What is the largest company in the Philippines? What is the biggest corporation in our country? If you are an aspiring business owner and entrepreneur, you may ask yourself those questions. Although you may be overwhelmed by how those companies are far bigger than your own … [Read more...]

Business Tips from the Philippines

When the phrase “business tips Philippines” came into my mind, the next move I made was to buy the domain name BusinessTips.ph to immediately create this business blog. With the help and blessing of our Almighty, this site, which I was imagining, became a reality in a short … [Read more...]

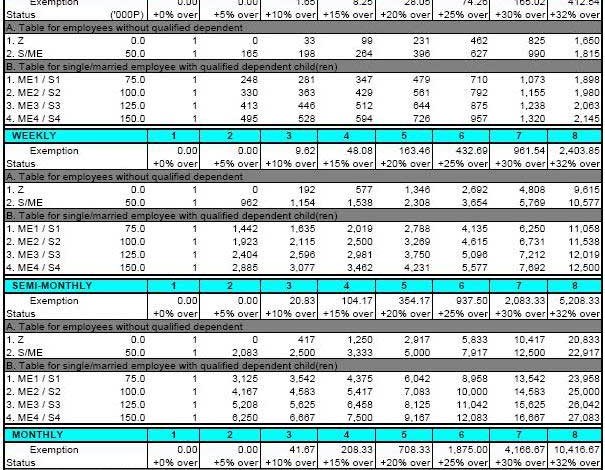

How to Compute Withholding Tax on Compensation (BIR Philippines)

How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s … [Read more...]

Business Taxes in the Philippines

Business taxes in the Philippines can either be Value Added Taxes (VAT) or Percentage Taxes. Furthermore, an Excise Tax can also be imposed on certain taxpayers who are in the course of trade or business as an addition to VAT. Unlike an income tax, which is based on the … [Read more...]

Withholding Tax on Compensation in the Philippines

Tax is the bread and butter of our nation. That is why our government, legislators and the Bureau of Internal Revenue (BIR), strive to improve our tax system for better internal revenue collection. Withholding taxes, such as withholding tax on compensation, expanded withholding … [Read more...]

How to Compute VAT Payable in the Philippines

How to compute Value Added Tax (VAT) payable in the Philippines? Any person or entity who is engaged in trade, business or in the practice of profession may be liable to business taxes. Business taxes can be either a Percentage tax or a Value Added Tax. Furthermore, a taxpayer … [Read more...]