PayPal is one of the business services that I’ve been using since I started my journey to blogging and making money online. It helps me buy the domain names, monthly web hosting, WordPress themes, and professional services for the development of my websites without giving my financial or credit card information to sellers. PayPal also facilitates some of my online transactions, such as receiving payments from clients online, whom I sell services or advertising space from this blog. PayPal has been my online buddy and payment gateway for a couple of years now. That is why I’m glad to introduce it to my audience for their consideration and give them an idea on how they can also leverage PayPal for their online businesses and other activities. To open a PayPal account is basically free. Here are the steps on how to open a PayPal account in the Philippines.

1. Go to PayPal website

Go to PayPal website PayPal website and click the signup button at the top to signup for a new account.

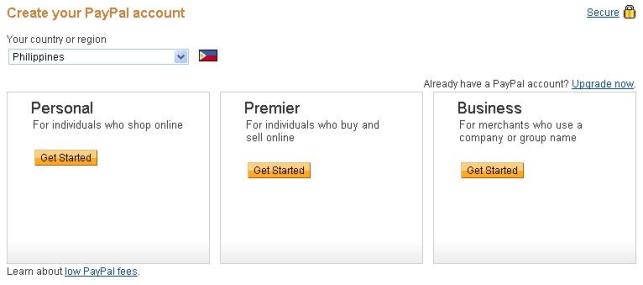

2. Create your PayPal account

After clicking on the signup button, choose your country or region. After that, choose the type of account that is right for you. There are 3 types of PayPal accounts, namely, Personal, Premier and Business.

The following are their different features:

a. Personal – this type of account is recommended for individuals who shop and pay online, or wish to send or receive personal payments for shared expenses such as splitting of dinner bills or rental charges. As its name suggests, this account is best for personal uses. If you are a regular seller online who wants to receive payments online, this account is not recommended due to higher transaction rates and limited capabilities.

b. Premier – this account is recommended for casual sellers or non-businesses who wish to get paid online, and who also make online purchases. This type of account is usually used by Internet professionals and freelancers, who don’t use a company or registered business name, to accept payments from their clients online.

c. Business – this is recommended for companies or merchants who operate under a company/group name. It offers additional features such as allowing up to 200 employees limited access to your account and customer service email alias for customer issues to be routed for faster follow-ups.

Take note that according to PayPal, they allow members to have one Personal account and one Premier or Business account. However, each PayPal account must contain unique email addresses and financial information. There is also no cost to setup any of the type of account. You may upgrade your account at any time.

If you want to receive credit card or debit card payments online from selling items or services on your own website or from other classifieds or marketplaces on the Internet, a Premier or Business account is recommended, as Personal account has higher transaction fees and has a limited capability of receiving credit or debit card funded payments. You may read our article on how to accept credit card payments online using PayPal.

3. Enter your information and activate your account

After choosing and clicking on the right type of PayPal account for your needs, you will be asked to enter your information, such as your email address (the one you will use to log in to PayPal), password, name, date of birth, nationality, address, phone number, et cetera.

PayPal will also ask you to link your credit card so that you can already verify your account right away. But you can escape this process for the meantime and proceed to the agreement and creation of your account. However, take note that verifying your account with your credit or debit card will give you more spending power since the sending limit on your account is removed. It will also give you the ability to withdraw your fund from your account. Furthermore, having a verified account will give you a “verified status” that increases your reputation as a seller or as a buyer. We will discuss in detail the verification process of your PayPal account in our next post.

After filling up your information, read PayPal’s user Agreement. It’s always important to read agreements and policies before agreeing on them. After reading and agreeing to them, you can now click “create your account” to almost complete the creation of your account. I said almost because you still need to do the following step.

4. Confirm your email address

After creating your account, you still need to confirm the email address you use to create your account. You can do this by going to your email’s inbox, opening the email that PayPal send you to confirm your account, and by clicking on the activation link found on the email. Once you click the activation link, you will be redirected to PayPal’s confirmation page and will ask your password to confirm your account. From there, enter the password you’ve just created and click confirm.

