in business, or those with mix income (both compensation and business income) who shall file a “NO PAYMENT” return (exception under RMC 12-2015);

e. Government-Owned and Controlled Corporations (GOCCs);

f. Local Government Units (LGUs), except barangays; and

g. Cooperatives, registered with National Electrification Administration (NEA) and Local Water Utilities Administrations (LWUA).

Are all taxpayers required to electronically file tax returns?

Not all taxpayers are required to file electronically. Only taxpayers enumerated above are required. However, nothing prevents them from using the eBIRForms / eFPS facility of the BIR as volunteering taxpayer. The existing procedures on manual filing shall still apply.

Is using eBIRForms mandatory to all taxpayers?

NO. Only those taxpayers enumerated in RR 6-2014 are mandated to use and enroll in the eBIRForms System. Individual and non-individual taxpayers who do not fall under those categories may still file manually using the printed BIR Forms or file using the generated form from the Offline eBIRFoms either manually or electronically by online submission or e-Filing.

Who are exempted from electronic filing?

Under Section 4(3) of RR 6-2014 and RR 5-2015, NO PAYMENT returns shall be electronically filed using the eBIRForms, however, the following taxpayers are exempted and may instead manually file their NO PAYMENT returns:

a. Senior Citizen (SC) or Persons with Disabilities (PWDs) filing for their own return;

b. Employees deriving purely compensation income whether from one or more employers, whether or not they have any tax due that needs to be paid; and

c. Employees qualified for substituted filing under RR 2-98 Sec. 2.83.4, as amended, but opted to file for Income Tax Return (ITR) and are filing for the purposes of promotion (PNP/AFP), loans, scholarship, foreign travel requirements, etc.

Do I still need to submit the e-Filed tax return to the RDO?

- For e-filed tax returns with corresponding FRN using the eFPS facility, there’s no need to submit the printed form of the tax returns to the RDO/LTDO/LT Office as it is already deemed received by the BIR (RR 3-2005), except for Annual Income Tax Returns as you will need to submit the Audited Financial Statements together with the required attachments.

- For e-filed tax returns using the eBIRForms without any attachments required, no need to submit to the RDO.

However, if there are any attachments required, submit the printed form of tax returns, together with the attachments, to the RDO/LTDO/LT Office within fifteen (15) days from the date of e-Filing.

