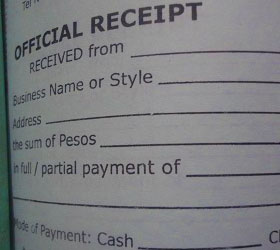

Official receipts and invoices are among the documents that make your business legal and compliant to tax laws. If you sell goods to customers or if you provide services to clients, chances are, they will ask you for official receipts. What if you don’t have official receipts or sales invoices to issue to them?

Official receipts and invoices are among the documents that make your business legal and compliant to tax laws. If you sell goods to customers or if you provide services to clients, chances are, they will ask you for official receipts. What if you don’t have official receipts or sales invoices to issue to them?

Customers usually ask for receipts. Business customers will ask for receipts to document their expenses and support them when they claim these as deductions to their income taxes. Customers, who are employees or officers of a company, will ask receipts to also support their claims when they liquidate their expenses and ask for reimbursements. That is why some customers will hesitate in getting your services or in transacting with you if they will know that you don’t have an official receipt or invoice to issue.

If you are targeting big and corporate clients or if you want to increase the number of your customers, having official receipts and invoices for your business is a must. Besides, the Philippine tax code says that all persons subject to an internal revenue tax shall issue official receipts or invoices for each sale of goods or services valued at P25 or more, with some provisions according to Section 237 of NIRC, as amended.

So how do you get official receipts and invoices for your business in the Philippines?

Getting duly registered receipts or commercial invoices for your business is not a one-stop process. You should register your business with the Bureau of Internal Revenue (BIR) to have them. And before you can register with the BIR, you first need to register your business with other government agencies like the Securities and Exchange Commission (SEC) for partnership and corporation or with the Department of Trade and Industry (DTI) for single proprietorship.

To guide you, here are the basic steps to get your duly registered receipts and invoices:

1. Register with DTI or SEC

If your business is in the form of sole proprietorship, you have to register first your business trade name with the DTI. Your registered trade name is what you will use and what will appear in your official receipts and invoices when you register with the BIR. If your business is in the form of partnership or corporation, you have to register your business first with the SEC instead of the DTI. Remember that when you register with the BIR, your DTI or SEC registration is one of their requirements. Here are some posts to guide you on the processing and requirements of registering your business with DTI or SEC.

– How to register your business with DTI

– How to register a stock corporation with SEC

2. Get business permit from the Mayor’s Office

The BIR will also require a business to submit a Mayor’s business permit or at least an application for Mayor’s business permit before it will register your business. Thus, the second basic step is to apply for your business permit at the local government office (City or Municipality Office) where your business is located. To check the steps and requirements for registration with the LGU, you can read our guide on how to get Mayor’s Business Permit for your business.

3. Register your business with the BIR

If you’re already done with the DTI or SEC, local government office, and other offices that the BIR may require you to obtain registration, you can already start applying for your business registration with the BIR. The following are the basic requirements and steps for registering your business with the BIR:

A. Accomplish BIR Form 1901 (for sole proprietorship) or BIR Form 1903 (for partnership or corporation) and submit it, together with the required attachments, to the Revenue District Office (RDO) having jurisdiction over the registered address of the business establishment. The following are the forms and requirements to be attached with your application:

a. BIR Form 1901 (for sole proprietorship) or BIR Form 1903 (for partnership or corporation) – Application for Registration

b. Birth certificate or any valid identification showing name, address and birth date (for proprietors or individual taxpayers)

c. Mayor’s permit or application for Mayor’s Permit

d. DTI Certificate of Registration of Business Name (for proprietorship) or SEC Certificate of Incorporation/ Co-Partnership (for partnership or corporation), and “License To Do Business in the Philippines” in case of resident foreign corporation

B. Pay the Annual Registration Fee (P 500.00) at the Authorized Agent Banks of the RDO.

C. Pay P 15.00 for the Certification Fee and P15.00 for the Documentary Stamp Tax (in loose form to be attached to Form 2303).

D. The RDO shall issue the Certificate of Registration (Form 2303).

E. For corporations, the taxpayer must pay the Documentary Stamp Tax on the Articles of Incorporation as prescribed under Section 175 of the NIRC, on the 5th of the month following the date of issuance of said article (per RR 4-2000).

Aside from the steps and requirements above you also have to register your books of accounts (Journal / Ledger / Subsidiary Income Book and Subsidiary Purchases/Expenses Book) and have them stamped by the RDO where the business is registered. The BIR examiner will usually advise you the types of books and taxes applicable to your business upon briefing.

Apply for Authority to Print Receipts and Invoices

Now, to apply for your official receipts and or invoices, you should use BIR Form 1906 (Application for Authority to Print Receipts and Invoices). Here are the documentary requirements and steps to apply for authority to print your receipts and invoices:

Documentary requirements:

a. Job order

b. Final and clear sample

c. Photo copy of COR/paid ARF of TP & Printer

d. Last booklet or previous ATP

e. Permit to Use Loose-leaf, if applicable

f. Printers’ Certificate of Delivery (PCD)

Procedures:

A. For taxpayers:

a. Accomplish BIR Form 1906 and submit the same together with the documentary requirements to RDO where the HO is located or concerned office under the Large Taxpayer Service;

b. Keep/File PCD and ATP copy duly received/issued by BIR for audit purposes;

c. Taxpayer’s branch office shall furnish its RDO a copy of the ATP issued by the appropriate BIR office having jurisdiction over the head office.

