How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But that day has passed by and you haven’t yet filed your income tax return. Now you want to know how much are the extra charges you need to pay for your failure to file your return on time. Penalties for late filing consist of interest, surcharge and compromise. The following are the steps and guidelines on computing penalties for late filing of tax returns with the BIR.

Computation of penalties on late filing of tax return

Let’s assume that due to economic crisis and insufficiency of available cash for payment, Mr. Pinoy did not make it to the due date in filing and payment of his annual income tax return or BIR form 1701 for the taxable year 2010 last April 15, 2011. His income tax due and payable is Php 10,000. Now he wants to finally file and pay his income tax on April 20, 2011. How much is the total penalty he needs to pay in addition to his income tax payable?

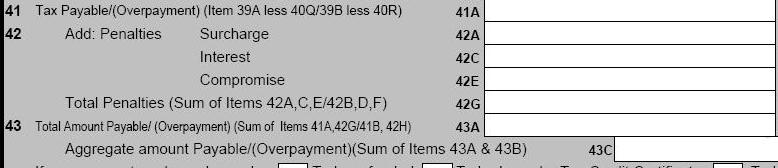

1. Firstly, take note that the total penalties equal the sum of interest, surcharge and compromise (please see image below). We will compute them one by one.

2. In computing interest, the rate of twenty percent (20%) per annum is used, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid.

In the example above, the interest is computed as follows:

Interest = Tax payable x 20% x no. of days late / 360

Interest = P10,000 x 20% x 5/360

Interest = P 27.78

Note: We use 360 days a year for conservative approach.

3. A twenty five percent 25% surcharge is imposed on a taxpayer as an additional penalty for failure to file any return and pay the amount of tax on or before the due date.

The computation of Mr Pinoy’s surcharge is:

Surcharge = Tax payable x 25%

Surcharge = P10,000 x 25%

Surcharge = P 2,500

Note: A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a) Willful neglect to file the return within the period prescribed by the Code or

by rules and regulations; or

b) In case a false or fraudulent return is willfully made.

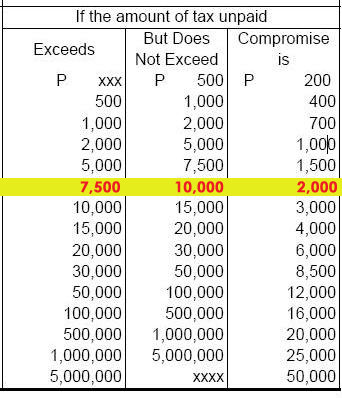

4. When it comes to the computation of compromise penalty, we need to refer to the Revenue Memorandum Order No. 19-2007 issued on August 10, 2007, which prescribes the Consolidated Revised Schedule of Compromise Penalties for violations of the National Internal Revenue Code (NIRC). For the purpose of computing the compromise penalty in our example, Mr. Pinoy’s compromise penalty is determined as follows:

Thus, compromise penalty is equal to P 2,000

5. Finally, the total penalties that should be paid by Mr. Pinoy is equal to:

Total penalties = interest + surcharge + compromise penalty

Total penalties = P 27.78 + 2,500 + 2,000

Total penalties = P 4,527.78

Therefore, the total amount of payable to be paid by Mr Pinoy, if he will pay his late income tax return on April 20, 2011 is P 14,527.78 (total income tax payable [P10,000]+ total penalties [4,527.78])

Penalty for non-filing of tax return

What if there is no tax payable to be paid in your income tax return, and you have not filed it with the BIR on the due date? How much is the penalty to be paid?

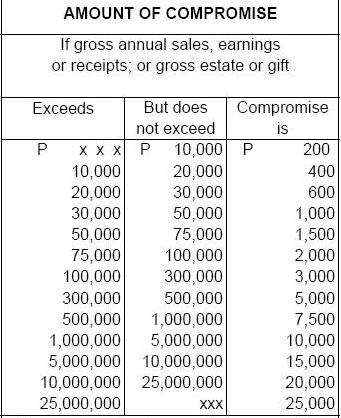

If there is no tax due in your return or you are exempted but required to file return but you have not filed it on the time required by the law, there is no interest and surcharge to be computed. However, a compromise penalty, based on your gross annual sales, earnings or receipts should be paid as determined below:

This means that if your gross annual revenue amounts to P200,000, and you failed to file your income tax return, although you have no income tax payable or even though you are exempt with NIL income tax due (but required to file), your compromise penalty will be P3,000.