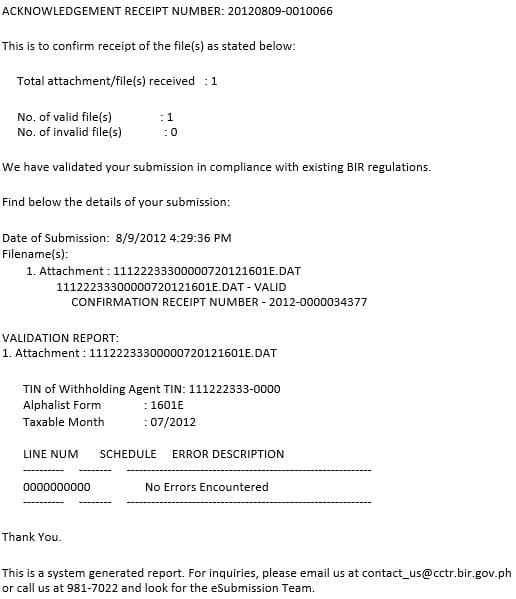

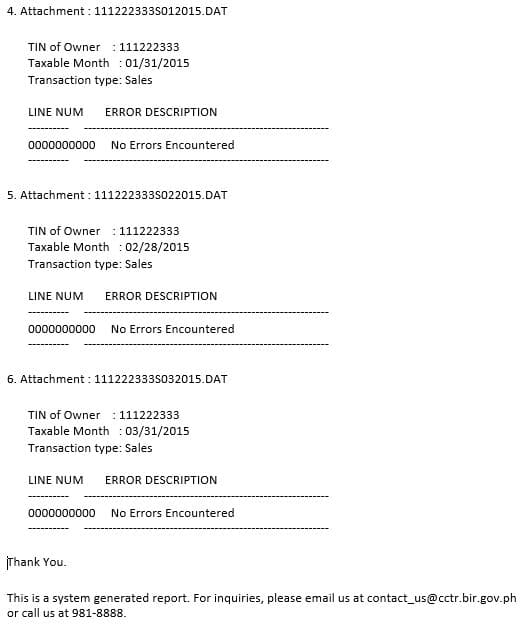

For the required attachments to be submitted such as Summary Alphalist of Withholding Tax (SAWT), Monthly Alphalist of Payees (MAP) required under BIR Form Nos. 1600, 1601-E, 1601-f, 2550-M/2550-Q and 1701-Q/1702-Q, it shall be prepared using the Data Entry Module. In the case of the Summary List of Sales/ Purchases/ Importation for all VAT taxpayers, the same is prepared using the BIR RELIEF module. All attachments are submitted to the BIR via email to: esubmission@bir.gov.ph. Validation report of the attachments generated by the BIR system shall also be included.

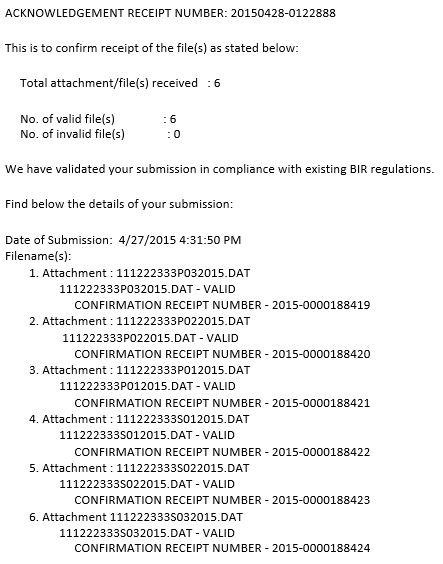

Sample validation report of Monthly Alphalist of Payees (MAP):

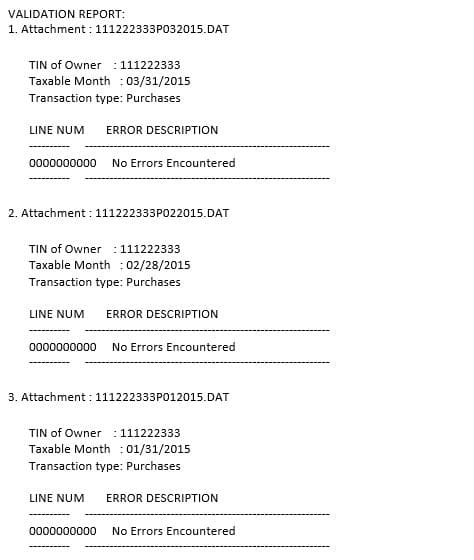

Sample validation of Summary Lists of Sales and Purchases (SLSP):

What BIR Forms are covered by the regulation?

The eBIRForms is an application covering thirty-six (36) BIR Forms comprised of:

- Income Tax Returns;

- Excise Tax forms;

- Value Added Tax forms;

- Withholding Tax forms;

- Documentary Stamp Tax forms;

- Percentage Tax forms;

- ONETT forms; and

- Payment forms.

For the complete list of the BIR Forms, please see this BIR webpage.

What are the penalties for failure to file returns under electronic systems of the BIR by taxpayers mandatorily covered by eFPS or eBIRForms?

All taxpayers, under the existing issuances, who are mandatorily covered to file their returns using eFPS or eBIRForms, who fail to do so, shall be imposed a penalty of P1,000 per return pursuant to Sec. 250 of the NIRC, as amended.

In addition, the taxpayer shall also be imposed with civil penalties equivalent to 25% of the tax due to be paid, for filing a return not in accordance with existing regulations, thus, tantamount to WRONG VENUE filing pursuant to Section 248 (A)(2) of the NIRC, as amended.

Finally, RDOs are directed to include non-compliant taxpayers in their priority audit program.

