How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But that day has passed by and you haven’t yet filed your income tax return. Now you want to know how much are the extra charges you need to pay for your failure to file your return on time. Penalties for late filing consist of interest, surcharge and compromise. The following are the steps and guidelines on computing penalties for late filing of tax returns with the BIR.

Computation of penalties on late filing of tax return

Let’s assume that due to economic crisis and insufficiency of available cash for payment, Mr. Pinoy did not make it to the due date in filing and payment of his annual income tax return or BIR form 1701 for the taxable year 2010 last April 15, 2011. His income tax due and payable is Php 10,000. Now he wants to finally file and pay his income tax on April 20, 2011. How much is the total penalty he needs to pay in addition to his income tax payable?

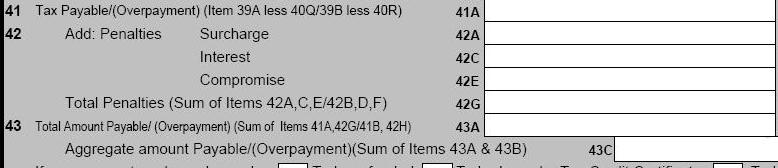

1. Firstly, take note that the total penalties equal the sum of interest, surcharge and compromise (please see image below). We will compute them one by one.

2. In computing interest, the rate of twenty percent (20%) per annum is used, or such higher rate as may be prescribed by rules and regulations, on any unpaid amount of tax, from the date prescribed for the payment until it is fully paid.

In the example above, the interest is computed as follows:

Interest = Tax payable x 20% x no. of days late / 360

Interest = P10,000 x 20% x 5/360

Interest = P 27.78

Note: We use 360 days a year for conservative approach.

3. A twenty five percent 25% surcharge is imposed on a taxpayer as an additional penalty for failure to file any return and pay the amount of tax on or before the due date.

The computation of Mr Pinoy’s surcharge is:

Surcharge = Tax payable x 25%

Surcharge = P10,000 x 25%

Surcharge = P 2,500

Note: A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud, for each of the following violations:

a) Willful neglect to file the return within the period prescribed by the Code or

by rules and regulations; or

b) In case a false or fraudulent return is willfully made.

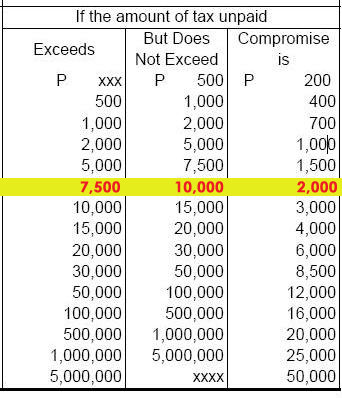

4. When it comes to the computation of compromise penalty, we need to refer to the Revenue Memorandum Order No. 19-2007 issued on August 10, 2007, which prescribes the Consolidated Revised Schedule of Compromise Penalties for violations of the National Internal Revenue Code (NIRC). For the purpose of computing the compromise penalty in our example, Mr. Pinoy’s compromise penalty is determined as follows:

Thus, compromise penalty is equal to P 2,000

5. Finally, the total penalties that should be paid by Mr. Pinoy is equal to:

Total penalties = interest + surcharge + compromise penalty

Total penalties = P 27.78 + 2,500 + 2,000

Total penalties = P 4,527.78

Therefore, the total amount of payable to be paid by Mr Pinoy, if he will pay his late income tax return on April 20, 2011 is P 14,527.78 (total income tax payable [P10,000]+ total penalties [4,527.78])

Penalty for non-filing of tax return

What if there is no tax payable to be paid in your income tax return, and you have not filed it with the BIR on the due date? How much is the penalty to be paid?

