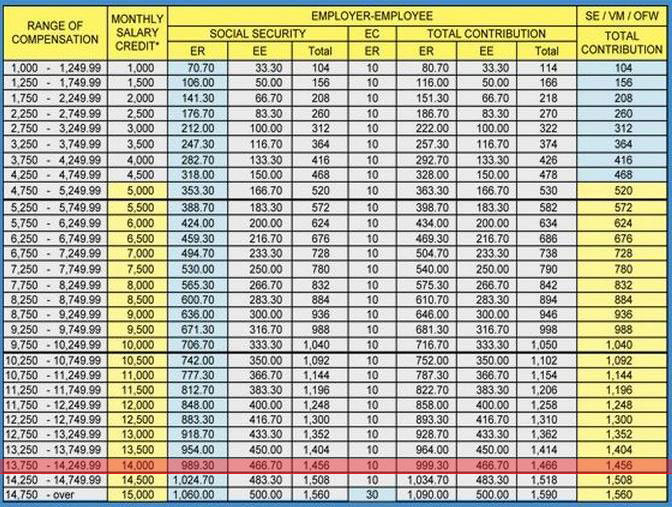

The Social Security System (SSS) contribution table is the schedule of the members’ monthly salary bracket and their corresponding employers’ share on contributions and total monthly contributions to be remitted with the SSS for employees, self-employed (SE) members, voluntary members (VM) and Overseas Filipino Workers (OFW). Employers, employees, SE members, VMs and OFWs need to look on this table to determine the amount they should contribute to the SSS.

Below is the current SSS Contribution Table as of the date of this post:

Please click the image to view a larger version.

To learn more on how to use the schedule above, please read our sample in our post titled “How to Compute SSS Contributions in the Philippines”.

For the SSS contribution deadlines, please read the following:

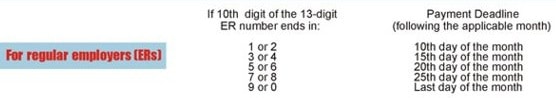

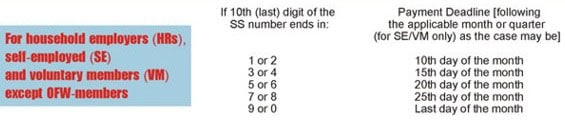

The new deadline for contributions or member loans

1. For regular employers (ERs)

For example, if the ER ID number is 03-1234567-8-012, the payment deadline for both contributions and member loans for the applicable month of June shall be on July 25.

2. For household employers (HRs), self-employed (SE) and voluntary members (VM)

For example, if the SS number is 01-23456789-9, the payment deadline for both contribution and member loans for the applicable month of June or quarter ending June, in case of quarterly payments for self-employed and voluntary members, is July 31.

3. For OFW members

The OFW members are not affected by the new policy of deadlines issued recently by the SSS. Hence, the OFW members can pay anytime during the applicable year for January to December contributions; or until January 31 of the following year for October to December contributions.

Note: In case the payment deadline falls on a Saturday, Sunday or holiday, payment may be made on the next working day. Otherwise, penalties shall be imposed on the late contribution and member loan payments of employers and late member loan payments of self-employed and voluntary members; while late contributions payments of self-employed and voluntary members shall be applied prospectively.

The frequency of payment shall remain on a monthly basis for regular and household ERs, and on a monthly or quarterly basis for self-employed and voluntary members. Payments on a quarterly basis shall mean payments for all three months in a calendar quarter (i.e. March, June, September, and December).

Reference: www.sss.gov.ph

Amruta is one of the writer contributor on this blog assigned to write on different topics, such as the latest business news, search engine optimization, making money online, online business promotion, social media, and the latest trends on the Internet.

Can I register in SSS as self-employed even if I don’t have employees yet?

Yes you can, as long as you are earning income. If you are not earning but you just want to contribute, you can be a VM (voluntary member) instead of a self-employed member.

Thanks for the response.