After confirming and activating your account, you can now sign in to you account and start using PayPal. To learn more about verifying your PayPal account to maximize your spending power, have higher withdrawal limits, increase security, and boost your credibility, please stay tuned for our next post.

To learn the different fees that PayPal charges for different transactions, please visit PayPal Fees page.

Do you have any question or experience to share about PayPal? Let’s discuss them in the comment section below.

Disclaimer: Although, I’ve been using PayPal for a number of years now and have not encountered any problem so far, I don’t guarantee that using it will not give anyone a problem. PayPal is a convenient and safe way to pay and receive money online. However, PayPal account holders must still take strict measures to prevent fraudulent transactions that may cause them financial damages or losses. It is advisable to transact or deal only with trusted sellers or buyers. It is also wise to always read PayPal terms and know your rights as a seller or as a buyer. Please check also the different fees charged by PayPal before using its service to know the cost of your transaction. This article includes our PayPal affiliate link. This means that every time we refer a new and qualified member, we may have a chance to earn a referral income in the future.

Amruta is one of the writer contributor on this blog assigned to write on different topics, such as the latest business news, search engine optimization, making money online, online business promotion, social media, and the latest trends on the Internet.

Another best article from you sir vic. Is Paypal safer than Alertpay?

Thanks. I really can’t compare the two yet, since Alertpay is still new. While PayPal has already been widely used and is already a popular payment gateway for most online stores. Besides, it’s still on the hands of the account holder when it comes to security.

Thank you for the information

Very informative. Thanks for the info you shared.

I have a few thoughts, say I would choose Premier:

Does paypal charge montly fees or yearly fees?

What if I need it for a single transaction, can I deactivate it immediately, does it have termination fees?

If I request payment thru it, would it charge me upon withdrawal and how much?

Enthusiastic for your reply. Thanks!

I already have a PayPal account with Canadian accounts and PayPal will not allow me to add my Filipino address or bank account. Any ideas what I can do?

Can buying a PayPal VCC from Aspkin forums or Auction Essistance be a good idea to verify my account?

i have already an account and i already sign up my security bank account (debit-mastercard) and they charge me 100pesos last month however up until now i dont reeceive any paypal code in my banking statement.. what should i do? should i contact my bank?please help

I opened up an account in the phillippines, but I can’t seem to verify my accuont. Is it a good idea to get a vcc from Auction Essistance to verify my account?

I Have a confirmed paypal account in the USA. I want to establish a Paypal account in the Philippines where I have a bank account at BDO.

Is it possible to have two accounts with paypal, one in the USA and one in the Philippines. I am a dual citizen.

how can i change my state because im from the philippines but when i sign up at paypal, the philippines is not in the options of the form, can i still withdraw the amount in my paypal here in the philippines but my state i sign is in the US?

Is it possible to open PayPal using my BDO account?

Can I inquire thru Phone? I am interested about paypal but I have to know the do’s and the dont’s Can I have the Telephone # here in Philippines

can I use debit card for PayPal? also when i try to open the website it says “Access Denied”

Yes, you can add your debit cards to your PayPal account.

Access denied has to do with IP bans or regional IP bans, and for most people, the message stops appearing in a few hours. I suggest you try with a different browser, computer or internet connection.

hi sir,

after clicking the sign up button, I cannot find the page where there is a selection for you country and also the three types accounts to choose from.

please kindly help me on signing up.

thank you sir.

Boy Asistido

Someone from US sent me money using paypal, Im from Philippines, I linked my savings- payroll atm card from my company. I waited 2-4 business days to withdraw the money from my account (BPI) but it does not appear on my online banking. . I also went to the bank but they said that they dont process paypal even if I have my code. They said I should wait to reflect it on my account. Can you please help me? What do I do? Thanks

Hello. Did you mean someone from US has sent money from his Paypal to your BPI? Or do you mean someone from US has sent money to your Paypal, and since your BPI is linked to your Paypal, you withdrew your Paypal balance to your BPI?

If you have a Papal account and you have properly linked your BPI bank to your Paypal, then you can withdraw money from your Paypal to your bank., which may take 2-4 banking days. Aside asking BPI, you should also ask the one who sent you the money from the US.