If you’re asking on how to earn or make some extra $500 a month from blogging online, here is my answer based on my own experience. Firstly, you have to understand that a 500 US dollar extra income that is regularly received monthly is somehow a form of passive income. Take note … [Read more...]

Different Kinds of Taxes in the Philippines

There are many different kinds of taxes in the Philippines. But we can group them into two basic types, namely, national taxes and local taxes. National taxes are those that we pay to the government through the Bureau of Internal Revenue. Our national taxation is based on the … [Read more...]

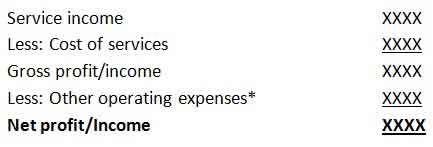

How to Compute Your Business Profit

What is a business profit? Business profit refers to the excess of the business' total income less all expenses within the accounting period, which may be presented monthly, quarterly or annually. However, please be informed that a loss, instead of a profit, will be the result if … [Read more...]

What is the Difference between Income, Revenue, and Gain?

What is the difference between income, revenue, and gain? These accounting terms are usually presented and seen in the income statement. They may have similarities, but they are actually different from each other. Financial statements preparers, accountants, and other accounting … [Read more...]

Is Google AdSense Income Taxable?

Perhaps, Google AdSense is the most popular and the simplest way to earn money on websites and blogs. It is also free and could instantly be implemented on any site of all sizes once your AdSense account is approved by Google. If you are already receiving cash from Google or … [Read more...]

Top Taxpayers in the Philippines

Taxes are the lifeblood of our country. Without tax collections, our nation won’t be able to construct bridges, streets, schools, hospitals, and other infrastructures for the public consumption. Without taxes, our government agencies and offices won’t run to serve the citizens. … [Read more...]