In this case, I am also allowed to register with Pagibig and Philhealth right? I am processing my permits as sole proprietor and SSS is mandatory, then that means I should register as self-employed and not as voluntary member?

Hi, what if the payment deadline for sss falls on saturday or sunday or holiday?

can i pay my sss contribution from january to december of this year? please i need answer and help.

is a voluntary member required to follow the standard table for contribution? like monthly salary credit is Php 8,000.00 but we opt to start with a lower contribution .

Hello po! I would like to ask if its possible for me to continue my contribution, my last contribution was december 2007. Now i am living in Norway and married to a foreigner and i decided to continue paying my contribution as a voluntary member is it ok if i will pay the highest contribution which is 1560, I’m a student here and i dont have job yet.

I have a salary loan issued last July 2013. However, I resigned with my work last November. But as indicated in the voucher, the first (1st) month amortization of my loan must be paid by September. My company deducted my salary for the first payment but when I check my SSS online, my previous company did not settle my account and it interest for 2 months now. My question is: the overdue payment indicated online is not updated, how can I compute the exact amount I need to settle by December 2013 so that I can voluntarily pay my loan for the meantime that I dont have a job.

hi po!..ask ko lang…can i pay my 2013 contribution even if its already last quarter of 2014??

hello po sir/ madam ask ko lng po if pwede po bang bayaran yong late na bayad 1year po [2013] ngayon. magakano po kaya if sakali. voluntary member po. salamat po

If my deadline falls on a Sunday can I still pay my contribution on Monday? Thank you.

Good om sir/mam, ask lng po kung pwde ko pb I-continue ung contribution for voluntary member last 2010 dko na updaye.thank po

Is there.a mode of payment yearly.thanks

Hi,i just wanna know if i can still pay my contributions from jan. 2015 up to present?im a voluntary member

I am a voluntary member, and I want to increase my monthly contribution, what should i do? Please advise, thanks!

Hello ma’am/sir,

May itatanong lang po ako tungkol sa payments ko po. Nag apply po kasi ako ng SSS as Voluntary. Last January 26, 2016 po. Tapos d po ako naka pag bayad nong month ng feb. ,March at nagong april po. Meron po ba penalty pag d naka pagbayad po? At pwede rin po ba na month of feb. At march lng muna babyaran ko?

Salamat po.

What if 1 year delayed in paying my SSS contributions …can I pay per month but my delayed first I pay …? And it is said ther that 3% per month the penalties so before I give my sss # to the company I work to.. I must fix first my delayed sss payments …

Another one is my sss id is in manila and I am in province now …I don’t have enough time to go there and get it …that id since 2012 …makukuha ko pa rin ba ? thru delivery na lang po sana ..

Hello po, my 1st loan is 5000, pwedeng malaman if I renew it, magkano po ba 2nd loan amount. 7500 po ang monthly salary ko po ngayon, regular na po ako sa work. 54months na po contributions ko po as of today. Please po. I need an information. Please

hi gud pm.as ko lang po dati kz ako may empoyer last 2 years ngresign po ako kz natanggap ako sa deped..gusto ko po ituloy ung hulog.19760 po salary nmin how much po kaya ang monthly ko ngaun ska pwede ko po b hulugan ung previous month?

hi,

base po sa sss table yung pinakamataas po na monthly salary bracket ang basehan mo para sa contribution, it means 1,590.00. Kung may counter part ang dep-ed sa contribution dapat monthly po sila magbabayad para iwas penalty, kung wala mahuhulog po na self employed po kayo so every quarter lang po ang papayagan ng sss na magbayad, halimbawa january february march ang deadline is april (date schedule of your sss deadline) pag MAY na kayo magbabayad ang jan feb at march hindi na yun tatanggapin.

Goo day po, tanong ko lang sana. Pwede po bang i-fix ng agency ko ang contributions ko for more than 1 year. For more than 1 year po kasi 181 lang lagi ang kaltas skn sa payslip ko. Eh hindi naman po Php 5,000 ang monthly ko.