You may wonder why the compromise penalty for non-filing of tax returns without tax payable may become higher than the the compromise penalty imposed on non-payment of tax returns. The first is based on gross sales/revenues/receipts, while the latter is based only on tax payable. In my opinion, it is fundamentally easy to prepare and file a tax return without payment than to prepare and file a tax return with tax payable. Hence, failure to accomplish an easier task would be a bigger sin, than failure to accomplish a harder task.

Source: Revenue Memorandum Order No. 19-2007/Revised schedule of Compromise penalty

Disclaimer: This post is for informational use only and doesn’t warrant a formal professional advice. Although, we have based the article on the most reliable resources available, we do not guarantee that the article is free from error, especially from typo-error. If you encounter any error, please inform us immediately for immediate correction. Moreover, new and subsequent laws, rulings and BIR issuances may render this post obsolete and inaccurate in whole or in part. We encourage our concerned readers to personally visit and inquire with the Bureau of Internal Revenue (BIR) in your area.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

What are the allowable deductions from gross income year 2006 philippines

Hi Vic! just want some clarifications on school taxes…we’re registered as nvat, and planning to close the account from BIR. would it be advisable to terminate it? what are the consequences for doing so?

Hi Sir, I would just like to clarify this income tax filing. I am working for an IT company and as an insurance adviser. Both companies are withholding my taxes and I am assuming that they have already filed the taxes separately (tax withheld). My only problem was this is my first time to work in two companies so I did not know I still needed to merge my income. My income in the IT company already places me on the top bracket for taxes. How can I compute for the amount of penalties i need to pay in BIR?

Thanks!

Hi Sir, We just set up a company this year and started deducting withholding tax from (5) employees last may. Since we its a small company and we don’t have an accountant or accounting department, We thought that the filing/paying for the w/h tax happens quarterly. We just found out that it needs to be paid monthly every 10th of the month. My question is does the compromise happen even on the monthly late payments? because in your example, 5 employees x 3 months late x 1000(compromise) totals 15,000 just for the compromise alone.. is there a way to ask for consideration from the BIR? Thanks

Hi Good morning!

Where can I find the provision mandating the taxpayer to file a BIR Return (e.g. 1601E) even if there is nothing to withhold/pay?

Thank you.

Pom

ask ko lang, ganito ang situation… late filing of withholding tax.

2004 was the year of sale and the sale was included as taxable income for 2004 ITR. but the withholding tax for the said sale was only paid in year 2008 with the corresponding penalties. Valid bang i-claim na tax refund ung CWT na maiissue sa pagwiwithheld nya ng late para sa sale ng 2004 during 2008 para sa 2008 ITR?

i’m confused.

help me please, how to compute the late payment for 1601. the interest,surcharge and compromise. our monthly remittance for rent 3,083.50 then for salaries 3,750.00. thanks.

Good day Vic,

I would like to know po regarding with non operating corporation and late filing since 2009,2010,2011. Mga magkano po kaya ang cost for those 3 years ? Are there penalties po ba even non op ang corporation?

Hi.

What BIR form should I use for me to remit the 10%tax I withheld from the commission of my agent? Thanks a lot.

Hi Sir Vic;

We employed the services of a CPA for the construction of our Institution’s Financial Statements. We deduted 10% professional fees tax from the total amount that was billed to us. When we were about to remit the tax withheld to BIR, we realized that Expended Withholding tax (BIR form 1601-E) is not found on our certificate of registration as part of our registered activities/tax type. Can we still remit the tax even if it is not part of the Intitution’s registered activities?

I’m having a hard time searching on how am I going to compute withholding taxes for our institution.

Can anyone help me with this:

How can we compute withholding income tax for the whole year for an employee who was a minimum wage earner from January to May, and then the salary increased on the month of June, exceeding the minimum wage.. Are we going to compute the withholding tax from January to December or just his salary from June to December?

How about if there are newly hired employees on the month of June, receiving salary that is more than the minimum. Monthly withholding taxes on their salaries are being deducted. What if say for instance the total salary of each is P 50,000 from June to December; P50000 less P50K personal exemption less SSS less Phil health= Negative Value… then we are required to refund the taxes withheld… shall we be given a tax credit certificate from BIR if this will be the case?

Or pwede bang huwag nalang kaming magdeduct ng wihtholding tax any way alam naman namin na negative value pag annual na ung computation?

Thanks a lot in advance..