Are those mandated to e-File but filed manually be penalized?

Yes, under RR 5-2015. If there will be an extension or waiver of penalties, the same shall be circularized in a revenue issuance.

In relation to RMC 43-2008, when there are technical problems encountered in the eFPS environment during deadlines for tax filing, the authority for manual filing of all tax returns of eFPS enrolled taxpayers is given once the Information System Group (ISG) of the BIR announced thru an official memorandum and posted in the BIR web and BIR e-mail the unavailability or limited capability of the system on the deadline date or the date before the deadline. However, taxpayers are still required to lodge/file via eFPS said declarations/returns, up to the step of getting the Filing Reference Number (FRN), fifteen (15) days from the date of manual filing to ensure submission of complete and accurate return data for uploading to the BIR Intergrated Tax System (ITS).

Can the offline eBIRForms be used even when the taxpayer is enrolled in the eFPS?

Yes, all taxpayers enrolled in either eFPS or eBIRForms or those who will file manually, are encouraged to use Offline eBIRForms for ease and convenience, and to provide them ample time to encode/edit and complete their returns.

Disclaimer: This article/guide is for general information use only and doesn’t constitute professional advice. Moreover, new and subsequent laws and tax rules may render whole or part of this article obsolete. If you see any errors, please contact us to correct them.

Ethel Jayne Perez is a CPA in public practice, a tax consultant and a former CPA Review Instructor. She is an alumna of the University of the Philippines Visayas Tacloban College.

Informative. Kudos to you for taking your time in consolidating and posting this..

Thank you for appreciating my effort. 🙂

Thank you for your informative article.

I have two questions left based on your article. hoping you can find time to reply.

1. I noticed you did not give an example of SAWT submission. My question is this, when making the data entry for sawt, do we have to consolidate it for 3months as in the manual format?

2. As efps filer, do emailing of SLSP to esubmission(@)bir.gov.ph apply?OR, we can attach it in our efps filing of quarterly vat?

Thanks a lot!

Hi Arsenia,

Regarding your first question, there’s no need to consolidate as SAWT is encoded on a monthly basis just like the SLSP. dat file generated form the Alphalist Module is then submitted via BIR’s eSubmission facility. Accordingly, validation report of SAWT would look like that of SLSP.

On the other hand, submission of SLSP for those taxpayers enrolled under EFPS, as mentioned in RR 16-2005 Sec 4.114-3 (B), shall be done through the electronic filing facility on or before the 30th day of the month following the close of the taxable quarter. Hence, it shall be done via esubmission@bir.gov.ph, a sample validation report of which is cited above.

Moreover, I would like to emphasize that SLSP is not a required attachment in the VAT return or 2550-Q, thus, should not be included in the attachment facility of tax returns.

hi about SAWT, when do we need to esub the SAWT? monthly ba? if not kelan?

eSubmission of SAWT is done upon filing of your tax returns. Example, SAWT for VAT is done at the same time when you file the corresponding VAT return, hence, monthly. While SAWT for quarterly ITR is submitted quarterly.

Thanks for the very detailed information. It’s been very helpful. I just have an additional question regarding the SLSP attachment for 2550Q. Should there still be a need to submit to our RDO the SLSP in CD format as we’ve done before? Or will the online submission to (submissions@bir.gov.ph) suffice?

Thanks for your help in advance!

Hello Kat,

There is no need to submit the SLSP in disk format if the same has already been submitted online through the eSubmission facility. The validation report emailed to you will be an attachment to the printed SLSP together with the SLSP transmittal to be submitted to the respective RDO. It will serve as your proof that the report needed was acknowledge and is in the prescribed electronic format. It shall likewise be considered as “duly filed SLSP”.

Hi Ms Ethel,

Just to clarify, if there are no transactions on the SLSP, is it still mandatory to file a “no transaction” on the RDO or will they just base it on the returns filed?

Thanks,

April

File a NO TRANSACTION report, otherwise, you will be subjected to penalties for non-filing.

