How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But that day has passed by and you haven’t yet filed your income tax return. Now you want to know how much are the extra charges you need to pay for your failure to file your return on time. Penalties for late filing consist of interest, surcharge and compromise. The following are the steps and guidelines on computing penalties for late filing of tax returns with the BIR.

Computation of penalties on late filing of tax return

Let’s assume that due to economic crisis and insufficiency of available cash for payment, Mr. Pinoy did not make it to the due date in filing and payment of his annual income tax return or BIR form 1701 for the taxable year 2010 last April 15, 2011. His income tax due and payable is Php 10,000. Now he wants to finally file and pay his income tax on April 20, 2011. How much is the total penalty he needs to pay in addition to his income tax payable?

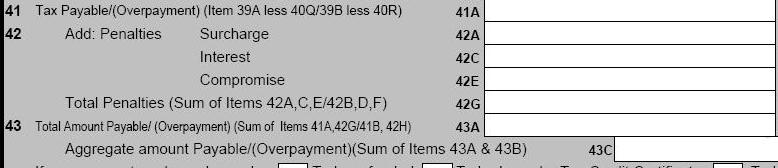

1. Firstly, take note that the total penalties equal the sum of interest, surcharge and compromise (please see image below). We will compute them one by one.

2. In computing interest, the rate of twenty percent (20%) per annum is used, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid.

In the example above, the interest is computed as follows:

Interest = Tax payable x 20% x no. of days late / 360

Interest = P10,000 x 20% x 5/360

Interest = P 27.78

Note: We use 360 days a year for conservative approach.

3. A twenty five percent 25% surcharge is imposed on a taxpayer as an additional penalty for failure to file any return and pay the amount of tax on or before the due date.

The computation of Mr Pinoy’s surcharge is:

Surcharge = Tax payable x 25%

Surcharge = P10,000 x 25%

Surcharge = P 2,500

Note: A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a) Willful neglect to file the return within the period prescribed by the Code or

by rules and regulations; or

b) In case a false or fraudulent return is willfully made.

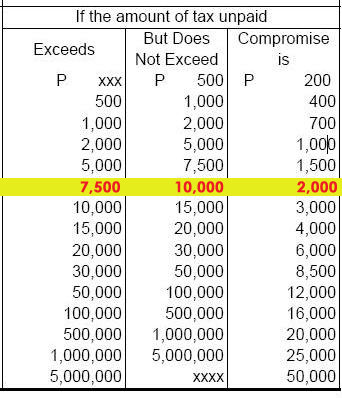

4. When it comes to the computation of compromise penalty, we need to refer to the Revenue Memorandum Order No. 19-2007 issued on August 10, 2007, which prescribes the Consolidated Revised Schedule of Compromise Penalties for violations of the National Internal Revenue Code (NIRC). For the purpose of computing the compromise penalty in our example, Mr. Pinoy’s compromise penalty is determined as follows:

Thus, compromise penalty is equal to P 2,000

5. Finally, the total penalties that should be paid by Mr. Pinoy is equal to:

Total penalties = interest + surcharge + compromise penalty

Total penalties = P 27.78 + 2,500 + 2,000

Total penalties = P 4,527.78

Therefore, the total amount of payable to be paid by Mr Pinoy, if he will pay his late income tax return on April 20, 2011 is P 14,527.78 (total income tax payable [P10,000]+ total penalties [4,527.78])

Penalty for non-filing of tax return

What if there is no tax payable to be paid in your income tax return, and you have not filed it with the BIR on the due date? How much is the penalty to be paid?

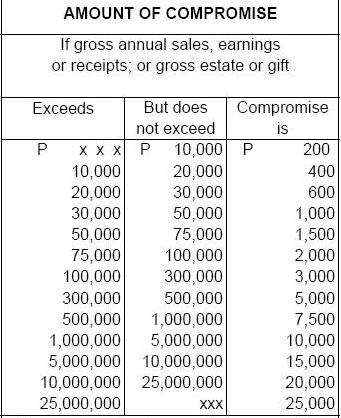

If there is no tax due in your return or you are exempted but required to file return but you have not filed it on the time required by the law, there is no interest and surcharge to be computed. However, a compromise penalty, based on your gross annual sales, earnings or receipts should be paid as determined below:

This means that if your gross annual revenue amounts to P200,000, and you failed to file your income tax return, although you have no income tax payable or even though you are exempt with NIL income tax due (but required to file), your compromise penalty will be P3,000.

