Almost everyone wants to improve how they save and spend their money — and the tech world has taken notice of it by launching a steady stream of financial tools to lend a hand.

And because of the recent global health and financial crisis that has beset the world, people need to move almost all transactions online for their safety. Cloud-based solutions like financial apps help people stay on top of their finances and their spending amid the pandemic.

Whether you need an app that subscribes to a particular budgeting method or knows when your bank account runs low, below are some of the most popular financial apps available in the market today.

5 Money-Saving Apps to Better Manage Your Finances

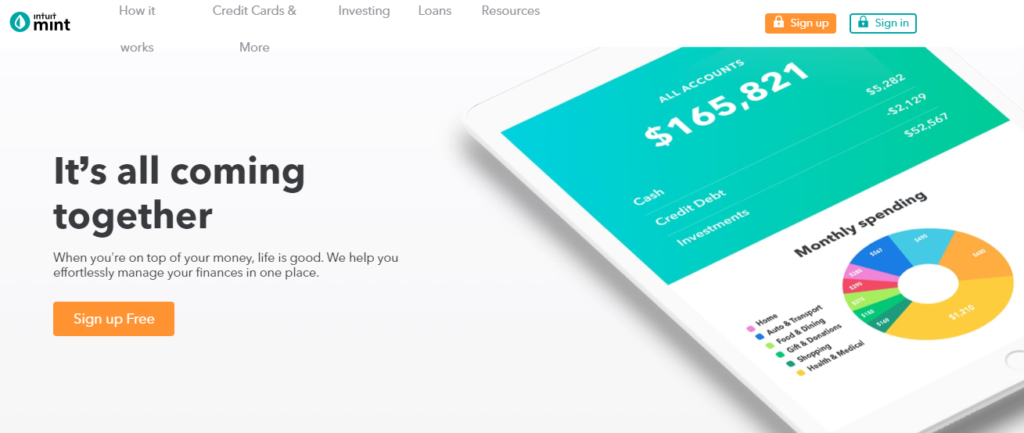

1. Mint

Mint, Intuit’s personal finance software, is one of the most excellently known personal finance apps. It is an all-in-one finance app that brings user’s money to one place, from balances and bills to credit score and more.

It also simplifies budgeting by allowing users to easily create budgets, with much-needed feedback or suggestions based on the user’s spending.

Mint also provides unlimited checking of credit scores and tips for users to improve it. Users can conveniently check all their money in one place, and conveniently manage finances from one dashboard.

With Mint, users can effortlessly stay on top of bills because bills are now easier than ever to track. Users can simply add them to the dashboard to see and monitor them all at once. Users will also be given reminders for upcoming bills so users can plan and never miss any payment schedule with bill notifications or reminders. Users also get notified when funds are low so users can be careful with their spending until they can replenish funds.

Consumers are more cautious now about how apps are keeping their online credentials safe and secure, so financial apps need to prioritize security in their services.

Mint is also serious about security. It is committed to keeping users’ data secure with multiple safety measures like secure encryption and multi-factor authentication. Users also must sign in with a unique 4-digit code and password.

Mint is bringing convenience because users can remotely access and manage their accounts from anywhere and enjoy continuous protection with VeriSign security scanning.

Mint also helps users create budgets they can stick to and see how they are spending their money. Mint can be accessed on the go, whether phone & tablet apps, so users can manage their money from wherever they are. Users can get personalized tips and advice for maximizing their money every day.

2. Chime

Chime is an Android and iOS smartphone banking app. It requires an FDIC-insured weekly budget and debit card to conveniently deposit funds, view transactions instantly, and monitor spending when out and about.

The mobile banking app also provides an automated savings account, allowing users to begin saving without worrying about it by immediately setting aside 10% of each salary they deposit into Chime. Users will be allowed to round up on transactions and transfer the difference to their savings if users use the Chime debit card.

The banking application lets users save money quickly and store it away in a bank account, so users are not tempted to misspend it on insignificant stuff. Chime does not charge late payments, international transaction fees, or monthly minimum and ATM usage fees.

3. YNAB (You Need a Budget)

YNAB is a personal finance software designed on YNAB’s Four Rules. These rules are giving every dollar a job, embracing your true expenses, rolling with the punches, and aging your money.

Rule 1: YNAB says users must give every dollar a job.

YNAB aims to help users prioritize how they use their money as it comes, and simply follow their plan. It helps users avoid spending money at a whim but based on a rock-solid plan.