How to file a No transaction report?

good pm ms ethel

i just wanna ask how to submit slsp online in efps?

tnx and regards

alona

“In the case of the Summary List of Sales/ Purchases/ Importation for all VAT taxpayers, the same is prepared using the BIR RELIEF module. All attachments are submitted to the BIR via email to: esubmission@bir.gov.ph. Validation report of the attachments generated by the BIR system shall also be included.”

With regards to SLSP online submission, what will be my subject before sending to esubmission email?

Hi Diane,

Subject would start with ALPHALIST ATTACHMENT(S), you may add other information like “ALPHALIST ATTACHMENT(S) for 2550-M Jan 2017”, for monitoring purposes.

Thank you for this article! I do have one question though.

I will be filing a “no payment” 2551M in December. I am using the offline eBIR forms program.

Do I still need to print and go to the RDO or is the current feature of being able to submit online using the offline eBIR Forms program sufficient?

Again, many thanks for writers such as yourself who help individuals such as myself! I appreciate the effort!

I had the same issue with my filing of 1701, I brought a hard copy to the RDO, but they said there is no need to do it since it will be reflected in their system.

So I think what you need to make sure is you have a copy of the confirmation email. This will serve as an evidence if in case there is any issue.

You may also want to call your RDO to ask about this to save you time and effort in going there.

Hope this helps. 🙂

Very Informative. I Hope you’ll continue this type of works.

Thanks a lot.

Hi Ron John,

Thank you for taking time to read my article and for the positive review.

Thank you for all the writers that made an effort to share us their knowledge, informations regarding business taxes. Super very informative. Now I have some questions below I hope you can help me. Thank you once again.

1) I’m going to file an ITR w/ “NO OPERATION”, to be submitted online, do I have to print a hard copy for this? If I’m going to print, do I have to print all the 12 pages even it’s a “NO OPERATION”?

2) A business with a branch, who will file the ITR? Is it the main office or both will file the ITR? I was confused on this because the branch has a different type of business with the main office.

Hi Carmelita,

I apologize if it took a long time to reply to your query.

It is mandatory for Annual ITRs to submit a hard copy including ALL pages of the ITR and all attachments in 3 copies to AABs, for those with payments, or to the respective RDO, for no payment or no operations. Please attach an affidavit of No Operations when filing.

For a business with different line of registered activities, Only ONE ITR is filed, information, including income and expenses is consolidated with the main office.

Hello, I would like to ask the following:

1. For 1701Q under eFPS do I still attach the 2307 or submit to RDO? If yes, when is it due? Is there a penalty for not submitting or submitting after due date?

2. For eFPS payment, if I file before or on the due date, how many days am I allowed to make the payment in epay?

Thank you.

Hi Marie,

For eFPS Filers, submission of SAWT must be done on or before the specified deadline of the tax return, via email to esubmission@bir.gov.ph.

Please refer to RR 26-2002 for the Staggered Filing of Returns of Taxpayers enrolled in the eFPS facility for the deadline of filing and payment of tax returns is based on the Industry Classification.

Hi Ms. Ethel,

Hope all is well. Thank you for this helpful post. Just to want ask question on entering a data in SLSP, we have an invoice under VARIOUS ACCOUNTS how can we enter this or are we allowed to use this? We are selling prepaid cards and we don’t get the info of each customer. Someone told me that it’s ok not to enter this to SLSP. Is it right?

Thank you very much!

Hi Sharon,

In your Summary List of Sales, you may use “Casual or Various Customers” for your various accounts. You need to include it in your report so as not to incur penalties in the future.

I think Ms. Sharon is not required to submit in her Summary List of Sales those information of her “VARIOUS” customers. Under RR 16-2005, as amended, only regular buyers/customers and casual buyers/customers. My opinion is to file it blank, as RR 16-2005, as amended, is clear on the submission of SLSP whether or not with regular buyers/customers and casual buyers/customers and local and importation purchases.

Hi Ma’am, do I need to esub 2306 received from our customers?

Hello Elizabeth,

2306 needs to be esubmit, do it at the same time of filing your monthly VAT returns.

