If you’re looking for an online tax guide in the Philippines, this blog strives to provide you that. We know that taxation is an essential part of doing business. We also understand that it may involve anyone who earns income, whether it’s from business, profession or … [Read more...]

Penalties for Late Filing of Tax Returns

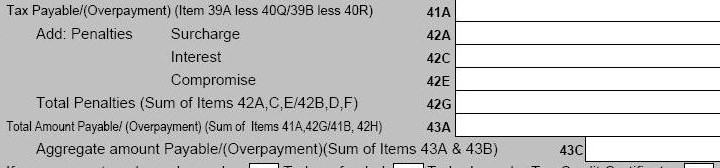

How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But … [Read more...]

Income Tax Computation in the Philippines

This post is a summary of all our published articles related to income tax computation in the Philippines. The deadline for filing and paying your annual income tax return, which is on April 15, is only a few days ahead. That is why I decided to share all of our available tax … [Read more...]

How to Avoid BIR Tax Audit?

How to avoid a BIR tax audit? April 15 is fast approaching and you need to make your annual income tax complete, filed and paid before that deadline comes. But though you need to hurry to make it before the due date, it’s still better to be prudent in the preparation and … [Read more...]

What are Deductions and Exemptions to Income Tax (Philippines)

What are the deductions and exemptions you can claim against your taxable income in computing income tax and preparing your annual tax return? The computation for income tax expense and payable for individuals and corporations (including taxable partnerships) differs. Individual … [Read more...]

Deductible Expenses (Allowable Deductions) in the Philippines

April 15 is fast approaching, and if you have taxable income, you need to file and pay your income tax before that due date. In computing your income tax, you need to determine your deductible costs and expenses to arrive at your net taxable income. In doing the computation, we … [Read more...]