In line with the government’s policy of providing fast and convenient manner of transacting with government offices, the BIR being one of the government agencies with a very important role in nation building, conceptualized and introduced eFPS (eFiling and Payment System) in 2001 to make the filing of tax returns and payment of taxes convenient for taxpayers through a much faster processing and immediate confirmation of tax returns filed and paid.

With the eFPS, taxpayers can avail of a paperless tax filing experience and can also pay their taxes online through the convenience of internet-banking service via debit facility from their enrolled bank account. In addition, since eFPS is available on the internet, taxpayers can file and pay their taxes anytime and anywhere, at their own convenience, as long as they are using a computer with secured and stable internet connection.

eFPS is available to all taxpayers with e-mail account and internet access who are registered in the BIR Integrated Tax System (ITS). Taxpayers who would like to avail of the eFPS shall register in accordance with the provisions of the applicable regulations, circulars and orders.

The following enrollment procedures shall be observed by all qualified taxpayers:

A. Enrollment of New Accounts

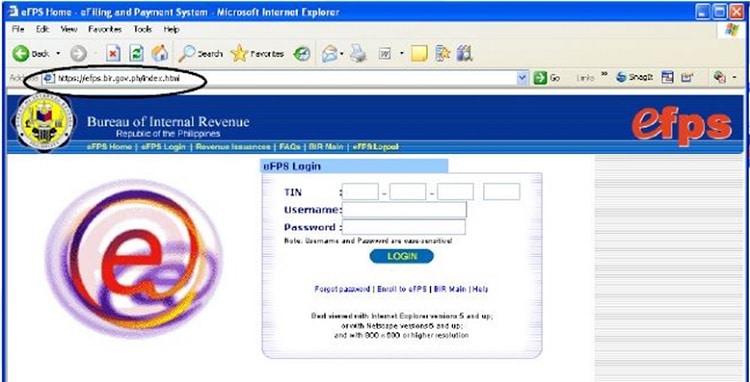

1. Access the BIR eFPS Login Screen. The following are the two (2) ways to access the Login Screen:

a. From BIR website: http://www.bir.gov.ph

b. Direct to eFPS Login Screen by accessing https://efps.bir.gov.ph/index.html.

