Taxpayers who are required to file their income tax returns under the Tax code, and those who are not required but opt to do so, will be filing with the new income tax returns issued by the BIR. This is for their annual income tax covering and starting calendar year 2011, which … [Read more...]

Income Tax in the Philippines

Philippine taxation is already one of the most discussed topics on this blog. I have observed that many Filipinos are still confused when it comes to knowing and understanding their tax obligations to the government. I can’t blame them because taxation, especially income tax … [Read more...]

BIR (Bureau of Internal Revenue) Philippines Website Information

Tax affects everyone’s life, not only for business owners and employees, but also for anyone who is under the government. Income earned, whether from business profit or from employment compensation, is generally taxed. The commodities and services everyone consumes may also be … [Read more...]

Tax Tips for Income Tax Filing and Preparation in 2012

In a few months from now, we will be filing our annual income tax return for the calendar year 2011. In the Philippines, income tax returns for the taxable calendar year are to be filed on or before the 15th of April. Since April 15, 2012 will fall on Sunday, we can assume that … [Read more...]

Business in the Philippines: Quick Things to Remember

Small, medium and big businesses contribute to the economic growth of a country. Good businesses give more jobs, build more infrastructures, and increase national revenue in the form of taxes collected from them. In our country where the rate of unemployment is rising and the … [Read more...]

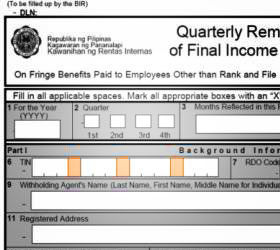

How to Compute Fringe Benefit Tax (FBT) in the Philippines

Employees are considered by many as the best assets in business organizations. They are the labor force that contributes to the productivity, as well as profitability and stability of any enterprise. Thus, making employees and workers motivated and happy is a necessity for every … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 8

- Next Page »