B. For the printer/supplier:

a. Prepare Printer’s Certificate of Delivery (PCD) in five (5) copies and submit to RDO where the place of business is located or concerned office under the Large Taxpayer Service within thirty (30) days from date of ATP and prior to delivery of receipts and/or invoices to taxpayer;

b. Furnish the taxpayer and its branches copy of the received PCD and approved ATP together with the taxpayer’s Sworn Statement within thirty (30) days from the issuance of PCD. One copy thereof shall likewise be submitted to the BIR Office that has jurisdiction over the head office of the printer.

Remember that you will need to look for a printing company to print your receipts or invoices. Some printing companies will help you on the process of applying for authority to print your official receipts or invoices with the BIR. If you are a service provider and doesn’t sell goods, you may only use official receipts. On the other hand, if you sell goods, you may be required to use both official receipts and invoices.

Finally, take note that the deadline to secure application for Authority to Print Receipts and Invoices is on or before the commencement of your business.

For more information and reference, please read the web page of the BIR on this subject matter.

Update: Under Revenue Regulations No. 18-2012, which took effect on January 18, 2012, all application of Authority to Print (ATP) will now be processed through the Online ATP System. Please check our discussion on this matter in our online forums.

Disclaimer: New and subsequent tax rulings, issuances and or laws in the future may render the whole or part of the article obsolete or inaccurate. This article was published for informational use only and is not provided to serve as legal, tax, or investment advice. Hence, we do not guarantee and is not liable for the accuracy or completeness of any information provided herein or in any outcome as a result for using this information.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi,

I’ve recently put up a company and got it registered last year, my question is if my reciepts and invoices were unused last year, can I still use it this year?

My previous comment was already obsolete because of the new BIR regulation. Please read my new comment below.

Hi Ron. There is a new BIR regulation “REVENUE REGULATIONS NO. 18-2012” This regulation is about BIR’s adoption of the online system for authority to print (ATP). Because of this adoption, all unused/unissued principal and supplementary receipts/invoices printed prior to the effectivity of this Regulation (January 18, 2013, shall be valid only until June 30, 2013. If your receipts and invoices were registered/printed last year, then will be valid only until June 30, 2013. Thus, you have to apply for the new ATP in accordance with the new regulation. You can read RR 18-2012 here:ftp://ftp.bir.gov.ph/webadmin1/pdf/67524RR%2018-2012.pdf You may also confirm with the BIR officer in your jurisdiction.

have you seen the new presentation of the “total amount due?” in the approved official receipt (typically on the left side of the OR)? it’s presented this way:

Sales (vat inclusive) XXX

less VAT XXX

Total Due XXX (huh?)

2 RDOs i checked are following this format. am i missing something?

Hi,

I am a Physical Therapist. Does the same process apply to professionals if we wish to be authorized to issues invoices?

If you are a service provider and doesn’t sell goods, you may only use official receipts. May I know what you mean by Official Receipts?

Thank you so much for this post. This will be very helpful in applying for the Official Receipt of our newly-founded company 🙂

WHERE CAN I BUY VATABLE RECEIPT FOR RETAIL ONLY. MY RECEIPT IS ABOUT TO EXHAUST. THE PRINTING OF MY OFFICIAL RECEIPT IS ON PROCESS. I NEED A VATABLE RECEIPT FOR THE MEANTIME WHILE MY INVOICES RECEIPT IS ON PROCESS.

hi.. im iT freelance.. how to start my own official receipt?

Hi, I have a business permit lapse 3years and still don’t have a BIR, how to process this problem.

Hi. I’m a freelance TV Director. A company is hiring my services to do a video for them. They require me to issue them a receipt once they pay for my services. Do I still need to go to DTI to register my services?

Yes, you need first to register your services.

hay sir pwde po bah ako gumawa ng sarili kong resibo,,yong normal lang nah paper,,

tinahtangap po bha ito ng bir

…thank you po

nope, u need to have your receipts printed by companies which are accredited by BIR

We are a government non-profit employee association and we would like to secure official receipt for our association thus what are the requirements. Ive read that the payment for ARF is free for non-profit org. Thanks & God bless.

Hi. Ask ko lang kung pwde na Official receipt lang ang meron ako at walang sales invoice. Thanks!

Yes as long as you are only rendering service.

ask ko lang po,gaano katagal ang pag asikaso ng buss.permits kasma na ang pagrelease ng o.r and sales invoice

Hello. I can’t really tell since it will depend on the BIR RDO you will be dealing with. It will also depend on the type of business you are operating. It may take a month or more since printing of O.R. can be time-consuming.

Helllo po. Sir pano po pag paubos na yung receipts na iniissue sa customer pano po kumuha ng mga bagong resibo ulit.

