The statement of changes in owner’s equity is a separate component of financial statements for a sole or single proprietorship business. It presents how the capital shown in the balance sheet equity section changes over a period of time. It also shows the effects on the capital account of the various business transactions that occurred during that period. This statement normally presents first the owner’s beginning capital balance. Then, it summarizes the net increase or changes in the owner’s equity by presenting the additional investments during the period plus net income (loss) for the period, and subtracted by the owner’s withdrawals during that period. The net changes in owner’s equity is then added to the beginning capital balance to arrive at the ending capital balance, which is also what is forwarded and presented in the balance sheet. Other forms of businesses, such as partnership and stock corporations have different presentations of statement in changes in equity. In this post, we will discuss how to make a statement of changes in owner’s equity from the adjusted trial balance and income statement we have shown in our previous articles.

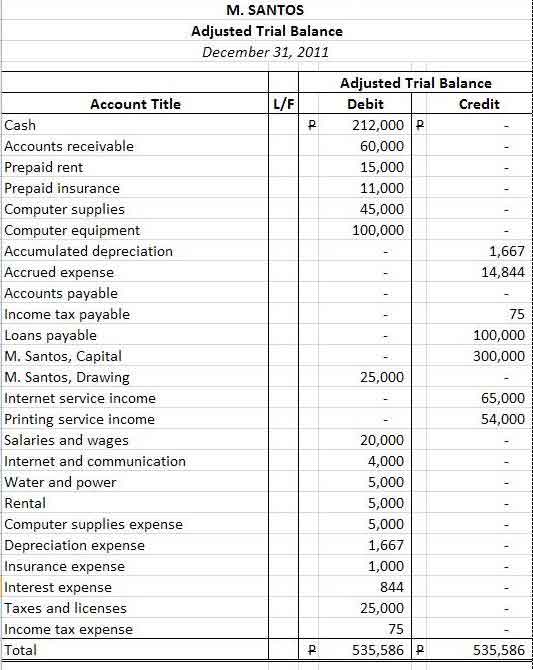

Here is the adjusted trial balance we have prepared in our previous discussions.

How to prepare a statement of changes in owner’s equity

For individual or sole proprietorship business, the preparation of statement of changes in owner’s equity is quite easy, especially if you have already adjusted your trial balance and have already prepared an income statement. All you need to do are the following:

1. Put a heading. The heading includes the name of the entity (individual or company), name of the financial statement (statement of changes in owner’s equity), and the reporting period, that is, for the year ended December 31, 2011 (the same with an income statement). Other complex forms of businesses may include additional information in the heading, such as when reporting a consolidated statements of changes in equity or when presenting comparative reporting periods. You may also indicate the currency (e.g., Amounts in Philippine Pesos) where the statement is based.

2. Present first the capital beginning. Since our example entity just started business on December 2011, our capital beginning balance is NIL.

3. Compute and present the net increase in owner’s equity. The net increase in owner’s equity equals the investments during the year plus net income during the year, less the owner’s withdrawals during that period. In our trial balance, the balance of capital is P300,000. Since, we don’t have a beginning balance in our capital, we can judge that this amount represents all the entity’s investment infused during the year. We can also trace this amount to the general ledger and general journal to make sure that the amount truly represents investments during the year.

The net income shown in the statement of owner’s equity is simply the net income in our income statement, which amounts to P51,414. The sum of the investments and net income during the year is subtracted by the owner’s withdrawals during that period. As shown in our trial balance sample, the owner’s drawings during the year amounted to P25,000. Accordingly, the net increase in owner’s equity for the year equals to P326,414 (P351,414 – 25,000).

4. Compute the ending balance of the owner’s capital. The last computation is the capital balance as of December 31 or the ending balance. It is simply computed by adding the net increase (decrease) to the beginning balance of capital. In our example, M. Santos, capital at the end of period amounted to P326,414. This is also the amount that we should carry forward to the capital balance in the equity section of the balance sheet.

This is how our statement of changes in owner’s equity looks like:

This statement of owner’s equity is only from a simple sole proprietorship business. Partnerships, stock corporations, and non-for-profit organizations have different and more complex presentations of statements of changes in equity. Take note that the term “owner’s equity” we used means there is only singular owner of that equity. Furthermore, in a complete set of financial statements, where notes to financial statements are prepared, the material accounts shown in the statement of equity are cross-referenced to the accompanying notes to financial statements.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

helpful thanks