After journalizing your business transactions, that is, recording them in the general or special journals, the next step is to post those journal entries in the general ledger accounts. To learn about recording transactions in the general journal, please read our previous article and simple tutorial on “how to record transactions in the general journal”. We will also use the sample journal entries made on that article in our discussion about posting entries from general journal to the general ledger here. So check out that post for your reference. Now, to begin our discussion on how to post general journal entries to the general ledger, let’s start with some of the basic things you should know about the general ledger.

What is the general ledger?

The general ledger is a primary accounting record used by a business in tracking its individual account balances. While the general journal is where you record accounting transactions in a chronological order, the general ledger is where you post and group those accounting entries per account to easily track its balances. You cannot easily check the balance of the cash account in the general journal since it records entries according to the date of transactions along with other accounts. But you can easily track it in the general ledger cash account. The general ledger is a collection of all the company’s accounts presented as a T account with a debit and credit side. The general ledger accounts are used in the preparation of the trial balance and the financial statements.

The process of recording a debit or credit in the general ledger is called posting. The posting of the entries from the journal to the ledger doesn’t require deep analysis since it already involves using readily made information from the journals.

Aside from using the general ledger, companies may also use a number of subsidiary ledgers or subledgers, such as accounts receivable and accounts payable subledgers. These types of ledgers are usually used by companies who need to keep track of their account balances per customer or per supplier. All the entries that are posted to these subledgers will transact through the general ledger account. For the purpose of our simple tutorial, we will only discuss about the general ledger.

Sample general ledger forms

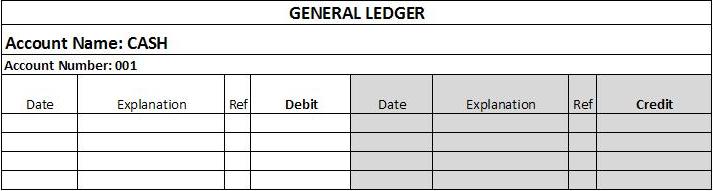

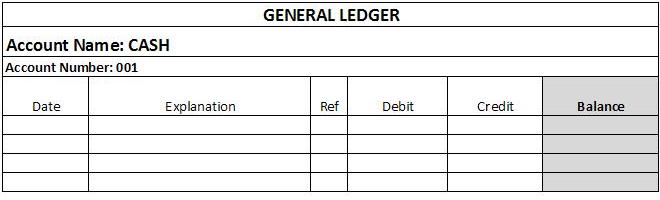

The general ledger includes the name of the account (e.g., cash and accounts receivable), account number, date of transaction, explanation or details of the transaction, posting reference (e.g., reference to the general journal or special journals), debit column, credit column, and a column for balances for other type of general ledger forms. Check out the following 2 different samples of a general ledger account.

A general ledger account presented as a T account.

A general ledger account presented with a balance column.

We will use the second form for posting our sample journal entries to the general ledger here. You can also create the sample forms above using Microsoft Excel.

How to post entries to the general ledger

As I mentioned earlier, posting entries to the general ledger doesn’t require much analysis since you will be using the entries already recorded in the general or special journals. All you need to do is to pick the entries from the general journal and post them in the general ledger per account. To illustrate, please see the journal entries we have made in our previous article as shown below (please visit links if you can’t read the documents):

Then check out how we have posted the journal entries to the general ledger account as follows:

In the example above, we made a general ledger for each of the account (i.e., cash, accounts receivable, accounts payable, etc.,). The account numbers are grouped into assets (100), liabilities (200), capital (300), income (400), and expense (500). If you have a larger business, you can further expand your chart of accounts (a list of account names with numbers) to accommodate your business accounting.

Beginning balances should be entered in the general ledger accounts, except for nominal accounts, such as income and expense. Since our sample entity has started only on that year, our beginning balances are zero.

To begin posting, just pick the accounts in the journal entries and post them in the corresponding ledger account. For example, in our journal entry #1, which has a debit entry to cash and a credit entry to capital amounted to P250,000 each, such entry will affect the cash ledger and the capital ledger. The cash ledger will also be debited with P250,000 and the capital ledger will be credited with the same amount. The ledger forms should also be filled up with the date of transaction, explanation, and posting reference. You just need to repeat this process for all the other entries in the general journal until you come up with the balance of each general ledger account. It is also important to remember the following nature balance of each account to facilitate posting and determining the ledger account balances.

Assets and expenses = a debit increases the account, while a credit decreases the account.

Liabilities, capital and income = a credit increases the account, while a debit decreases the account.

In our example, the cash ledger has the most entries since it is the account that is mostly used by the entity’s business transactions. It is also the account that is mostly recorded in the general journal. This post is only designed for small and simple manual accounting system. The transactions are taken from a sole proprietorship entity. But you may also use a software like MS Excel to facilitate your recording. Furthermore, you can also modify and enhance the forms and accounts according to your business need.

In our next article, we will show to you how to make adjusting journal entries and how to prepare a trial balance using the examples above. If you have some questions about this post, feel free to make a comment below.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Good Day, I really appreciate the information you shared:) Very clear and informative.

Thank you so much…I hope you will share more information to us…readers:)

ask ko lang po paano po gawin ung journal and ledger.update po ako sa disbursement and receipts.Thanks.

Good Day.Pano po mag fill up ng Quarterly Income hindi po asi ako familiar sa mga term po baka puede po niyo ako matulungan.First time ko lang po.

Hi po.. good day! thankful po ako sa Tips niyo.

I’m an employee po and Officer In Charge ng company sa isang outlet nila. Ganito po kasi yun yung ledger po kasi namin eh na late po ng pag update at naubos na kasi ang incharge na sales dun e siyang binigyan ng responsibilty to monitor kaso nagresigned na xa (AWOL) and yun hindi na namonitor till then nalaman ko na ubos na ang lahat ng ledger..nagpunta ako sa BIR at ang sabi 20thou daw ang magiging penalty sa ganung kaso. Sir I really need an advice from you ano paraan for that case since employee lang din ako at sa akin mashoulder ang ganung halaga.. Sana po matulungan niyo ko..

SALAMAT po.. GOD BLESS at sana marami pa kayo matulungan..

Hi! ask ko lang po kung paano mag file sa 3 Journal ng BIR for travel agency? Thanks po