You may wonder why the compromise penalty for non-filing of tax returns without tax payable may become higher than the the compromise penalty imposed on non-payment of tax returns. The first is based on gross sales/revenues/receipts, while the latter is based only on tax payable. In my opinion, it is fundamentally easy to prepare and file a tax return without payment than to prepare and file a tax return with tax payable. Hence, failure to accomplish an easier task would be a bigger sin, than failure to accomplish a harder task.

Source: Revenue Memorandum Order No. 19-2007/Revised schedule of Compromise penalty

Disclaimer: This post is for informational use only and doesn’t warrant a formal professional advice. Although, we have based the article on the most reliable resources available, we do not guarantee that the article is free from error, especially from typo-error. If you encounter any error, please inform us immediately for immediate correction. Moreover, new and subsequent laws, rulings and BIR issuances may render this post obsolete and inaccurate in whole or in part. We encourage our concerned readers to personally visit and inquire with the Bureau of Internal Revenue (BIR) in your area.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi,

I’ve been working freelance (via web for various clients) for almost 4 yrs now. I haven’t filed a single ITR in those 4 yrs. Am I still required to file ITRs for all those years? Could you pls. estimate the amount i have to pay for penalties.

I averaged about 20,000 monthly working almost 24/7.

Thank you.

Hello,

Thanks for visiting. A self-employed person (professional)like you is generally subjected to monthly business taxes (VAT or percentage tax), quarterly income tax, annual income tax and annual registration fee. Thus, it would be difficult to estimate your penalties. I suggest that you register with the BIR ASAP as a self-employed professional. Please read this guide for professionals from the BIR ftp://ftp.bir.gov.ph/webadmin1/pdf/taxguide.pdf. A BIR officer /RDO in your area can answer your other queries.

hello, im quite confused about the filing of 1601 E it should to be monthly or quaterly…? thank you

1601E should be filed monthly and not quarterly. It should be filed on or before 10 days following month end.

Hi, is the same computation of penalty applies in 1601E and 1601C filing?

Thanks.

hi…can someone help me please….in this situation…

i open up a business last july 2010 and i am required to submit monthly percentage tax and withholding tax expanded and income tax….but i failed to comply on those requirement…from july 2010 to dec 2010 i was not able to pay for those taxes that i need to pay. i want now to settle all of those that i need to file….

what my problem is i dont know where i am going to based the 20% interest as addition to my 25% surcharge based on the taxable income…..

or can someone please clarify to me how can i compute penalties?

thank you….

Hi Aiza,

You should compute your penalties per each return failed to file or pay. Example, if you did not pay percentage tax for July to December 2010, you should compute penalties for each of the monthly return, and indicate it for each of the return to be filed (there is a penalty schedule portion at the bottom of the return). The 20% interest is based on the unpaid amount of tax (tax that would have been paid if filed on time). For more clarifications, you can visit personally with your RDO in your jurisdiction. A BIR “officer of the day” will help you compute your total taxes payable, including penalties (interest, surcharge and compromise).

Hi, Vic!

In the computation of INTEREST for penalty for late payment of 2551M, do I also use the formula AMOUNT DUE x 20% x No of days late/360 days ?

Or since it’s supposed to be monthly, do I divide by 31days?

Sorry. This is the very first time I’m filling up 2551M. And I’m delayed by 25 days already.

I really appreciate the great service you’re giving us here….

Hi!

The 20% interest is the annual interest rate to be charged thats why they are using the no. days delayed over 360days or no. of months delayed over 12months. so i prefer you use the tax due x 20% x No. of days delayed/360 days.n_n

Hi Vic! Your tips are very helpful. I’m just confused on the monthly deadline…..is it right that if my business opened Mar 1 ; my 1601-e (for rental) needs to be paid on or before April 10 ? my certificate of registration was completed April 7 only. Will I start my payment on april or still march ? thanks in advance.

It is ideally better to follow the substance (actual transaction) over form (completion of the registration). !601-E for March is payable on or before April 10. You may please inquire with your local RDO to confirm this.

