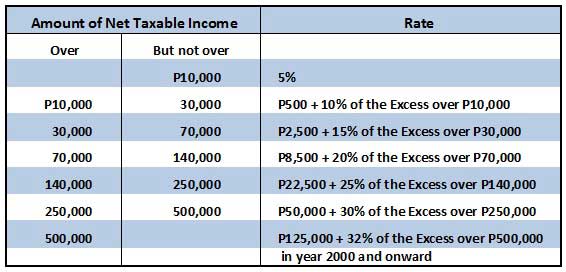

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates for individuals, which is a form of progressive computation that increases the tax rate as the taxable income increases. In other words, a taxpayer who has a higher taxable income could be subjected to higher tax rate than a taxpayer who has a lower taxable income.

The Philippine Tax Code imposes these graduated income tax rates for individual taxpayers who are:

1. Resident citizens on their taxable income from all sources within and outside the Philippines.

2. Nonresident citizens on their taxable income from all sources within the Philippines.

3. Resident aliens on their taxable income from all sources within the Philippines.

4. Nonresident aliens engaged in trade or business within the Philippines on their taxable income from all sources within the Philippines.

These rates will be based on the amount of your net taxable income, which is the net of your gross taxable income less your allowable deductions (itemized deductions or optional standard deductions) and personal and additional exemptions. Please read our post on how to compute income tax for self-employed individuals to learn more.

Take note that non-resident aliens who are not engaged in trade or business within the Philippines are taxed at fixed rate of 25% instead of the graduated tax rate on their gross amount of income derived from all sources within the Philippines.

Furthermore, aliens employed by Regional Headquarters (RHQ) or Area Headquarters and Regional Operating Headquarters (ROH), Offshore Banking Units (OBUs), Petroleum Service Contractor and Subcontractors are taxed at fixed rate of 15% on their gross income in the Philippines.

For the tax rates of individuals on their passive income, such as interest income, royalties, and prizes, please read this reference page from the Bureau of Internal Revenue (BIR) website.

Amruta is one of the writer contributor on this blog assigned to write on different topics, such as the latest business news, search engine optimization, making money online, online business promotion, social media, and the latest trends on the Internet.

Leave a Reply