The statement of changes in owner’s equity is a separate component of financial statements for a sole or single proprietorship business. It presents how the capital shown in the balance sheet equity section changes over a period of time. It also shows the effects on the capital … [Read more...]

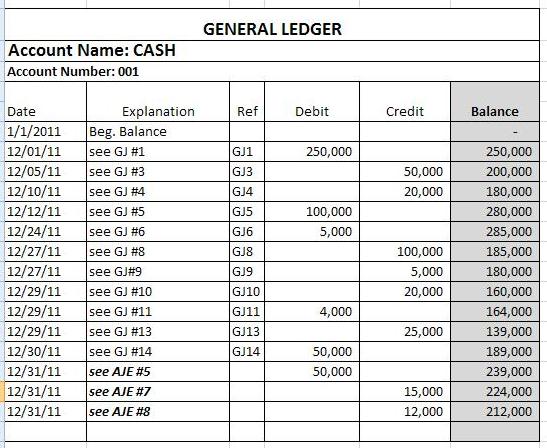

How to Prepare an Adjusted Trial Balance

The trial balance is an internal report, listing all the account titles and their balances from the general ledger. It is prepared at the end of accounting period to check errors in the accounting cycles, which include identifying transactions, analyzing them, recording journal … [Read more...]

Examples of Adjusting Journal Entries in Accounting

In our previous post titled how to make adjusting journal entries (AJE), we have discussed the common types of adjusting entries, namely, accrued revenues, accrued expenses, unearned revenues, prepaid expenses, depreciation (estimation), change in accounting estimate, and prior … [Read more...]

How to Make Adjusting Journal Entries

In our previous article, we’ve discussed about the preparation of a trial balance. After the trial balance is prepared, we need to ensure that our accounting records are accurate and our financial reports will be fairly presented. Adjusting journal entries (AJE) are necessarily … [Read more...]

What are Notes to Financial Statements and their Purpose?

What are notes to financial statements and what is their purpose? The financial statements tell us about the important financial information of a certain business or entity which also help us make more informed judgments, such as whether we should infuse more capital or not to … [Read more...]

What is a Statement of Changes in Equity and its Purpose?

What is a statement of changes in equity and what is its purpose? A statement of changes in equity is a separate component of financial statements. It presents an entity’s total comprehensive income for the period (profit or loss plus other comprehensive income for the period), … [Read more...]