Thank you so much sir Vic…now i know already how to compute my penalties….my question now is that….i am a non-vat registered and i am required to submit my percentage tax….just for clarification on how i will compute it…..for month of july i will used the 2551M form same with month of aug….but how about my sept? is it the 2551M form or the 2551Q form? or is it the quarterly percentage tax is the composition of my july-sept operation?

thank you…

Hi Aiza, the usual percentage tax return is filed monthly (2551M). There is no quarterly percentage tax (2551Q) to be filed, except for these kinds of businesses:

1.Franchise grantees sending overseas dispatch, messages or conversation from the Philippines;and

2.Proprietor, lessees or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and racetracks.

Please inquire with the RDO in your jurisdiction. There maybe other new updates to this topic. Thanks.

I file my business tax monthly (2551M). I failed to file last month (August) as I missed it on my calendar. How do I compute for my penalty?

Vic. I am honestly close to tears/nosebleed whichever comes first. I hope you can help me. I’m also an online web worker. I got the services of an accountant to file my taxes. I discovered just now that the income they typed on my 2010 annual ITR is incorrect. They typed a lower figure than my actual income. That means the taxes I paid are short of the figure I should really have paid.

My question is, how can I correct this error? Will I also be subject to penalties because of this error?

Taxpayers has the right to amend their ITR until the BIR issues LA (Letter of Authority) to audit. Thus, you can file an amended ITR, reflecting your correct records. Your original ITR filed should be attached in your amended ITR. It may be charged for interest and other penalties. I’m not sure if all local RDOs have uniform rules on this. To confirm and know what are the penalties for amended return, please call or visit the nearest BIR in your area. Thanks. I hope that the accountant you mentioned be corrected.

Thank you so much Vic 🙂

Hi Vic, thank you for this post, it help me understand how surcharge and interest can be computed even for the estate tax return.. My question is: Is the first table in item 4 only applicable for late filing of income tax return? How about for late filing of estate tax return of a deceased person? Example: My grandfather died in 1990, his gross estate at that time is 100,000 so tax due at that time is 3,450.. we did not file estate tax return that time and plan to file and pay it this year so we can transfer the land titles.. I have computed the surcharge and interest based on your sample above, my only problem now is the compromise penalty.. does it mean that both the 2 tables above applies for us for late filing and not filing the return on time? hope you can enlighten me 🙂

@ Nhice

It should not be both; it should either be:

a. when you have tax payable and you didn’t pay and file on time (1st table)

or

b. when you have no tax payable and you didn’t file on time (2nd table)

When you have amount of tax payable, you automatically goes to (a). (b) is only for taxpayers who have no tax payable (e.g., tax-exempt or those with zero or negative/overpayment returns).

Take note that these article only gives you guide on the estimation of your penalties. I suggest that you visit the RDO in your jurisdiction for the exact computation of your penalties.

Thanks for all your help Vic

Hi Mr. Vic!

i would like to ask regarding late filing of 2550m. for example is deadline for manual submission for May 31, 2011 is June 20, 2011 and for e-filing is June 25, 2011(saturday) (group A).

i e-filed my return June 27, 2011(monday), due to no internet connection last June 25,2011. My VAT return for may is net input, so no payment for the said return. Will that be considered late?

and what are the consequences or penalties if ever?

thanks and more power to you.

@Shen

As there is penalty for non-payment of tax return (BIR return with computed tax payable), there is also penalty imposed on non-filing of tax return (BIR return with no computed tax payable i.e., exempt or overpayment). Please read “Penalty for non-filing of tax return” in the article above.

With regard to your failure due to no internet connection, I think it should be justified, and you should communicate with the RDO in your jurisdiction.

HI SIR VIC,

i always have a problem in coping up the deadline for filing my 1601 e & c because the cut off of the bank where i remit my tax is until 12pm only, i just want to ask if there are alternative way for me not to be penalize? a friend told me that i can still pass my 1601 e& c forms to the rdo directly that day aND show them that i already have my check ready for payment which was not accepted by the bank because of their 12pm cutoff, and i will make my payments at the bank on next banking day? is that true? how much is my penalty, for e.g., my tax liability is 15,000.00..

thanks so much if you can answer this question of mine.

please reply sir,as soon as you can,.thanks

I resigned from my previous company (Company A) this year and got hired by a new company (Company B). Company A was able to give my 2316 form for 2010 before I entered Company B. Company B made tax deductions for several months until new payroll system was implemented – that is using the Annualized Tax Table from the BIR as compared to previous payroll system that uses the monthly tax table. With that regard, Company B is now asking for my 2316 form 2011 from Company A so they could consolidate the correct tax amount due for the year. I emailed Company A and received this reply “No 2316 yet since you still don’t have final pay. Your 2316 last 2010 is already given to you.”