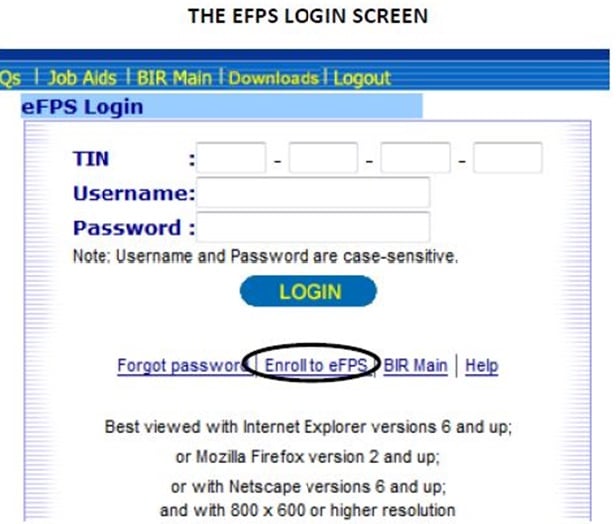

2. Select “Enroll to eFPS” to proceed to the Enrollment Form Screen.

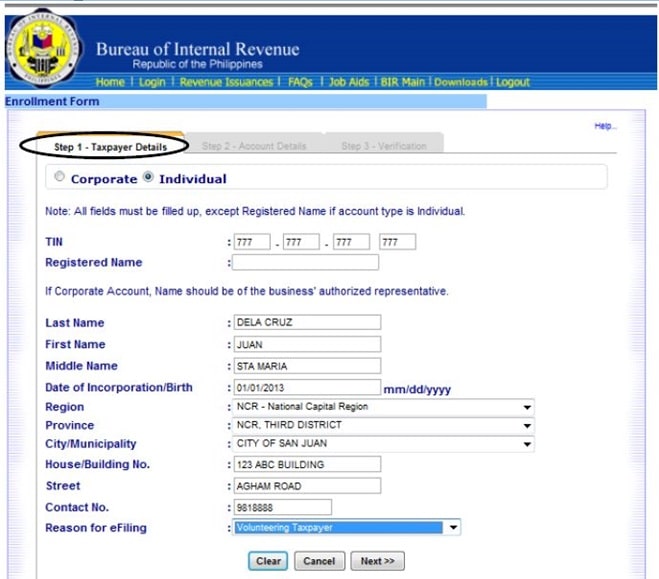

3. The eFPS enrollment form has three (3) parts:

3.1. In the Taxpayer Details part, the enrollee must supply his profile information such as:

1. Selecting if the taxpayer is an individual or a Corporate user

2. Taxpayer Identification Number (TIN)

3. The Registered Name of Taxpayer (for Corporations only)

4. Last Name, First Name and Middle Name of the authorized user

5. Date of birth (in mm/dd/yyyy format)

• For Corporate users: Date of Incorporation

• For Individual users: Taxpayer’s Date of Birth

6. Registered address of the Taxpayer

• The Region (to be selected form the drop-down list)

• Province (to be selected form the drop-down list)

• City or Municipality (to be selected form the drop-down list)

• House / Building No.

• Street Name

7. Contact Number

8. Reason for e-Filing (to be selected form the drop-down list)

9. Click NEXT to continue.

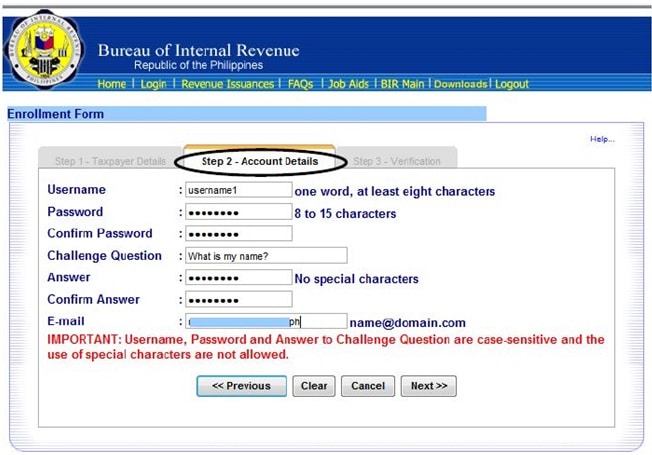

3.2. The second part of the enrollment form is the Account Details wherein the user is required to supply the following information:

1. The desired username (one word, should be at least 8 characters)

2. The desired password (8 to 15 characters)

3. Challenge Question

4. Answer to the challenge question (no special characters)

(NOTE: Username, Password, and Answer to Challenge Question are case-sensitive and use of special characters is not allowed.)

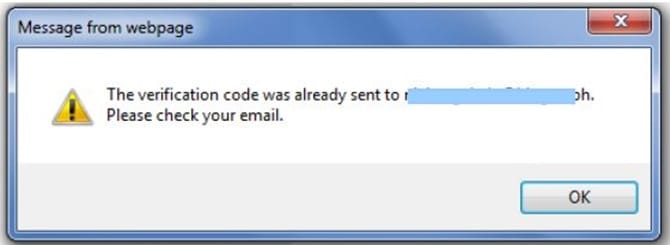

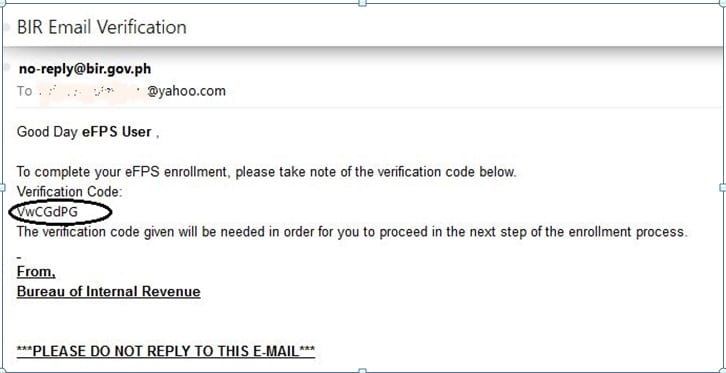

It is necessary to indicate a VALID EMAIL ADDRESS where the system will send the VERIFICATION CODE to be supplied in the next portion.

