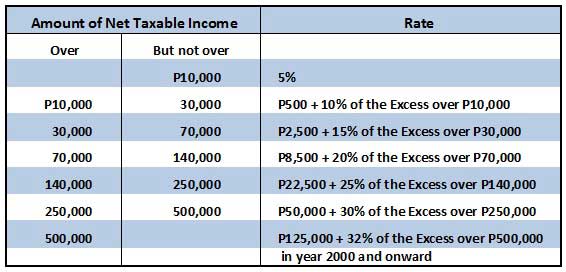

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]

How to Claim Employees’ Income Tax Refund in the Philippines

How can employees claim their income tax refund? If you are an employee, you may notice that your employer is deducting and withholding a tax amount on your compensation income on a monthly basis. Your employer is just actually complying with the Bureau of Internal Revenue (BIR). … [Read more...]

Tax in the Philippines

The tax system in the Philippines is quite difficult to grasp by small and medium business owners, professionals and other income earners, especially if they don’t have any basic knowledge in accounting and taxation. For big companies and corporations, they have the money to hire … [Read more...]

10 Mistakes to Avoid When Filing Income Tax Return

There is only one week left until April 15 is here – the deadline for annual income tax filing. If you are already done filing your income tax return with the BIR, then congratulations for making it earlier than the due date. For others who have not yet filed their income tax … [Read more...]

BIR Interactive Forms for Income Tax Filing Now Available

On November 2011, the Bureau of Internal Revenue (BIR) has issued Revenue Regulation No. 19-2011, requiring taxpayers to use the revised forms for filing their income tax returns. The new forms, which include BIR Form 1700 (Annual Income Tax Return for Individuals Earning Purely … [Read more...]

New and Revised Income Tax Return BIR Forms

Taxpayers who are required to file their income tax returns under the Tax code, and those who are not required but opt to do so, will be filing with the new income tax returns issued by the BIR. This is for their annual income tax covering and starting calendar year 2011, which … [Read more...]

- 1

- 2

- 3

- 4

- Next Page »