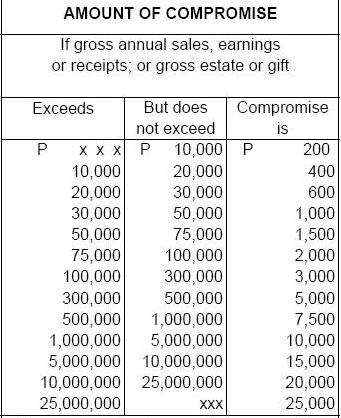

If there is no tax due in your return or you are exempted but required to file return but you have not filed it on the time required by the law, there is no interest and surcharge to be computed. However, a compromise penalty, based on your gross annual sales, earnings or receipts should be paid as determined below:

This means that if your gross annual revenue amounts to P200,000, and you failed to file your income tax return, although you have no income tax payable or even though you are exempt with NIL income tax due (but required to file), your compromise penalty will be P3,000.

You may wonder why the compromise penalty for non-filing of tax returns without tax payable may become higher than the the compromise penalty imposed on non-payment of tax returns. The first is based on gross sales/revenues/receipts, while the latter is based only on tax payable. In my opinion, it is fundamentally easy to prepare and file a tax return without payment than to prepare and file a tax return with tax payable. Hence, failure to accomplish an easier task would be a bigger sin, than failure to accomplish a harder task.

Source: Revenue Memorandum Order No. 19-2007/Revised schedule of Compromise penalty

Disclaimer: This post is for informational use only and doesn’t warrant a formal professional advice. Although, we have based the article on the most reliable resources available, we do not guarantee that the article is free from error, especially from typo-error. If you encounter any error, please inform us immediately for immediate correction. Moreover, new and subsequent laws, rulings and BIR issuances may render this post obsolete and inaccurate in whole or in part. We encourage our concerned readers to personally visit and inquire with the Bureau of Internal Revenue (BIR) in your area.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

dear sir vic,

ask ko lang po kung paano magcompute ng penalty for 2551m… totoo po ba 1000 kaagad ang penalty… yun kasi sabi ng bookeeper po… thanks…

Good day! My partner overlooked a sale and wasn’t able to file it on our 2551m and 1701q. Is it still possible to declare it on our itr. And what about the penalty? Thanks

Hi Sir Vic,

My friend and I applied in a real estate company in Paranaque in September 2013. We were hired, however, our supposed to be Manager asked us to present lots of requirements, and those include: Photocopy of COR, OR, ATP, NBI, etc. And before we can get the ATP (Authority to print receipt), we were advised that we need to file or register the business we are into, so we processed an application to get a certificate of registration in our name and address of the company. After that, we were told that we can only start in our work if we have six bundles of OR in possession. We were told by BIR that the OR we requested will be given to us in three months time, so as a fresh graduate, we don’t want to wait that long, we backed out in our application in that real estate company without knowing that we have to close lend that business. And now, it’s already been 19 months, we both have work already, however, my friend resigned in her previous company and now applying again in a different industry, that’s when we found out that we have to settle the penalties for those 19 months. What should we do? My friend was told that we must pay Php 1,000.00/month. From September 2013 upto present. 🙁 Hoping that you can help us.

I have a friend who started business 2013, he register before bir, but does not file any income tax or prrcentage tax, or even secure a receipt, how much penalty would he bears.?

Hi Sir Vic,

I am mandated to use the ebirform online submission of my returns. I will be filing my return (2551M) “LATE” this month, With Payment Returns should be filed to the Authorized Agency Bank. HoweverIm quite confused if I can fill out

Hi Sir,

I have 3 stores, main, branch 1 and and branch 2. Branch 1 already closed since 2011, and now i have to close my main branch. I went to transfer my RDO and told that there are many open cases and have to settle first before i can transfer. I have a bookeeper before but we have no contacts with her (as far as i know i gave my monthly payment to her). We have open cases dated 2008 pa. My bookeeper has no problem closing branch 1 in 2011. What should i do, i can’t afford to pay all the penalties kaya nga i am closing. Is there anyway to lessen my interest and penalties?