Good day Vic! I really need your help in this. I have started my Poultry Supplies business last 2009 but due to the TIN issue (for it needs to be transferred from Manila to province), it has been the cause of delays (besides of the accountant who could be able to help in doing this has been transferred) in filing business application to BIR. Yearly, I renewed my municipal license. Just recently, the BIR representatives tax mapped our town. Still, I could not be able to go there for some personal reasons. My average monthly gross sales is P2000.00 What is the first thing I need to do and to prepare for a business application? How much do you think I need to pay for all the late registrations and monthly payments I did not pay? Would it cost me a lot? One thing more, my father and I had different municipal business name in one location and had planned to register it this year as one. Please help and guide me in this. What’s the best thing to do? Thank you! 🙂

BIR penalties is computed with Interest (20% per year), surcharge (25%) and compromise based on tax payable. Thus it would depend on your tax payables. The BIR officer will compute it for you. If you want to combine two registered businesses and register it as one, the other should be closed and be transferred to the other one. To close a business is to apply a closure to the government offices it was registered.

Good Day Vic! I was able to pay the estate tax on time but not the transfer tax. I’m currently from Cebu and my father died last June 8, 2012. Can you help me how much I would be paying for the transfer tax plus surcharges (25%) and interest per month of 2% (if paid after the 60-day period) given the following information: Zonal Value of Land: P400,000 ; FMV of Building: P250,000. I would be paying the transfer tax once I received my documents from the BIR this January 31. Thanks.

Hi Vic.

Just wondering how to compute for penalties for year 2009, 2010 and 2011 for no payment of percentage, quarterly and annual ITR for no sales? We registered in 2009 and had our licensed renewed just late last year. How do I compute for 0 sales since we plan to start our operation this January?

is there a penalty for late filing of 1902(application for registration) of an employee but is also exempted from monthly witholding tax because minimum salary only. thanks.

Hey good day Sir!

Just want to ask the penalty computation for late filing of form 2305 (declaration of additional dependent)suppose to be added after I gave birth last September of 2012?

Thanks!

Hi sir good day. My case is that we submitted a 1601-E (commission) for a corporation last September. It’s the only transaction for the whole year that we had to withhold. After that we no longer submitted 1601-E since there is nothing to withhold. Are we going to get penalized for non-submission for Oct-Dec?

Good day to you sir vic,

gud day to you sir vic.. just wanna ask if it is a requirement for me to submit 2551Q aside from annual registration, annual ITR-FS, and monthly percentage tax (2551M)? i am regularly paying those 3 but failed to comply with the quarterly income tax.. i am operating an internet shop/cafe with 23 units of computer.. thus this mean that aside from my monthly due i am still required to pay quarterly for my business? thank you and more power..

With your kind of business, you are also required to pay quarterly income tax. However you are not required to pay quarterly percentage tax (2551Q), but only monthly percentage tax (2551M). Take note that Percentage tax is different from income tax. Income tax is paid annually (1701) and quarterly (1701Q) for single proprietorship/individual taxpayer.

Good day,

I was looking around the web for some answers to what my supervisor told me about the imposition of surcharge, interest and compromise and then, I found your website . My company was recently classified under the Large Taxpayers services and we do the filing and payment of returns online. There was this one time that I had to amend 1601C and not surprisingly, EFPS automatically computed the penalties based on the amount still payable. But a few days later, my bisor told me that it was possible to waive the surcharge for a voluntary amendment. I tried it out before writing this and I was shocked to find out that I could have saved hundreds of thousands from the amount due by removing the surcharge. So my question is: is surcharge not imposed on an amended return? On a similar note, I filed a late purchase of DST(Form 2000) via EFPS as well, only this time, the system did not compute for Compromise but would not allow me to submit unless I put an amount there. I opted to put something from the Compromise Table’s “Failure to File and/or Pay..” but later on I was told I could have placed any amount less than what I did since the system didn’t compute for itself. Is late DST purchase subject to compromise penalty?

Sorry for asking too many questions. I searched around the web and found a lot of articles but reading them doesn’t really give me the confidence that I interpreted them correctly. On the other hand, I’d think twice of asking from the BIR itself since, at the back of my mind, they’d give me an answer that would not necessarily be correct but would prompt a higher collection.

Thank you very much for your insights. I would really appreciate it.

Jay

We have a school our annual income is 100M. we also sell school supplies, school uniform and books. We issue official receipt under the name of the school. The school is exempted from paying taxes. How about selling school supplies, school uniform and books, selling these kind of items are subject to tax and value added tax? Thank you

I was registered as a professional self-employed taxpayer last February 6. I ordered Official Receipts (ORs) printed by an accredited printer immediately after the required tax briefing for newly registered taxpayers. A few days later, my printer reported that all authority to print (ATP) receipts have been put on hold pending the re-accreditation of ALL printers in my RDO (098) for the new online ATP application.