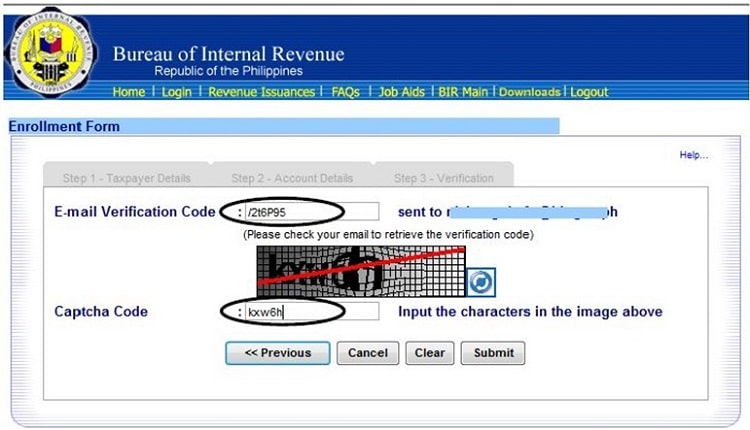

3.3. In the Verification portion of the Enrollment Form, supply the EMAIL VERIFICATION CODE as stated in the e-mail. Then, input the CAPTCHA CODE and click on “SUBMIT”.

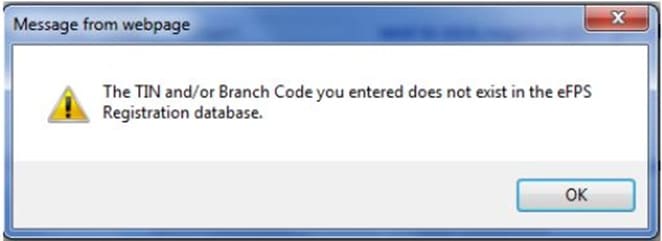

4. If the message box below appears, it means that your TIN is not yet pre-loaded in the eFPS Registration database. Pre-loading of TIN is one of the pre-requisites in the eFPS availment. You must coordinate with your RDO by submitting a Letter of Intent. Once done, you may fill-up the enrollment form again.

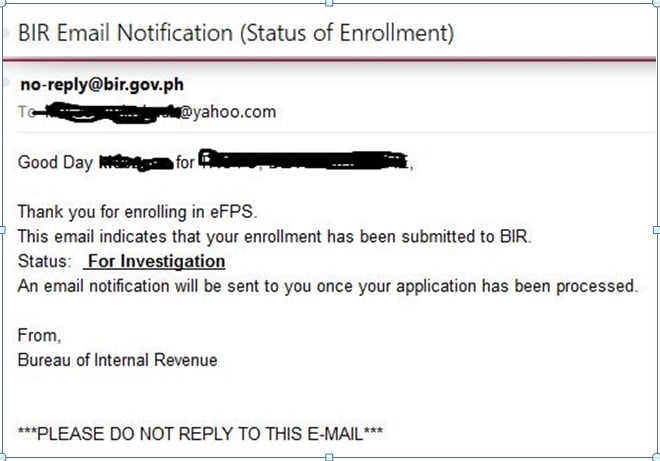

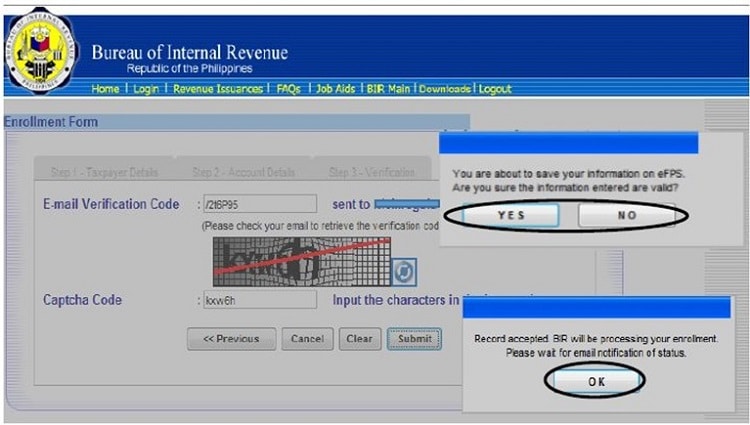

5. If you have submitted the Enrollment Form successfully, a subscreen with the following message will pop-up “Record accepted. BIR will be processing your enrollment. Please wait for email notification status.”

