People need money to finance their cost of living (i.e., food, clothing, medicine, education, leisure, et cetera). Thus, they strive and work hard to earn such money to cover those expenses. However, in almost every country, especially the Philippines, tax is inherent. Income tax … [Read more...]

How to File Income Tax Return in the Philippines

How to file your annual income tax return in the Philippines? On April 15, 2011, every individual or entity (eg., partnership or corporation), who are required to file their income tax return and or pay their corresponding income tax due and payable should already be done doing … [Read more...]

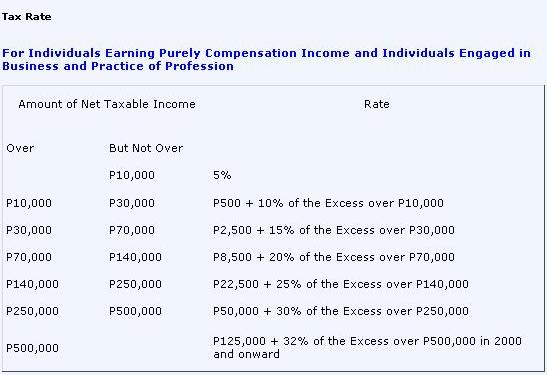

How to Compute Income Tax in the Philippines (Single Proprietorship)

How to compute annual income tax in the Philippines for self-employed individuals, such as proprietors and professionals? Computing income tax expense and payable is different for individuals and corporations. Taxable corporations may be taxed using a fixed income tax rate. On … [Read more...]