The balance sheet or the statement of financial position is one of the major components of financial statements, which include the income statement, statement of cash flow, statement of changes in equity and the notes to financial statements. The balance sheet gives readers of financial statements the snapshot of an entity’s financial condition. It presents the company’s assets, liabilities and equity, which show the basic accounting equation (assets = liabilities + equity), where total assets must always be balanced with the sum of the total liabilities and total equity. If you own a business and you have an accountant, the accountant will be the one who will prepare your balance sheet. But small business owners or even professionals and freelancers who just want to make a simple balance sheet can try to prepare this statement on their own.

Steps to be made before the preparation of balance sheet

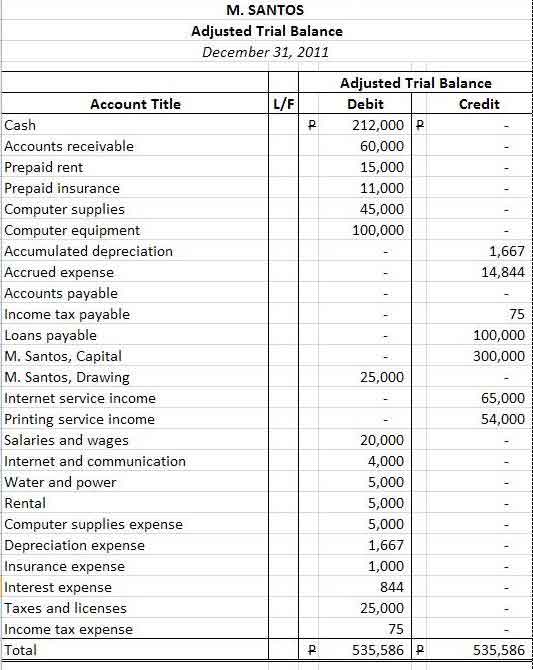

In the accounting cycle, the balance sheet and other financial statements are prepared after the adjusted trial balance is done. Preparing the balance sheet without doing the previous steps of the accounting cycle will give the preparer troubles in coming up a fair balance sheet statement. Thus, if you want to learn how to prepare a balance sheet or statement of financial position, you should first learn the following steps of the accounting cycle.

1. How to record journal entries

2. How to post entries to the general ledger

3. How to prepare a trial balance

4. How to make adjusting journal entries

5. How to prepare an adjusted trial balance

You may read and study the above articles up to the preparation of the adjusted trial balance. In those articles, we have used the same examples of transactions and events, from recording the journal entries up to the adjustment of the trial balance. We will now then use the account titles and balances in the adjusted trial balance in our preparation of the balance sheet. Here’s the adjusted trial balance we have prepared from our previous article.

How to prepare a balance sheet from the adjusted trial balance

Once the trial balance is adjusted and updated to correct errors and other adjustments, we can now prepare the balance sheet and income statement. The following are the simple steps you need to know in preparing a simple balance sheet:

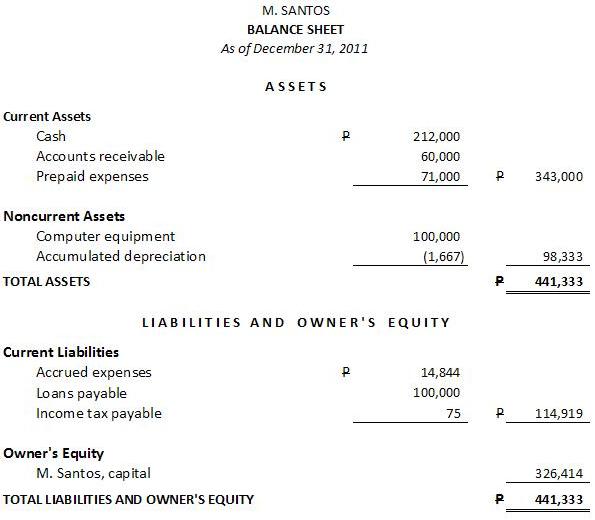

1. Start with the heading. The heading includes the name of entity (individual or company), name of the statement (balance sheet), and the reporting period (ex. as of December 31, 2011). Some complex forms of businesses may include a more detailed heading, such as when reporting a consolidated balance sheet and or when presenting comparative years. Below is an example of a simple heading in the balance sheet we have prepared from our sample adjusted trial balance. You may also indicate the local currency (e.g., Amounts in Philippine Pesos) used in your balance sheet statement.

2. Present your assets. Classify you assets into current and noncurrent assets. Current assets are cash; cash equivalent; assets held for collection, sale, or consumption within the entity’s normal operating cycle; or assets held for trading within the next 12 months. The rest are considered noncurrent assets. From our adjusted trial balance, our current assets include cash, accounts receivables and prepaid expenses. Take note that we have grouped the prepaid rent (P15,000), prepaid insurance (P11,000) and unused computer supplies (P45,000) into one account, that is, prepaid expenses totaling P 71,000. On the other hand, our noncurrent assets only consist of computer equipment and its accumulated depreciation. This results to a net carrying amount of P98,333 for the computer equipment.

3. Present your liabilities. After we’re done with the total assets, next are the liabilities. Liabilities should also be classified as current and noncurrent. But in our example, we only have current liabilities. Our current liabilities include accrued expenses, loans, and income tax payable. After presenting our total assets and liabilities, our balance sheet already looks like this.

4. Add the owner’s equity. The balance sheet is an equation of “Assets = liabilities + equity”. Thus, we need to add the owner’s equity in the “liabilities and equity” section of our balance sheet. The owner’s equity presented may only show the ending balance, that is, the ending balance amount shown in the statement of changes in owner’s equity. This amount is already the result after adjusting the investments, withdrawals, net income (loss) for the year, and other adjustments from the beginning balance of the owner’s equity. After, presenting the owner’s equity, our balance sheet will already look like this.

Note that the “total assets” and the “total liabilities and owner’s equity” must be balanced. Also remember that this is only an example of a balance sheet for a single proprietorship business. Other forms of businesses, such as partnership and corporation, may have different presentation in the equity section of the balance sheet. Furthermore, the term balance sheet is amended to statement of financial position by IAS 1 (International Accounting Standard) in 2007. Hence, if your country is covered by this standard, the statement of financial position is a more appropriate term than the balance sheet. But for the purpose of this example, we have used the term balance sheet, since it is the most common and most searched term on the Internet. Also remember that in a complete set of financial statements, accounts in the balance sheet are also cross-referenced to the accompanying notes to financial statements. This article is only a quick guide to preparing a simple balance sheet for an individual or a single proprietorship business.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi. I would like to ask a latest statement of Equity format and statement of cash flow format in merchandising.

i wold like to be updated on this once you got this answer to your question as soon as possible. furthermore, how can i know that my equity is balanced? beside, i would like to know the liability in our given example.