You have to obtain an authority to print new receipts with the BIR. You may visit the BIR authorized printer who will print your new receipts so they can assist you.

Hello good day. May buy and sell po ako na negosyo. Kakaumpisa lang. And nasa online din po. We making our transaction through the internet. Pwede po ba ako mag apply sa bir para magkaroon po ako ng invoice or receipt?

Hello, Yes, actually income earners, whether they are earning offline or online, have to register with the BIR to have their official receipts/invoices and file and pay their tax obligations.

good day sir gusto ko po sana magkaroon ng official reciept, isa po akong freelance make up artist may mga client po kasi ako n nghahanap ng official reciept fo rmy services, ano po una kong gagawin para makakuha ng reciept thanks po

Hello Mark. Official receipts are obtained from the BIR. In order to have your official receipts, you have to register with the BIR as a self-employed professional. You have to file BIR Form 1901 , pay BIR annual registration fee, register your books of accounts, get authority to print your O.R., and other documents that the BIR may require you. Once you are registered with the BIR, you also need to file and pay your taxes, monthly, quarterly and yearly. For more inquiries, please visit the BIR in your RDO.

Hello sir, nag apply po ako ng business permit, naka register na po kami sa sec, sa ngayon po pina process pa lang po ung mayors permit ok lang po ba mag apply na ako sa bir para po makauha ng bir receipt kahit wala pa pong mayors permit? Ok lang po ba baranggay permit ang dadalhin kasi po medyo matatagalan makakuha ng mayors permit?

Nope. You have at least DTI Registration, Brgy Clearance and Mayor’s permit

Gaano kabilis sir ung pag issue ng printing press at BIR ung Official Receipt and Billing Statement. Naibigay ko na sa printing press ung ATP at recibo

Thanks

Hello. It will depend on the capability of the printing press you have chosen. Sometimes, when they are serving a lot of clients, their turnaround could be longer. You may ask them when can they finish the job as they are the one who can tell it.

PANO PO MALALAMAN KUNG REGISTERED SA BIR YUNG RESIBO? MAY BINAYARAN KASI KAMING LUPA SA ISANG REALTY COMPANY..YUN DAW ISANG WAY TO CHECK IF THEY ARE LEGIT TNX

Hi. The official receipt shall indicate the business TIN (VAT or Non VAT), the BIR Authority to Print Number, Date issued and validity, the name of the printer and its accreditation number., etc. You can also bring it to the BIR to check if it’s in their database.

Hi Sir. napasa na po namin lahat ng requirements sa BIR. Wait nalang daw po kami 2 to 4 weeks para mabigay samin yung mga receipts. Pwede na po ba kami mag start operate habang hinihintay namin makuha yung mga receipts?

thank you.

Hello. Actually, by law, you cannot accept payment for good or services, without issuing official receipts or invoices. The failure to issue receipts or invoices to your customers has big penalties. Therefore, it is safe to just wait for your official receipts before you start selling. You may also visit your RDO to ask for consultation regarding the matter.

Hello sir what if naka terms po yong costumer then naiwala po nya yung copy nya. Then sasabihan nya wala daw siya pero nasakin yung carbon copy na isa. Pano po paraan don para po bayaran ni costumer ung nawalang copy.

Hi. I’m not sure if I understood your question. Are you the seller? If you are the seller, then maybe you can give your customer a photocopy of the carbon copy in your possession for whatever purpose he/she will use it. However, you should not give the original carbon copy since it is owned by you.

Hello, ask ko lang po , ung date ng ATP is april 2017 pero ung tatak ng BIR is april 2018? valid po ba yung ATP na ganun? ganun katagal process ng ATP?

Hello Odette. The processing of ATP usually lasts a week or longer in other RDOs, but will not last a year. Perhaps, there is an error in dating your ATP. The validity of ATP is for 5 years. You can check the official receipts or invoices for the date of issuance of ATP and its expiration.

Sir, I would like to have an Official Receipt for my small home business, it is a silkscreen printing. Kailangan pa po ba ang marriage contract at live birth ng mga bata?

hi dear sir!,

goodmorning po! how much is the official receipt and how many booklets will be issued if ever? my associate told me that it’s like P30,000.00. i am new to this OR of this amount. its for this year onward…

thank you and Godbless Sir!

Hi sir..

I have a retail business.. but I didn’t apply for BIR.. hanggang business permit lng po.. mga 2 1/2 yrs na po ung business ko.. and at first kasi I don’t have any idea.. I thought ok na ung sa business permit.. pwede pa ba ako kumuha Ng BIR? Pano po un?

ask lng po sir if sa ibang printing press po kme mgpapaprint anu po yung requirements na kukunin? kasi naubos na official receipt nmin at matagal na kme nka pg request ang bookkeeper nmin but until now wla pa kasi offline dw sa BIR kaya ngayon na momroblema kme ksi my violation kming 20k

Sinundan ko po yung steps para makakuha ng receipt, kaso bakit po temporary receipt ng BIR yung binigay sakin ng BIR? yung itsura po ng receipt is pahaba po (vertical), hndi po sya horizontal. bakit po ganon?