My printer could not give me a predictable day/week when my ATP will get approval. As of Feb. 27 only one printer (not my printer)was re-accredited by the said RDO. As a result for the month of Feb., I could not operate because I can’t issue ORs to my clients.

I am I justified to file a ‘No Operation’ monthly percentage tax return for February?

Can I get permission from my RDO to issue Provisional Receipts until my printer gets re-accredited?

Thank you.

Sir,

We purchased an agricultural lot that has a market value amounting to P261820.00 last June28, 2012. I failed to pay the taxes. How much is the surcharge+interest that I will be paying if I will pay it this month. Thanks.

Hi, may i ask for the penalty computation for late filing of Expanded Withholding Tax (2307)/ 1601E? thanks

Hi Mr. Vic,

We filed late for the 1604E on the efps with zero amount on it, coz we have no transactions on that particular month.how much are we going to pay or put an amount in the 0605 form also in the efps.

thanks.

Bill

Dear Sir,

Is the schedule for compromise penalty applicable to both individuals and corporations? I am in the process of retiring the BIR registration of a corporation that is non operational since 2007 and was told that the minimum penalty for each form not filed for corporations is P1,000. Is this true? Thanks for your reply.

hi, here’s the situation… penalties were imposed against an entity for violation of Sec236 of the NIRC. there were compromise penalties imposed upon the entity… if the entity wishes to question the same and the regional director keeps on denying the motion… can there be an appeal before the BIR Commissioner, if yes, will the appeal toll the running of the period within which to collect. your reply is highly appreciated. thank you

Dear Sir Vic,

We failed to file the ITR yesterday due to negligence. Although all the forms have been signed, even the payment slip to the bank. Now, we are computing our penalties and followed your formula. But upon checking on the form 1702, on # 41, the rate is 30% instead of 25%. If possible, could you help us compute? Our tax due supposedly was P37,962.10. This was the amount we were supposed to pay last April 15.

Thank you so much and hoping for your reply. This site is very helpful.

Jin

Thank you for the information you’ve provided. It helped me alot especially I was enlightened by the computation of tax penalties. Bec. I myself experienced to failed to pay my due last dec and I almost panic bec my accountant’s computation on my penalty was way too high from what I’m supposed to pay. Thats why when I went to BIR I was very thankful that I’m not paying that much. I don’t know if there was motives behind it. Can you advised me on consignments? the do’s and dont’s… I’m new in the business that’s why your site is very helpful to me… thank you… and God bless

Hi,

I would like to ask what is the computation if on April 15, 2013 (1st deadline) you paid a certain amount, since that is only your available cash on hand. then you plan to pay the balance on July 15, 2013 (2nd deadline). What is the computation? Example, I only paid 20% of the total income tax due and the rest of 80% is on July 15, 2013, can you show me the computation? By the way, I work with an interantional organization. thanks

Can I file for ITR for previous years? Needed as evidence of employment.

hi, is the 1601C has a attachment like alpha list?

thanks

hi, here is my situation, the company i am working now is paying sss & philhealth contributions under its name but the payment is covering employer/ee’s share. so how can we transfer the contributions to the employee’s name? thank you!

Hi sir Vic

I just want to seek advice for my situation,

MY new company required me my form 2316 or ITR for this year, but my previous company said they cant give me form 2316 because I’am considered as a consultant, and they can only give me form 2307

Later I found that the filing for ITR has a deadline, and I have to pay for penalty

I just want to ask if how much will I pay? is it an excuse that my previous company should tell me that I should file my ITR on my own?

and if that is the situation they should give us our form 2307 before the deadline

It is my first job that is why I really don’t have idea with this

I have not yet file my ITR since I’am still waiting for my form 2307 for April-May 15, 2013

Thank You very much for sharing this site, very helpful and informative. 🙂

hi! i have a small food business opened last june17, 2012. I intentionally did not register to bir and secure any permits just so i may outlay my capital right if say, it’s not feasible for me to continue on then i’d be switching another location.

now, come October last year, a group of people from BIR had a tax mapping mission here in our area. and they said we’re being penalized 20K for late registration. Is this really the amount of penalty? don’t they have a grace period for new business entities to experiment first? because if i’m still operating now, then there might not be a need for continuous operation. although i would like to really know, because right now, i’d like to file all business requirements e.g. dti, mayor’s permit and bir.

Hello,

I have an electronic repair shop (non- vat). How do I file taxes for giving commissions to people bringing repair jobs. Thank you.