Company B stated that: “When we file our annual income tax return for the company, whether or not you submit to us your 2316 from your previous employer/s, we will declare you as those having more than one employer for the taxable year (January to December 2011). If you have submitted your 2316 with the company early enough for us to reconcile your tax due, at the end of the calendar year, you do not need to go to the BIR yourself to settle this on your own. However if you do not provide your 2316 on time, you will have to settle this on your own with BIR whatever is the correct amount of tax to be paid. If you do not file on time, you may have to pay necessary fines. Please take note that correct filing of taxes is a requirement of the government to which we must all comply.”

Question: If I fail to submit the 2316 (yr 2011) form to my new employer, and have to go to BIR, are there necessary documents that I need to present to be able to settle the correct tax amount? How much will be the ‘necessary fines’ if i did not file on time? How much time will I be given to file my taxes?

Thank you very much. Hope to hear your answer.

Hi Shane. To do it, you need to file a 2011 ITR and the 2316 from both A and B so you could deduct the withholding taxes from your annual income tax due. You have within April 2012 to file the 2011 annual income tax return for pure compensation income. If you file late, then, 25% one-time surcharge, 20% interest and compromise penalties will additionally be paid. I think you need not panic and there is so much time.

Hi Sir Vic,

I am really worried right now. I work in a bank, under its Trust Dept. We have this account which was assigned to me. To make a short description of the transaction:

Company X, a GOCC awarded private Company Y as joint developer for specific properties.

On the other hand, we in “Bank A” (a government bank) have a Trust Agreement with Company X to be the Trustee for the management of the proceeds of those specific properties.

Every month, Company Y collects rental fees from the merchants of those properties and sends it to us as Trustee and we are the one who issues official receipts with the merchant’s name.

Company Y is entitled of Management and Marketing Fees for doing its function. We as Trustee is the one who issues a check as payment to them with instruction from Company X.

Last October 2010, we issued a check as payment to Company Y. We were told we need to withhold taxes from their Mgt. and Mrktg fees and pay it to the BIR. The amount of tax is P 294,965.76.

At that time, I have no idea what form to use and how to file it. Is it 1601? Or 1604E?

Then do I have to submit 2307 to Company Y?

I had our accounting set up a CWT on the account’s books and the entry is named as AP-BIR. However I forgot about it and until now it hasn’t been filed yet. ?

Which form should I use and how should I fill it up? How much are the penalties already? It’ll sure be charged against me. 🙁

Thank you in advance.

Hi JA. Withholding taxes on management fees is under BIR Form No. 1601-E which you will have to file and pay not later than the 10th day of the month following the month of payment or accrual, whichever comes first. I am sad to say that you will have to be penalized for late filing – 25% one-time surcharge, 20% interest from the time it should have been filed until the time it was fully paid, and compromise penalty based on BIR table. The common remedy is to make it appear that it was not filed late by remitting the same using current date, but, I do not suggest because it may lead to a fraudulent filing that is a ground for a 50% one-time surcharge and even imprisonment. Thanks.

Hi Vic.

I know estate tax compromise penalty has been asked already. My understanding from your explanation is that if there is estate tax payable, we compute compromise penalty based on tax due (1st table); and if there is no estate tax payable but it has not been filed yet, we compute penalty based on gross estate (2nd table). I was told that this only applies to income tax? What if BIR officer insists that we base compromise penalty on gross estate, even if we already have tax payable, is there anything we can show him as basis/proof that he is making the wrong computation? Thank you so much!

Hi Mark. You may check the link for Annex A of BIR RMO 19-2007 for the basis. ftp://ftp.bir.gov.ph/webadmin1/pdf/36076Annex%20A.pdf

Thanks Ghar! BIR officer showed this penalty chart, and explained that computation will be based on gross estate. Is this like a loophole in their tax collection policies since the chart (Annex A of BIR RMO 19-2007) does not really indicate what type of tax is involved? Thanks again!

