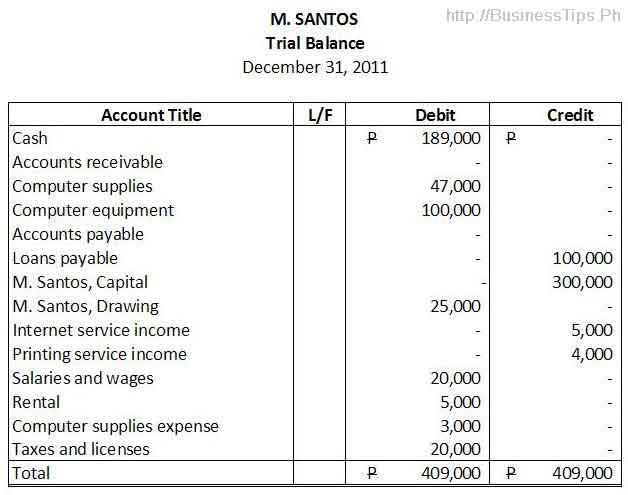

The trial balance is an internal report, listing all the account titles and their balances from the general ledger. It is prepared at the end of accounting period to check errors in the accounting cycles, which include identifying transactions, analyzing them, recording journal entries, and posting them to the ledgers. In our previous article titled “how to prepare a trial balance”, we have discussed the preparation, purpose, parts, and other important things we should know about the trial balance. We have also shown the following sample of an unadjusted trial balance as our example.

The trial balance should be balanced, otherwise, there could be mistakes that should be adjusted and corrected. However, the fact that a trial balance is balanced is still not a definite confirmation that the accounts’ balances are already accurate. There might be other events that need adjustments. Adjusting entries may include accrued revenues, accrued expenses, unearned income, prepared expenses, depreciation, change in accounting estimate, and prior period errors.

Adjusting entries are recorded in the general journal just like other regular transactions. They are then posted to the ledger just like other journal entries to reflect the adjustments and correct their balances. To prepare an adjusted trial balance, you need to reflect those adjusting entries to adjust the account titles’ balances shown in the trial balance. To illustrate, let’s take a look at the following examples of adjusting journal entries from our previous post (debits are shown in the right; credits are in the left).

AJE #1

Depreciation expense P 1,667

Accumulated depreciation P 1,667

To record depreciation expense for the month of December (P100,000/5years/12months)

AJE #2

Internet and communication expense P4,000

Accrued expense P4,000

To record Internet and communication accrued as of December 31, 2011

AJE #3

Water and power expense P5,000

Accrued expense P5,000

To record water and power expense accrued as of the end of accounting period

AJE#4

Computer supplies expense P2,000

Unused computer supplies P2,000

To correct balance of unused computer supplies as of December 31, 2011 (P47,000 – 45,000 = P2,000)

AJE#5

Cash P50,000

Accounts receivable 60,000

Internet service income P60,000

Printing service income 50,000

To correct erroneous recording of Internet service income on account, reflecting the P60,000 that was erroneously omitted (P66,000 – 6,000 = 60,000) and to record omitted P50,000 printing service income on cash.

AJE#6

Interest expense P844

Accrued expense P844

To accrue interest expense for 19 days – Dec 12- Dec 31 [(P100,000×16%/360)x19days=P844.44]

AJE#7

Prepaid rent P15,000

Cash P15,000

To record the unexpired rental fees paid (January to March with P5,000 each month).

AJE#8

Insurance expense P1,000

Prepaid insurance 11,000

Cash P 12,000

To record payment of insurance and the corresponding expense for the month of December (P12,000 x 1/12 = P1,000)

AJE#9

Taxes and licenses P5,000

Accrued expense P5,000

To accrue taxes and licenses as of December 31, 2011.

AJE#10

Income tax expense P75

Income tax payable P75

To record 2011 income tax due and payable

The adjusting entries are recorded in the general journal and then posted in the ledgers. When forwarded in the trial balance, it would look like this :

The debit and credit entries are entered in the adjustments columns. The AJE numbers are also indicated to facilitate referencing. The adjusted trial balance will help us in the preparation of our balance sheet (statement of financial position) and income statement. Our next posts will tackle on the preparation of these financial statements. If you have any questions, please feel free to use the comment box below. Thank you and see you in our next posts.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Am afraid you omitted to include the final result.

“The adjusting entries are recorded in the general journal and then posted in the ledgers. When forwarded in the trial balance, it would look like this :”

A blank space follows instead of showing the final Adjusted Trial Balance.

Please can you edit the above?. Thank you.