Sir, question need to clarify. I’ve got my certificate of registration when it is the last month of my contract. After then, i resigned. My official receipt that has been issued was not able to use. No one informed me about what to do in my o.r. ,I have not been using it for almost a year. Recently, someone informed me that it should be file for closure. In that situation, should i have penalties which is my first job and haven’t discussed about the taxes?.

Thank you for helping me.

Hi po…Sir ask ko lang po if ano po ang penalty sa late submission of Quarterly SLSP?

Thanks

hi.. I forgot to filed last march 2013 of 1604e of our company, if i am going to file this month/year january 2014, how much will be the penalty?

Hi Sir. I’m lucky to have found this site. Thank you for all the information you share and for answering the queries of everyone. Pretty please help me with mine. 🙂 My friend is a doctor, and she registered as self employed in 2008 in Batangas. But then she went to Manila and became a resident Doctor at PGH in 2009-2012. PGH filed her taxes and gave her 2316 for those years. However she was not able to change her tax status from self employed to employed. Last year she started practicing her profession, and was given 2307 by a clinic where she rendered her service for 2 months, thats Nov 2013 and Jan 2014. Now BIR is requiring her to pay the penalties for not filing 2551M and 1701 from 2009 to date. That’s 200 per month, so more or less that’s 12000 and she still needs to submit the monthly forms for those years. My question is in her 1701 for 2009 to 2012, does she still need to input her income on the form even though she already has her 2316 from PGH? or can she just declare it as no transaction? And also does she still need to pay her percentage tax for the month of Nov 2013 and January 2014 even if it’s already late? or can she just file it as no transaction? she is paying all the penalties anyway.. kindly help us with this sir. thank you sooo much.

P.S. She is registered as “professional”. Thank you.

Excuse me po!

anu po ang dapat kong gawin 2months na kasi akong dina

kakabyad ng 1601E dko po magets yung attachment na sinasabi sa banko.?

reply naman po.at magkanu na kaya penalty ko?please po thank you..

Hi, is the computation above still unchanged? I forgot to file/pay my percentage tax and it is quite trouble for me to go to RDO so the officer of the day can do my penalty computation. If the formula above is still true, is it ok not to have it countersigned by someone from the BIR and just pay it, including the penalty in the bank?

Hi Sir, Last April 25, hindi umabot ung messenger namen sa pgfile ng 2550Q, excessive naman ang input vat namen compare sa output vat, kaya ipapareceive lang xa sa BIR, ang kaso nung assessment, Php25,000.00 daw po ang compromise. Is it true? kc ung mga nde naifile nmen na vat return from 2009, Php1000 per return lng ang fee na binayadan. pls advise po. thanks

What if I have not filed my VAT return for a certain month when I have no sales and only expenses, does this mean I don’t have to pay any penalty?

Thanks…

Good day!

Sir, for example nag file po ako ng 1601 e amounting 500 for the month of january. then later on i found out the exact amount is 600. so can i just adjust the difference the next month i filed. is there a penalty for that?

thank you..

please email me at c09045578@yahoo.com thanks

Hi sir,

I am going to file the amended return on 2550 M due to some errors for the previous 3 months. But we have ZERO vat payable. We only hav input taxes. How much penalty do i hav to pay? Thanks for the help.

Hi Sir Vic,

Im self employed practicing my profession. I got a contract last Jan 2014, without knowing i need to register with BIR with my status. I register with BIR last july 2014 with a penalty of 10, i already pay my percentage tax this july, the company is paying my witholding tax since January, do i need to pay my percentage tax from jan-june 2014? do i need to file 1701Q or is it possible i will just file the 1701? thank you for your reply

Hi! I was employed from Jan to Mar 2014 in Company A. Last May, I received my 2316 from the company. I got hired last May and submitted my 2316 to Company B. But then I resigned 2 months after. They have not given me my 2316 yet. Now, I am employed in Company C and they are asking for my 2316…Can I just submit the photocopy of 2316 from Company A instead?

If I don’t submit the 2316 to Company C, what will be the implications? Thanks

Hello! I have been a freelancer since 2012 and I am now planning to register as a taxpayer. Say, I plan to declare my earnings since 2012, which specific taxes do I have to pay? The percentage tax, quarterly ITR or annual ITR? Kase based sa understanding ko, dine-deduct din naman yung pecentage tax at quarterly ITR dun sa annual ITR, tama ba? So parang reundant kung I’ll pay pecentage tax at quarterly ITR, only to deduct them from the annual ITR.

I know late registration or filing is subject to penalties so before pursuing my registration, gusto ko muna sanang i-compute how much tax, I need to pay. Thanks. 🙂