The RMO is for general application. Maybe you get back to the BIR officer and ask for another RMO specifically for Estate tax and I bet if there is another. I do not see this as a loophole on the provisions or regulations, but a loophole of implementation because officers themselves, either does not now or just make them a tool for some personal motives.

hi. i hope you can enlighten me about my problem.

my husband opened a business (practice of medical profession) with address at home last 2006. a few months later, he suffered an injury thus he stopped operation of practice at home and he has filed NO OPERATIONS monthly since until the present.

unfortunately, we werent told that even if we werent operating, we had to pay the renewal fee of 500 annually.

but we religiously filed our NO OPERATION returns at the RDO as well as the Quarterly returns.

now we are set on putting up a new practice, this time, no longer at home but at a rented unit, still under the same RDO.

how is the best way to go about this… we want to keep the practice of profession at home open, despite its non operation, as well as start a new practice elsewhere….

i hope you could help.. im having sleepless nights…

btw, DTI, barangay clearance and mayor’s permits are all done.

Hi my dad died july 13 1992 and my mom died sept 24 2006 they both not make a will they have property worth 7 million left to 8 children all adult problem is state tax is not yet paid. just wondering if you can help me to compute the estate tax we will pay it this year is there a penalty property is divided into 3 lot one lot is our main house the other is occupied by my brother pleased help me to how much money do we have to prefer and lastly can i nogotiate it to bir the mode of payment , hoping for your kind reply thanks.

Hi Sir Vic,

If we did not file the monthly percentage tax for three months how can we compute for the penalties?

Thank you

HI Sir Vic, do you know how to compute the interest if i fail to file vat remittance with the amount of 109,840.32, this amount should be remitted to bir month after i received this. i received this amount jan of 2009, until now i haven’t paid it yet.

thanks so much.

Dear Sir,

my business was registered on BIR July 29, 2011…we have no sales for august since we were still completing all that is needed for the business and we don’t have official

receipts then, we started doing business september and paid percentage tax for that month come october. would like to know now about august? am i required to file for august though we don’t have sales? is the basis for percentage tax the date of registration?

and if it is whats the procedure to correct it on my filling for the percentage this coming 20th for month of october?

in addition, since we incurred expenses on august, could we include it on the computation of our quarterly income tax?

thanks and more power!

Hi Vic,

I just want to know if VAT & ITR return can still be amended be though Letter of Notice (LN) had been issued?

Thanks

Jhun

Hi,

Once notice is issued, which may come in the form of a Letter of Authority, Tax Verification Notice, or Letter Notice, you will lose your privilege to file an amended return. You may verify this with the BIR. Thanks.

Hi vic i wasnt able to file a 1604 e until now what is the remedy for it?

Hi, you should file it, but the BIR may compute for penalty for late filing.

Hello. Can you please help me…. Is sale of old transportation equipment subject to 12% vat eventhough this is not ordinary course of our business. Then another one we are renting a place and the lessor pay our utlity bills, then they reimburse the amount to us. Is the utility expense subject to withholding tax if we’re top 20,000 corp. The lessor doesn’t want to accept 2307 on utility since they are not top 20,000 corp.

hi Sir Vic, If I failed to file the quarterly income tax for self employed individual.Do I have a penalties?

If you failed to file and/or pay the taxes you should be filing/paying which are stated in your certificate of registration, you are liable for penalties.

Hi sir vic! i was previously employed for 10 months (oct2009-aug2010). my previous employer filed my tax for my first 3 months only. (i got my 2316 for that). after i resigned and got my final pay, i saw a portion that says: TAX DUE computed from my remaining months with them. should i have paid that even if i was not connected to any company?

hi sir vic..i was hired december 16, 2010 as a financial analyst (consultant) in a national government agency. Since it’s my first job, i wasn’t able to file my quarterly income tax return for 2011. A total of 13% of our gross salary (10% professional tax and 3% percentage tax) is deducted every payday (BIR Form 2307). My question is: are we going to pay for penalty for not filing a quarterly ITR? Thanks.

Are you registered as a self-employed professional with the BIR?

Sir Vic,

Hello again..I was registered as an individual earning purely compensation income (BIR Form 1902)..But i am only a contract of service personnel. All of us here who are “contactuals” are all registered using BIR Form 1902. Contradicting nga po yung status ko sa BIR registration ko.. What do i need to do para po makapag-file ako ng ITR?thanks sir vic..

Hi. What’s with your contract? Are you not considered as a pure employee? If you are considered employee then your employer should withhold taxes for you. Then they will issue you BIR form 2316 “Employer’s Certificate of Compensation Payment / Tax Withhelds”.