6. Print the email notification status from the BIR.

7. Submit all the necessary documents to the respective RDO having the jurisdiction for account activation.

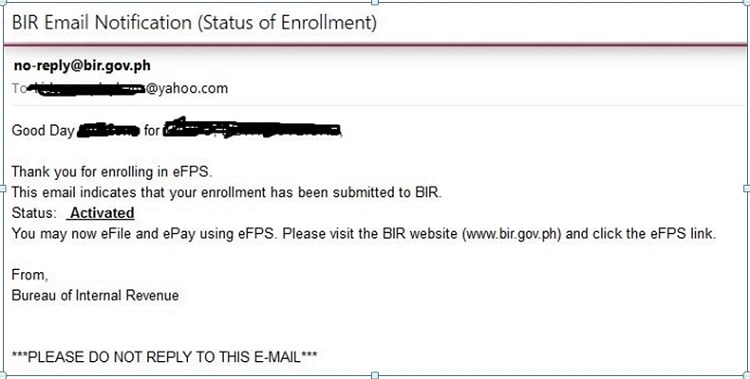

8. Receive an e-mail notification (within 3 to 10 working days) from LTAS/RDO-TASS indicating the status of application.

9. When account is activated, taxpayer may start filing tax returns. In addition, eFPS enrolled taxpayer is required to maintain an online banking facility with any authorized agent bank (AAB) where he intends to pay through the bank debit system.

B. Enrollment of Additional Users for Existing Corporate Accounts

For Corporate taxpayers, enrollment of a maximum of three (3) usernames associated to a single TIN and Branch Code combination is allowed. The following steps need to be carried out:

