Whether you’re a self-employed individual or a professional, it is a legal duty for every citizen in the Philippines to file an income tax return annually. This is because, according to the law, incomes, regardless of their sources, have corresponding income tax rates. Responsible citizens know these too well so every year, professionals and self-employed individuals take time to process the necessary papers and submit them to their designated Bureau of Internal Revenue (BIR) offices.

However, not everyone is aware of how to file their first BIR Form 1701A. Unfortunately, these processes are not often taught in school especially to future professionals who will very much likely need guidance on this particular obligation.

This article will help first-time taxpayers of the important steps and the basics of filing Form 1701A. However, before we continue, it’s important to answer the following questions first.

What is the BIR Form 1701A?

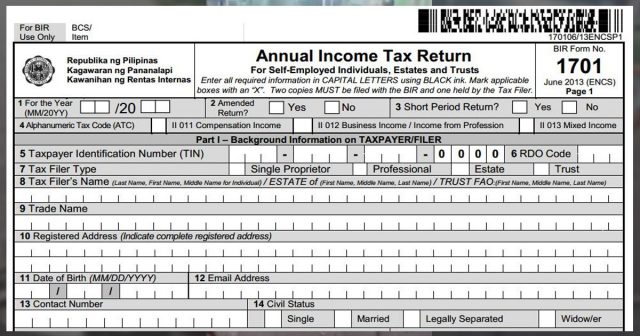

To carry on with this obligation, citizens should get their hand on one of the most important BIR papers: the BIR Form 1701A. This form is the primary document that taxpayers use in declaring their annual income tax returns. Furthermore, the form is only composed of two (2) pages and it’s relatively easy to fill out. This is a totally different form compared to its old version that was set in numerous pages.

Additionally, the form was created to provide a simple process for taxpayers to file their Annual Income Tax Returns, hassle-free.

Are you qualified to file a BIR Form 1701A?

While there are some types of taxpayers (businessmen, tradesmen, professionals, practitioners, resident citizens, non-resident citizens, resident aliens, or non-resident aliens) that are qualified to file the BIR form 1701A, the form should only be used if an individual’s qualifications fit the circumstances below:

- If the taxpayer chooses the optional standard deduction.

- If the income falls into the category of graduated income tax rates.

- The second circumstance is applicable regardless of the receipt/sales/amount, including the other non-operating income.

- Lastly, the form can be used if the receipts/sales do not go over the P3M margin, and the concerned taxpayer takes advantage of the set percentage (8%) flat rate of income tax.

Which category do you belong to? Professional or Self-Employed?

A. Self Employed Category

These taxpayers are composed of single proprietors, individuals who own their businesses or enterprises, or any income earner whose incomes come from any business venture that is non-VAT or VAT-registered.

B. Professionals Category

Under this category are experts of specific fields of professions that can function independently without relying on an employer or a place of employment. These individuals include lawyers, architects, doctors, engineers, certified public accountants (CPA). The common thing about these individuals is that their source of income is generated by practicing their professions.

Most of the time, professionals will always go for 8% flat rate instead of choosing the alternative graduated rates as long as their gross receipts do not go over PHP3 million.

What are the parts/ sections included in the BIR Form 1701A?

As mentioned before, the BIR Form 1701A is an important document through which taxpayers can input file their annual income tax returns. The said document follows the rules and regulations of the new TRAIN Law. Additionally, it follows the new tax rates for 2019 as mandated in the new tax law.

Here are the parts included in the form:

Part 1. The first part covers the background information of the taxpayer/ income tax filer.

Part 2. The next portion declares the filer’s Total Tax Payable.

Part 3. The third part presents the specific details of the payment to be made.

Part 4. This part is where the computation of the filer’s Income Tax is indicated.

Part 4-A. This part covers the Graduated Income Tax Rates.

Part 4-B. This portion is for the 8% Income Tax Rate

Part 4-C. Lastly, this part presents the Tax Credits/ Payment

Part 5. The last part of the BIR Form 1701A covers the Background Information of the filer’s Spouse.

Filling out BIR Form 1701A

Now that we’ve covered the basics, let us proceed to the most important part of this article. How do you fill out a BIR Form 1701A, depending on the category in which you belong to? The answer is actually simpler and more convenient compared to the previous years.

Here are the two-part steps that you should know.

Page One (1)

- Select the appropriate Alphanumeric Tax Code (ATC) and choose the Taxpayer Type. Here, you are presented with two options: professional and single proprietor.

- Choose 012 or 015 for Single Proprietor.

- Choose 014 and 017 for Professional.

Page Two (2)

- The second and last page provides the computation of your income tax according to the selected tax rate (between 8% and Old Standard Deductions or OSD).

- Fill out the details that declare your previous tax payment or tax credit.

- Most importantly, review and validate every entry on the form before you affix your signature and finally pay your taxes for that year.

- Payments can be made through any accredited banks, local government units, or head directly to the BIR office.

Conclusion

Paying one’s taxes is a legal duty that every Filipino must adhere to. However, it is nothing new that most people don’t know how to take on even the first and basics steps of filing one’s income tax. It should be emphasized that this step is an important part of not just answering to your responsibility as an earning citizen but also in helping the country achieve progress through your contributions.

While there are others who fail to declare their earn annual income because of not being able to know what to do or where to go, there are others who may know the basics but are not as diligent. Filing income taxes in the Philippines often fall in April. While this is a common fact for most businessmen and professionals, many still fail to file early and rely on the power of “last minute” filing just to meet the deadline.

Now that you know your first step to filing your BIR Form 1701A, hopefully, you’ll be a good example to your fellow self-employed/independent professional. Remember to be a responsible citizen and file your taxes regularly!

BusinessTips.ph is an online Business Ezine that provides free and useful articles, guide, news, tips, stories and inspirations on business, finance, entrepreneurship, management and leadership, online and offline marketing, law and taxation, and personal and professional development to Filipinos and all the business owners, entrepreneurs, managers, marketers, leaders, teachers and business students around the world.

Leave a Reply