I have 2 employer for 2011. Jan-June and July-Dec. I have 2316 from previous company. I have tax refund too. My question is Should I also have tax refund from my recent company too? I have given them my 2316 from previous company and they said i need to pay more.. I got refund from my previous company of 6,000+ and i have tax witheld due jan-nov of 2,000+ based on my previous company 2316..I can believe I need to pay 7,000+ as my tax witheld due from my recent company.. what will i do? I need your reply please to lessen my burden.

If I work only from 1-3 months and salary is taxable, will i still have tax refund? and can i request also for 2316?

As long as they have withheld taxes on your compensation even if it’s only for 1-3 months, they should issue you BIR 2316 certificate of withholding.

hi sir vic

If i have 2 employer in 2011. 6 months in previous and 6 months in present.. Will I also have tax refund in my present? Because my previous company i received tax refund. my 2316 from previous company states my tax withheld 2,000++, and tax refund 6,000. After giving my previous 2316 to my present employer.. they ask me i still have to about 7,000 need to withheld. My question is how will i know if this claim is right? Should i get tax refund if i work less than a year?

One solution to prepare future huge estate taxes is for you to prepare now. If you have a lot of properties, assets and savings. Get a life insurance coverage enough to pay for your estate taxes instead of leaving that problem to your heirs. I am a Financial Advisor from a top financial institution that caters in planning and servicing individual, busineses and family who will have future financial need. You can reach me at 09178878858 or email me at zaldydeleon@ yahoo.com

Hi Sir Vic,

I failed to file ITR this Month on time. I want to go and settle it but I don’t know how much is the penalty. I am a proprietor. will it be the same thing in which i should go to the bank and bring the forms with declared income? i am new into this but last month i paid on time 3% of my income. now it was late so please let me know what to do.

ITR is paid quarterly and annually. I think you’re referring to the 3% percentage tax. If you’ve failed to file on time, you can visit the BIR office and have them computed your penalties for the late payment of your percentage tax. You can also try to compute your penalties, using the formula above and pay your late percentage tax return with penalties in any authorized bank.

hi sir vic,

i received my form 2316 from my employer, but just found out that my personal exemptions were not updated (additional-for dependent child), i filed my 2305 to change my status in October 2011, and provided the form to my employer immediately. to make the story short, the form i submitted to my employer was lost and so my 2316 info was not updated.

is there any way i can still claim for that additional exemption for year 2011? is there such thing as amended 2316 filed in the BIR? will there be penalties? Thanks so much!

Hi Sir Vic,

I have a question regarding e-submission of MAP. Would i be penalized if for instance, i e-filed and e-paid the tax returns (lets say 1601E) before the due date but i was late in e-submitting its MAP/additional attachments. Thanks!

My uncle would like to have a document or a certification saying that he is the “administrator” of the propertes left by his dad (he died without a will/testament).

We are assuming that to be able to have such document, the prerequisites are:

(1) that estate taxes had been fully paid before one of the legal heirs can assume administratorship over a property left by his father

(2) Signatures/consent of the other heirs (his siblings)

Is this correct?

HI, I registered last 2004 as a professional and practiced for more or less a year before I and 4 other colleagues of mine formed a corporation at 2005 –which was later dissolved, too a year after. however, I just found out that my “practice of profession” was not retired even after we formed our corp. Now, I decided to go back to “Practice of profession” and when I went to BIR to register, I was informed that I have penalties because apparently it was not retired and i have failed to file and pay for my tax since the corporation.

Where would they base my penalties if I don’t have “sales” or “services rendered” during those years? are they going to base that on the “sales” i made for 2004?

by the way, after the corp from 2005-2006, i went into a partnership from 2006 to present.

how can i compute my penalty if the company doesnt have employee then i forgot to submit the 1601c, let say 1 month late of submission

Sir,

Magkano penalty sa late filing ng 1604E?

Thanks!

Hi Sir Vic!

We are planning to file estate tax return with respect to our grandmother who died in 1991. We have computed an estimate of the estate tax payable, and the penalty is so large. Does the BIR allows condonation of penalties? The BIR have an Application for Abatement of Tax, Penalties…. so we presume that there’s a possibility that the estate tax payable be reduced? Please help.

Hi, there may be. But it will depend on the RDO in your jurisdiction.