HOW TO SUBMIT MAP THRU E-SUBMISSION?

Make sure that you prepare the MAP using the BIR Data Entry Module. Generate DAT File, Validate it first to make sure that there are “No Errors” in the report. Then fill in the details needed as follows:

TIN:

REGISTERED NAME:

LASTNAME:

FIRST NAME:

MIDDLE NAME:

ADDRESS:

FILING REFERENCE NUMBER:

EMAIL1:

EMAIL2:

EMAIL3:

Lastly, email the attachment to esubmission@bir.gov.ph

where do you see the filing reference number? thanks!

Hello ma’am, I would like to ask with regards the filing of 2550Q. Whenever we file 2550Q, we attached the summary list of purchases and sales (for each month) in the online form. We then receive a validation for the files in the email from barcadm@bir.gov.ph. We’ve been doing this without e-mailing to esubmission@bir.gov.ph.

Are the emails sent by barcadm@bir.gov.ph not the same as the emails sent by esubmission@bir.gov.ph?

They both say the files are validated and are received by BIR.

I am asking this question because when we sent our printed copies of the files to the BIR office, they were asking for SLSP verification slips (which are supposed to be emails). We showed them the emails sent by barcadm@bir.gov.ph but won’t accept them. They asked for the emails that has the format in your blog: the image of Sample validation of Summary Lists of Sales and Purchases (SLSP).

Furthermore, since we weren’t able to send to esubmission@bir.gov.ph, are we still going to incur the penalty despite attaching the files to the eFPS?

Thank you in advance!

Since there is a specific procedure and guidelines for online submission of Summary List of Sales and Purchases, as discussed in RR 16-2005, I believe that fines and penalties will be incurred for failure to file and submit information returns. Penalty shall be based on RMO 7-2015 for the Schedule of Revised Compromise Penalty.

hi thanks for the info. is it okay if i just use the offline ebir form instead of the online? coz i cant find the enrollment link at the bir website. if for example i failed to file my 2551 m in a month shall i go directly to my rdo to pay the fines? pls reply thank u in advance.

Hi Ria,

Yes, you may eFile tax returns using the offline eBIRForms package. For failure to file and pay on-time of tax returns, please proceed to your RDO for the accurate computation of penalties.

Bakit po sa mc-03-2006 required na attachement ang sawt sa 2551m? ibig po ba sabihen nito every month na mag-file ako ng 2551m meron dapat sawt?

Hi Rolando,

SAWT is only required if you are filing tax returns with claimed Tax Credits. This happens when you have transactions or income which were subjected to Withholding Tax and is covered by BIR Form 2306 and/or 2307.

Ms. Ethel, Just want to clarify the following:

1. Do I still need to go to my RDO and submit docs after efiling my returns via eBIRForms? I have email notification of returns received by BIR online. I have returns with Payments and No Payments. I have also a return with attachment form 2307?

Hi Raquel,

If tax returns were e-Filed and e-Pay or manually paid through AABs (Authorized Agent Banks) or Collection Agents, printed form of the documents need not be submitted to the RDO, since payment to them are deemed received by the BIR.

In reference to RMC 19-2015, if there is no required attachment for electronically filed returns, such as the cases of No Payment Tax Returns, no need to submit. Just ensure that you keep a copy of the email notification or the Tax Return Receipt Confirmation.

However, if there are other attachments such as Monthly Alphalist of Payees (MAP) or Summary Alphalists of Withholding Tax (SAWT), you need to make sure that schedules are prepared using the Data Entry Module and submitted via email to esubmission@bir.gov.ph before submitting hard copy to your RDO.

Some RDOs would advise you not to submit hard copy to them as long as you have the Tax Return Receipt Confirmation for the tax returns, and Validation Report for the required attachments. Please verify this first with your RDO.

Further, the above-mentioned are only applicable to Monthly Tax Returns. For Annual Tax Returns such as 1700, 1701 and 1702, it is mandatory that you submit hardcopy of the Form together with the 2307 to your RDO and have it stamped received.

clarification about Annual Tax returns.

