How to compute Percentage Tax payable in the Philippines? How to prepare and file your percentage tax return with the Bureau of Internal Revenue (BIR) or with an Authorized Agent Bank (AAB)? The following are steps and guidelines in the preparation and computation of percentage … [Read more...]

How to Compute Overtime Pay in the Philippines

How to compute overtime pay in the Philippines? Justice and equality must be served in the workplace. That is why our Labor Code has fixed the maximum hours and days of work, which is equivalent to a maximum of eight (8) hours a day (Article 83, Labor Code of the Philippines) for … [Read more...]

The Best Business Blog in the Philippines

The best business blog in the Philippines, this is my vision for creating this blog. But in every great mission and objective, there must be great procedures and endeavors to be made to reach those goals. This is not my first business blog, but this is the first blog I especially … [Read more...]

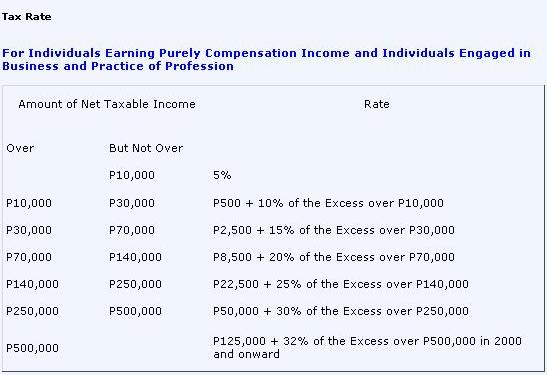

What Taxes Should I Pay in the Philippines (Self-employed)

What taxes should you pay in the Philippines? What taxes should self-employed individuals pay in the Philippines? Self-employed taxpayers are those individuals who receive income from business or from practice of profession. Persons who receive mixed income (income from business … [Read more...]

How to Prepare Income Tax Return (Corporations and Partnerships in the Philippines)

Previously, we have tackled the steps and guidelines on the computation and preparation of income tax for professionals and individuals who are engaged in business in the Philippines. This time, we will move on to discussing how to compute and prepare income tax return for … [Read more...]

How to Compute Income Tax in the Philippines (Single Proprietorship)

How to compute annual income tax in the Philippines for self-employed individuals, such as proprietors and professionals? Computing income tax expense and payable is different for individuals and corporations. Taxable corporations may be taxed using a fixed income tax rate. On … [Read more...]