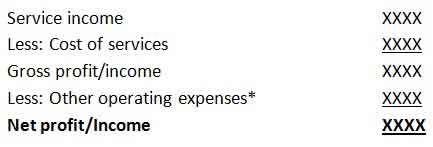

What is a business profit? Business profit refers to the excess of the business' total income less all expenses within the accounting period, which may be presented monthly, quarterly or annually. However, please be informed that a loss, instead of a profit, will be the result if … [Read more...]

Income Tax in the Philippines

Philippine taxation is already one of the most discussed topics on this blog. I have observed that many Filipinos are still confused when it comes to knowing and understanding their tax obligations to the government. I can’t blame them because taxation, especially income tax … [Read more...]

How to Compute Fringe Benefit Tax (FBT) in the Philippines

Employees are considered by many as the best assets in business organizations. They are the labor force that contributes to the productivity, as well as profitability and stability of any enterprise. Thus, making employees and workers motivated and happy is a necessity for every … [Read more...]

How to Compute Capital Gains Tax on Sale of Real Property

How to Compute Capital Gains Tax on Sale of Real Property in the Philippines? When a person sells real property, classified as “capital asset”, he may be liable for taxes, which include local property taxes, documentary stamp tax and capital gains tax. Capital Gains Tax, as it … [Read more...]

How to Compute Documentary Stamp Tax (DST) on Transfer of Real Property

How to compute Documentary Stamp Tax (DST) on transfer of real property in the Philippines? When we sell or buy real property, we execute a contract or deed of absolute sale, where the selling price, parties, details of property and other stipulations are stated. The deed of sale … [Read more...]

How to Compute Quarterly Income Tax Return: Philippines (1701Q)

How to compute quarterly income tax return in the Philippines for self-employed individuals? If you are a professional who practice your profession or a self-employed individual engaged in a sole proprietorship business, you may be looking for a guide on how to prepare your BIR … [Read more...]