Founded in the UK in 2011, Wise (formerly TransferWise) was established with the mission of making international money transfers instant, convenient, transparent eventually free. Today, Wise operates globally, serving over 16 million customers with the cheapest transfer fees and the best exchange rates – they actually use real-time exchange rates.

This guide covers everything you need to know about Wise money transfers in the Philippines, including fees, safety, speed and how to transfer money.

The Problem with Philippine Banks

The traditional banking system is not designed for international use, which makes international payments slow and expensive. Banks in the Philippines charge high fees on international transaction, such as exchange rate mark-ups.

With the Wise Account, however, Filipinos can now save time and money, while ensuring that they and their families benefit from every dollar they earn.

How does Wise Money Transfer Work

Wise is a financial technology company, not a bank. While banks use the SWIFT network to process international payments, Wise has created its own global network of bank accounts. This enables Wise to cut out intermediary costs and process transfers faster.

As well as being regulated and licensed in the Philippines by the Bangko Sentral ng Pilipinas (BSP), Wise is also overseen by a range of other global bodies, making it a safe place to keep and send your money.

Why You Should Use Wise

Once you have a Wise account you will be able to arrange international payments, or add and convert funds in your Wise multi-currency account.

Here’s a rundown of the key features you’ll get with Wise:

Receive money for free

If you are a remote worker, freelancer or independent contractor based in the Philippines, you can obtain unique bank account details in over nine different currencies, including AUD, CAD, EUR, GBP, HUF, NZD, SGD, USD and TRY, and receive money for free into your Wise Account.

You need to give your account details to clients, friends, family, or companies and get paid in one of these nine currencies directly into your Wise account.

And after that you can convert and move money from your Wise Account easily to a local bank account or e-wallet. Currently, Wise supports 8+ local e-wallets, including GCash, Maya, GrabPay, Starpay, Bayad Wallet, TayoCash, ShopeePay, and JuanCash.

Send money abroad

With a Wise account you can send money in 40+ currencies to 160+ countries. Wise show you how much it will cost to send and convert money with low conversion fees before you complete your transfer. The fee will depend on the payment method you choose and the currencies involved.

More than 50% of Wise transfers are instant and 90% of transfers are delivered within 24 hours.

Multi-currency account and card

You can enjoy the hassle-free benefit of a Multi-currency account. With the Wise borderless account, you can hold money in over 40 currencies instantly, with no holding fees or minimum balance required.

Wise card, which is an extension of Wise Account, lets you spend in 160+ countries, at the mid-market rate with low conversion fees. If you don’t have the required currency in your Wise account, Wise will automatically convert it for you at the lowest possible fee.

How to open a Wise account

Signing up is fast and easy. You initially just need to input your personal details and email and your account will be created in minutes.

Here’s how to open a Wise Account:

- Download the Wise app or head to the Wise desktop site

- Tap register

- Create an account using your email, Apple ID, Google ID or Facebook details

- Add your personal information, following the onscreen prompts

- Get verified

- Top up your account, order an international debit card or set up your first transfer

- You’re ready to go

To get verified you need to upload photos of your ID and a selfie. If your nationality is Filipino, you might choose to use:

- Philippines National ID (PhilID)

- Passport

- Driving licence

- UMID

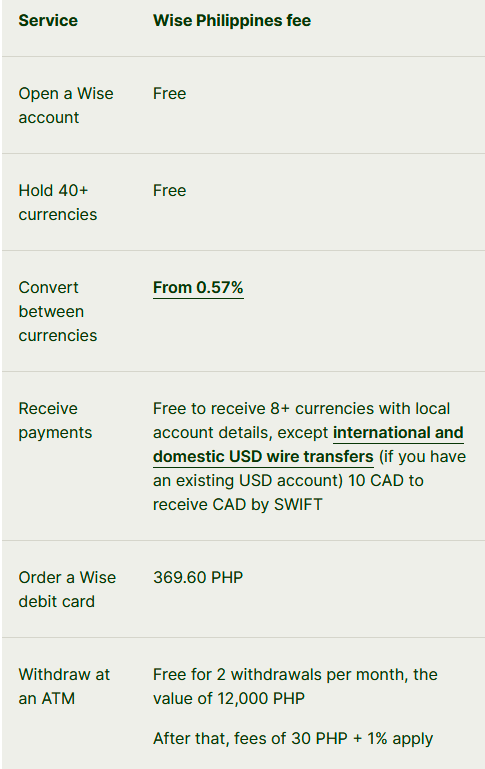

Wise Philippines fees

Let’s walk through the key fees you should know about before you use Wise in the Philippines.

Summary

Wise is an established financial technology company that offers secure international transfers and multi-currency prepaid cards at competitive rates. Customers can send money to over 160 countries in more than 40 currencies.

Although exchange rates and transaction charges are transparent, it may be possible to find cheaper deals elsewhere, depending on your specific transfer.

BusinessTips.ph is an online Business Ezine that provides free and useful articles, guide, news, tips, stories and inspirations on business, finance, entrepreneurship, management and leadership, online and offline marketing, law and taxation, and personal and professional development to Filipinos and all the business owners, entrepreneurs, managers, marketers, leaders, teachers and business students around the world.

Leave a Reply