Thanks for your help

Hopefully you could answer me sir! Please super need answer. So I’m a job order worker in a government hospital and the bir considers us practicing professions. Pero parang empleyado lang naman talaga. One of the bir requirements is atp so to have receipts (which is di naman talaga namin magagamit). In my case, I wasn’t aware na ibabalik pa pala yung atp sa printer as soon as naclaim na from bir. One and a half month kong late naibalik sa printer and they told me to ask the bir what would be the remedy. And yun bir told me to pay for Php 1000 penalty. Is it right? What to do?

Hi!

I just want to know what would happen if i don’t pay my taxes for almost 2 years now.

My business is under Non-vat.

Your response is really appreciated.

Hi sir! pwede po ba magtanong kung anong consequences is mali yung nagamit mong form sa remittance? instead na 1601E, 1601C yung nagamit na form. Contractual employees kasi sila and ang tax rate is 10%. please help. kelangan ko kasi sa alpha list ko. salamat

Hi Mr. Vic! I’m a newbie in the world of taxation. Please enlighten me on this matter because I really want to contribute in our country’s progress (in my own little ways, which includes paying taxes).

Background story:

I was an employee from Sept, 2013-Aug.2014. I resigned Aug. 2014 to go back to school. From Sept 2014 and the whole 2015 I did online freelancing on the side while studying. My intention was to be a freelancer temporarily while I’m still finishing my degree so I did not really care much about the technicalities about taxation. My original plan was that after school I’ll be an employee so I don’t need to think about taxes because HR will do it for me. This 2016, I’m done with my degree and I realized that freelancing works for me and I want to continue it.

What should I do to start fresh with freelancing as a full time career given the following:

1. 2014 ITR – I did not file 2014 ITR last April 15, 2015

Jan 2014-August 2014: employed

Sept 2014- Dec 2014: trying freelancing, online company withheld 10% of my salary under my TIN

2. 2015 ITR –

Jan 2015-Dec 2015: continued freelancing, the online company withheld 10% of my salary under my TIN

3. 1st quarter 2016,

JAn2016-March2016: made a decision to make freelancing as a full time career

Hello

Is this also applicable for amended VAT returns penalty computation?

Sobrang taas na ngayon ang penalty sa sole proprietorship, just imagine from 200 per open case noon, ngayon 1000 pesos na per open case. Ano naba nangyayari sa BIR natin, yung sakin sitwasyon kasi nag aral ako kaya naging busy at diko napa close ang business kahit wala na, after more than 3 years at may employer na sana ako, diko na mapalipat ang rdo ko dahil sa nakakagulat na halaga sa penalty, grabe ang graduation gift sakin ng mga taga BIR.

Hi Sir Vic!

I am an avon sales leader and they required me to get business permit even if I really don’t have a store. I just got a 5%-7% commission fee(CF) with 10% TaX deductions from my avon recruits who have purchases in a month for a minimum of almost 600 each and if my own group targeted the minimum group sales. If not achieved and I don’t have Personal Sale in my account for a minimum of 2,000 , I do have no commission fee to be received. The average group sale(GS)of my group is 30,000 or 15,000 a month excluding my Personal Sale.

If GS is 30,000 but not more than 60,000 I got 7% of it minus 10% Tax. and

5% minus 10% tax for 15,000 but not more than 30,000

Sample: 30,000×7%=1,500-10%=1,350 as my CF..

My concern here sir are:

1. Do we really need to pay for the 10% tax and the 3% percentage tax monthly?

2. I just received in one Remittance Advice the summary of my CF from Avon for the month of Nov2011-April2012 last May 12, 2012 due to I just settled all the requirements for my business permit last april 2012 which I started Jan. 2012 because of technical problem at BIR office. Question here: I am confused regarding of my Percentage Tax monthly for these months Nov2011-April 2012 what should I do?