If we file and pay via online on April 15 (the annual deadline),

do we need to submit the hard copy and attachments on the same day, April 15, which is the deadline, ?

Or could we submit the hardcopy as mentioned “within fifteen (15) days from the date of eFiling.”

Does that mean we could submit the hard copy on or before April 30?

Here’s a great tip that’s helped me a lot: if you’re a freelancer or solopreneur, Taxumo.com as an easier way to file & pay for your taxes online. Hassle-free and easier than BIR’s platform! You can compute your tax dues and it even autofills BIR tax forms.

ano po ang mga posibilidad na pagkakamali para sa eTRA na pdi kang makasuhan?

Good AM.

Ma’am Ethel, I’ve been filing via eBIRforms for 1 year now. I don’t have idea with this SLSP. But every 2550M and 2550Q filing, I always input all my sales and receipts in the Schedule 1 (Sales/Receipts) and Schedule 2 (Purchases/Importation of Capital Goods) which are detailed in Date of purchase, Description, Amount(net of VAT) and Input Tax. Is this different to this SLSP or this will serve as the SLSP for every VAt filing? Please Advise. Thank you very much.,

Hi! I would just like to ask. I use ebirforms to fill up my 1701A. When they implemented the system some 2 – 3 years ago, i registered in our RDO so i can file online. I never received my password for the online access despite several follow ups. So i just used the ebirforms offline and email my 1701A. I then go to the RDO to have my documents stamped just to have proof. I inquired this year and i was told no need to have a hardcopy stamped. My question is, how do i attach the 2307 form to my 1701A when emailing it. If i don’t need to attach the 2307, how does BIR know what employer paid the tax, since it is no longer specified if the filler is under PROFESSIONAL category. BTW, since my total fees are just minimal, i have no payment due. Tax withheld is even refundable. Thanks so much

Hi Ms. Ethel, how to file 2307 to online? thankyou.

its my first time to file my 1701… they told to be to submit a scanned copy of my 2307 and email it. How am I going to do that? i dont know what swat is and data entry. i hope you can help me. thank you!

Hi,

Inquire lang po. No operation ang business and I kept on filing using EBIR forms. Kakakuha ko lang po ng Taxpayer’s Case Inquiry and it seems na lahat ng naifile ko ay nakalagay as open case sa kanila. Wala po akong payment pero bakit po nila nakalagay as outstanding?

Hi Mam Malou

Ginagamit po kasi namin ang eBIRforms. Ngayon po need daw po i-alphalist data entry yung mga BIR 2307 sa SAWT. Panu po kami magkakaroon ng esubmission? san pong email babato ito. Thank you

Hi,

My email address is way too long, thus one of the letters was noot captured, but I already click the “FINAL COPY” button for my return 1700 for the year 2016, with no payment (becaause 2316 from two employers were credited ). I have not received the tax return receipt confirmation and it was required by the RDO when I was about to submit it. What I do?

I have a couple questions with regards to filing of tax returns by self-employed professionals. I hope you can help me with my tax dilemma. I am a home-based and online ESL tutor. I am registered with BIR as a self-employed professional.

1. I am still required to file for the tax returns (2551M, 1701Q, and 1701) even if I have no income for a a certain month/quarter/year, right?

2. The ESL company deducts 10 percent from my salary every month as a creditable withholding tax. It correspondingly provides me BIR Form No. 2307 every month and every quarter. I have an overpayment in taxes last year. Usually, I will just choose the “carry over” option and apply the overpayment to the next quarter/year. But this year, I have returned to formal employment as a regular employee for a BPO company. I cannot anymore use the “carry over” option as I am expecting no future income from self-employment. Is it viable to opt for the “tax refund” or “tax credit certificate option”? How can I apply for one if it is viable? What are the mandatory requirements/attachments?

I use Taxumo.com for filing. Best way to file taxes online, really easy.

Hi Ethel,

Thank you for a very informative post.