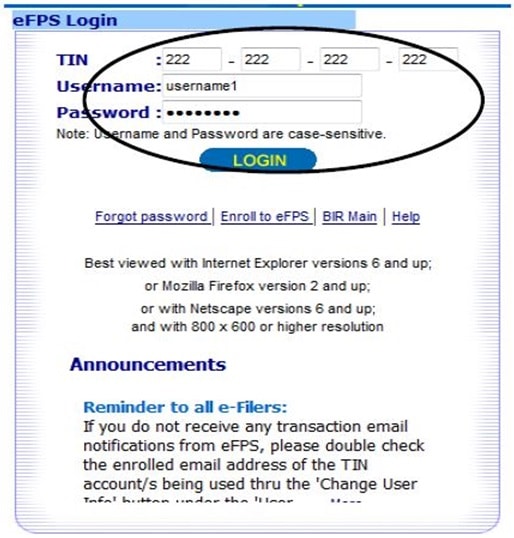

1. The primary user shall access the BIR eFPS Login Screen. Refer to Scenario A Step 1.

2. Enter the following data in the TIN, Username and Password field as defined during the enrollment process.

3. Click on the “LOGIN” button.

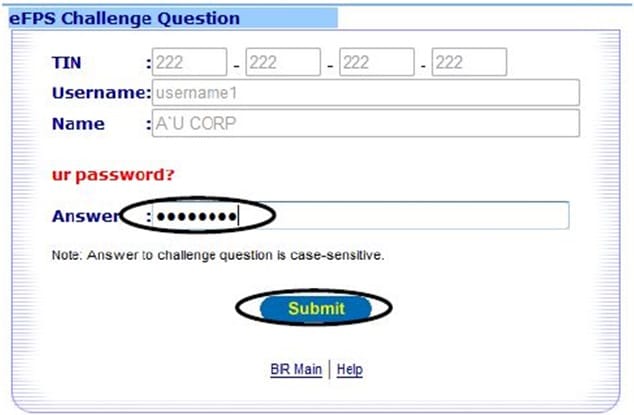

4. Enter the answer to the challenge question. Then click “SUBMIT” button.

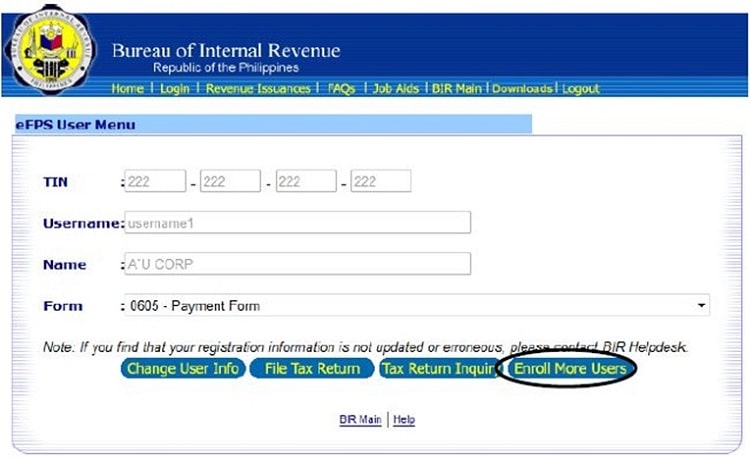

5. Click on “Enroll More Users” at the bottom of the screen.

6. The online Enrollment Form screen will now be displayed. Take note that the field for the TIN and the Registered Name of Taxpayer are already pre-filled. The additional user may now fill-up the enrollment form in accordance with the same procedures provided for in Number 3 of Scenario 1.

7. After “SUBMIT”, you may either proceed or cancel your enrollment. If you click on button, the focus will stay on Step 3 – Verification screen.

If you click on the “YES” button, a message box will appear on the screen informing you that your enrollment has been received for processing. Click “OK” to proceed. User is then returned to the User Menu.

If you have already reached the maximum number of enrollees, the Enrollment Form will not be accepted.

8. Submit the necessary documents to the respective RDO.

9. Wait for an email notification.

What are the requirements to enroll in BIR eFPS?

- A computer with a secure and stable internet connection.

- An internet browser installed such as Microsoft Internet Explorer version 6 or higher, Mozilla Firefox version 2 or higher, or Netscape Navigator version 6 or higher.

- Valid email address.

- Taxpayer must be registered with the BIR Integrated Tax System.

- For juridical entities or artificial persons, enrollment shall be made by the officers required by law to file returns. Thus, for domestic corporations, submit a Board Resolution authorizing any two (2) officers designated to file the return under Section 52 (A) of the Tax Code (president or other principal officer and Treasurer or Asst. Treasurer of the Corporation; the managing partner of the Partnership; managing head for Joint Venture; and the country manager for resident foreign corporation) who shall enroll for the system usage to the Large Taxpayer Assistance Service Section / Revenue District Office – Taxpayer Assistance Service Section (LTAS/RDO-TASS)

- Letter of intent to enroll with eFPS and any accredited agent bank.

- Photocopy of Valid IDs of authorized representative(s).

- Printed email notification from the BIR.

- Enrollment with any eFPS Authorized Agent Bank (eFPS-AAB) for use of their e-payment system, in accordance with the bank’s procedures.

Can a taxpayer enroll more than once?

NO. Enrollment is done only once per company. However, once the initial user is activated, he/she may enroll additional users following the procedures in Scenario B.

For corporate taxpayers, enrollment of a maximum of three (3) usernames associated to a single TIN and Branch Code combination is allowed. For individual taxpayers, only one (1) username is allowed to a single TIN and Branch Code.

What to do when eFPS user forgets password and other necessary information?

In case taxpayer forgets necessary information such as the Username, Password, and Answer to Challenge Question, the following procedures must be undertaken:

- Submit written request to BIR for re-enrollment in case taxpayer forgets the necessary information or there is a change in the corporate authorized signatory (RMO 5-2002).

- Receive communication by e-mail from LTAS/RDO-TASS that their request for re-enrollment has been approved.

- Perform the procedures in Scenario A, after approval of the re-enrollment request, if the reason for re-enrollment is the change in the corporate authorized signatory.

- Receive an e-mail notification (within 3 to 10 working days) from LTAS/RDO-TASS indicating the status of their application.

What are the possible reasons / grounds for the rejection of the enrollment?

There may be several reasons / grounds for the rejection of enrollment, these include, but not limited to the following:

- Upon investigation, taxpayer was found to be bogus;

- E-mail address does not exist; and

- Persons enrolled is not authorized by President of the Corporation / Head Office.