Rule 2: YNAB encourages users to embrace their true expenses to improve financial plans.

YNAB suggests that users take those big, infrequent expenses (like annual memberships, Christmas expenses, and the like) and break them into manageable, monthly “bills.” When users create a monthly goal to fund these expenses, when the time comes to pay them, it will be easier because the money was already set aside monthly. It prevents users from going through financial crises every time these significant expenses come up.

Rule 3: YNAB says rolling with the punches is to be flexible in times of overspending.

YNAB teaches users how to be flexible and address overspending as it happens. Users need to identify a category where they overspend, be flexible to move funds from other categories, without breaking their monthly budget, and without the guilt.

Rule 4: YNAB recommends that users age their money.

YNAB aims to help users age their money by at least 30 days before having to use it. When users are spending money they earned last month, it will be less stressful, money-wise. It may not happen instantly, but gradually, if users stick to their YNAB financial goals, it can be done. YNAB wants to help its users be more purposeful about their spending, consistently spend less than they earn, and be more than prepared for the future.

The rules not only enable users to build a better budget but also help users gain leverage in their spending. Monthly updates also remind users how the budget is going during the month and help them find ways to boost their savings. According to YNAB, the average user saves $600 during the first two months and $6,000 in the first year. It also comes free of use in the early 34 days.

4. Acorns

Acorns is an American financial technology and services company that specializes in micro-investing and robo-investing. As of 2019, Acorns had over 4.5 million users and over $1.2 billion in assets under management.

An app that is helping more than 650,000 members, mainly millennials, save $25 million. It operates by encouraging citizens to spend directly through debit and credit card transactions.

On all payments, Acorns connects to a debit or credit card to round the spare change to the next bill. When the roundups hit $5, it withdraws funds and invests in a custom stock fund.

Jeff Cruttenden, just 29, had the concept in 2011 while he was a student in Portland, Oregon. In 2012, Cruttenden founded the business in partnership with its father, Walter, but it took a few years to launch the business.

The software is developed by Dr. Harry Markowitz, Nobel Prize winner. Acorns personalize a portfolio of mutual funds, such as real estate and corporate bonds. Users address simple questions regarding investment priorities and risk expectations that dictate when they adjust.

There is even an opportunity for manually spending roundups for those willing to invest time.

The Acorns app reduces speculation when raising funds without charging a fee. Users can also terminate their account at any time. However, Acorns deducts $1 every month for accounts that fall below $5,000, and 0.25% per year on accounts that exceed the amount. Average buyers place $100 a month into mutual funds. Acorns also lets users invest more. With the funding, Acorns aims to carry out a desktop app and grow internationally. Currently, the app is accessible in the U.S. only

5. ClarityMoney

ClarityMoney focuses on helping users stop throwing away expired services by assisting them in finding and canceling unwanted subscriptions. The software also analyses users’ consumption habits and gives them suggestions to enhance their financial health.

Clarity Money helps users make savings account deposits and track their savings as well. They can create multiple investment funds with different objectives. Savings deposits are assisted by an FDIC-insured bank and insured up to $250,000. Users can keep track of their monthly income by showing how much they have already spent, given they have connected their debit and credit cards. The app also offers users free use of Experian’s Vantage Account credit score.

Conclusion

If saving in the bank is challenging, using an app that does it automatically can be a good first step. Being used to regularly set money aside in a savings account— seeing your savings increase and grow — can keep you on track to handle income and expenses successfully.

If you do not have a bank account, you can open one online or at a local bank. Work your way to cover necessary living expenses worth 3 to 6 months for a savings account or emergency fund.

This latest pandemic teaches us all the value of having some savings. People lost their jobs, businesses had to close under strict social distancing rules, and those who got sick had to spend so much on medical bills to fight for life. There are some things we cannot control, but for the things we can, like our salaries and earnings, we need to make room for savings and investments to help us better prepare for the future.

Mayleen Meñez worked for seven years in TV and Radio production, and also as a Graphic Artist/Editor. Finding her true passion, she devoted 15 years in NGO and community development work, where she experienced being a coordinator and teacher, travelling both in the Philippines and countries in Asia. She homeschools her three kids and reinvents Filipino dishes in her spare time. Writing has always been a hobby and pursuit, and she recently added content writing with Softvire Australia and Softvire New Zealand up her sleeve, while preparing for her next adventure in the nations.

Leave a Reply