My company is a BPO and our sales are only with overseas clients so all sales are zero-rated. Do I still need to file SLSP for VAT and ITR? If so, what ATC should I use?

Thanks much

Iris

Hi! meron na po kasi akong efps account pero hinahanapan po ako ng proof of efps usage since every time na magbabayad ako ay over the counter ng bank.

how can I use my BPI account to pay my taxes? do I need to register my account to efps?

Thank you so much

Hi. Any bank account should undergo with the BIR’s efps registration requirements to be used for efps filing.

Hi Mam!

Thanks for your post. This is really helpful! BTW, Do you have any tutorial on how to use the Relief Module? And confirm ko lang po whether Vatable po ba ang incentives from foreign companies to local farmers association? Thank you very much.

Hi. As of now we don’t have a comprehensive tutorial for the Relief Module. You may visit the website of the BIR to check some guidelines https://www.bir.gov.ph/index.php/downloadables.html

With regard to your last question, I recommend that you get an official confirmation from the BIR in your RDO to make sure.

can you give sample computation for tax refund.

I found sample computation here https://www.lilkuya.com/compute-income-tax-refund/

Hope this guide has been helpful to you.

Hi Ms Ethel, we’re an Efps user and we normally file earlier than deadline. May I ask what is the deadline of submission of 1702Q along with its attachments (SAWT, Sworn Dec, DVD of 2307) to its respective RDO? Because we usually submit it 15 days after the efps filing, but suddenly, revenue officers insists that we filed late and penalty has to be computed.

HI ma’am

Ask ko lang po pagkatapos ko pong isubmit yun form online kailangan ko po bang e email yun tax return receipt confirmation sa esubmission@bir.gov.ph?

Hello, for the regular monthly tax filing, after the submission is validated, there is no need to email the tax return receipt confirmation. You only email during e-submission of 1604E alphalist, BIR Relief, and the like.

Hi Madam,

Ask ko lang po regarding sa filing ng 2550Q,

DAT.file lang po ba ang isesend sa esubmission@bir,gov,ph? or kasama yung report na “No Error Encountered?

Mga ilang days po ako maghihintay ng Validation Report from BIR?

Thank You!

Hi . Are you filing for eFPS or just the regular eBIRForm. What I know is that when you file for regular monthly eBIRforms like 2550 and there is no error on it, you will immediately receive the tax return receipt confirmation. And when you receive it, no need to email the BIR, unless you are submitting attachments like on alphalist and BIR relief. Just to make sure, please visit the BIR revenue office in your RDO to inquire and confirm. Thank you.

HI…Pagnagfile po ako ng 2551M At may atchment akong 2306 1 percent po ang do i need to pay anoyher 2 percent to make it 3% po …

Hello. When you file and pay BIR tax returns, like 2551M, you just follow the computation in the form. You will pay your tax due after deducted by any allowable creditable tax you have paid as stated in your certificate of tax withheld.

Nagfile po ako ng 2550Q, sa sobrang haba ng DVI ko, halos paulit ulit lang ako, inaabot ng time session, sabayan pa na mahina ang internet suma tutal nalate pa rin ako, october 25 deadline, nreceive ng BIR ng october 26, 12:33AM, wala pa rin po bang konsiderasyon, halos napuyat na ako para mafile lang

Hi. It’ s sad to know that. But it’s up to the BIR if they give some consideration. Actually, there are several taxpayers who also have the same situation like yours. Here, we advise that online or efps filing be done earlier not on the deadline to avoid such issues.

Good day..

would like to ask lng po if I can pay the the monthly tax without the tax return receipt confirmation from the BIR. I already did the efiling four days ago and been waiting for the confirmation but have have not received up to this date. Today po kase ang deadline. But I already have printed the 2551 M form. Pwede po kaya magbayad kahit wala non?

Thank you

Hello, what are you filing? eFPS or eBIRForm? The receipt confirmation is needed since it is attached to the form. Please ask BIR to give you some assistance for the matter.