Is the eFPS user allowed to change password?

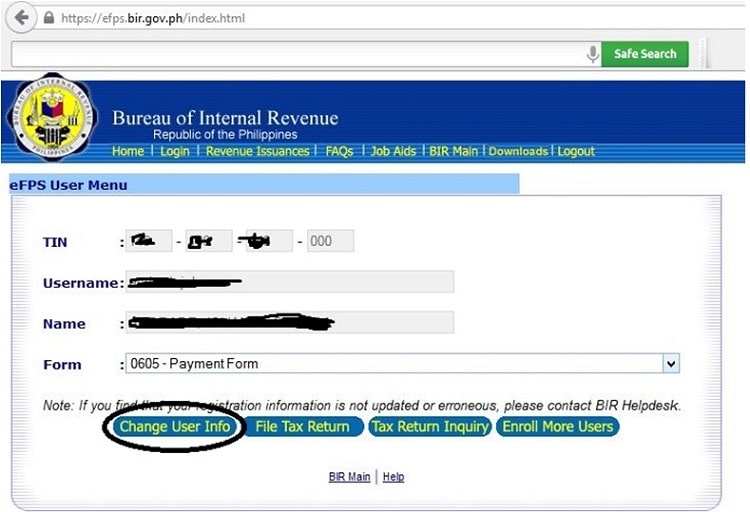

Yes, eFPS user is encouraged to change the user password regularly for security purposes using the Change User Info facility.

For more information about eFiling of taxes in the Philippines, please read my article “How to file tax returns online in the Philippines.”

Disclaimer: This article/guide is for general information use only and doesn’t constitute professional advice. Moreover, new and subsequent laws and tax rules may render whole or part of this article obsolete. If you see any errors, please contact us to correct them. For more information, please visit the Frequently Asked Questions (FAQ) page of BIR’s eFPS or visit the nearest RDO in your area.

Ethel Jayne Perez is a CPA in public practice, a tax consultant and a former CPA Review Instructor. She is an alumna of the University of the Philippines Visayas Tacloban College.

Hi Ma’am can i ask if a newly pass CPA can practice public accounting?

No not yet until that CPA had acquired MEANINGFUL EXPERIENCE in public practice for 3 years. I think 2 years as a Junior auditor and 1 year as a Senior Auditor. Try to search it in google for further details :))

good evening sir/madam, i’m trying to enroll on eFPS but to no avail.could you please help me on this since i have to file on or before the 20TH of this my income tax according to the BIR employee and what have been discuss on the seminar.yhanks and more power

Hi Eliseo,

Please be informed that not all taxpayers are mandated to enroll and use the eFPS facility. If you are a newly-registered taxpayer, you may opt to use offline eBIRForms package. Kindly refer to this page http://businesstips.ph/how-to-file-tax-returns-online-in-the-philippines/

Good Afternoon Sir/Madam,

I want to ask, how to change the password in efps? because we forgot the password and username as well. May we request to change of password?

Thank you so much for your help.

sincerely,

Eric Abasolo

Good day.

Our agency TIN number/Branch code is does not exist in efps database, Can we

submit our Letter of Intent to RDO electronically?

sincerely

Ferdinand

Good day Ma’am/Sir,

Im trying to enroll in EFPS but the TIN number/Branch code does not exist in efps database, can I submit the Letter of Intent to RDO online?

Hi Angelie,

Yes you have submit first Letter of Intent and Board Resolution to your Specific RDO.

This would be your first registration to efps system tru the RDO. After that, if they allow that your ,gonna move into next level, you may start to register in efps.

Thank you

hi ma’am.. I tried to enroll in the efps and has been in step 3 so far. but everytime i click submit the dialogue box say ” the user type is incorrect. what does this mean? thanks

Hi po . What are the contents po of the Board Resolution pertaining to this po . Authorizing any two (2) officers designated to file the return under Section 52 (A) of the Tax Code (president or other principal officer and Treasurer or Asst. Treasurer of the Corporation; the managing partner of the Partnership; managing head for Joint Venture; and the country manager for resident foreign corporation) who shall enroll for the system usage to the Large Taxpayer Assistance Service Section / Revenue District Office – Taxpayer Assistance Service Section (LTAS/RDO-TASS) Thank You and Hoping for immediate response .

