A trial balance is an internal accounting statement prepared to check the accuracy of the company’s accounting records. As the “trial” on its name suggests, it is made to check if there are errors committed during the accounting process, which involves journalizing and posting entries to the general or subsidiary ledgers. The trial balance must be balanced. Though, balancing is not an absolute confirmation that the records are already accurate. Trial balance is prepared every end of the accounting period, which can be annually, quarterly or even monthly. It gets data from the ledgers. Thus, if your ledgers are accurately prepared, you’ll most likely come up with a fair trial balance statement. The trial balance is not final – obviously, it’s a trial statement. Adjusting entries shall still be made, recorded and reflected to correct the accounts on it. The company’s trial balance gives users a quick picture of its financial condition and performance. Once the adjusted trial balance is made, financial statements (i.e., balance sheet, income statement, cash flow, and statement of equity) can be prepared out of it. In this post, we will have a simple discussion on how to prepare a trial balance.

We have already discussed how to record entries in the general journal and how to post entries to the general ledger (please go and visit the two links for your reference). If you’ve read and followed those two articles, then you will find it easier to understand how to prepare a trial balance. This is because the trial balance uses the information from the general ledger accounts. Here are the steps on preparing a simple trial balance.

Prepare a trial balance format

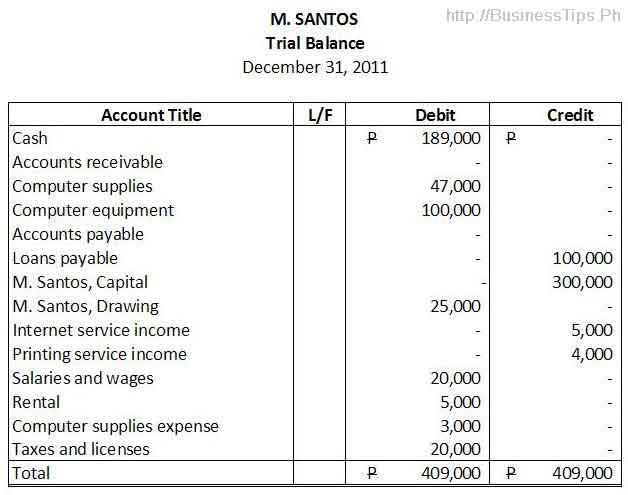

The following is the trial balance we have prepared from the general ledger accounts’ balances in our previous article.

The trial balance above is prepared using MS excel. Thus, you can make it on your own. It is composed of the following:

a. Header – This consists of the name of the entity or company, name of the statement (trial balance), and the date of the reporting period.

b. Account titles – These are the accounts shown on your general ledger (e.g., cash, accounts receivable, et cetera).

c. Ledger folio – This is the reference number from the ledger accounts.

d. Debit column – The account’s balance in the ledger when it results to a debit amount of balance.

e. Credit column – The account’s balance in the ledger when it results to a debit amount of balance.

f. Total – the totals of the amounts in the debit and in the credit column. The two should be equal or balanced.

Actually, a trial balance is just like a statement or a summary of your ledger account balances.

Fill up the account title column

To begin with your trial balance preparation, fill in your ledger accounts in the “account title” column according to the following order: asset, liability, equity, income, and expense. If you’re maintaining a chart of accounts, you can also base your account titles on that chart. Remember to be consistent in using your account titles.

Post the accounts’ balances

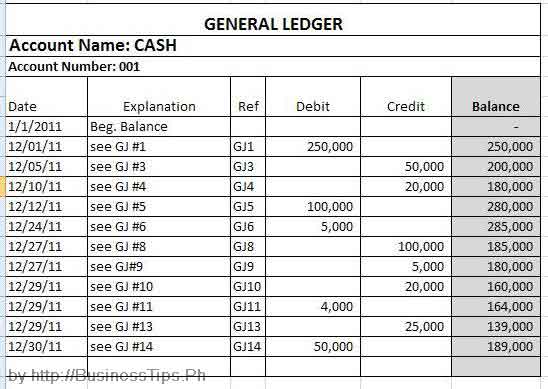

The debit and credit columns in the trial balance reflect the balance amounts of the accounts in the ledgers. To fill up the debit or credit columns, just extract the balance of the corresponding account from the ledger. For example, since our balance in the cash ledger resulted in a debit balance or a positive balance of P189,000 (please see image below), the cash account in the trial balance will also reflect a debit balance of P189,000. Remember that the natural balance of cash is a debit amount. Thus, when it shows a positive balance, it means it’s a debit balance. You can also fill up the reference number of you ledger account to the trial balance for easy referencing and indexing.

Do this for your other ledger accounts. If the balance of the account in the ledger is credit, then reflect the amount in the credit column of the trial balance. Asset and expense accounts naturally have debit balances, while liability, capital, income, and contra asset accounts (ex. depreciation) naturally have credit balances. In our ledger examples, debit balances are those with positive balances, while credit balances are those with negative balances.

Balance the totals of your debit and credit columns

After posting the ledger balances for all your accounts in the trial balance, it’s time to compute and foot the total of the debit column to the total of the credit column. The two totals must be equal. If they will result in different amounts, there must be an error in your posting. Hence, you should review your process to make sure that you have correctly reflected the ledger balances to the trial balance. Once they become equal, you can already have your trial balance. However, agreement of the totals in the debit and credit columns doesn’t mean your financial records are already error-free. A trial balance may still contain errors even if it is already balanced. Some of these possible errors include omission of a journal entry, double recording of entry, and recording or posting to the wrong account. These errors need to be adjusted and corrected. This is what we will discuss in our next posts which are about recording adjusting journal entries and about the preparation of adjusted trial balance. So please stay tuned.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Please tell me me what is the account used for the profit shares disbursed?