If you own a business or providing professional services, you need to know if you are making profit or incurring loss. You need to take a look if your business is generating more revenues than your total expenses. This financial information is found on the income statement. The income statement is also called profit and loss statement or statement of financial performance. It reports the net income or net loss for the accounting period. If the balance sheet tells us the financial condition of a business as at the end of reporting period (e.g., as of December 31, 201X), the income statement tells us the financial performance of a business for a certain reporting period (e.g., for the year ended December 31, 201X). Business owners, managers and investors look into the income statement to view the company’s profitability and make important financial decisions. For the government, it is also where income tax can be based, with some reconciling factors.

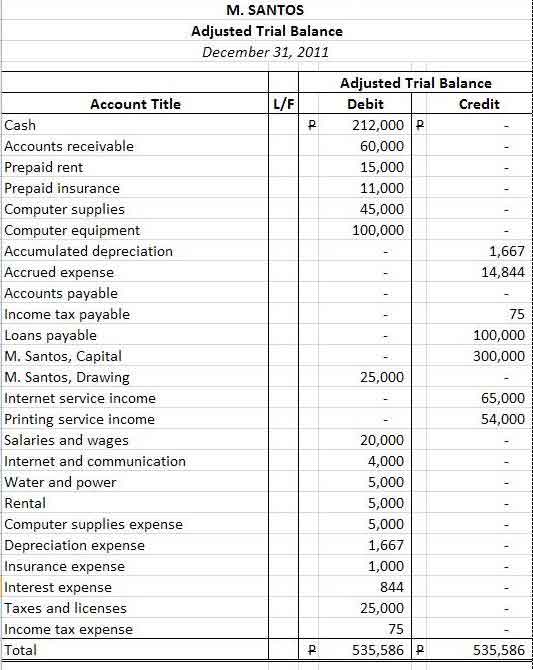

In this post we will discuss how to prepare a simple income statement for an individual or a single proprietorship service business. We will also use the examples we have tackled in our previous accounting articles, covering journalizing, posting to the general ledger, preparation of trial balance, adjusting journal entries, and preparation of the adjusted trial balance. Please read the mentioned articles to supplement your understanding about the different accounting steps. After the adjusted trial balance is done, we can already prepare our income statement and balance sheet. Below is the adjusted trial balance from our previous discussions. Our income statement will be based on this.

Steps on preparing an income statement

The following are simple guides and steps on how to prepare our income statement from the adjusted trial balance above.

1. Put the heading. The heading includes the name of the entity (individual or company), name of the financial statement (income statement), and the reporting period (e.g., for the year ended December 31, 2011). Some complex forms of businesses may include a more detailed heading, such as when reporting a consolidated income statement and or when presenting comparative years. Below is the simple heading in our income statement prepared from our sample adjusted trial balance. You may also indicate the local currency (e.g., Amounts in Philippine Pesos) used in your income statement.

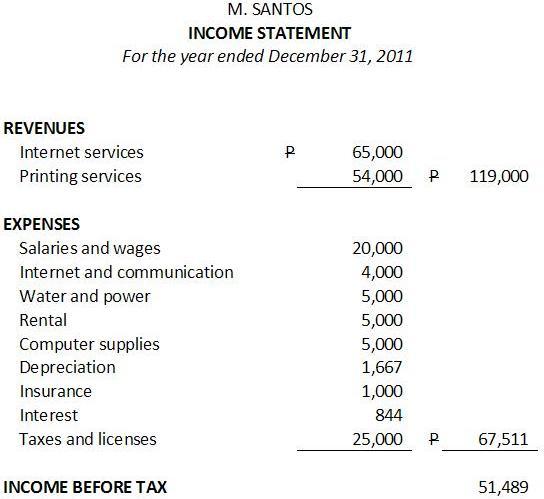

2. Present the revenues or sales. Since our example represents a service entity, we use the term revenues. Merchandising companies that sell goods use the term sales instead of revenues. In our sample adjusted trial balance, our revenues include Internet services (P65,000) and printing services (P54,000), with a total of P119,000.

3. Present your expenses. The next step is to present our expenses and subtract their total to the total revenues to get our income before income tax. From the sample adjusted trial balance, our expenses with a total of P67,511 (excluding income tax), consist of salaries and wages, internet communication, water and power, rents, computer supplies, depreciation, insurance, interest, and taxes and licenses. Our income before income tax equals to P51,489 (P119,000 – P67,511).

4. Compute the net income. To arrive at the net income, we need to subtract our income tax expense from our income before tax. Based on our adjusted trial balance, our income tax expense amounted to P75. Hence, our net income is equal to P51,414 (P51,489 – 75). After doing the steps above our simple income statement will already look like this.

Things to remember:

1. The income statement and balance sheet can also initially be prepared directly from a worksheet with the adjusted trial balance. Thus, in our sample adjusted trial balance, you can add columns for balance sheet and income statement balances. All you need to do is to forward the account titles’ balances that should be presented in the balance sheet and in the income statement.

2. The net income amount at the bottom of our income statement is what we will forward in the “income for the year” in the statement of changes in owner’s equity.

3. After the amendment of International Accounting Standard (IAS) 1 in 2007, the term statement of comprehensive income is used instead of the income statement. However, income statement is retained in case of a two-statement approach.

4. When a business results in a loss, the statement is sometimes called “statement of loss”.

5. For corporations, the earnings per share may also be required to be presented in the statement of income.

6. For consolidated income statement, the earnings attributable to the parent entity and attributable to the minority interest are also shown in the consolidated income statement.

7. Other industries, such as merchandising, manufacturing and other complex forms of businesses may have different presentations of income statement.

8. In a complete set of financial statements, material accounts in the income statement are indicated with notes and cross referenced to the accompanying notes to financial statements.

For the preparation of a simple balance sheet or statement of financial position, please read our post “how to prepare a balance sheet.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

As to what nature of business is this form most applicable?