3. I did’nt reached my group sale for the month of May so automatically I will not received a CF which I supposed to be received last June 12, 2012 for Avon has a new rule regarding for our CF. Minimum of 30,000 GS are the only Sales Leader who will received CF. Sir, do I also need to file percentage tax even there will be no remittance advice to be given to me for the Month of May.

4.What should I do and what are the requirements for me to cancel my business permit because I am planning to stop as being an Avon Sales Leader

Please help me..

Thank you and God bless!

Hi, I’m Anne, I’m inquiring this issue of my friend regarding her concerns about BIR Late Filing Penalties, her previous CPA last 2015 process the amendment of articles (CORPORATION), amendment of change name and increase of capital stock in SEC and she got the original copy of documents from her before she terminate her services last February 2016 but much to her dismay that the amendment she request didn’t proceed to BIR Department. How can she know the processing of documentation/penalties computation incurred in this issue for her to settle this once and for all.

Please advice. Hoping for immediate response.

Thank you!

I ended my employment from my previous company on June 30, 2016. I was hired by my NEW company on July 1, 2016 .I have not cleared from my previous company because they claim i have not liquidated my transactions. I have already filed an affidavit of loss for all the receipts and is pending approval. Despite this, i am willing to wait out my clearance from my previous company BUT i want to know: Is it legitimate for them to NOT GIVE OUT my ITR (BIR 2316)? Can i demand the release of my ITR despite my wanting to wait it out for not being cleared yet? I am asking because i do not want to be a delinquent tax payer.

Hello!

I started a business, its singe prop business. Started last Nov 2016. I don’t have any idea how to file for Income Tax. i am also being charged for expanded vat, 5% of my rent.

can you help me with my income tax? And do i really have to pay the expanded vat of 5%?

thanks

hi sir Vic.i would just like to ask if the penalty for late filing of 1701Q is the same with annual ITR? ( interest + surcharge + compromise? i asked a friend from BIR and told me if for example my tax payable is 500 pesos, my penalty would by ranging to 2000, but as i compute it with what you posted,parang it will not cost that much. which is right? thanks.

Good day sir. I’m going to ask lang po what if one day late filing of 1702Q is there any penalty imposed po even if we are a tax exempt. establishment kasi po we’re cooperative. Thanks po.

Sir, I would like to inquire because I was hired on a contractual basis and was advised to register in BIR. I attended a seminar that was conducted every Friday however the filing and forms to be uaed are not clear for job order/contractual basis personnel.

Now I was informed that I have 10 open cases, what would be the first step and other process that I need to do to avoid problem with my new employer for I was back on a private company

Thank you and have a great day! 🙂

Hi! Question, what if the Company filed the return late and paid it late as well, what would be the basis of computation of penalty for late payment, the taxable amount only or taxable amount plus penalty for late filing? Thank you

Hi Ly,

I’m not sure if I understood your question right. Did you mean that the filing and payment of your return are two different dates? Anyway, there are three kinds of penalties imposed on late payment of tax:

1. Interest – basically at 20% per year based on your unpaid amount of tax.

2. Surcharge – 25% outright surcharge on your unpaid amount of tax (or in some cases, 50% surcharge, see article above.)

3. Compromise – based on tax amount payable since you have unpaid tax payable (see table in the article).

For the purpose of computing penalties, unpaid tax amount means only the unpaid tax amount due, excluding the penalties. Just to make sure, it’s better to visit the BIR to let them compute your applicable penalties, since some banks may require that a BIR officer must sign to verify that the computation of penalties on the return is accurate.

Hi Sir Vic,

How could be my penalty if I forgot to file my 1701Q? It happens that the deadline is Nov.15 but i filed it Nov.16. No taxable amount to be paid.

Thank you.

Hi! Old thread but, is it okay to compute my penalties myself, then input and submit them in the online eBIR forms? Or do I really have to visit my RDO for an official computation. I’m also paying through GCash. Appreciate your help!