The following are sample balance sheet (statement of financial position), income statement, and statement of changes in owner’s equity for an individual or sole proprietorship business. These sample financial statements are actually the ones we have discussed and prepared in our previous accounting discussions. The account titles and balances presented on these reports are derived from the adjusted trial balance we have made during our previous post. To learn how we’ve prepared the balance sheet, please read our article on “how to prepare a balance sheet”. To learn how we have created the income statement, please read our article titled “how to prepare an income statement. For the preparation of the statement of owner’s equity, please read our article on how to make a statement of changes in owner’s equity. You may also browse all our articles about accounting in our accounting category page.

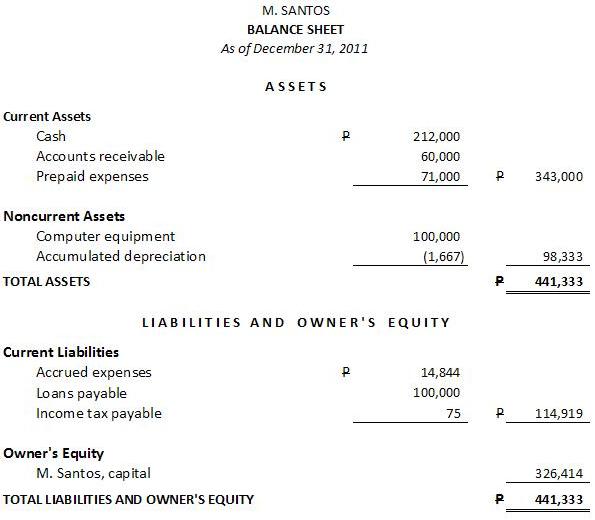

Sample balance sheet:

Sample income statement:

Sample statement of owner’s equity

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hi Sir Vic,

If I were to file my FS with the BIR (for income tax purposes), should it be in a comparative form or not?

Please assume that I am a sole proprietor.

Thanks!

Hi Sir Vic,

I have seen an Income statement without provision for Income tax expense and the Income before tax is the Net Income already. Is this allowed in presentation of Income Statement for sole proprietor? I am thinking maybe the reason behind this is because the owner is under Cash basis. Am I right? Please help. Thanks.

I need a complete business plan for a proposed boarding house. do you do this sort of work? how much do you charge?