Hello po. I submitted my percentage tax (2551M) via eBIRForms, but I have not received the confirmation receipt email. What should I do? I’ve been doing the same thing since April but this is the first time that the email did not seem to arrive (it’s been 4 hours now, actually.

Do I really need the confirmation email when I pay through the bank? Or can I just print the generated 2551M and submit it to the bank, since I am not a “zero income” filer and thus, not mandated to eFile via eBIRForms.

I often pay my taxes via the bank. But what if I will be paying via GCash or that new DBP payment portal where you can pay taxes with your credit/debit card? It means that I don’t have to print anything offline, right?

Or should I really be worried that I am not getting my confirmation receipt email?

Hello. Sorry for the late reply. It’s actually important to wait and print the confirmation email and attach it in the BIR return when you pay and file at the bank to ensure that your filing is complete.

What remedy have you done to solve your issue? Can you share it with us? Thank you.

Hello, I was penalized by BIR due non-filing of MAP and SAWT. Just like to know the maximum penalty for every return. The assessor says per line item?? is that true and he mentioned the SAWT is needed to input in Alphalist per OR. Please advise.

Hi Miss, we almost finished filing 1701…do we need to file the hard copy together with 2307 forms to our RDO? Thank you.

Hi Cherry. Usually, when your 1701 has an income tax payable to be paid, you just pay and file it at any BIR accredited bank, and then let the bank teller validate it. Also, make sure that the ITR, the Financial Statements and the Notes to Financial Statements are stamped and signed by the teller. Some banks may also require the taxpayers to show their TIN Card or Certificate of Registration to verify the Taxpayer Identification Number (TIN).

If there is no payable income tax on the ITR, you file it at the RDO instead.

Hi Sir Vic,

I stumbled upon your post https://businesstips.ph/how-to-compute-income-tax-in-the-philippines-single-proprietorship/#comment-140 but cannot comment there anymore so i’m gonna try here. I stumbled upon that article of your because i’m searching for an answer on how do I list deductions on my 1701. I’m currently doing it and was not sure on how do I use Schedule 4 and Schedule 6 in eBIRForms when using itemized deductions. Btw, I’m a mixed income earner that’s why I used itemized deductions. The line of business is transport. My question/s are below:

1. What’s the difference of Cost of Sales/Services (Schedule 4) and Ordinary Allowable Itemized Deductions (Schedule 6)

2. When I tried “test filling” the fields in eBIRForms, I assumed that I should fill up the fields direct salaries/wages because I’m only an operator of a TNVS and I give “salary” or the “hatian” to the driver. I also field up direct materials, supplies and facilities with the expenses I have for load, gas and toll fees that was incurred. Is that correct?

3. But after filling up those in Schedule 4, I got confused in the lists in Schedule 6 (Ordinary Allowable Itemized Deductions) because there are some items for expenses that I already added on Schedule 4 (ex. salaries/wages). The one I entered in for direct materials, supplies and facilities also are in Schedule 6 like fuel, tolling fees and etc., So what is the general guideline in using those 2 Schedules?

Hope you can help me on my queries above. Thanks in advance!

Hi,

I submitted the annual 1701 form online via eBIRForms (no payment) and got a BIR confirmation feedback via email. Do I still have to submit the hard copy of the to the RDO?

Thanks.

hello po, pano po kung hindi po kami nakapag file at nakapag bayad ng Expanded withholding tax for the month of April and may tapos binayaran nalng po namin ito pagdating ng 2nd quarter? nag file po kami ng 1601EQ ang amount po na nakadeclare doon ay amount for 3 months (april, may, june). pwede po bang mag file nalng kami ng zero filing for the month of april and may?ano po ang magandang gawin regarding dito? Salamat po

Hello. The 1601EQ for the 2nd quarter already includes the 3 months for the quarter. The new form 1601EQ which is to be filed every quarter has already replaced the old form 1601-E which is to be filed monthly. Thus, there is no need to file for each month but for each quarter of the calendar year since the new form was made available by the BIR.

I am using EFPS Tax Returns do I still need to submit or email an Alphalist to BIR?