I tried to enroll to EFPS, but I can’t proceed to Step 2 account Details, It says here that the TIN you entered does not exist, but all the Info in step 1 are correct. What should I do?

Hi Ms Jessa,

before you enroll to EFPS you must submit Letter of Intent and Board Resolution to your RDO for your registration. If they allowed your letter that’s the time you will register in EFPS. If it’s not working try to contact your Rdo for assistance.

Thank you.

Hi! Good day M’m, I tried to enroll in eFPS, 1-3 steps are done but until now i haven’t yet received the code to finalized my application. Can I enroll it over again until I received the CODE?

Thanks and more powers.

Hi,mam activated napo eFPS Namin .. What’s the next step ? We’re applying for BIR ICC

i am done with the step 3 but i coundt proceed beacuse the dialogue box says the user type is incorret what should i do?

previous accoutant left company and i didnt know the id & password. how can i reset this id & password?

And also i heard that if we didnt use efps after register, there is penalty 25% base on off line paid amount. Is is true ?

Please ask assistance from BIR IT personnel for the retrieval of account details, you need to gain access with the associated email address.

Further, please take note that non-usage of eFPS after your registration constitutes failure to file tax returns, and shall be subject to penalties. In addition to that, filing a tax return in a manner not in compliance with existing regulations tantamount to wrong venue filing subject to civil penalty of 25% of the tax due.

Hi po. Id like to ask if i can change the “reason of eFiling” from “large taxpayer” to “bidder” because our purpose is to get a tax clearance for bidding that is why we enroll to efps. My status now is for verification. tnx..

I submit my requirements for efps last january 25 2017.until now i cannot proceed to enrollment of efps because it always say’s that my TIN are not in the data base.what should I do?thanks!

Hi Angie,

Please verify with your RDO if your TIN is already uploaded in the eFPS database before you proceed with online enrollment.

Hi ma’am, thanks for your guide, so helpful but for some reason I cant proceed to step 2. I’m trying to enroll to eFPS as corporate. what will be the category i should use under “Reason for eFiling”? I need to successfully file online for “no transaction” return, else we’ll pay another penalty for this month. I’m lost. Your help will be greatly appreciated. Thank you

Hi,mam good day .Ask q lang po,Dapat bo mgenroll first sa bank before magregistered sa EFPS,kasi ngenroll-naapproved po ako sa Efps(Oct.10,2016)at naapproved yung application namin sa bank na mguse ng Efps is (Jan 2017) pa mam.My problem po is makakapenalty ba ako pg hindi ko ginamit yung efps agad since matagal na approved yung application namin sa bank dahil sa requirements ng bank.Hope you could help me with this matter mam.Huhuhu so confused po talaga sa pag iisip nitu.

Hi Mam Ethel,

Doon sa enrollement sa eFPS, tanong ko lang kung anong appropriate selection sa “Reason for eFiling”. I have recently registered my “Residential Apartment for Leasing”, as an owner, this February 2017. I am not sure what is the appropriate selection. I haven’t had the chance to visit my RDO to clarify.

Appreciate your assistance.

Hi, we are a foreign supplier that registered with PHILGEPS. May I know is foreign supplier can register with EFPS system? We do have tax clearance and TIN number. But how about the oversea bank whether can be linked with EFPS?

Hope to hear from you soon. Thank you.

Hi,

I’m trying to pay my tax via Gcash, it’s asking me for my RDO 5-digit code. My BIR issued certificate of registration bears 007 040 (issued by RDO 040).

What should I encode ?

Our company has diffeent branches which means different RDOs. Will i need to register them all? I want pay online all of our branches.

Thank you

Hi,

Yes, all branches must be registered at their respective RDOs. You may check the RDO of your head office, to confirm if you can consolidate your filing and payment of taxes.

Or you can do the easier way: Taxumo.com. Trust me it”s better than the efps… #protip

Hello po, tanong ko lang po sana kung papano gamitin ang eFPS para mag file ng withholding tax, sabi po nila ito raw po ang gamitin namin para maka-iwas po kami sa penalty. tax exempted po kasi kami.