Hi Vic,

I am so glad to have found your site, i went to BIR last week for a change of RDO code, and i was really shocked about being told about not closing a business status. I used to be an agent for an Insurance company kasi, that was 2005, di daw ako nag fifile ng 2551m, which i was really not told, kaya yung penalty ang laki na, my point lang is how come ngayon lang nila ako ni inform to think na i started working as a professional sa BPO since 2008, and i have been with 4 different companies already, i told them na sana nung unang RDO transfer request palang eh nakita na nila at na inform na ako para di na lumaki at tumagal.

I drafted an email to send sa BIR about it and i was really blessed na nahanap ko tong site mo before ko isend. I told them about my concern and asking for any recommendation since di ko din nga kayang bayaran yung penalty all at once. would you know kung pwedeng i go through na yung change ng RDO theni will just pay the penalties sa bank or dapat bayad ng buo?

i hope you can give me some advise about my concern, i have been very stressed na about it since last week. Thank you very much and God Bless

For payment of delinquency taxes, the payment form must first be signed and approved by the BIR before you can file and pay it in the bank.

If the assessment is not yet final, you can ask with the BIR for compromise and tell them about your case.

If you’re a pure employee, you should not be taxed with percentage tax. But as a self-employed professional, you are required to file and pay percentage tax. This is actually stated in your certificate of registration if you were registered as a professional with the BIR.

Hi sir.. Good day.. i hope you can enlighten me..

I was a new broker/dealer of a property-house and lot here in Bicol. This was my very first transaction. After the final negotiations, I was the one tasked to process the documents-filing at bir and make payments with the bank. With complete documents submitted to BIR, I was given a payment form. Due to some unforeseen events, I went to BIR again to re-assess our payments for capital gains and documentary stamp tax, which now included penalties(we exceeded the allowed time). It was computed at Php22,100 total penalties. I paid for the whole penalty amount but I requested the seller to facilitate payments and filing at BIR and completion of the papers. I was given an update that it was already okay and the buyer was given the certification already – a go signal for transferring of property title. When I went to the buyer to check the papers, I was surprised that the deed of sale was already new and the original deed of sale was cancelled(to which the penalty computations were based). I checked the paper but it shows NO penalty payments. I would like to know the implications and effects of a cancelled deed of sale vs a new deed of sale.. Was the previously computed penalties also cancelled? Note: the buyer is insisting that payments of penalty were made with BIR, but if that’s the case, then it should be reflected on the payment/certification form, right? Thank you very much sir in advance.. Have a great week end! 🙂

I fear that the penalty computation may have already been entered in the system of the BIR and may appear upon processing of C.A.R. Yes, it will appear on the Certification once paid. Another implication is on the notarization, if made by another lawyer as there may be no two deeds of sale over a single property by the same parties.

Good morning! Thanks for the reply.. M’Belle, I do have a copy now of the CAR and it has no penalty indications at the details of payment. Is it a clear evidence that no penalty payment has really been made as what the seller is insisting? By the way mam, deed of sale(s)-old and new were made by the same lawyer. Thanks very much! This will really help me..

I see. Case closed then with the copy of the C.A.R., unless, it will later be invalidated.

thanks very much..:)

hi sir,

how will i treat subcon expenses?

it is subject to 2% creditable withholding tax right?

will i still use it as a source of input tax for my computation of VAT remittances?

tnx

Yes it is a source of input VAT if the same is sourced from a VAT registered supplier. Yes 2% may apply.

Hi Vic,

Would like to know if there is penalty, interest and surcharge that should be paid if vat payment was paid late though e-filing was done on time. Deadline was last 26, but we did the payment this morning.

Please advise. thanks

hi sir vic,

i registered my business in bir last november 2010. i always pay my monthly percentage tax. unfortunately wasn’t able to file the 1701Q or the ITR quarterly since then. i want to fix this at once. how much will be my penalties?

thanks!

dear sir vic,

Pls help me with my problem. i am working with DOH. my husband and i file joint income tax return.my obligations with BIR is done by the office through withholding tax.However, my husband has a private practice of his profession as architect. His obligations with BIR were done by a bookeeper .Unfotunately the bookeeper had a problem and we lost contact with him. Unfortunately, we dont have file copies of documents in his possession. With this issue, I am considering filing income tax return alone…i mean not as “joint return” so that my husband can settle separately his tax without affecting mine. Is this ok or not ? what can you advice my huusband so he can settle this problem ? thnx so much. by the way, your family name is my maiden surname.

we failed to submit our annual books of accounts to BIR for stamping since 2003, what are the remedies and do you have a sample letter of compromise penaty