Hi Ma’am,

The BIR sent us collection notice due to not enrolling to EFPS after requiring us to enroll. But according to the previous accountant, she already have enrolled and passed the corresponding requirements to the BIR. However, she has not received any email that our efps account is already activated. The only email she received is the status that our account is “for investigation”. What is our best remedy to waive the penalties they are imposing to us? Thanks.

Hi, to waive the penalties is up to the BIR. That is why it is always important to follow up with the BIR with the requirements they are asking. For the activation of efps, it’s always good to keep in touch with BIR to make sure that you EFPS enrollment is complete.

Hi, same scenario with us, we enrolled and no notification from BIR that our enrollment was activated, until such time the sent us collection letter for wrong venue (means we must use epfs, but how if can’t open it?) I tried to coordinate with our RDO assigned to efps, he said he cancelled our enrollment and asked to enroll again. But the collection department insisted to pay the penalties on our 1st enrollment even if it was rejected/cancelled. Now we can’t still use efps, until such time we paid the penalties.

Hi po…gusto ko komoha nang tax clearance…..anu ba requirements po? di po require ang efps?

Hi. What’s the purpose of your tax clearance? Anyway, you can check the requirements of tax clearance in this BIR Page for whatever purpose: https://www.bir.gov.ph/index.php/tax-clearance/tax-clearance-application-form.html

hello mam/sir, my tin no is 158-509-933-000, hindi po kasi natuloy ung transport business q nadisapprove po kasi ung application q… someone told me na dapat ifile q uli sa inyo ung tin at linawin na wala nmn po trabaho at kita, hindi q nmn po kasi alam n ganon… ano po ba gagawin?

Hello. I’m sorry but we are connected with the BIR. We suggest that you personally visit the BIR RDO where you applied to clarify and resolve your issue. Thank you.

I need an accountant to sign my books to comply with BIR regulations. Would you recommend anybody? How much would be the fee? I update the entries (lease) so it is easy to check my books. thank you.

Hi. I think it would depend on the nature, size, complexity, business operation and other qualities of your business. Usually accountants will check if you’re a corporation or not, VAT or Non VAT, have bank loans or none, have special operations, and other things. We cannot really recommend anyone since it will also depend on your location.

Hello, good day! We plan to change the email address we enrolled in EFPS, should we still need to submit a letter of intent in our RDO or can we just simply change it in the “Change User Info”?

Hello. I’m not 100% sure about it, but I think you need to ask permission first with the BIR to change your email info in the online system. However, to make sure, kindly visit the BIR RDO office and confirm the requirement. Thank you.

Good Day.. Ask q lng po paano ba makkakuha ng 17.14b na tax clearance para s requirements ng Philgeps na pag uupgrade to Platinum member.. may Tax clearance npo kmi pero hndi cya 17.14b.. ano po ang kailangan nming gawin kc sole Proprietor po aq na Travel Agency.. tnx

The 17.14B tax clearance is under Exec. Order 398. You can read the requirements for BIR tax clearance for bidding purposes here: https://www.bir.gov.ph/index.php/tax-clearance/tax-clearance-application-form.html

Please visit the BIR RDO in your area for more inquiries and confirmation.

Good day. Paanu po ba iregister yung other business through efps. Nakaregister na po yung main branch code sa efps. Kailangan po ba seperate ang ang pag file sa efps po. Paanu po ang procedure. Thank you.

Hello. Yes, there is a need of separate filing for the eFPS of the branches. The procedure is the same when you filed the eFPS for the main business.

Hello,

Our company is a US company and we have a sales transaction for a company that is located in Philippines. Do we need to register to file the VAT return? If so, where we can register?

Thanks

hi po Good Day! ask ko lang po nag eenroll kasi kami sa efps ngaun pero hindi kami maka proceed kasi lagi po “USER TYPE YOU CHOOSE IS INCORRECT” ano po gagawin namin?salamat po!

ah sole proprietor po ang company namin ..

Hello mam i’m trying to enroll to efps but the system say’s (”The TIN and/or Branch Code you entered does not exist in the eFPS Registration database. Please email contact_us@bir.gov.ph”)

what to do po? when my TIN # is tama nman and other details that i given.

And about letter of intent i send already to our Branch in BIR office for this transactions.

Thank you.